Banquet Hall Business Plan & Financial Model

Downloaded by more than 300 entrepreneurs. Stop Procrastination and Start Planning Today with Our Comprehensive 63 Page Business Plan Template. Cut down on research, learning and overall business plan writing time consumption by at least 200 hours. Just fill up and print. Use in simple Doc and Spreadsheet.

Grab your doc file and spreadsheet fast before we run out of stock!

Dear Entrepreneur,

Transform your ‘someday’ into ‘today’ with our Startup Toolkit (Business Plan + Financial Model). Move past procrastination, discover your clear path forward, and boost your drive. Let’s tackle the fear of failure head-on!

Don’t allow apprehension or unfamiliarity to deter you. Our guide clarifies the process, providing straightforward steps and tactics. Embark on your venture now and transition from dreaming to operating.

This is not just another generic business plan filled with uncertainties and generic figures in a dull spreadsheet!

For those feeling daunted about where to start, this plan offers a detailed, step-by-step journey from idea to operational status, ensuring you address all critical aspects without feeling lost.

But Everyone Says This…..Tell Me What’s Inside?

Here are just few of the questions answered in the business plan & financial model:

✔️Find out if it’s worth spending money and time into this idea.

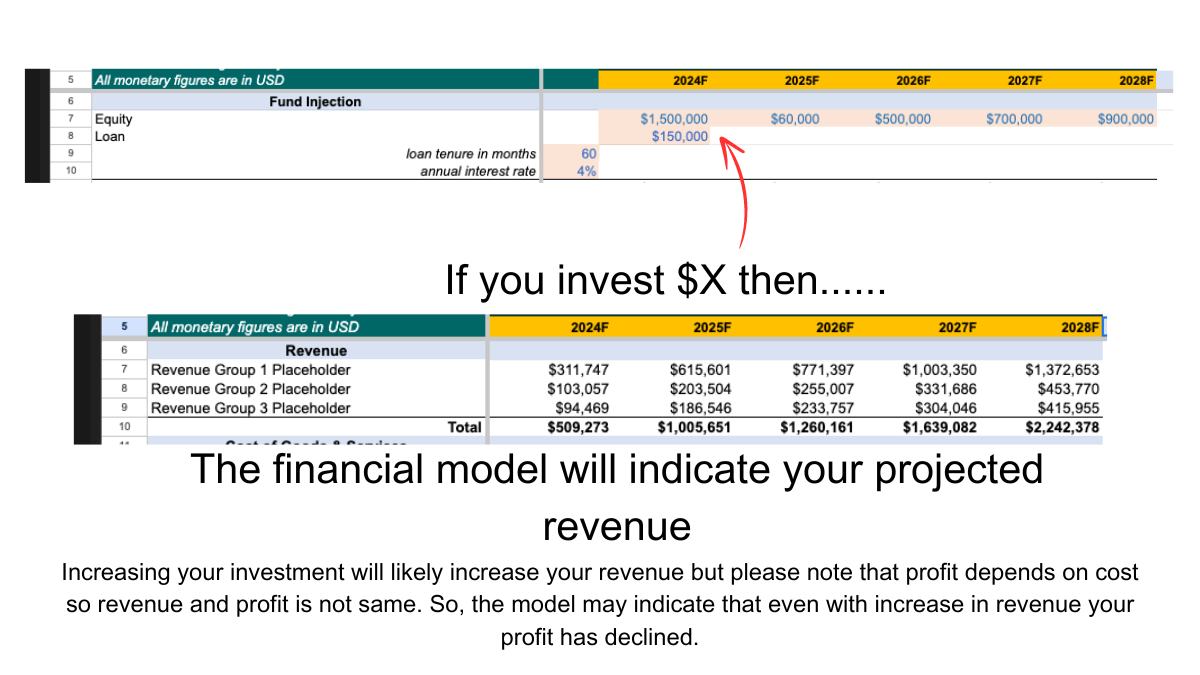

✔️How much money can you make if you invest $X into this?

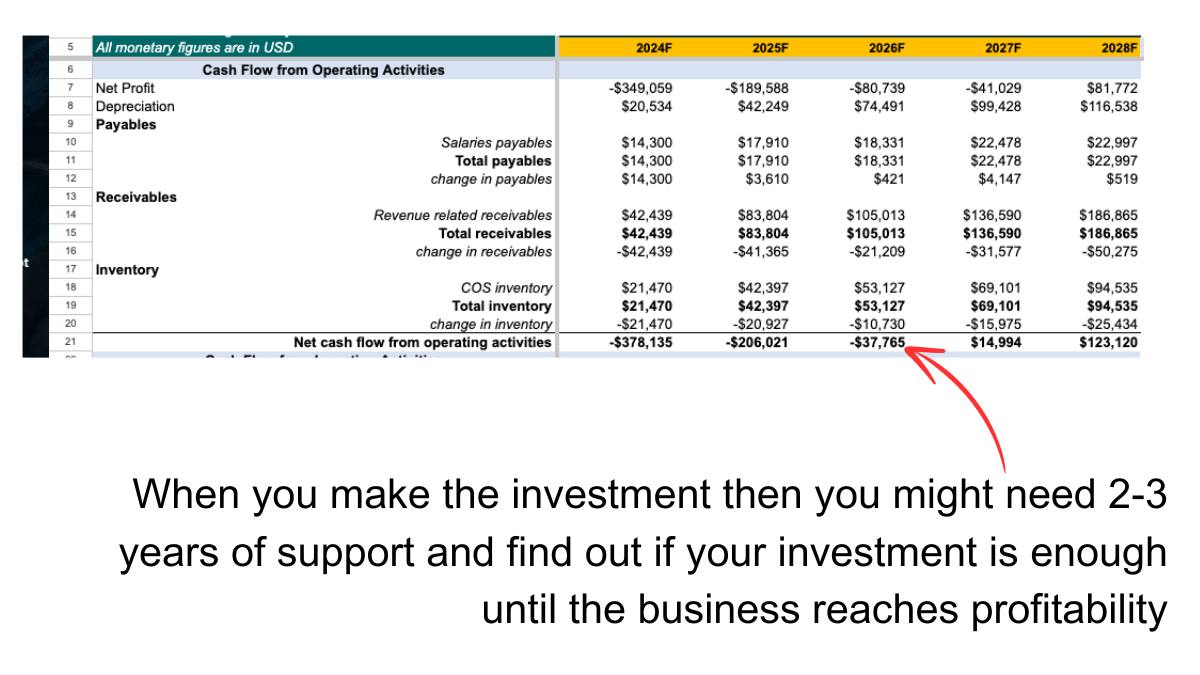

✔️Is $X amount of investment enough?

✔️When will the business break-even?

Now Let’s Get Started Writing the Business Plan

Start with Financial Model…..

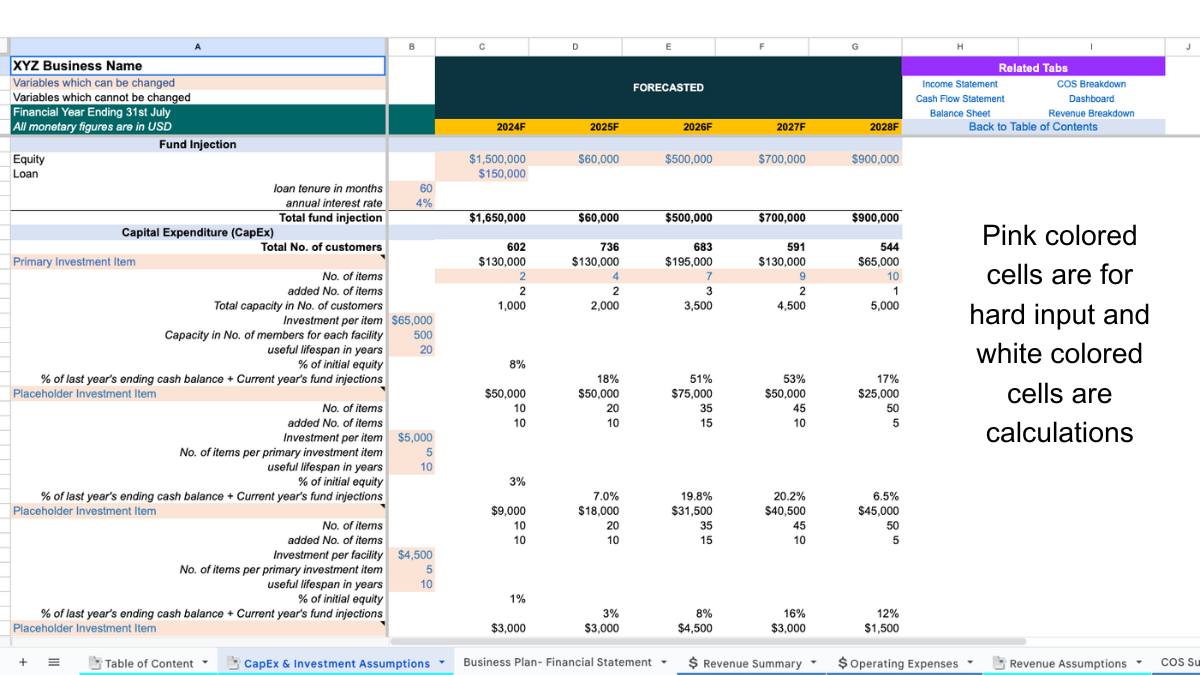

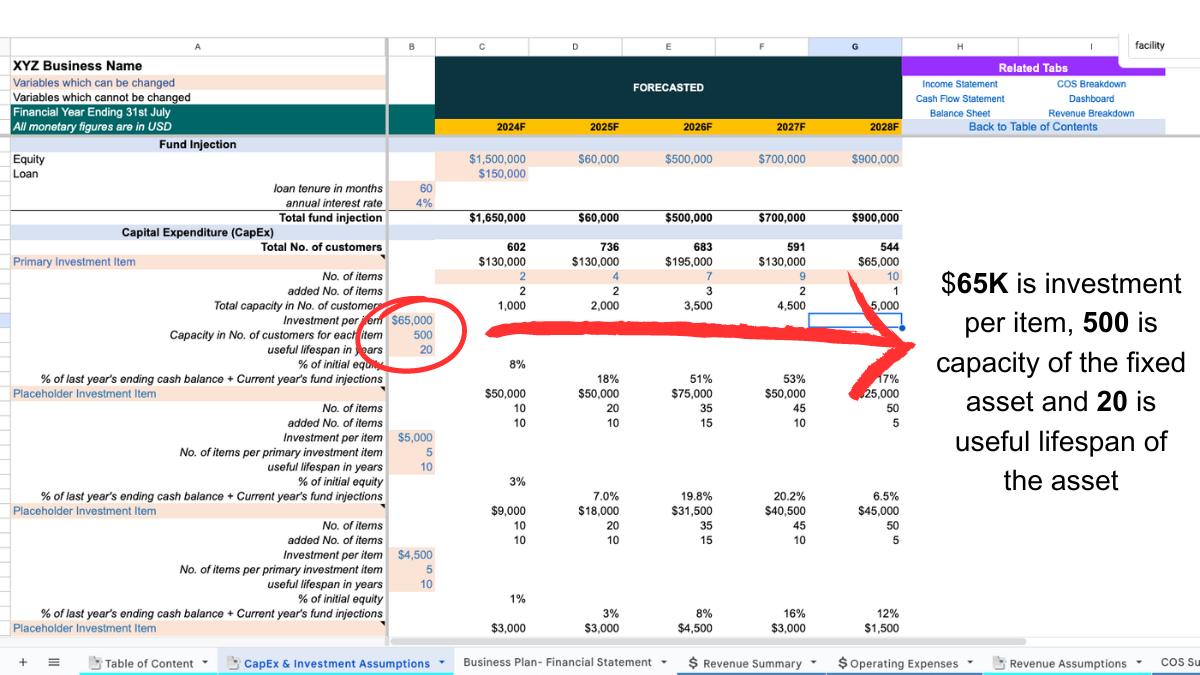

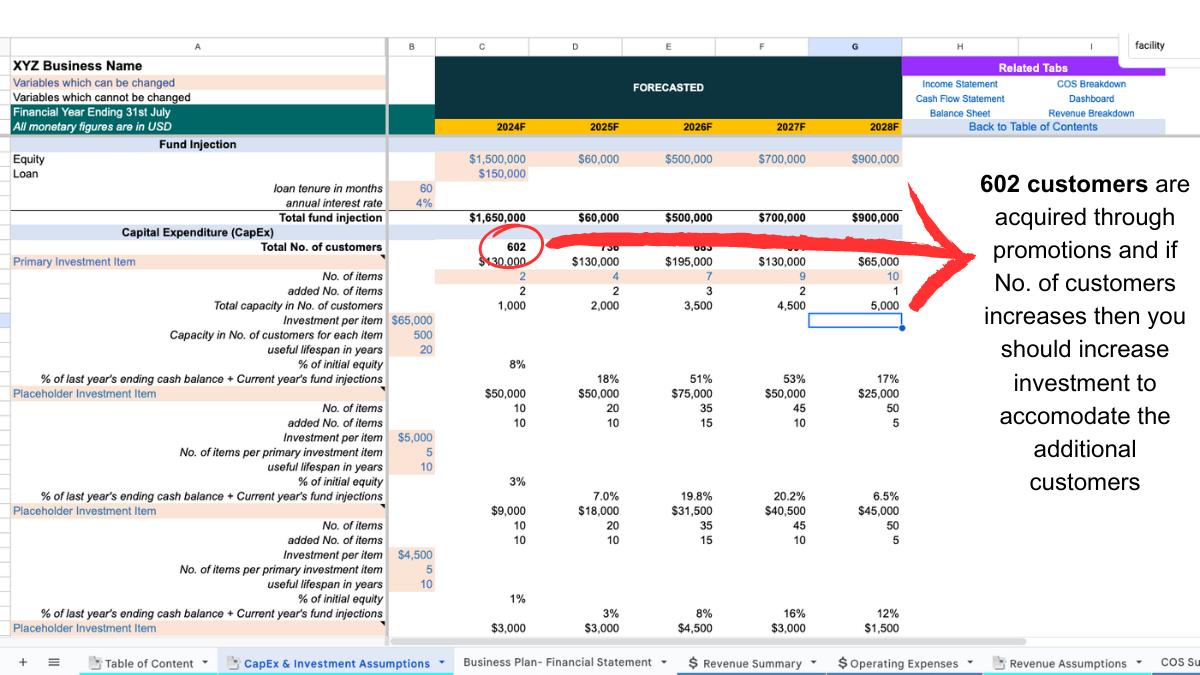

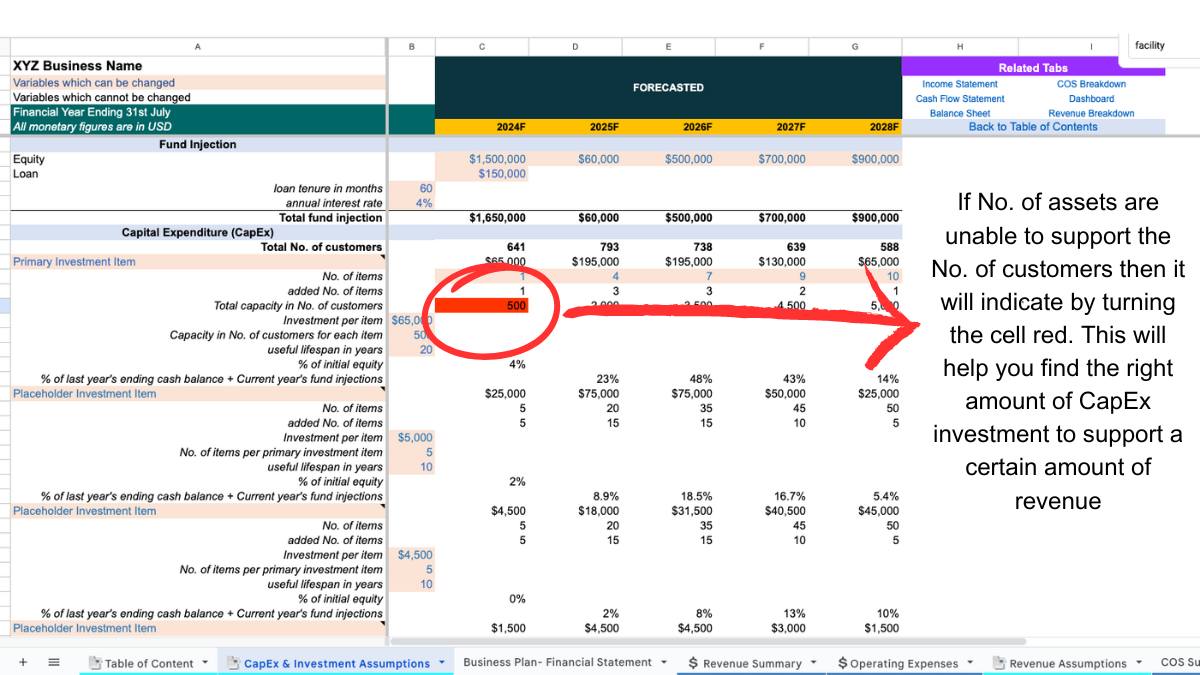

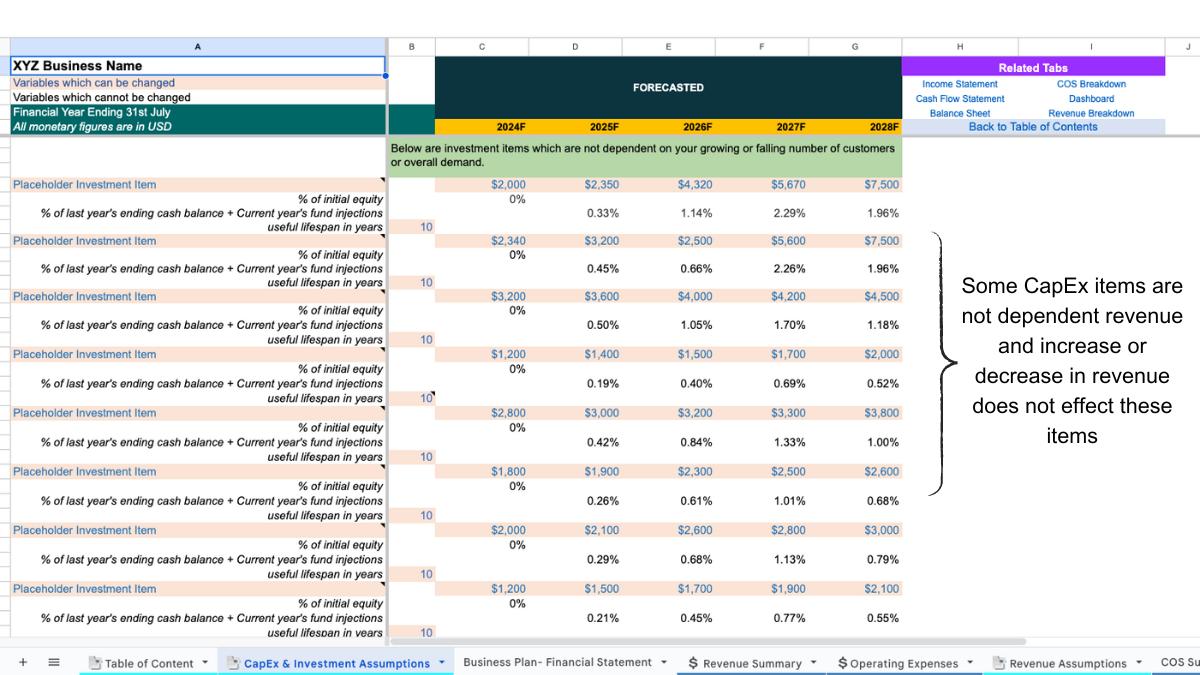

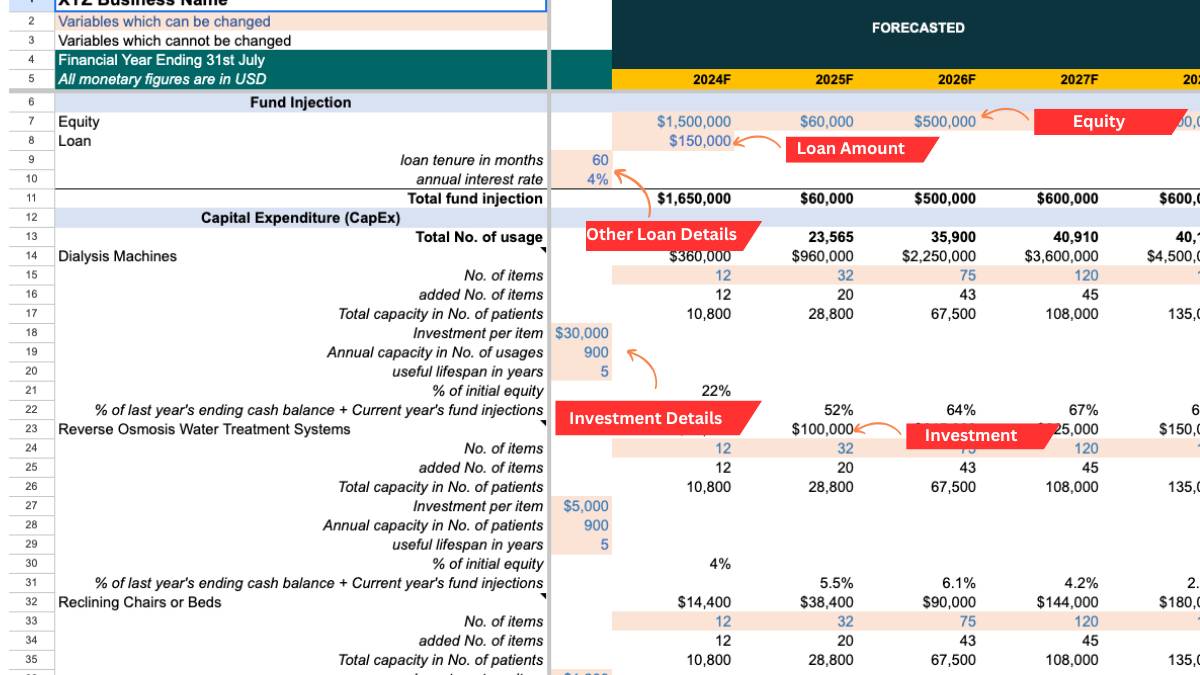

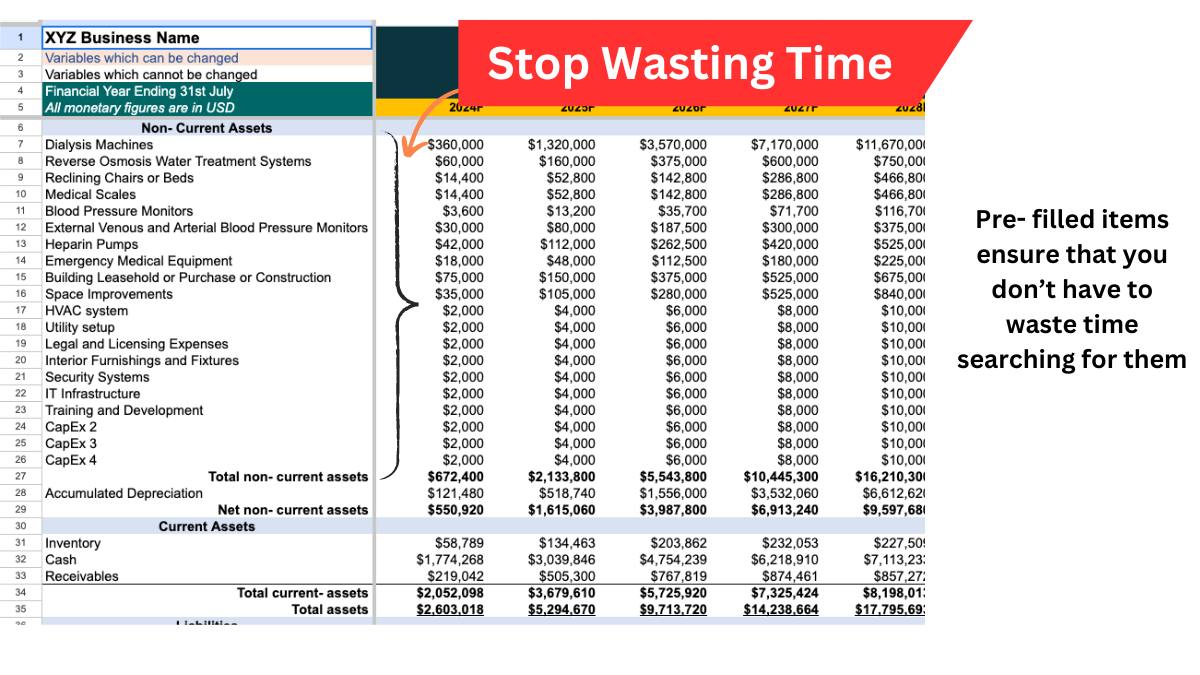

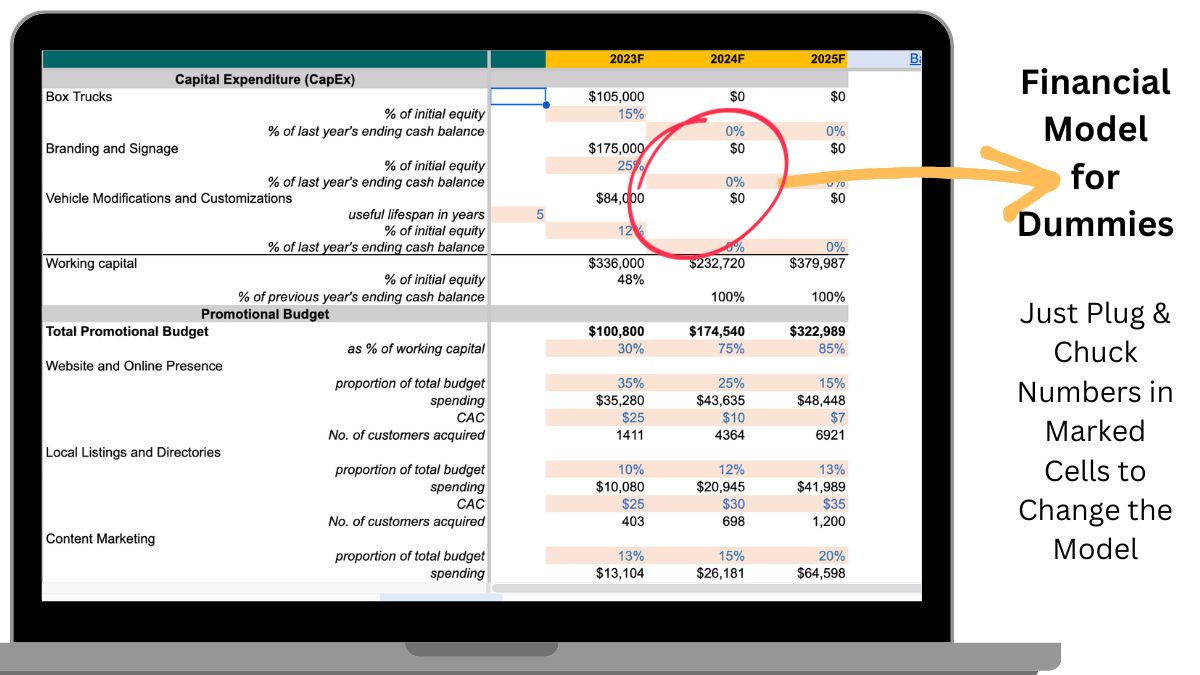

When you start the financial model, you should start with the CapEx assumptions and Capital Structure. The capital structure consists of your equity and debt information throughout the projected years. CapEx assumption consists of investment on fixed assets which will help the business generate revenue over long term (more than 1 year). It is important to note that the difference between asset and expenses involves the fact that once you spend on a expenses then it is gone and it does not have the ability to generate future cash flow like assets. For e.g. if you purchase a building then it is an asset as it has the possibility of generating future cash flows and earnings through rent. On the other hand if you pay your utility bill then it is an expenses as it does not have the potential to generate future cash flow and earnings.

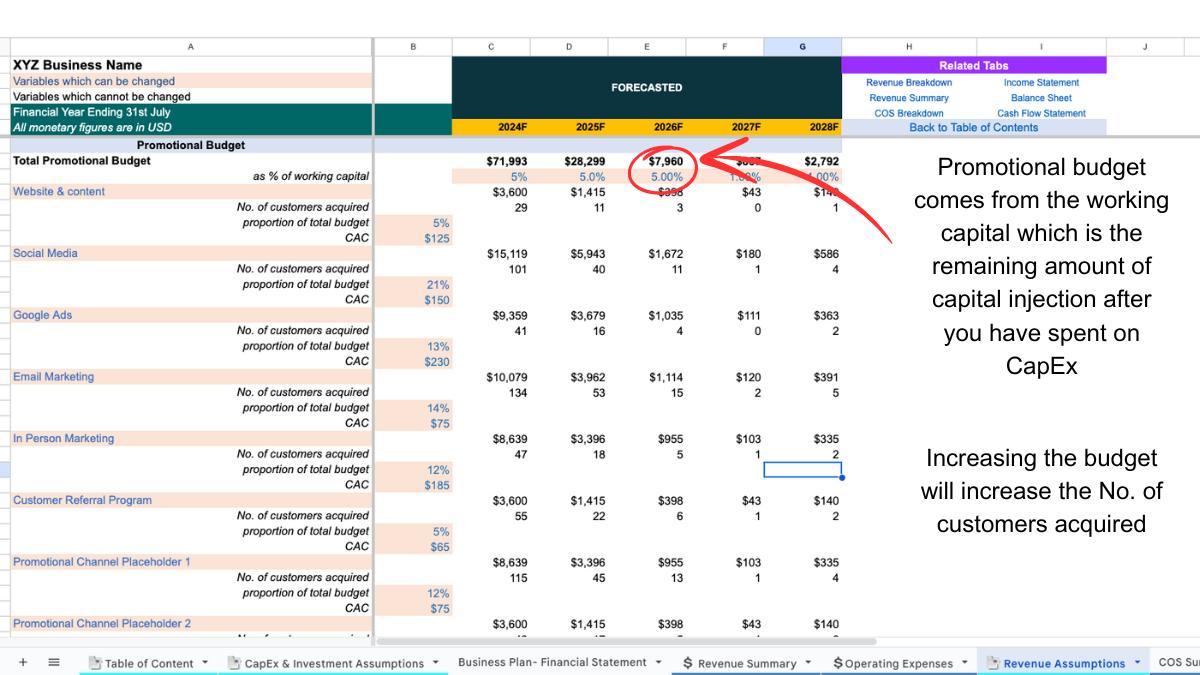

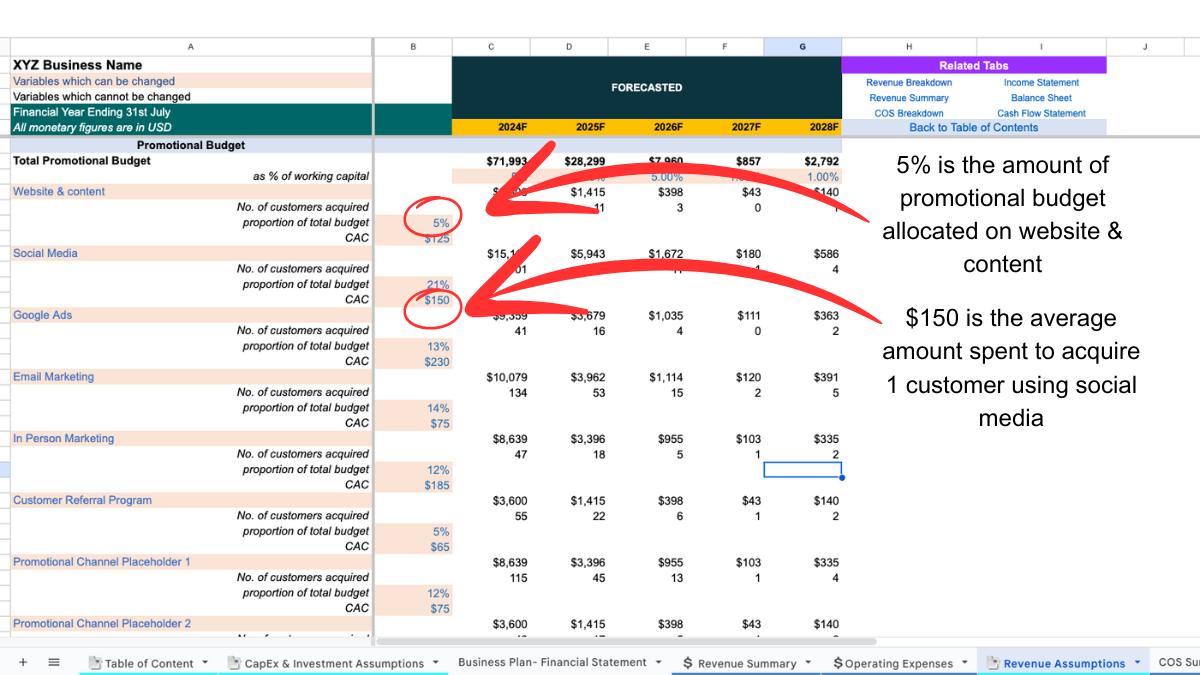

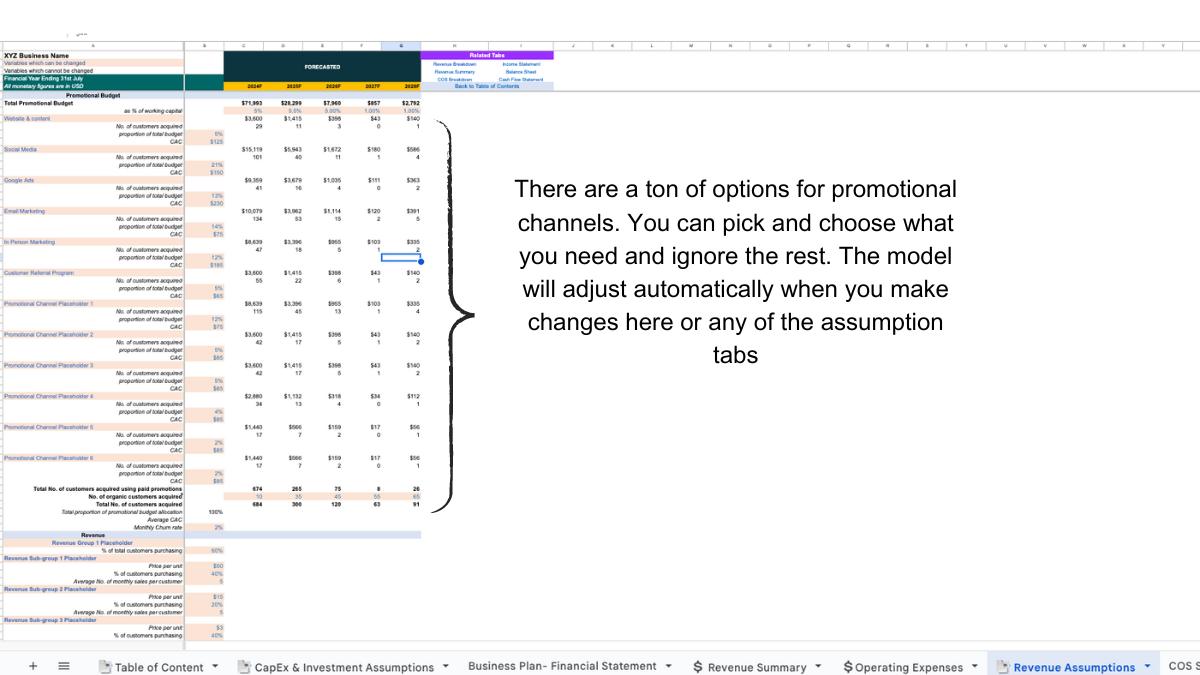

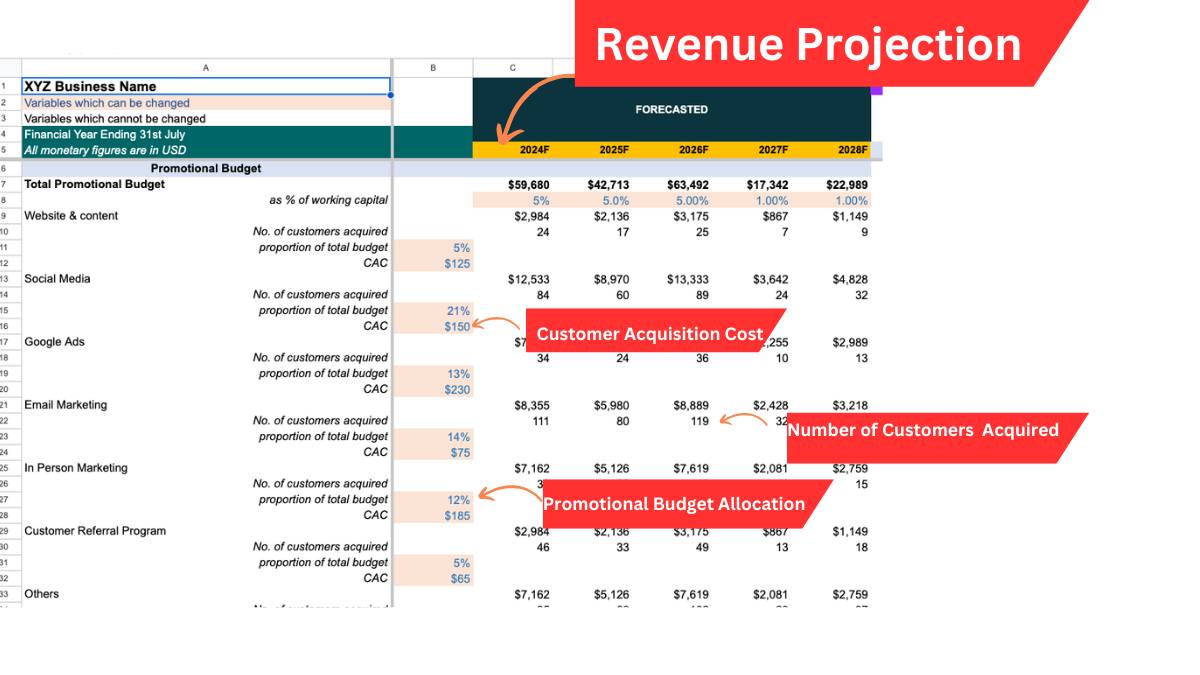

Now, let’s focus on Revenue Assumptions but before that we have to look at the promotional budget allocation.

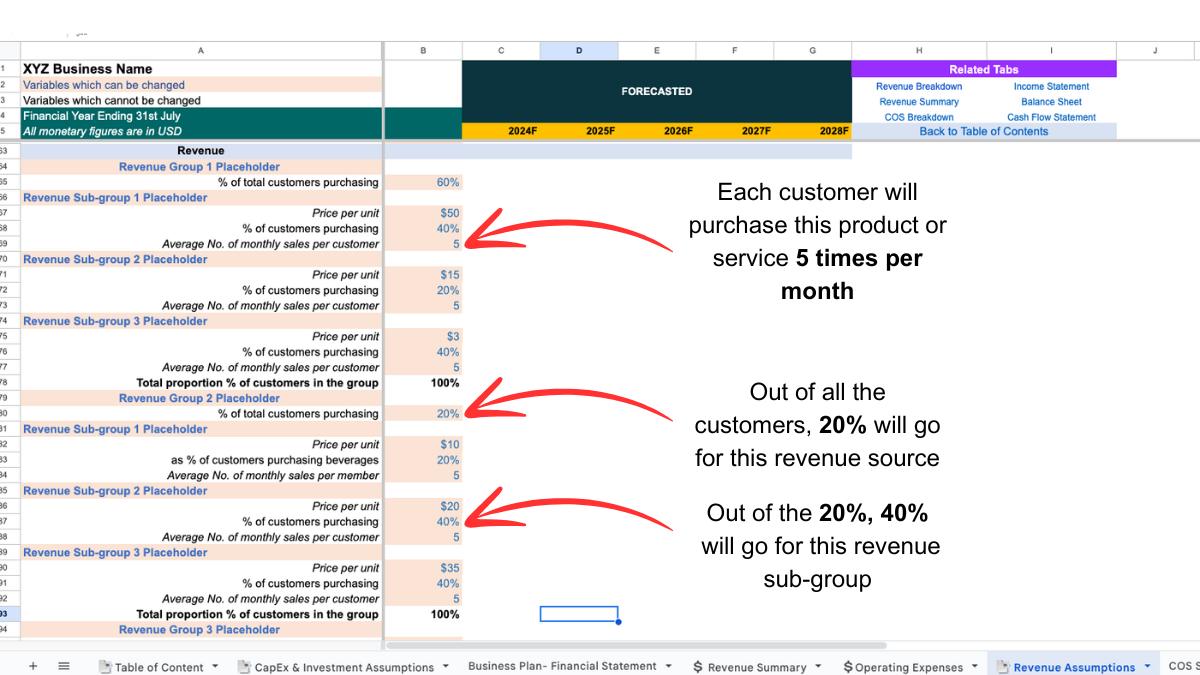

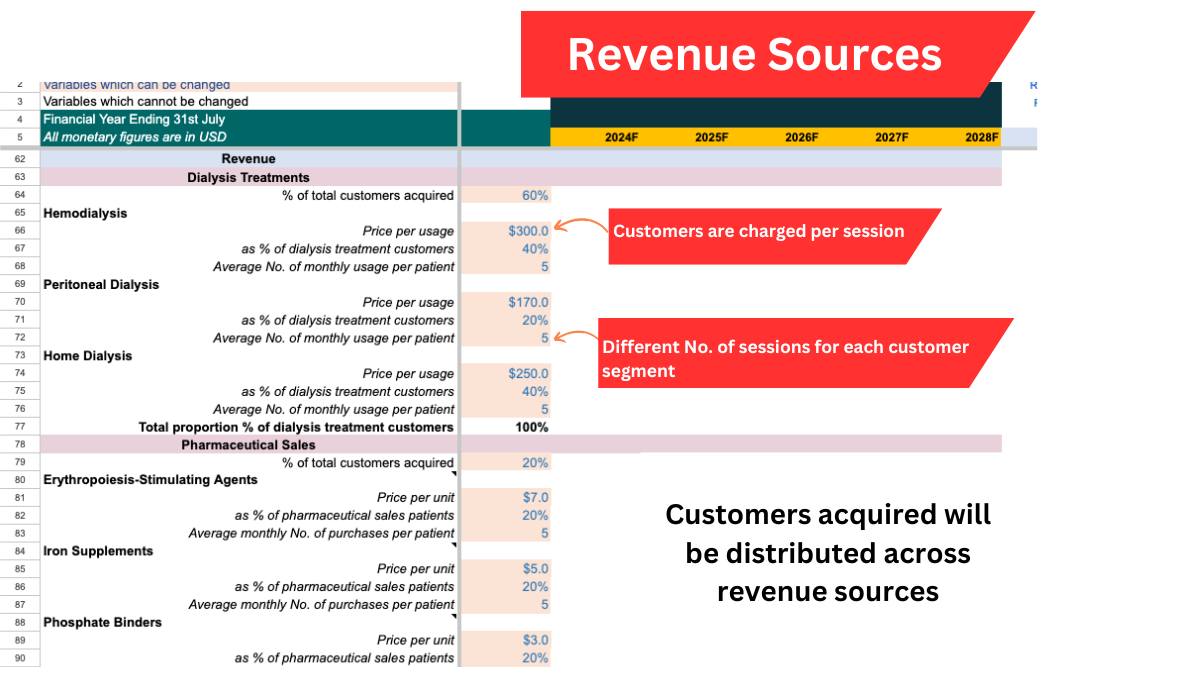

Now, let’s look at the Revenue Section

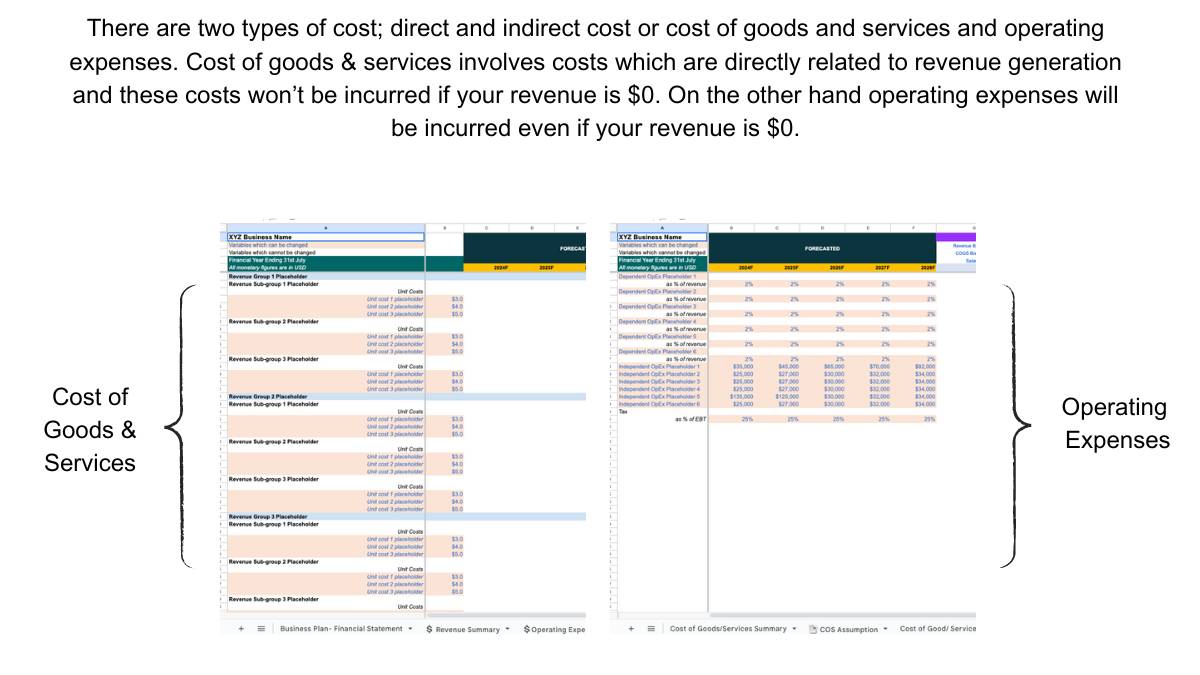

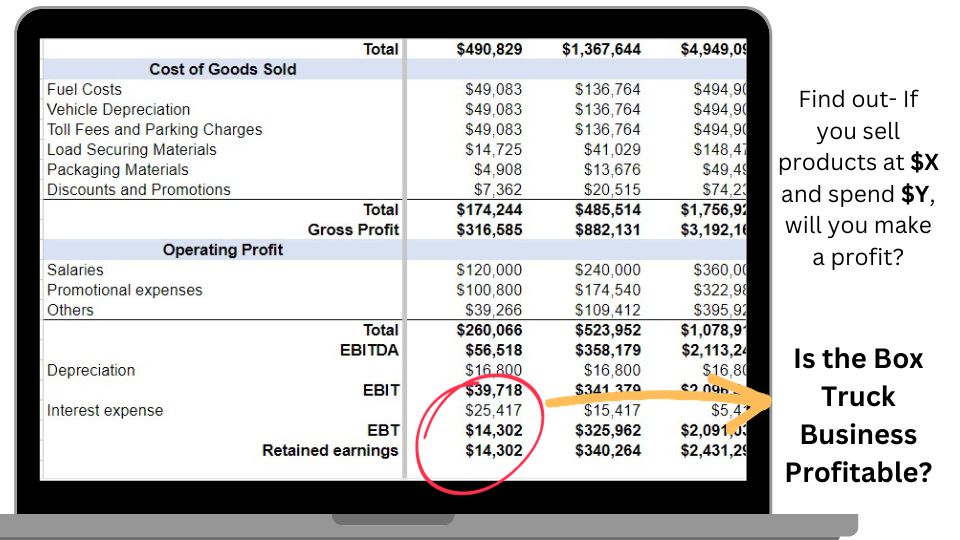

After Revenue, lets move on to Costs……..

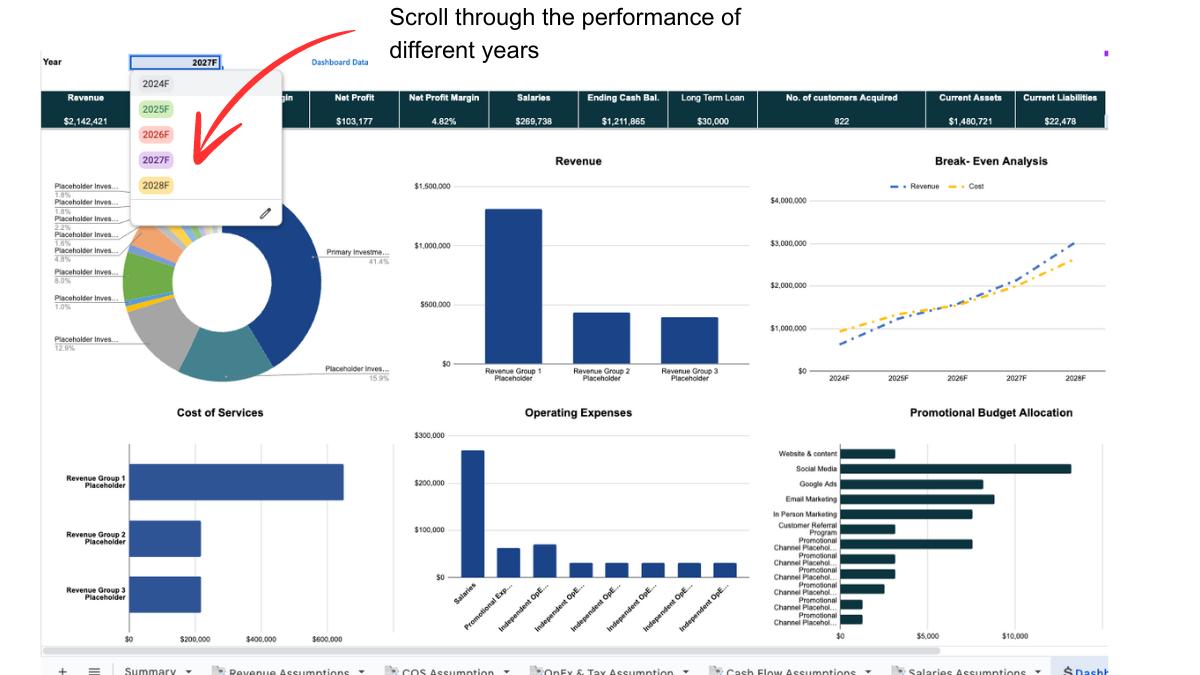

Once you are done entering numbers across assumption tabs then check the Dashboard

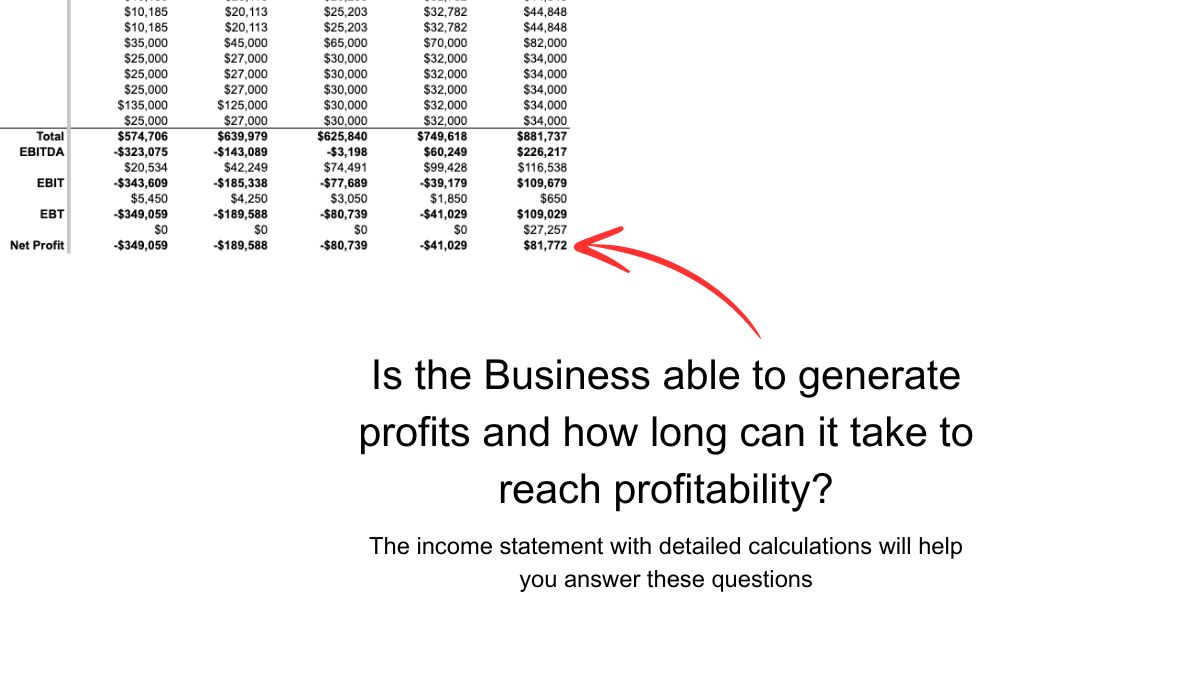

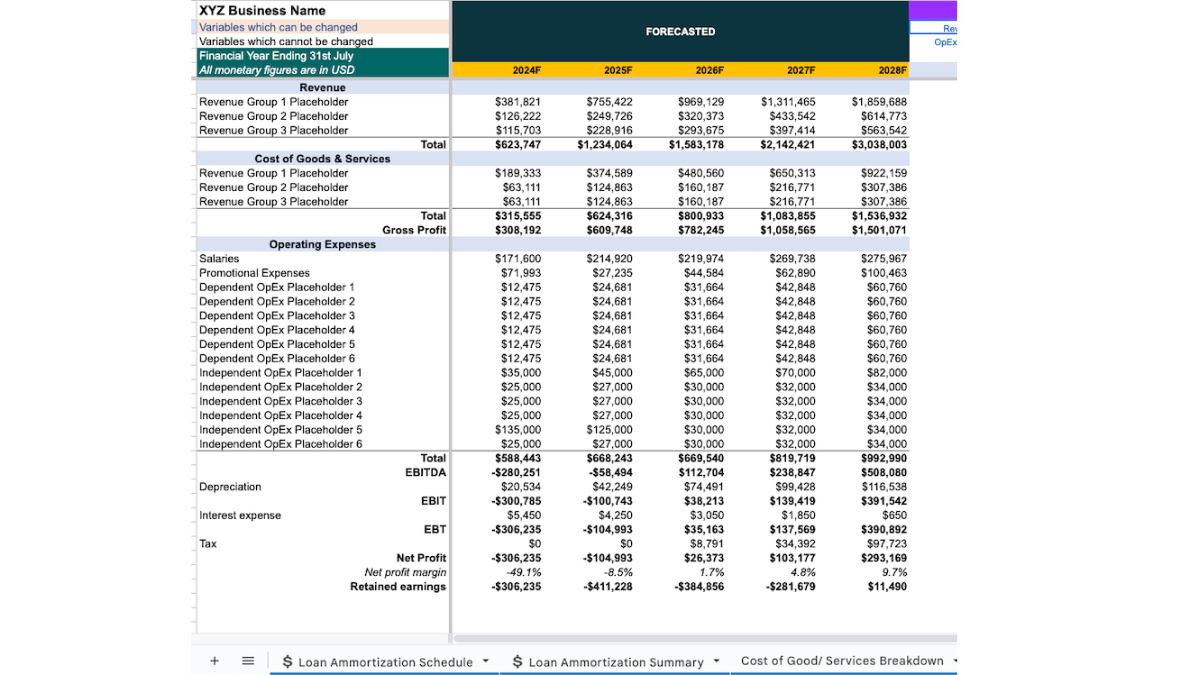

Then check the Income Statement…..

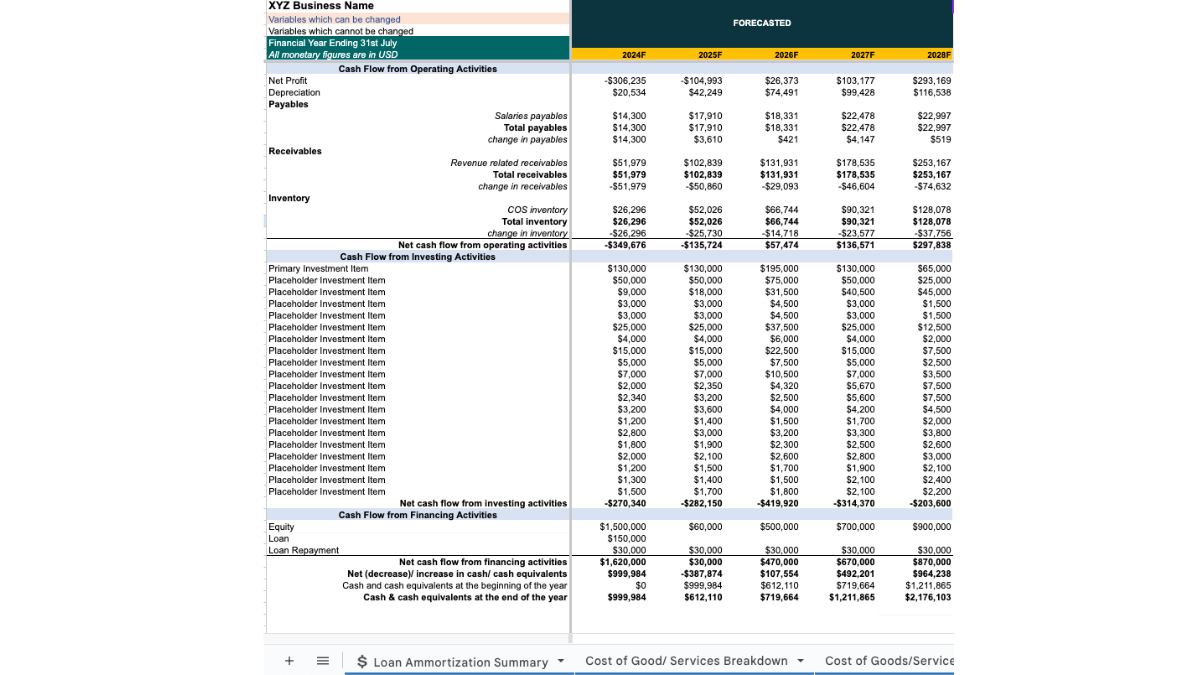

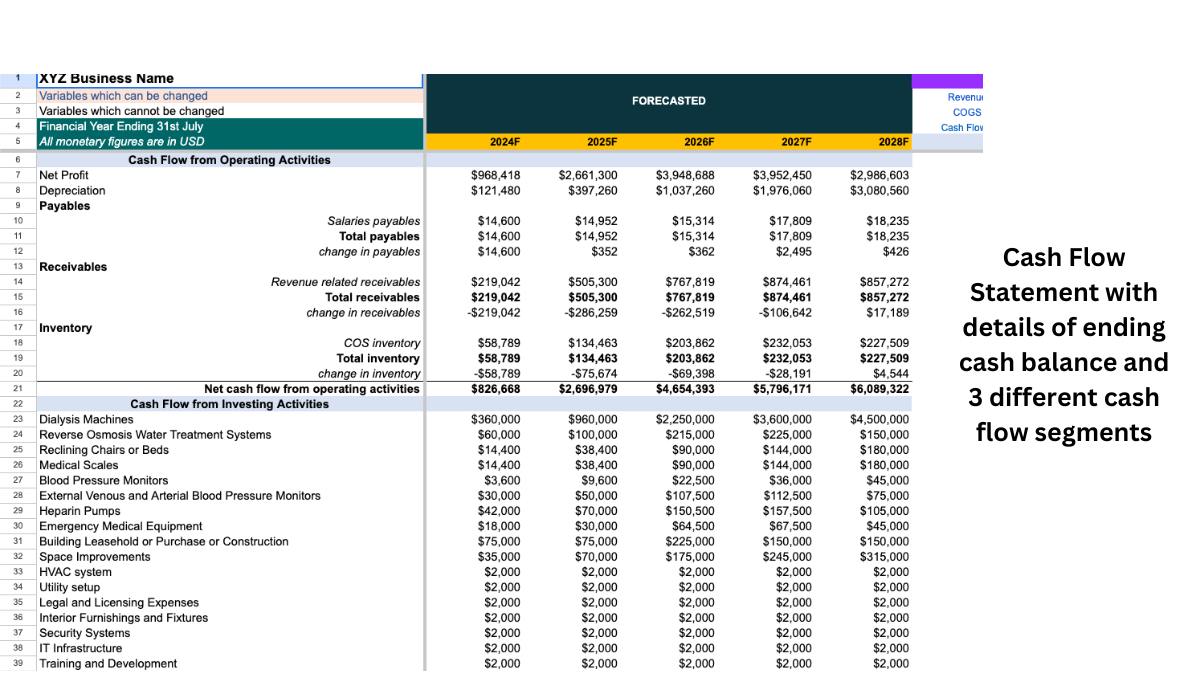

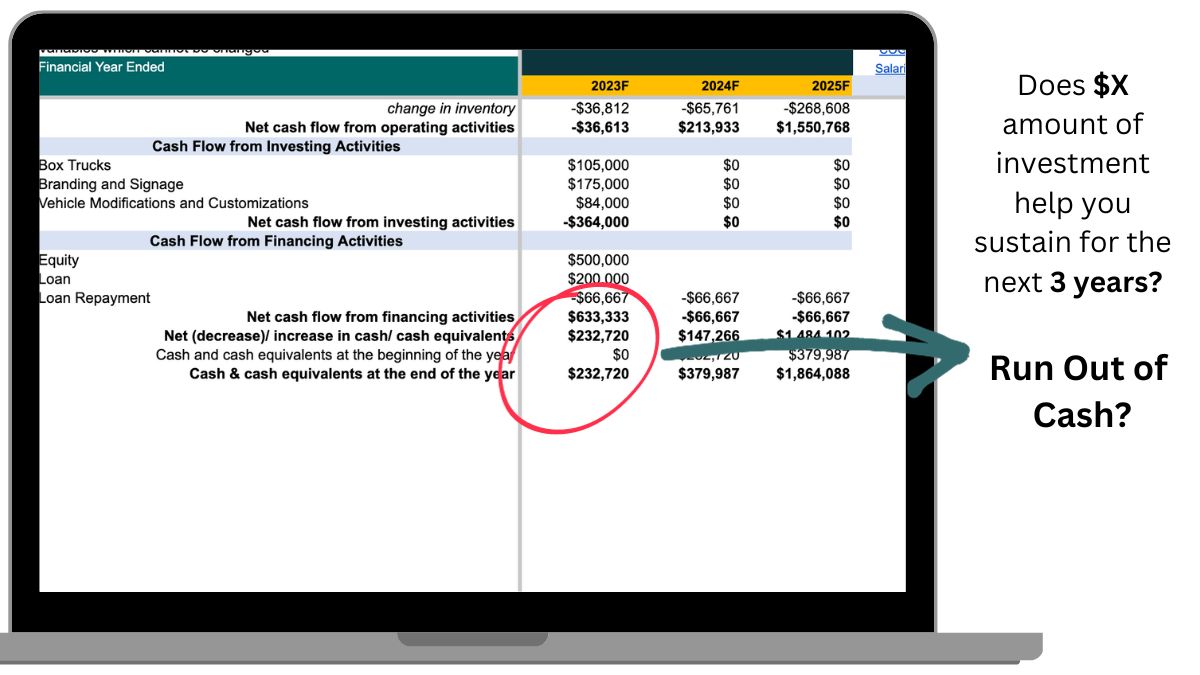

Then check the Cash Flow Statement…..

Then check the Balance Sheet…..

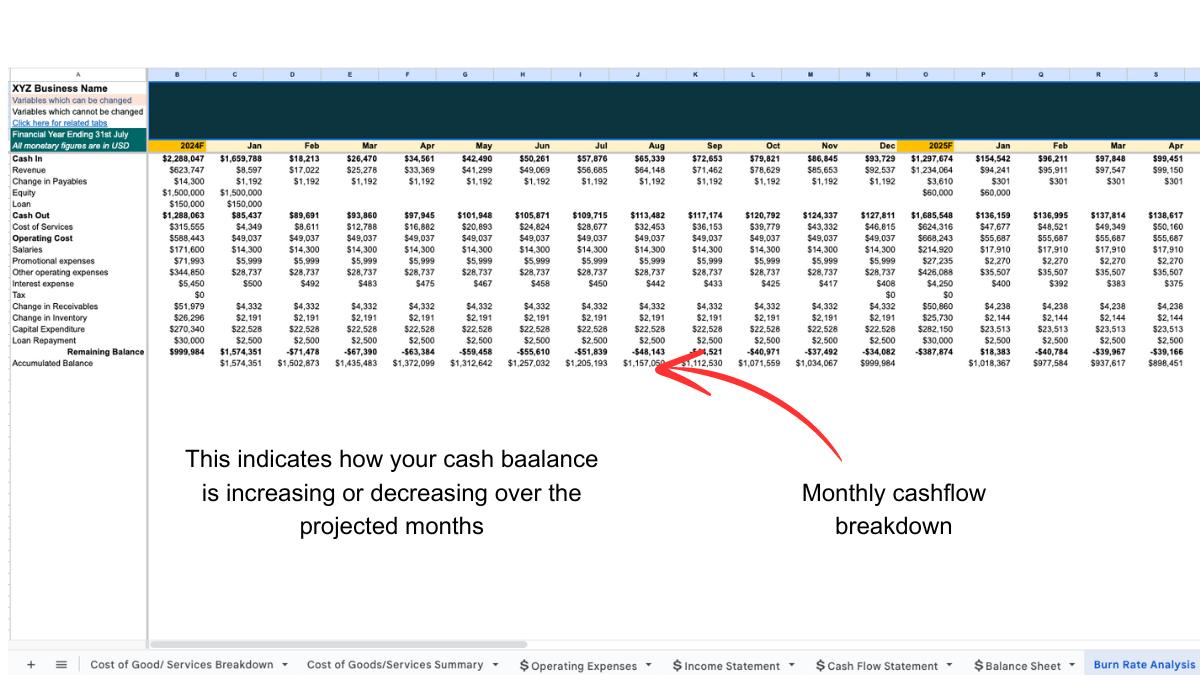

Burn Rate Analysis

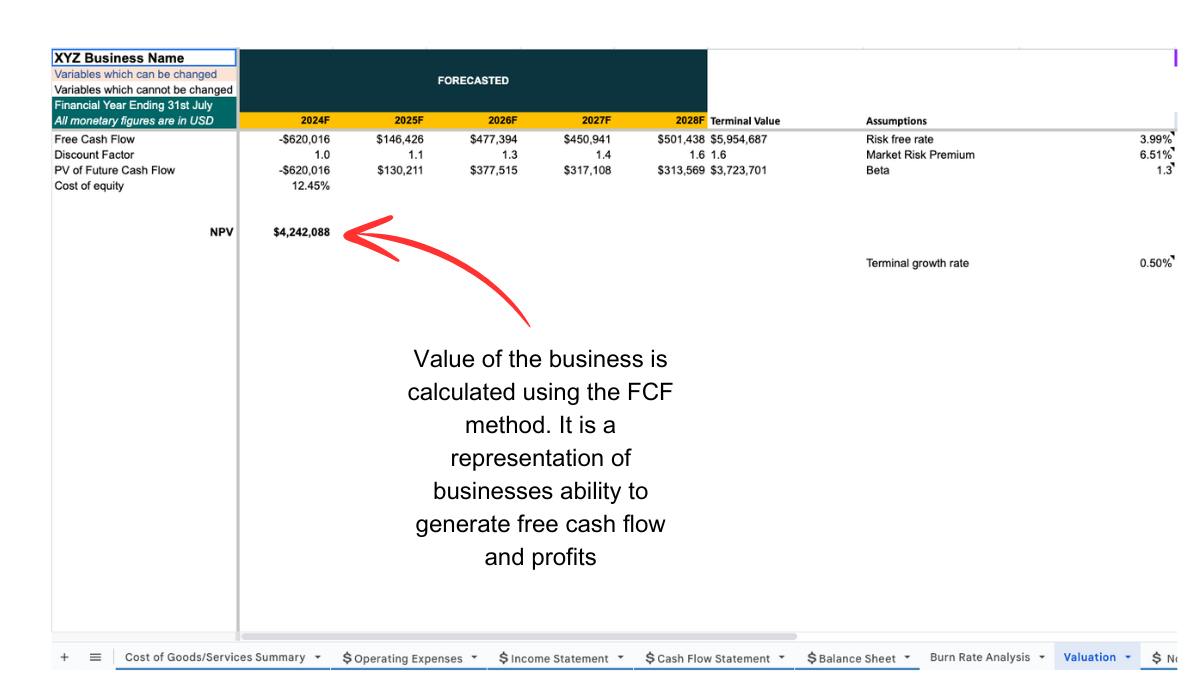

Valuation of the Business

Who is my target market?

How do I acquire customers from my target market?

Grab your doc file and spreadsheet fast before we run out of stock!

Cut The Bullshit And Show Me Some Goddamn Pages For Free So I Know What I’m Getting Here!

Okay, okay…Now, before we make this magical little exchange where you give me money and I give you your very own copy of Sell Like Crazy…

Sample Business Plan

We have written a business plan and financial model using this template so that you get a clear idea on how powerful the template is!

Sample Financial Model

But My Business Is Different And This Won’t Work For Me…

That’s what you might be saying to yourself…

That’s what that little voice in your head is probably muttering…

“This all sounds great”….

“But my dialysis center is different and this won’t work on my type of patients”….

However, I will personally GUARANTEE you it will.

You see, if for some strange reason you try the strategies outlined in this template and they don’t EXPONENTIALLY grow your dialysis center…

Sound fair? Cool.

Listen, I’ve either got balls the size of church bells…

Or have completely lost my marbles.

Because I mean, show me someone else who stands behind their products like this. Seriously.

Anyhoo.

After you download the template……..

How to Write the Ecommerce Business Plan?

I will write a complete business plan for XYZ Dialysis Center in this demo!

Step 1: Download the Business Plan

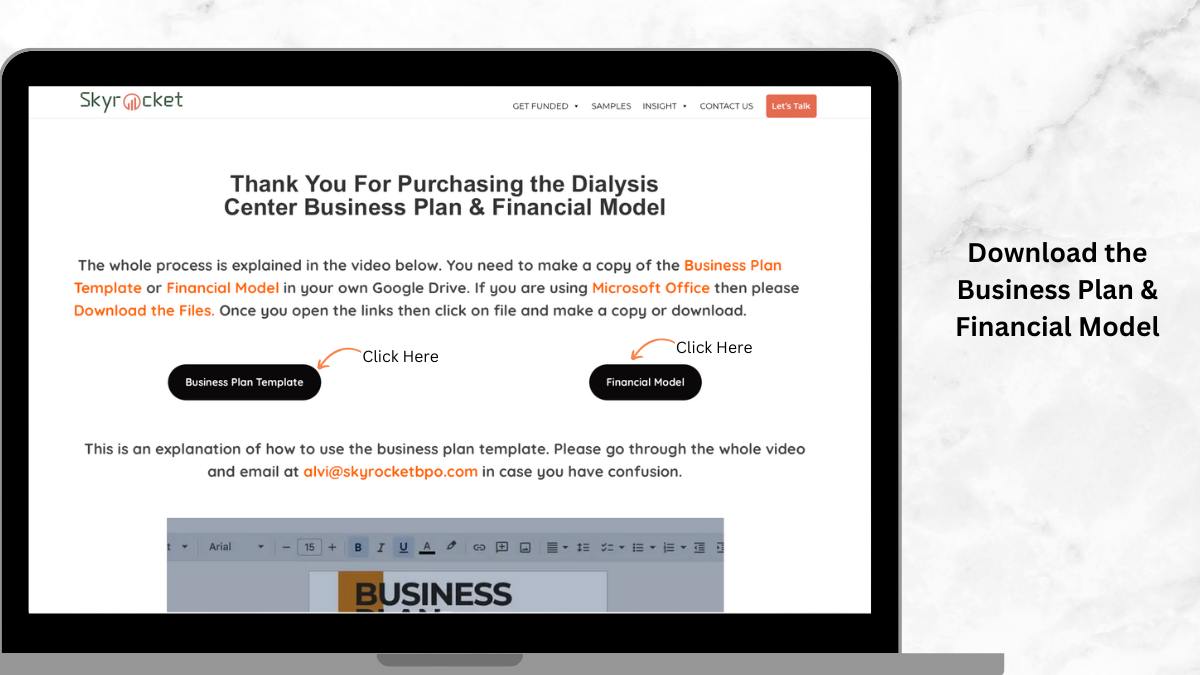

After you download the Business Plan then you will be redirected to the Thank You Page which contains link to the business plan template and financial model. The click on the Business Plan Template Button and Financial Model to use them.

Step 2: Start with the Financial Model & Industry Analysis

You should start the Business Plan from the Financial Model and Industry Analysis sections as it helps you build the structure of the overall business and your plan.

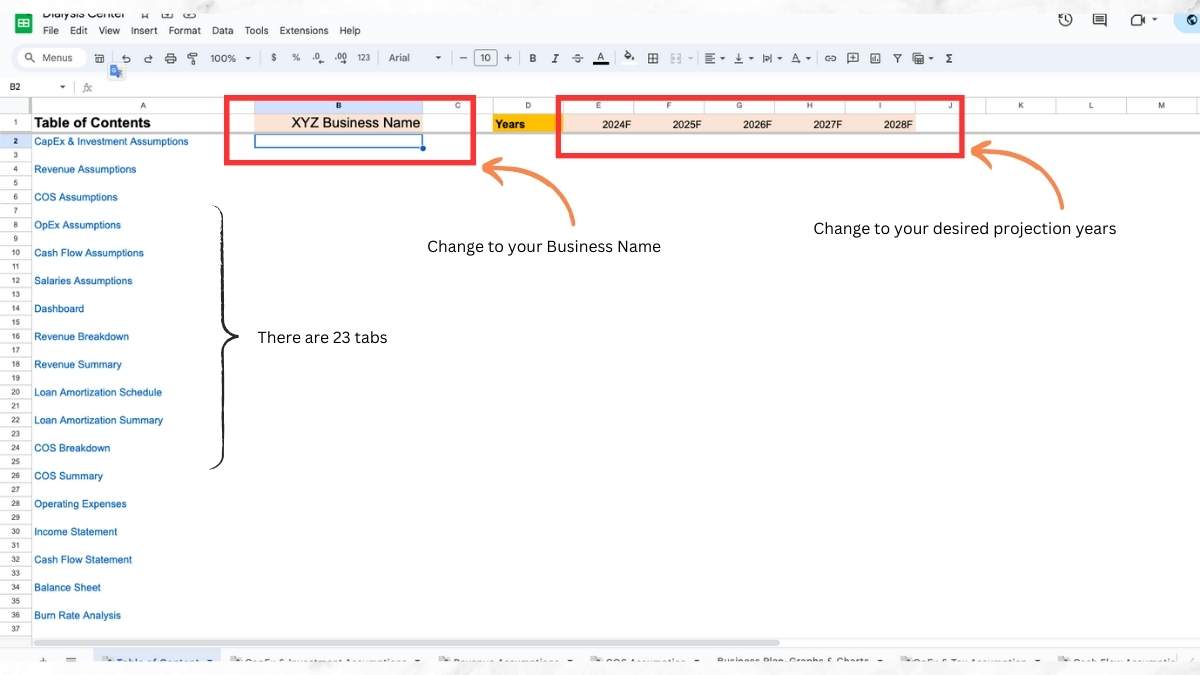

When you open the financial model then it looks like this:

Step 2: Financial Model Starts with Investment

Find out how many trucks are necessary to generate $500K per year. If you want to invest your own money then just enter the figure in equity cell of the spreadsheet. If you wish to take a loan for N number of years with X% of interest then just enter the figures and the model will take care of everything.

This is part of CapEx where we have provided prefilled items. Dont have to waste time on finding the items. You have the option to choose between large, mid or small trucks and you can also operate with 3 types of trucks simultaneously. We have researched prices of large trucks, mid sized trucks and small trucks. The best is that you dont have to worry about if you need more or less investment based on revenue projections.

The Prices of key items such as trucks, maintenance equipments and other key investment items are well researched and already entered in the modely. So, you dont have to waste your precious time browsing countless pages on Google to find these info. However, if you think of changing any of the investment figures then you can do that as well.

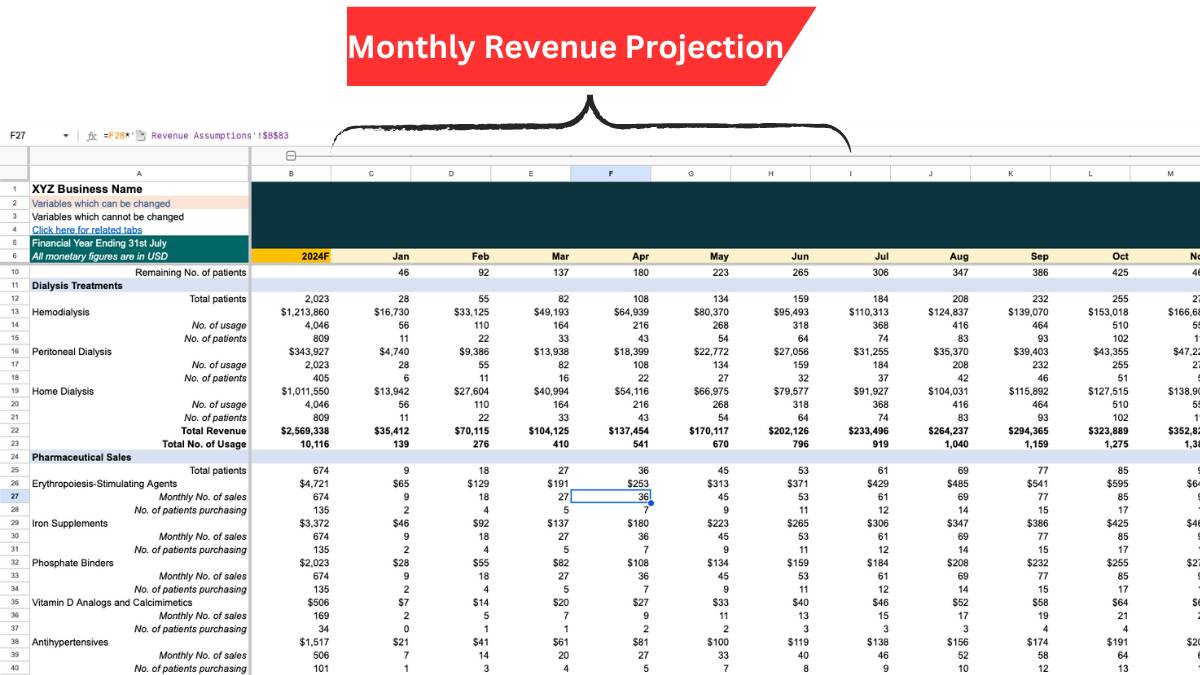

Step 3: Revenue Assumptions

The revenue of your business depends on how many customer you can acquire. Now there are 2 ways to acquire customers- increase marketing budget or find people organically who are willing to take your services. In our model, you can adjust for both the ways! In addition, we have included number of promotional channels which might be used by you such as website, in-person marketing, Google Ads, etc. So let’s say that you are using in-person marketing and you have 3 people on payroll to find new customers by either cold calling them or visiting them personally. If you spend $50K on salaries for these 3 people per month and on an average they are able to bring in 25 new customers every month. So, for acquiring each customer you need to spend around $2,000. In the model you can adjust these factors and find out if your business can be profitable and your cash flow can be sustainable to run your business for the long term.

Let’s delve into the revenue structure for your dialysis center, connecting it to the patient acquisition metrics from the previous discussion. In the initial year, let’s envision your center engaging 100 new patients. Of these, 70% enroll in ongoing treatment plans, reflecting strong patient retention or a subscription-like model, while the remaining 30% are associated with one-time or short-term treatments. Consequently, 70 patients contribute to your Recurring Treatment Revenue, and 30 patients to your One-Time Treatment Revenue.

Further breaking down the group with recurring treatments, consider:

40 patients are on a fixed schedule, receiving multiple treatments per week (high frequency),

20 patients visit for regular but less frequent sessions, perhaps aligned with specific health plans or during certain times of the year (moderate frequency),

10 patients come in for occasional treatments, possibly when transitioning between different health stages or evaluating their treatment plans (low frequency).

This segmentation allows for a tailored revenue framework suited to the unique dynamics of your dialysis center, providing a transparent outline of revenue expectations with detailed breakdowns by month. Such a structured approach aids in precise revenue prediction, accounting for new patient rates, retention levels, and turnover, all of which are crucial for your financial statements and overall fiscal strategy.

By estimating revenue on a monthly basis, you acquire a nuanced understanding of patient behaviors over time — the rate of new patient intake, the proportion of returning patients, and the attrition rate. This granular insight facilitates more accurate financial forecasting and informed strategic planning for your dialysis center.

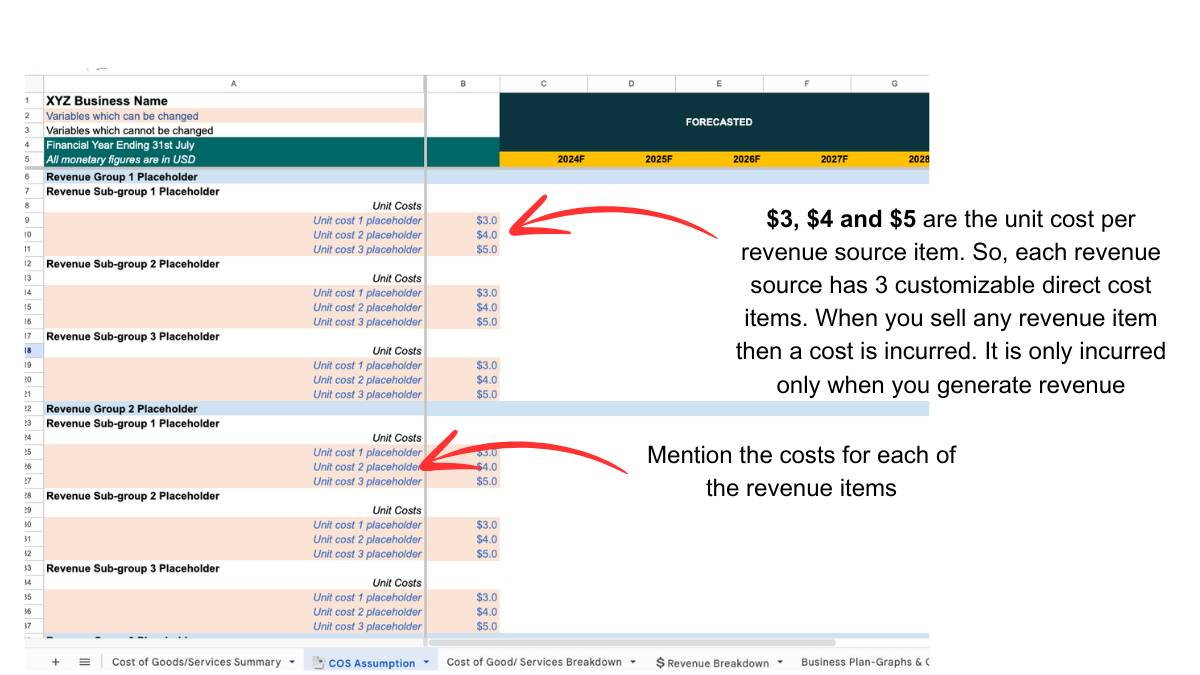

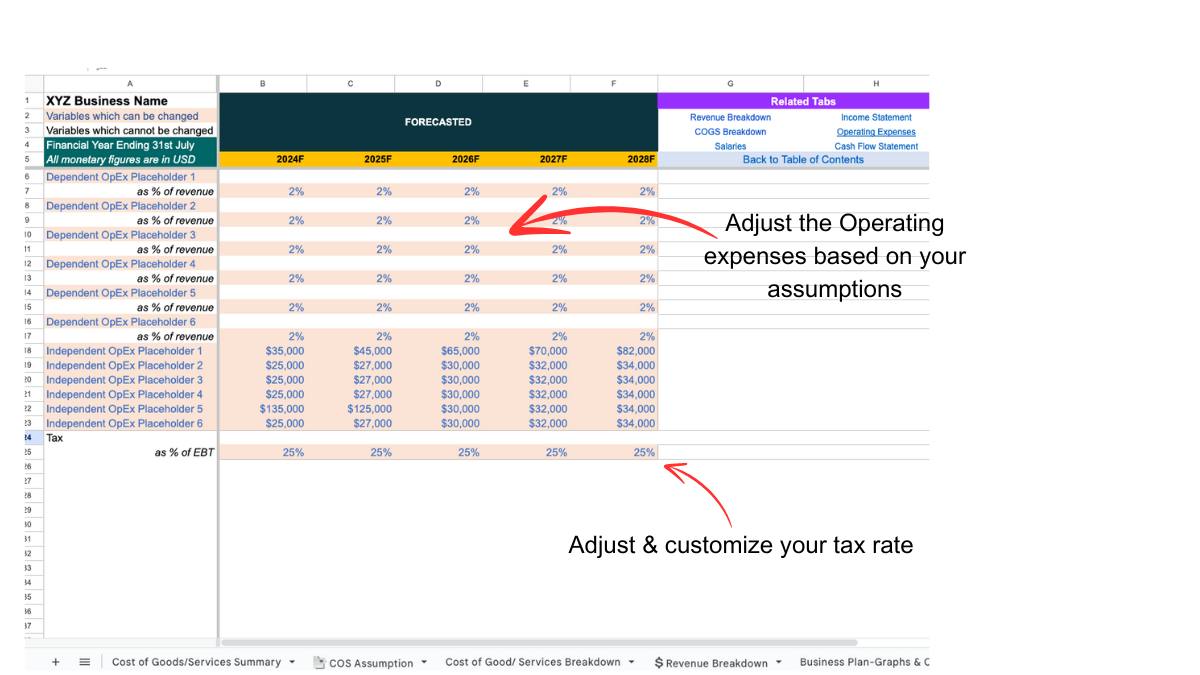

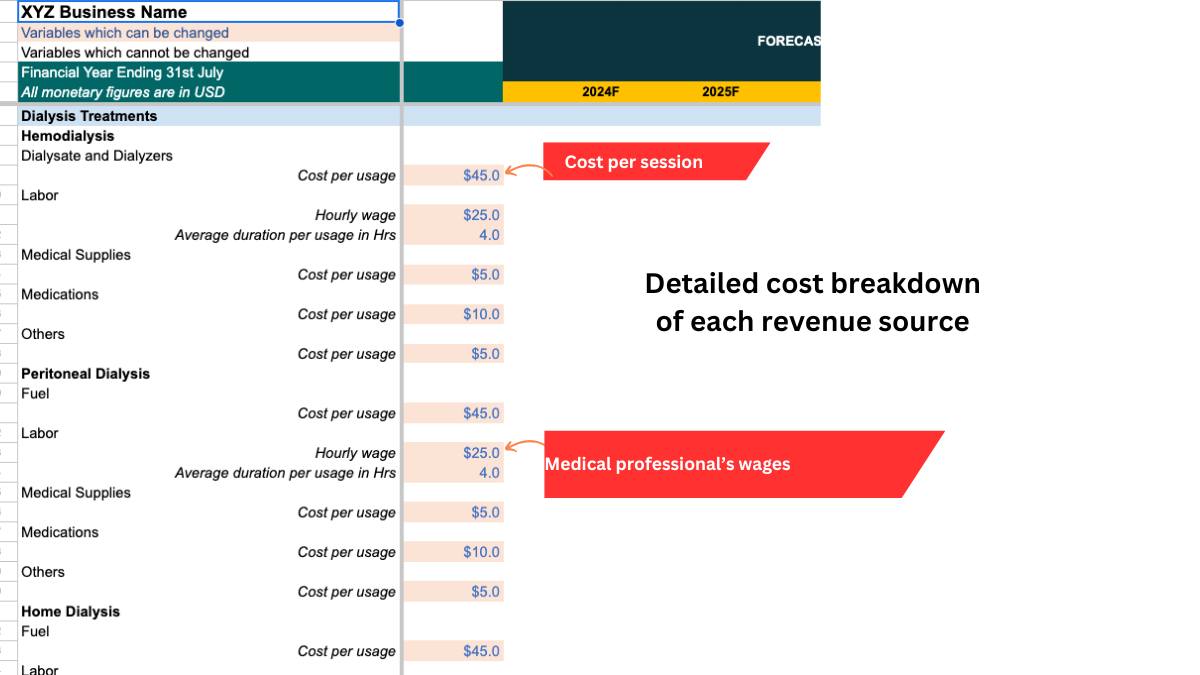

Step 4: Cost Assumptions

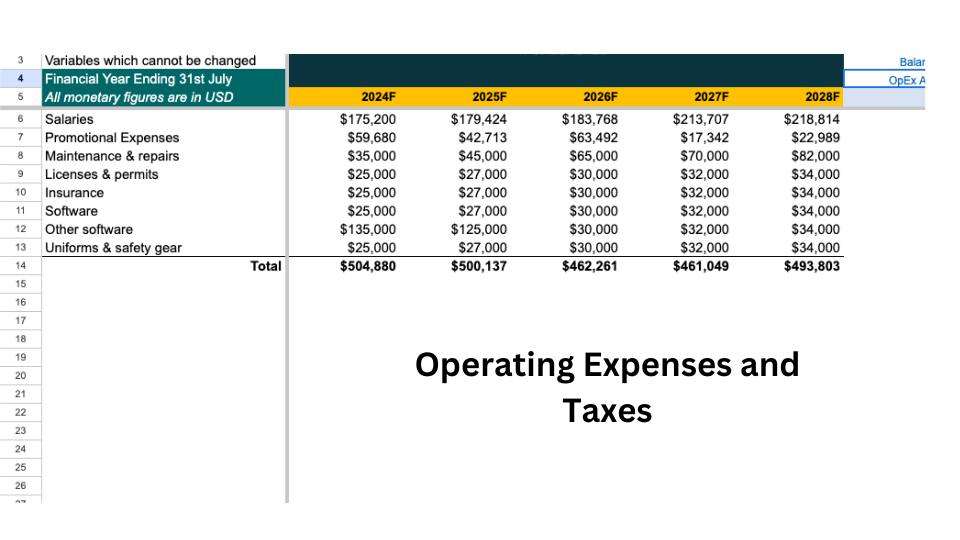

In the context of your dialysis center, understanding the distinction between variable and fixed costs is essential for effective financial management. Variable costs change with the number of treatments provided—for example, as you treat more patients, the costs for medical supplies (such as dialyzers, tubing, and saline solutions) and consumables will increase. Other variable costs may include utilities like water and electricity, which can vary with usage levels, and charges for medical waste disposal, which grow with the volume of waste produced.

Conversely, fixed costs remain steady regardless of the number of patients treated. These include expenses such as rent for your clinic space, salaries for your core administrative and medical staff, and subscription costs for any healthcare management software used in operations. These costs are incurred even if patient numbers fluctuate.

According to Generally Accepted Accounting Principles (GAAP) and the Financial Accounting Standards Board (FASB) guidelines, these costs are categorized into Cost of Services Provided (CSP) and Operating Expenses (OPEX): Cost of Services Provided (CSP): This category includes all the variable costs directly associated with providing dialysis treatment. It covers the cost of medical supplies, direct labor by medical staff engaged in patient care, and any other direct costs like sanitation and patient-specific treatment adjustments. Operating Expenses (OPEX): These represent your fixed costs, encompassing all the overhead necessary to operate your center but not directly tied to patient care. This includes rent, utilities, non-medical employee salaries, marketing expenses, and any software or administrative costs.

Understanding the difference between these two types of costs is crucial for accurately reporting your financial performance, forecasting future expenses, and pricing your services competitively while ensuring your center remains profitable.

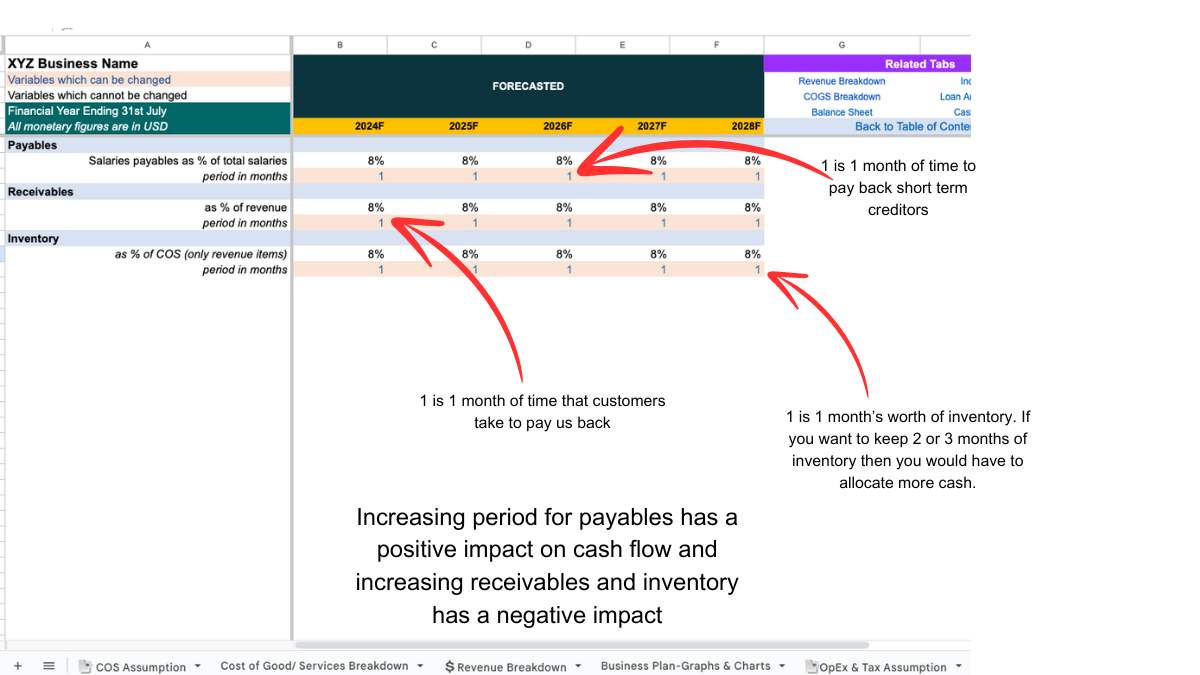

Step 5: Cash Flow Assumptions

For your dialysis center, effective cash flow management is crucial and relies on assumptions related to patient billings, supplier payments, and inventory management.

Patient Billing Assumptions: If patients or insurance companies delay payments for treatments, this will increase your accounts receivable balance, potentially affecting your cash flow. Offering incentives for prompt payment or implementing more stringent billing policies could help mitigate this issue.

Supplier Payment Assumptions: Postponing payments to your suppliers for medical supplies (such as dialyzers, tubing, and saline solutions) might temporarily improve your cash position. However, it is essential to manage these delays with care to avoid harming relationships with suppliers. Negotiating extended payment terms in advance can offer similar benefits to your cash flow without the associated risks.

Inventory Assumptions: Maintaining large amounts of medical inventory can significantly immobilize cash. Implementing just-in-time (JIT) inventory practices or improving demand forecasting can help reduce the financial impact. For a dialysis center, it is also vital to balance the need for sufficient medical supplies and equipment against the costs of holding large inventories.

These assumptions are critical to your financial strategy and cash flow management. By judiciously handling patient billings, supplier payments, and inventory levels, you can ensure a more stable cash flow, facilitating smoother operations and the financial flexibility to capitalize on opportunities for growth in your dialysis center.

Now Let’s Dig Deeper….

Step 5: Analyze Results of the Financial Model

Now that you have entered every assumptions into the model, WHATS THE OUTCOME?

✔️ Minimum Capital Requirements: Estimate the essential startup funds based on anticipated expenses for initial facility setup, marketing, medical inventory, and operational costs in line with your service delivery targets.

✔️ Cash Flow Projections: Analyze how cash flow might be affected under various circumstances: if patient numbers fall short in the initial years, if patient acquisition costs exceed expectations, or if there are unexpected rises in medical supply expenses. This analysis will help gauge your clinic’s financial stability without substantial initial capital.

✔️ Securing Financing: When seeking funds through loans or investor contributions, this financial model will guide you in detailing: the total capital required, the justification for this amount, intended use of the funds, the timeframe for achieving profitability, and comprehensive plans to reach these financial goals. It also supports your patient service and expansion predictions with robust figures and assessments.

✔️ Viability Evaluation: Assess the feasibility of opening a dialysis center by examining market needs, competitive landscape, pricing models, and expense frameworks.

✔️ Strategic Planning for Established Facilities: For those already active in the healthcare sector, this financial model provides an impartial viewpoint to enhance your strategies, improve clinic operations, and strategically plan for future growth or new service offerings.

Step 6: Start Writing The Business Plan with Industry Analysis

You should start the business plan from the industry analysis which will help you finetune the numbers in the model. For e.g. in the competitive landscape analysis of industry analysis you have to extract pricing and other information of competitors. Now, sometimes the prices are available on your competitors website or social media and in many cases you may have to contact your competitors. The prices will help you identify the appropriate pricing strategy which can later be fed into the model.

Step 6: Marketing Plan

Start your marketing plan which the promotional channels that you plan to use. Now, in the previous section (industry analysis) you conducted a competitive landscape analysis and that helps you identify the promotional channels used by your competitors. There are tools to identify performance across these promotioanl channels of a particular business, for e.g. you can use Semrush to find out the No. of visitors on a competitors website per month. This can help you figure out how polular a competitors is. Also, you can find out which blog pages are visited most by the target market in your competitors website to find out interesting topics for your target market.

Step 7: Operational Overview

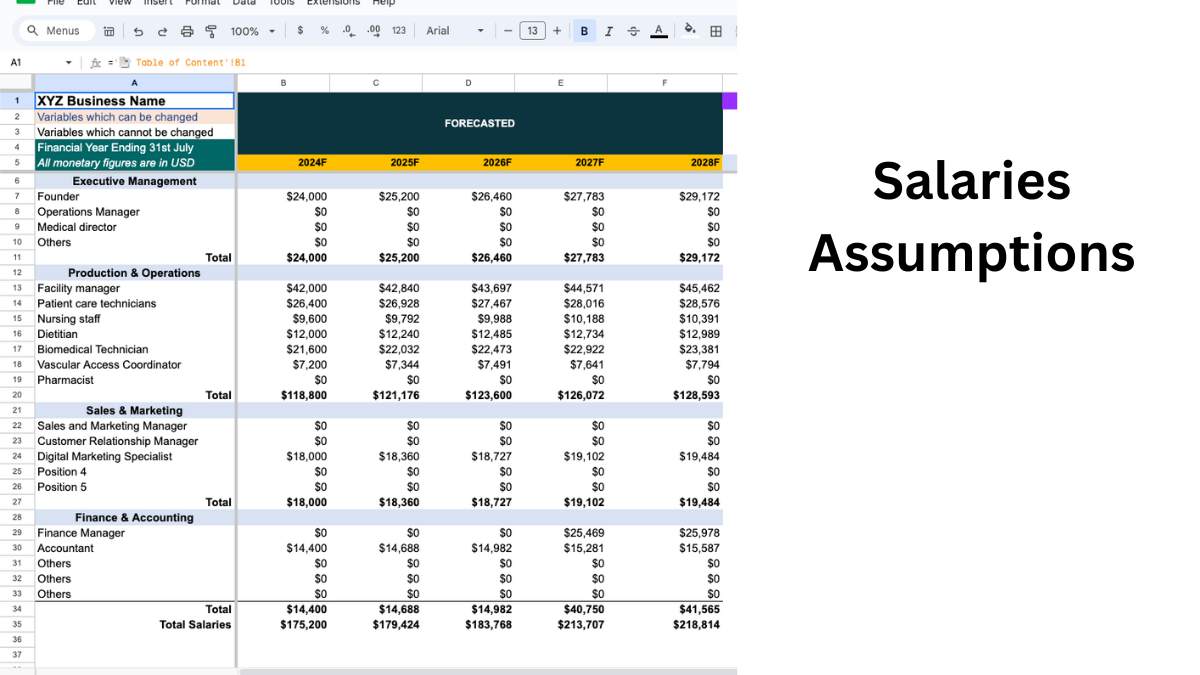

Step 8: Organizational Overview

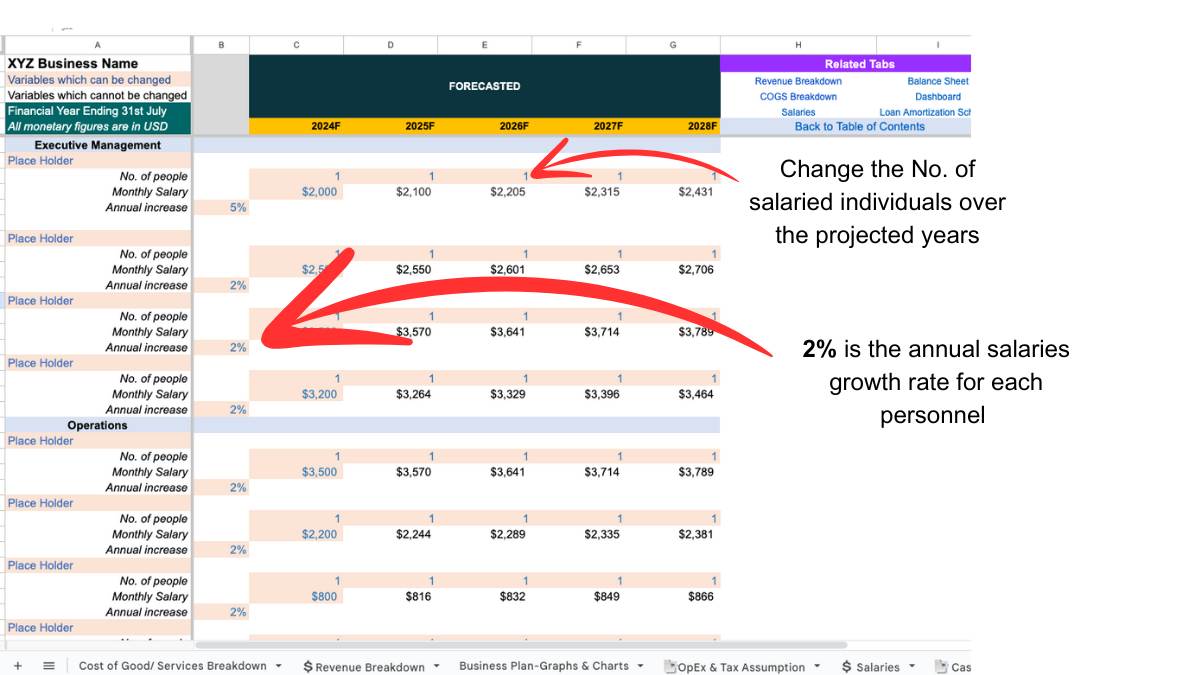

Make a list of personnel that you plan to recruit, their salaries and other benefits. Write down the job description of each position. Then create an organogram with appropriate hierarchy.

Pick & Choose! The most applicable positions and job descriptions for the dialysis center have likely been provided. Retain what is necessary and remove what is not. The requirements for each dialysis center vary. For example, if you are partnering with external medical services, you might not need in-house nephrologists.

Step 9: Executive Summary + Other Sections

Make a list of personnel that you plan to recruit, their salaries and other benefits. Write down the job description of each position. Then create an organogram with appropriate hierarchy.

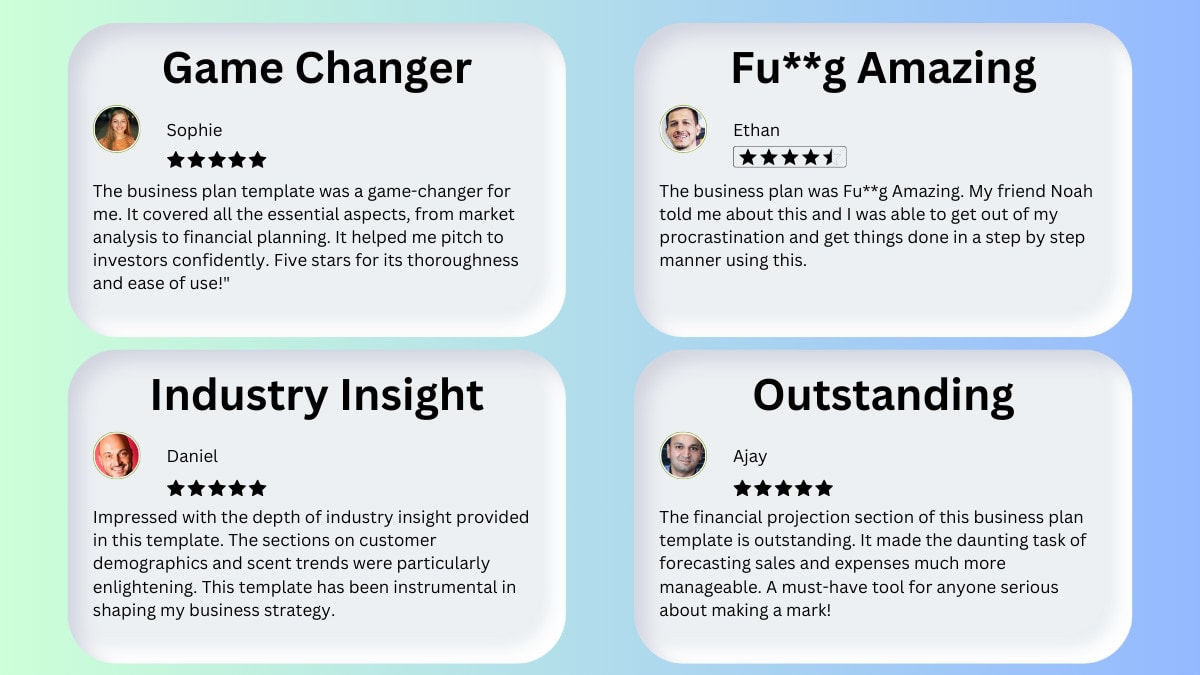

Reviews

340+ Downloads & Counting

The dialysis center business plan templates and financial model have been a game-changer for my startup. They’re incredibly detailed and easy to use, making my business planning a breeze.

★★★★★

I was hesitant at first, but the template and financial model have exceeded my expectations. They’ve provided me with a roadmap for success in the box truck industry.

★★★★★

The dialysis center business plan is well-structured and comprehensive. Combined with the financial model, they’ve given me a clear understanding of the box truck market and its potential.

★★★★★

I’m impressed with the quality of the financial model. It had a lot of info which I did not even think of earlier.

★★★★★

F.A.Q

Yeah but will this template help me get a loan?

Maybe. This mostly depends on your business idea, previous experiences, ability to provide collateral and relevant factors. This is a template for present your plan in the best possible way. In addition, the financial model helps to validate your business concept or your expansion plan. It’s kind of hard to provide more for just $49.

Is the payment secure?

Our payment is processed by Stripe or PayPal so you can rest assured about your data privacy and security.

What is the refund or cancellation policy?

Due to the fact that templates are downloaded, we cannot give refunds.

Digital material is exempt from the 14-day return policy applicable to physical products. Because of this, our downloadable content are non-returnable. All sales are final. You can also check out the video in the product page to get an idea of contents of the template. This should help you get a clear idea on the features of the product.

However, we do value the customer experience and are accessible to assist you with any problems you may have while using our goods. If you have particular queries regarding our product, please use the chat box on this page or send an email to [email protected].

How can I edit the template?

Simple. If you are using Google Doc and Sheets then just make a copy in your own Google Drive. In case you are using Microsoft Office then Download the files and start editing.

What about support?

You can email us at [email protected] and we will respond in 24 to 48 Hrs. We offer in-person or email based support depending on your needs.

Every other reason for not buying....

❌ “But you can’t replace hiring a business plan writer to do this”

✅ This template costs $49 not $2,000. Also, you have more control over the writing process. The template is very specific so you will have relevant info in Industry Analysis, Financial Model and other sections.

❌ “I feel like just browsing online and using the free templates available online.

✅ Sure, if you wish to spend 4 weeks instead of 2 days to write a plan then please go ahead. Our research team found that free resources are very generic and does not offer fill-up and use facility. Also, you won’t get the specialized financial model from the free resources.

❌ But wouldn’t everyone’s content look the same?

✅ Nope. Our customers are smart and customize by adding their own images, logo, company description, etc.

❌ “But can you guaruntee that I will get a bank loan using this?

✅ No, I cannot guarantee anything for $49. The purpose of this template is to make it easier and less time consuming for you to write a business plan.

Who developed this template?

Our templates are developed by CPAs, CFAs and Ex- consultants of BCG, Mckinsey, PwC and KMPG. Elma Steven is the Head of our Quality Control.

Can I validate my the prospect of my MVP using this?

Yes. The financial model will help you plug in price, unit cost, payables and other assumptions which will allow you to project the revenue, profit and other KPIs.