Written by Elma Steven | Updated on April, 2024

How Do I Write the Rental Property Business Plan?

Rental Property Business Plan is an outline of your overall rental property business. The business plan should includes a 5 year financial projection, marketing plan, industry analysis, organizational overview, operational overview and finally an executive summary. Remember to write your executive summary at the end as it is considered as a snapshot of the overall business plan. You need to be careful while writing the plan as you need to consider various factors that can impact the business’s success.

Table of Contents

Executive Summary

Sophia Martinez’s Sunshine Gateway Rentals is a private vacation rental company in the vibrant and beautiful Miami Beach neighborhood. We are experts at making our guests feel right at home and our offerings include vacation rentals for the short or long term, customized itineraries and concierge assistance based on their specific needs. With a wealth of expertise and a genuine enthusiasm for making guests’ stays really memorable Sophia brings more than fifteen years of experience to the table in the hospitality sector. Sunshine Gateway Rentals’ excellent, well-maintained homes, together with our outstanding customer service and commitment to tailoring holiday experiences to each guest’s unique requirements constitute our USP.

Mission: Our focus is on ensuring every guest feels valued, providing impeccable service and crafting unique personalized experiences that make every stay special.

Vision: Our vision is to establish Sunshine Gateway Rentals as a leading name in Miami’s vacation rental market, renowned for our commitment to quality, guest satisfaction and for creating a home away from home.

Industry Overview:

The US vacation rental market is a booming industry, with a current size estimated at USD 19.39 billion in 2023 (Statista). While the overall market growth rate is projected to be moderate at 1.49% from 2023 to 2027 reaching USD 20.57 billion by 2027 (Grand View Research) specific segments within the market are experiencing faster growth.

Check out this guide on how to write an executive summary? If you don’t have the time to write on then you can use this custom Executive Summary Writer to save Hrs. of your precious time.

Financial Highlights:

Business Description

Business Name: Sunshine Gateway Rentals

Founders: Sophia Martinez

Management Team:

Legal Structure: LLC

Location: Miami

Goals & Objectives:

✔️Market Expansion Goals: The plan is to increase the number of properties by 15% per year by using various areas to provide a range of experiences from urban retreats to seaside grandeur. To increase our market reach as a result of this growth by catering to a wider audience including families, business travelers and foreign visitors.

✔️Customer Experience Enhancement: Achieving a yearly gain of 20% in repeat customers is our goal and we will gauge our performance by listening to guest comments. To use technology to facilitate effortless communication and quick service delivery guaranteeing that each visitor has a pleasant and trouble-free stay.

✔️Brand Development and Marketing Strategy: We want to engage in a strong advertising campaign in order to make Sunshine Gateway Rentals a household brand in the Miami vacation rental industry. As part of this effort we will be relaunching our website, launching focused social media campaigns and forming strategic alliances with regional organizations to boost our visibility online. In the first two years we want to boost brand awareness and direct bookings by 30%. Digital marketing will take center stage in an effort to attract the increasingly tech-savvy vacationers who value ease and quality in their booking processes.

✔️Operational Excellence and Sustainability: Sunshine Gateway Rentals is committed to reducing its environmental impact without sacrificing operational performance. From property maintenance to guest services we want to optimize processes for efficiency while maintaining high standards. We can both attract eco-conscious visitors and lessen our impact on the environment by installing energy-efficient equipment and implementing trash reduction programs at our facilities. Through these savings we want to reduce operating expenses by 25% while simultaneously increasing our appeal to a worldwide environmentally conscious audience.

✔️Financial Performance Objectives: Sunshine Gateway Rentals needs development and financial stability more than anything else. Achieving a consistent 20% increase in revenue year over year and sustaining a high occupancy rate of 70% or above across all properties are our financial objectives. To that end we want to broaden our client base implement smart pricing, and provide first-rate service. To maintain Sunshine Gateway Rentals’ competitiveness and profitability and to respond to market developments we must conduct regular financial evaluations. Only then can we secure a sustainable and prosperous future.

Services:

✔️Luxury Accommodations: Sunshine Gateway Rentals offers a wide variety of stunning villas where you may relax in complete luxury. Our selection of accommodations includes chic downtown apartments, serene retreats and luxurious beachfront villas. Modern amenities like as fully-equipped kitchens, high-speed internet, smart home features and quality linen allow guests to experience the ideal blend of comfort and modernity at each of our locations.

✔️Personalized Concierge Services: Sunshine Gateway Rentals caters to each client individually by offering concierge services tailored to their specific requirements. Our concierge service is committed to creating personalized itineraries and they can do everything from organizing transportation to and from the airport and vehicle rentals to reserving exclusive meals and entertainment. For those seeking an additional level of luxury we also provide specialized services such as private chefs, spa treatments and boat rentals.

✔️Event Planning Assistance: For guests looking to celebrate special occasions, Sunshine Gateway Rentals offers event planning assistance. Whether it’s a family reunion, a romantic beach wedding, or a corporate retreat, our team collaborates with local vendors and planners to help organize memorable events. We ensure every detail is taken care from venue decoration to catering and entertainment.

✔️Local Experience Packages: With our carefully crafted local experience packages we aim to fully immerse our clients in the Miami lifestyle. Water sports adventures, individualized shopping experiences exclusive access to Miami’s clubs, events and guided tours of the city’s cultural highlights are all part of the package. Our goal is to ensure that our visitors have a genuine and memorable experience in Miami.

✔️24/7 Guest Support: Recognizing the importance of reliable support, Sunshine Gateway Rentals offers 24/7 guest assistance. Our dedicated team is always available to address any inquiries or issues ensuring a worry-free stay. Whether it’s a late-night request or an emergency situation we are committed to providing prompt and effective solutions.

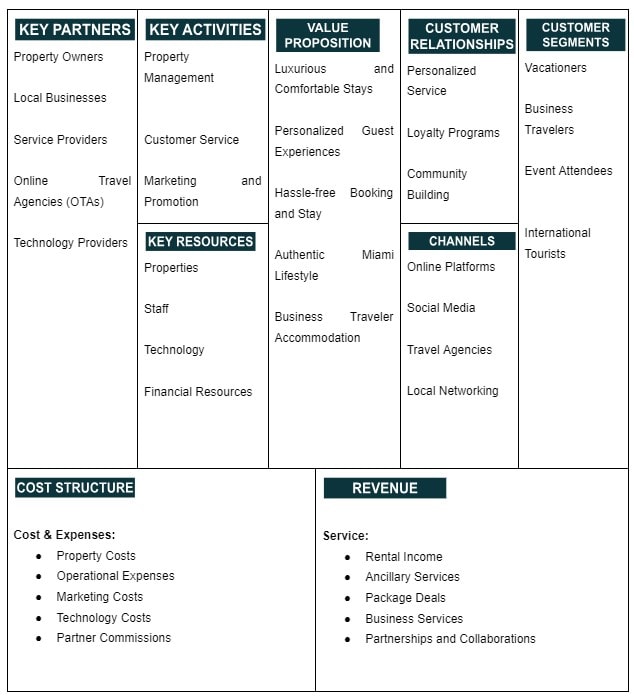

Business Model

Check out 100 samples of business model canvas.

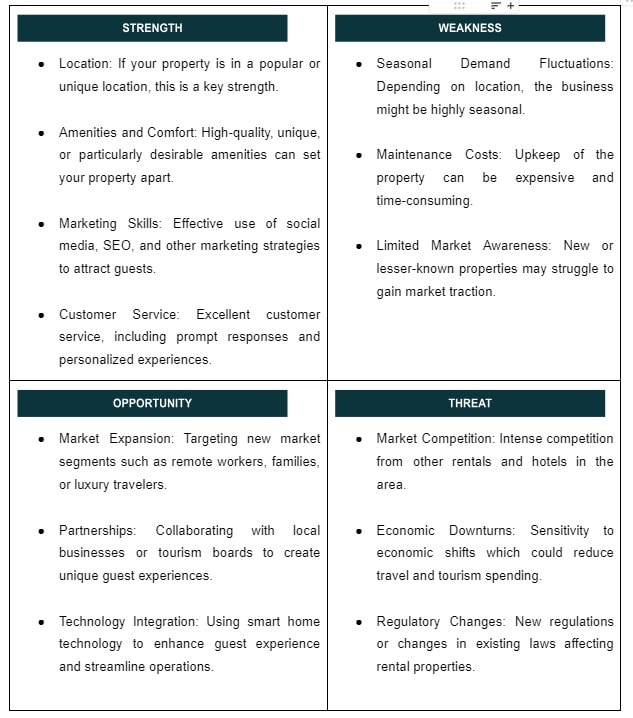

SWOT

Check out the 100 SWOT samples which will give you a better idea on SWOT writing process.

Marketing Plan

Promotional Channels

Digital Marketing and Online Presence – $12,000 (24%)

✔️Website Enhancement: Develop a user-friendly website with booking capabilities, showcasing the property with high-quality images and virtual tours.

✔️Search Engine Marketing (SEM): Use Google Ads to target potential customers searching for vacation rentals in your area.

✔️SEO Strategy: Optimize content with relevant keywords about your property, local attractions and vacation tips to improve organic search rankings.

Social Media and Content Marketing – $10,000 (20%)

✔️Platform Diversity: Focus on Instagram, TikTok and Facebook leveraging the unique features of each for maximum engagement.

✔️Interactive Content: Create engaging content including polls, Q&As and behind-the-scenes tours to increase interaction and visibility.

✔️User-Generated Content: Encourage guests to share their experiences, photos, creating a community around the property.

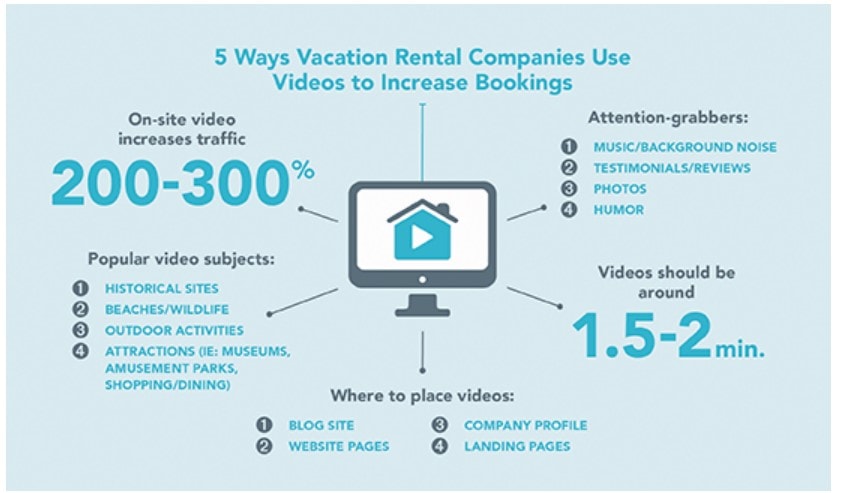

Video Marketing – $8,000 (16%)

✔️Property Showcases: Create high-quality video tours of your property to give potential guests a real feel of the experience.

✔️Local Attraction Highlights: Produce videos featuring local sights and activities positioning your property within the broader travel context.

✔️YouTube Advertising: Utilize YouTube ads to reach a broader audience interested in travel and vacation rentals.

Email Campaigns and CRM – $6,000 (12%)

✔️Personalized Email Marketing: Develop targeted email campaigns based on guest preferences and past stays.

✔️CRM Integration: Use Customer Relationship Management tools to maintain guest data and personalize communication effectively.

Public Relations and Media Outreach – $5,000 (10%)

✔️Press Releases: Distribute press releases about your property, special events, unique offerings to travel and lifestyle media.

✔️Media Hosting: Invite journalists or travel writers for complimentary stays in exchange for coverage in travel publications or blogs.

Community Engagement and Local Marketing – $4,000 (8%)

✔️Local Networking: Engage with local business networks and community groups for referrals and joint marketing efforts.

✔️Participation in Local Events: Sponsor or participate in local festivals or events to increase brand visibility and community involvement.

Print Advertising and Collaterals – $3,000 (6%)

✔️Brochures and Flyers: Design and distribute brochures in local tourist spots, cafes and travel agencies.

✔️Print Ads: Place advertisements in local or niche travel magazines and newspapers to target specific demographics.

Promotions and Special Offers – $2,000 (4%)

✔️Seasonal Deals: Offer special rates or packages during off-peak seasons to attract guests.

✔️Flash Sales: Host time-limited promotions to create urgency and boost bookings during slow periods.

Brand Management

Social Media Engagement and Branding

✔️Developing a Cohesive Brand Identity: Craft a brand voice that appeals to your target demographic, focusing on the allure, comfort and unique aspects of your property. Use a consistent visual theme across all platforms.

✔️Engaging with User-Generated Content: Encourage guests to share their experiences and tag your property. Feature these stories and photos to build trust and authenticity.

✔️Interactive Live Features: Host live sessions on platforms like Instagram or Facebook to showcase your property and answer potential guests’ queries in real time.

Search Engine Marketing (SEM) and Local SEO

✔️Targeted Ad Campaigns: Create ads that highlight the unique selling points of your property be it luxury, location or exclusive amenities.

✔️Optimizing Website for SEO: Ensure that your website is user-friendly, visually appealing, optimized with keywords like “vacation rental” and “luxury stay”.

✔️Leveraging Google My Business: Regularly update your Google My Business listing with attractive photos detailed amenities, and updated contact information.

Email Marketing Strategies

✔️Newsletter Campaigns: Regularly send out newsletters featuring updates, special promotions, local events and engaging guest stories.

✔️Audience Segmentation: Tailor your email content for various audience segments like families, business travelers, honeymooners to increase relevance and engagement.

Local Partnerships and Collaborations

✔️Networking with Local Attractions: Form partnerships with local tourist attractions and events for mutual promotion and visibility.

✔️Collaborating with Travel Agencies: Work with travel agencies to create attractive package deals or exclusive offers for their clients.

Content Marketing

✔️Educational and Informative Content: Develop blog posts and videos focusing on local sightseeing tips, travel guides and insights into the local culture.

✔️Highlighting Property Experiences: Regularly update your blog, social media with stories, photos and guest experiences to showcase what makes your property special.

Go To Market Strategy

Online Presence and Local Integration

✔️Develop a Captivating Website: Create an attractive and easy-to-navigate website showcasing the unique aspects of your property, local attractions and high-quality images. Include an efficient booking system.

✔️Engage in Content Marketing: Regularly publish blog posts about travel tips, local sightseeing and unique aspects of staying at your property aiding in SEO.

✔️Local Online Directories: List your property on popular travel and vacation rental websites to enhance local search visibility.

✔️Community and Business Partnerships: Form alliances with local businesses, tourism boards, event organizers to offer combined packages and establish a strong local network.

Launch and Promotional Strategy

✔️Organize a Memorable Launch Event: Host an open house or a special event to introduce your property to the local community, travel enthusiasts and influencers.

✔️Introductory Offers: Create enticing opening offers or packages that include unique local experiences, drawing initial guests and reviews.

Digital Marketing and Relationship Management

✔️Dynamic Social Media Presence: Use platforms like Instagram, Facebook and Pinterest to regularly post engaging content about your property and the surrounding area.

✔️Consistent Email Marketing: Send out newsletters to your subscribers with updates, seasonal offers and personalized travel tips.

✔️Loyalty and Referral Programs: Implement schemes to reward repeat guests, encourage referrals, enhancing guest loyalty and attracting new customers.

Brand Development and PR

✔️Engage with Local Media and Bloggers: Collaborate with local media and travel bloggers for features leveraging their audience to increase your visibility.

✔️Active Community Participation: Get involved in local events, sponsor local initiatives, enhancing your brand’s presence and goodwill in the community.

✔️Influencer Marketing: Partner with travel influencers, offering them a stay in exchange for social media exposure and content creation.

Analytics and Continuous Improvement

✔️Track and Analyze Performance: Use tools like Google Analytics and guest feedback to monitor the effectiveness of your marketing strategies.

✔️Strategy Refinement: Stay adaptable, making data-driven adjustments to your marketing tactics in response to performance metrics and market trends.

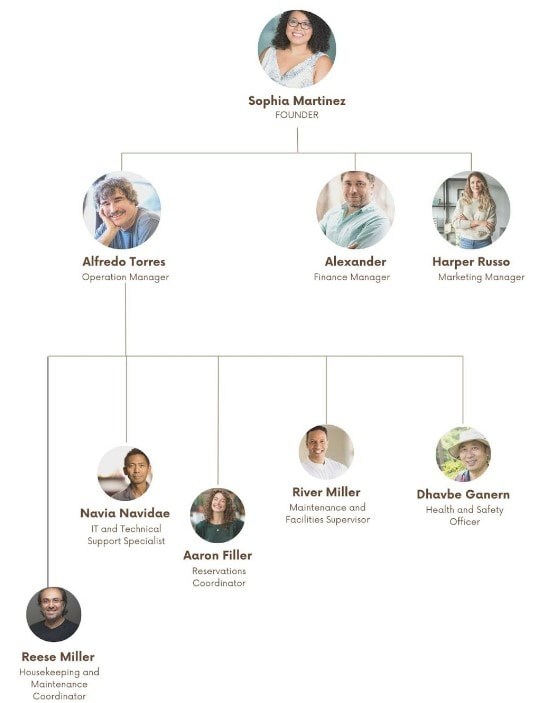

Organizational Overview

Founder

The newest vacation rental enterprise in Miami is the brainchild of Sophia Martinez, She is energetic entrepreneur profound fondness for the city’s thriving tourist industry and cultural offerings. Providing memorable vacations and her understanding of the demands of today’s tourists have pushed her to pursue a career in hospitality.

As a former traveler, Sophia saw a need in the market for vacation rentals that provide a blend of high-end amenities and genuine local culture, so she decided to give it a try. The combination of her company management experience and her travels gave her the edge she needed to succeed in the cutthroat vacation rental industry.

Sophia knows all the ins and outs of Miami’s many neighborhoods cultural centers and hidden treasures since she has lived there for the most of her life. Extensive work experience she launched a vacation rental company that provides guests with more than just a room it opens the door to Miami’s distinct culture.

Committed to making sure each guest has a smooth and unique experience. All of her hotels have been hand-picked to showcase Miami’s unique character and style while still providing guests with the contemporary conveniences they need.

Positions and Responsibilities

Chief Executive Officer (CEO) – Sophia Martinez

Oversight and administration of the vacation rental business’s entire strategy are Sophia’s responsibilities as CEO. Supervising operations, establishing corporate objectives, forming strategic relationships and attending industry events as a representative of the firm are all part of this role. Sophia is in charge of making decisions and keeping the company in line with what customers want and what the market is doing.

Property Manager

Responsibilities include overseeing property maintenance, managing booking schedule and ensuring guest satisfaction. They also coordinate with cleaning services and handle any on-site issues that arise during guest stays.

Marketing and Promotions Manager

Responsible for crafting and executing marketing strategies to elevate the property’s visibility. Managing the online presence on social media and vacation rental platforms, creating promotional materials, engaging in local and online marketing campaigns to attract new guests.

Financial Manager

Oversees all financial aspects of the business, including budgeting, revenue management, expense tracking and financial reporting. They ensure the business remains profitable, manage payroll and are responsible for financial forecasting and strategy.

Housekeeping and Maintenance Coordinator

Responsibilities include scheduling cleaning, overseeing repairs, ensuring high standards of cleanliness and upkeep are met consistently.

Organogram

Operational Overview

Services

Premium Accommodation Options

✔️Luxury and Comfort: Properties equipped with high-end furnishings and amenities for maximum comfort.

✔️Variety of Choices: Offering a range of accommodations from cozy studios to spacious family villas.

Personalized Guest Services

✔️Concierge Service: Tailored recommendations for dining, entertainment and local attractions.

✔️Transportation Arrangements: Assistance with car rentals, airport transfers and local transport options.

Local Experience and Adventure Packages

✔️Customized Tours: Collaboration with local guides for personalized tours and experiences.

✔️Adventure and Leisure Activities: Access to water sports, hiking, cultural tours and relaxation packages.

Wellness and Fitness Amenities

✔️On-site Wellness Facilities: Properties with gyms, spas and wellness centers.

✔️Yoga and Fitness Classes: Offering sessions with certified instructors, either on-site or at local studios.

Business and Remote Work Facilities

✔️Work-Friendly Spaces: Properties equipped with high-speed internet, workstations and meeting facilities.

✔️Virtual Assistant Services: Offering administrative support for business travelers.

Industry Analysis

According to SkyQuestt the worldwide vacation rental market is booming with a projected CAGR of 5.3% and a startling USD 119 billion by 2030. A number of reasons are coming together to drive this expansion such as a dramatic increase in tourists more disposable money, the widespread use of online booking platforms and a stronger demand for personalized adaptable vacations.

Source: thebusinessresearchcompany

Statista predicts that the United States’ vacation rental industry would grow from its current valuation of USD 19.39 billion to USD 20.57 billion by 2027 solidifying the country’s position as a worldwide tourism powerhouse. Motives for this modest expansion are comparable to those of the worldwide market with the added benefit of tailwinds such rising urbanization and a preference for domestic travel.

Recognizing the ever-changing nature of the worldwide vacation rental business is crucial, even while the US market provides a solid basis. Adding to the industry’s diversity, the emerging markets in the Asia-Pacific and MENA regions are set to see substantial expansion in the near future. Exciting growth is also being seen by niche sectors that cater to pet owners, eco-conscious visitors and glamping lovers.

Source: hughesalexander

The future of holiday rentals is being greatly influenced by technological improvements. Smart home technology is making guests’ stays more comfortable and convenient while virtual reality tours are giving them immersive previews. Visitor management software, owners, managers can streamline their operations and concentrate on providing great experiences.

Even while things are looking up, there are still obstacles. It is imperative that owners and operators of vacation rentals keep up with the ever-changing legal landscapes as governments throughout the globe are enacting new rules in this sector. Market rivalry is heating up so you need a marketing strategy that stands out from the crowd.

Source: hello.pricelabs

Key Stats (USA):

- Number of vacation rental properties: ~1.2 million (AirDNA)

- Average occupancy rate: 62% (AirDNA)

- Average daily rate: USD 230 (AirDNA)

- Most popular platforms: Airbnb, Booking.com, Vrbo, Expedia

- Top destinations: Florida, California, Hawaii, South Carolina, Texas

- Fastest-growing segments: Luxury rentals, resort areas, Gen Z & Gen X travelers

Source: landlordtoday

Industry Problems

✔️Booking and Reservation Challenges: Less tech-savvy visitors may find this especially difficult. Disappointment and complaints may also arise when there are differences between the property’s web description and its real condition.

✔️Check-in and Accessibility Issues: For those with mobility issues, the lack of adequate accessibility features like ramps or elevators in properties can be a major concern.

✔️Amenities and Property Condition: Issues with amenities whether due to poor maintenance or misrepresentation in listings can significantly impact guest satisfaction.

✔️Neighborhood and Environmental Factors: Unanticipated construction noise, disruptive neighbors, or a location that feels unsafe, especially at night, can negatively affect the guest experience.

✔️Communication and Customer Service: Poor communication with the property manager or host can lead to frustration. Ineffective customer service, whether during the booking process, stay or after departure can leave guests feeling undervalued and unlikely to return.

Industry Opportunities

✔️Streamlined Booking and Reservation System: Implementing a user-friendly and efficient online booking system can significantly enhance the reservation experience.

✔️Enhanced Check-in Experience and Accessibility: Implementing self-check-in options such as key lockboxes or smart locks can offer flexibility and convenience.

✔️Maintenance and Amenities Upkeep: Regular maintenance checks and prompt repairs can ensure all amenities are in working order enhancing guest satisfaction. Stocking essential items and maintaining high cleanliness standards will contribute to a positive overall experience for guests.

✔️Neighborhood Insights and Environmental Comfort: Collaborating with local authorities or neighborhood associations to address safety concerns environmental factors like lighting and parking can improve the area’s appeal.

✔️Effective Communication and Customer Service: Providing a welcome guide with important information, having a dedicated team to respond to inquiries, and ensuring availability for emergencies can build trust and reliability.

Target Market Segmentation

Geographic Segmentation

✔️Miami-Dade County Visitors: Target tourists and visitors coming to Miami-Dade County focusing on areas known for high tourist influx such as Miami Beach, Coral Gables and the Art Deco District.

✔️Specific Miami Neighborhoods: Concentrate on attracting guests to specific vibrant and popular neighborhoods like Wynwood known for its street art, Downtown Miami for its business travelers and Coconut Grove for its bohemian vibe.

Demographic Segmentation

✔️Age Groups: Cater to different age demographics from young couples and families to retired travelers, understanding that their needs and preferences in accommodations will vary.

✔️Income Levels: Offer a range of properties from budget-friendly options for cost-conscious travelers to luxury rentals for high-end clientele.

✔️Cultural Diversity: Reflect Miami’s rich cultural diversity in your offerings ensuring properties are appealing to a wide range of cultural tastes and preferences.

Psychographic Segmentation

✔️Leisure Travelers and Vacationers: Focus on individuals and groups seeking leisure travel experiences offering them a mix of relaxation and local attractions.

✔️Business Travelers: Cater to business professionals who seek comfortable, work-conducive environments with high-speed internet and convenient access to business centers.

✔️Adventure Seekers and Cultural Enthusiasts: Target travelers who are drawn to the unique experiences Miami offers such as its beaches, nightlife and cultural festivals.

Behavioral Segmentation

✔️Frequent and First-time Miami Visitors: Focus on both repeat visitors who have a fondness for Miami and first-timers eager to explore the city’s charm.

✔️Event-Based Travelers: Cater to guests traveling for specific events or festivals in Miami offering tailored services like event transportation or guides.

✔️Remote Workers and Digital Nomads: With the growing trend of remote work, target digital nomads and remote workers looking for comfortable long-term stays with good connectivity.

Market Size

✔️Total Addressable Market (TAM) for Vacation Rental Property:Your vacation rental property business’s Total Addressable Market encompasses the whole potential market for vacation rental services in the USA. Everyone in need of short-term lodging, whether they are tourists, businesspeople or other types of visitors falls within this expansive industry. The rising popularity of digital nomadism, the preference for vacation rentals over conventional hotels, and the trend of experiential travel are all factors impacting the TAM. The travel and tourism sector is dynamic and ever-changing due to changes in consumer tastes and habits and TAM’s breadth reflects this.

✔️Serviceable Addressable Market (SAM) for Vacation Rental Property: A more narrow subset of the Total Addressable Market (TAM) is your vacation rental property’s Serviceable Addressable Market. When you examine your Miami location, the assets you provide and the demographics you target, this indicates the part of the market that your firm can actually service. Your SAM will differ from those that target budget lodgings or business travel if your facilities provide luxury experiences in popular regions like Miami Beach or cater to specialized niches like eco-tourism or cultural tourism. In order to focus your marketing efforts and tailor your services to the demands of your SAM it is crucial to identify this market segment.

✔️Serviceable Obtainable Market (SOM) for Vacation Rental Property: The market share that your vacation rental company has a reasonable chance of capturing is called the Serviceable Obtainable Market. Taking into account your existing resources, market positioning and competition landscape this statistic shows the possible market share which is a critical consideration. Uniqueness and attractiveness of your hotels, quality of guest services, web presence and marketing tactics and overall visitor experience are factors that will impact your SOM. To help you acquire and increase your market share within the appropriate section of Miami’s vacation rental market, the SOM gives a realistic objective for occupancy rates, revenue targets and market penetration. This will guide your tactical and strategic efforts.

Industry Forces

Market Demand and Travel Trends

Your business can tap into these trends by offering distinctive, well-located properties that cater to a diverse range of travelers, including families, business travelers, and adventure seekers.

Competition

The secret to sticking out is to differentiate your properties via distinctive themes, outstanding customer service, customized experiences and specialty segmentation marketing. Attracting and retaining customers may be as simple as highlighting what makes your homes or cultural events special.

Technological Advances

It is essential to use the newest technology in property management. Requires digital marketing strategies that make good use of customer relationship management technologies and have a strong social media presence.

Regulatory Environment

Navigating local regulations related to property rentals such as zoning laws and tourist taxes is critical. Keeping changes in these regulations and ensuring compliance is essential to avoid legal issues and maintain a reputable business.

Financials

A financial plan provides a comprehensive projection of a company’s financial health and its anticipated monetary performance over a specified period. This section encompasses a range of financial statements and projections such as profit and loss statements, balance sheets, cash flow statements and capital expenditure budgets. It outlines the business’s funding requirements, sources of finance and return on investment predictions. The financial plan gives stakeholders particularly potential investors and lenders a clear understanding of the company’s current financial position. A financial plan helps businesses demonstrate their financial prudence, sustainability, and growth potential.

Revenue & Earnings

Cost of Goods Sold & Expenses

Income Statement

Balance Sheet

Cash Flow Statement

Revenue Summary

Cost Summary

Loan Amortization Schedule

Salary Summary

Non- Current Asset Schedule