Written by Elma Steven | Updated on January, 2024

In an era where beach vacations and pool parties are all the rage, swimwear businesses seem to be catching the eyes of many entrepreneurs. But as with any venture, the big question remains: is it truly profitable? Below, we delve into a hypothetical financial analysis, touching upon revenue sources, costs of goods sold, and operating expenses, to provide a clearer picture.

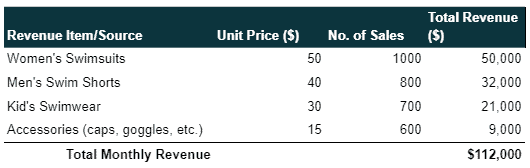

Revenue

Here’s the revenue table for the swimwear business:

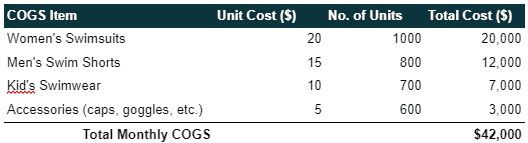

Cost of Goods Sold

Here’s the table for the Cost of Goods Sold (COGS) for the swimwear business:

This table gives a simplified and hypothetical breakdown of the cost involved in producing or acquiring each item for sale. Actual costs will vary based on factors like sourcing, manufacturing processes, and more.

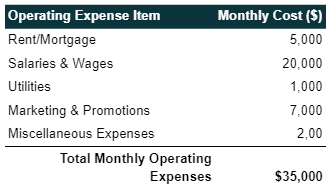

Operating Expenses

Here’s the table for the Operating Expenses for the swimwear business:

To determine the net profit or loss, we will subtract the Cost of Goods Sold (COGS) and Operating Expenses from the Total Revenue.

Total Monthly Revenue: $112,000 Total Monthly COGS: $42,000 Total Monthly Operating Expenses: $35,000

Net Profit/Loss = Total Revenue – COGS – Operating Expenses = $112,000 – $42,000 – $35,000 = $35,000

Net Monthly Profit: $35,000

So, based on these hypothetical figures, the swimwear business would be making a net profit of $35,000 per month. However, these numbers are illustrative and may differ depending on numerous factors like business model, location, seasonality, and market demand.