Avoid Guesswork and Use the Proven Business Plan Template & Financial Model

Downloaded by more than 300 entrepreneurs in the resort & hospitality sector. Stop Procrastination and Start Planning Today with Our Comprehensive Resort Business Plan Template. Cut down on research time by at least 200 hours.

Grab your doc file and spreadsheet fast before we run out of stock!

Dear Future Resort Owner,

Ever fantasized about owning a resort that guests can’t wait to escape to? It’s time to push past the hesitation, shake off the doubts and step into your role as a trailblazing resort entrepreneur. Our ultimate guide is your golden ticket from daydreaming to doing. Start your transformational journey now – future guests and your future self will rejoice. ✨ #ResortRevolution #StartYourJourney

Make the leap from ‘maybe someday’ to ‘let’s do this today’ with our Resort Startup Toolkit, blending a Business Plan + Financial Model. Goodbye, delays; hello, direct route to success. Transform your dream into a thriving resort destination, converting concepts into concrete outcomes. We’re here to tackle the fear of stepping out of your comfort zone!

Let no hesitations or the unknown scare you away. Our resort business plan template & overall toolkit demystifies the startup process, laying out easy-to-follow steps and actionable insights. Begin your entrepreneurial adventure now and move from mere dreams to opening your resort’s doors.

Step aside, generic business templates with uninspiring forecasts and tedious tables!

If the thought of starting sends shivers down your spine, fear not! Our meticulously crafted plan leads you through every detail, from brainstorming to operational excellence, ensuring no stone is left unturned without ever feeling adrift.

But Everyone Says This…Tell Me What’s Inside?

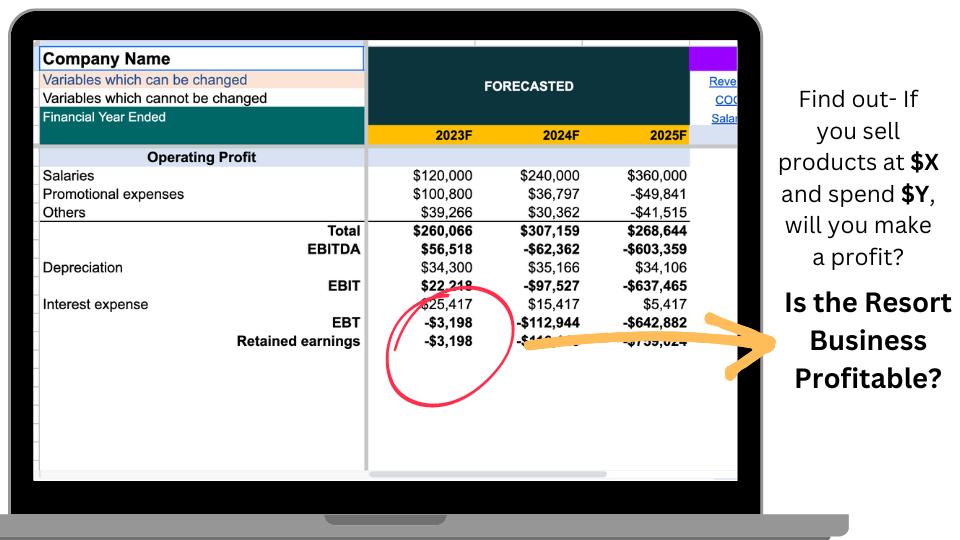

Here are just few of the questions answered in the business plan & financial model:

✔️Find out if it’s worth spending money and time into this idea.

✔️How much money can you make if you invest $X into this?

✔️Is $X amount of investment enough?

✔️When will the business break-even?

✔️Will you run out of cash if you invest $X amount?

Who is my target market?

How do I acquire customers from my target market?

Grab your doc file and spreadsheet fast before we run out of stock!

Discover Our Impact on Several Resort Ventures

Transformed a budding resort idea into a breathtaking vacation paradise, generating a stunning $7 million in revenue in just eight months. This extraordinary growth was fueled by our meticulous business plan and refined financial model, optimizing operations and enhancing guest experiences, propelling a rapid rise in the hospitality scene.

Revitalized a struggling resort from a modest annual revenue of $200k to a flourishing $2 million establishment in just 14 months. Employing our specialized hospitality strategies and astute financial planning provided a clear roadmap for expansion, improving amenities and guest engagement strategies to effectively attract and retain a wide range of guests.

Launched a niche resort experience from a bare piece of land to an astonishing $13 million in sales in its first year, driven by our comprehensive market research, perfected guest management techniques, and adaptive pricing positioning. These strategies ensured the resort’s offerings met increasing demand while maintaining profitability.

Catapulted a small, family-run resort from $3 million to a staggering $50 million in sales within 18 months. The resort’s reach and scope increased significantly, by incorporating our customized hospitality marketing strategies and enhancing operational efficiencies, ensuring exceptional growth and a broadened market presence.

Elevated the performance of a specialist resort from an initial $4 million to an incredible $25 million in annual revenue, all within one year. This was achieved by implementing our precision guest engagement methods and efficient service processes, supported by accurate financial forecasting.

Steered a new resort project from inception to a phenomenal $51 million in bookings within just eight weeks. This rapid success was made possible through the deployment of a well-structured guest services funnel and focused resort marketing strategies, which are key components of our business plan crafted to enhance visibility and swiftly increase guest commitments.

Cut The Bullshit And Show Me Some Goddamn Pages For Free So I Know What I’m Getting Here!

Okay, okay…Now, before we make this magical little exchange where you give me money and I give you your very own copy of Sell Like Crazy…

Sample Business Plan

We have written a business plan and financial model using this template so that you get a clear idea on how powerful the template is!

Sample Financial Model

But My Resort Is Different And This Won’t Work For Me…

That might be the doubt whispering in your ear…

That’s probably the hesitant voice speaking inside your head…

“All this sounds promising”…

“But my resort is unique, and these strategies won’t work with my kind of guests”…

Yet, I personally GUARANTEE you they will.

Imagine, if by some odd turn you apply the approaches outlined in this blueprint and they don’t DRAMATICALLY elevate your resort…

Does that sound reasonable? Excellent.

Either I’m incredibly audacious…

Or I’ve simply lost it.

Because, honestly, find someone else who backs their toolkit like this. I mean it.

Anyhow.

Once you download the blueprint…

How to Write the Resort Business Plan?

I will write a complete business plan for Resort Business Plan in this demo!

Step 1: Download the Business Plan

After you download the Business Plan then you will be redirected to the Thank You Page which contains link to the business plan template and financial model. The click on the Business Plan Template Button and Financial Model to use them.

Step 2: Start with the Financial Model & Industry Analysis

You should start the Business Plan from the Financial Model and Industry Analysis sections as it helps you build the structure of the overall business and your plan.

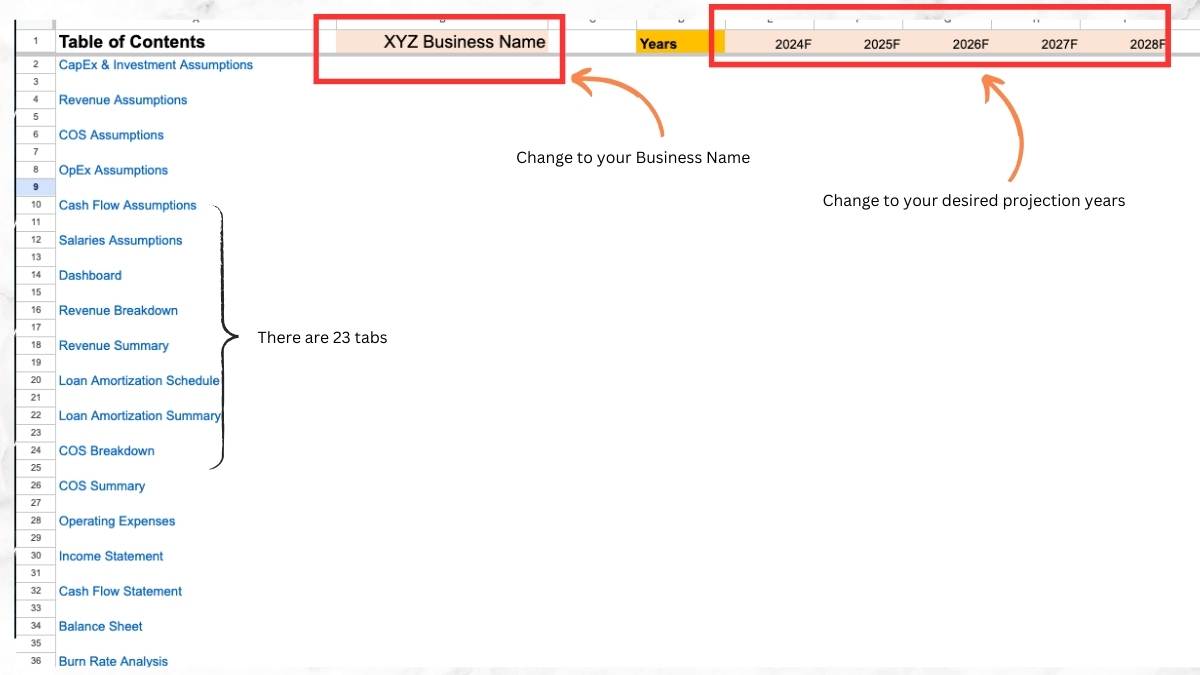

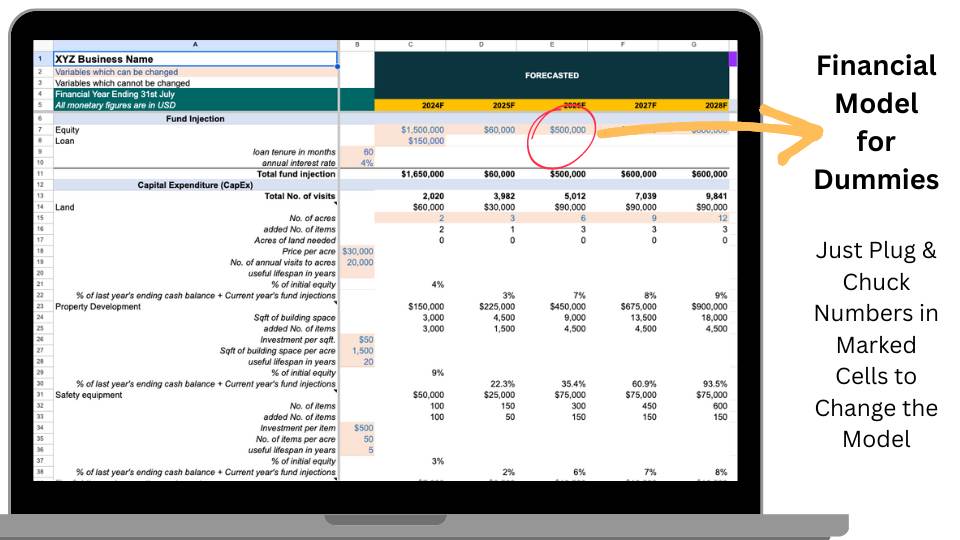

When you open the financial model then it looks like this:

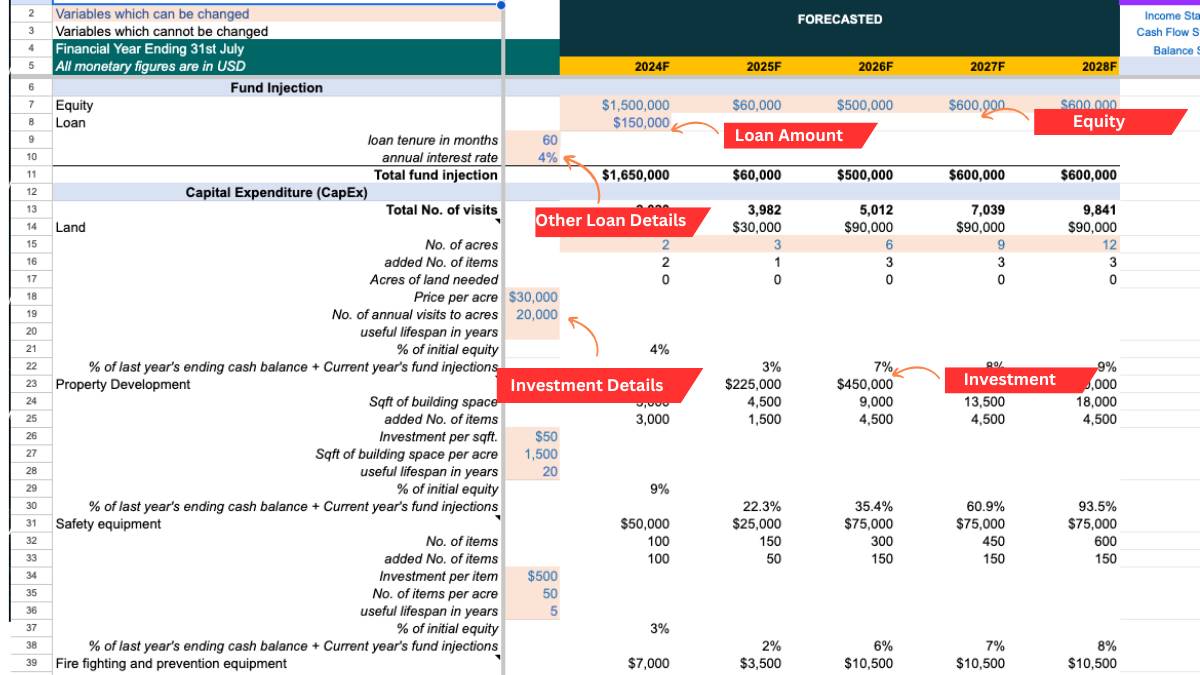

Step 2: Financial Model Starts with Investment

Discover the number of rooms needed to generate $500K annually for your resort. Whether you plan to invest your own funds or explore financing options, simply input the details in the designated fields of the financial model. If you’re considering a loan for a specified number of years with a certain interest rate, the model will handle all calculations seamlessly.

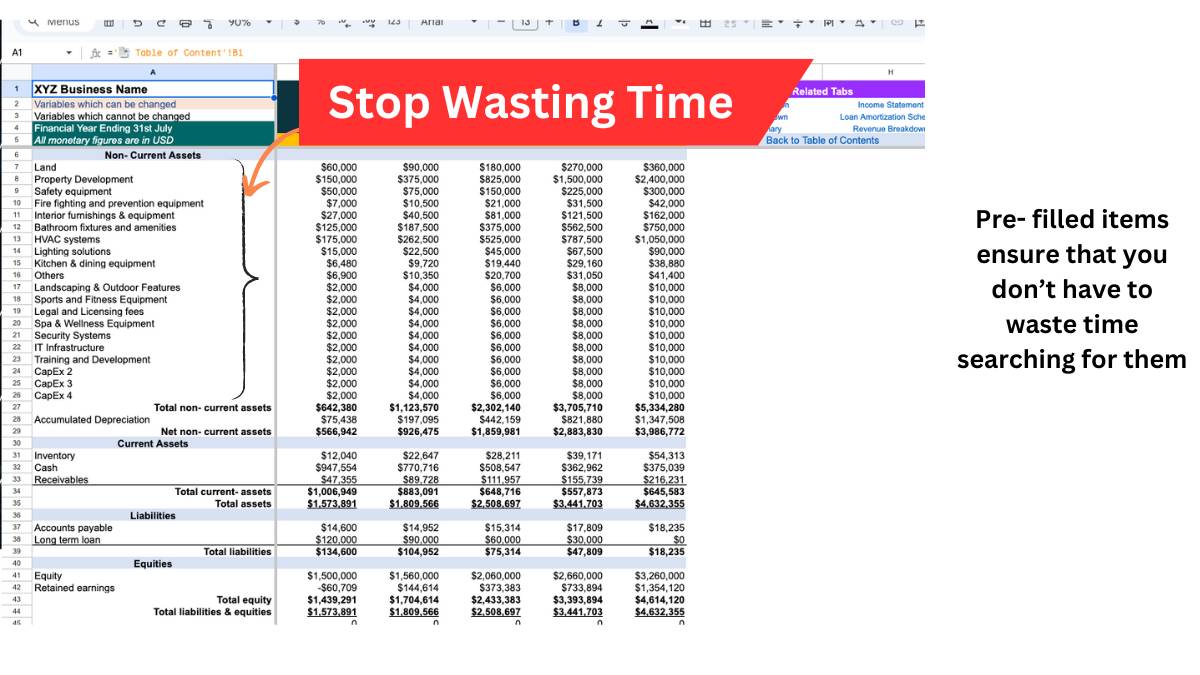

This is a crucial section of the CapEx in our resort financial model, where we have pre-filled essential items to save you time. You can select from a range of options, including large, mid-sized, or small trucks, and even operate with all three types simultaneously for optimal efficiency. Our research has determined the prices of these trucks, ensuring accurate projections without the need for extensive research on your part.

Prices for key investment items such as trucks, maintenance equipment, and other essential assets have been thoroughly researched and input into the model, eliminating the need for you to search for this information online. However, should you wish to adjust any of the investment figures, you have the flexibility to do so.

Step 3: Revenue Assumptions

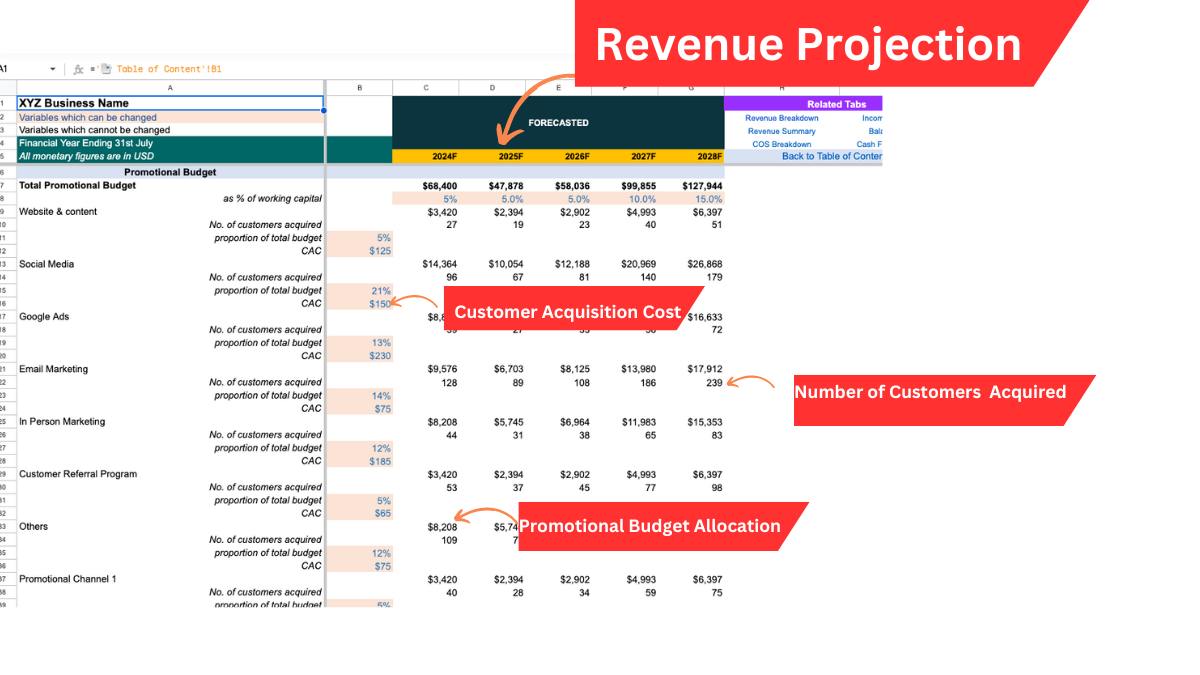

The success of your resort business hinges on the number of customers you can attract. There are two primary methods to acquire customers: increasing your marketing budget or reaching out to potential guests organically. Our resort financial model allows you to customize and adjust for both strategies.

Furthermore, we have included various promotional channels in the model that you may utilize, such as your resort’s website, in-person marketing efforts, Google Ads, and more. For instance, if you are employing in-person marketing and have three staff members dedicated to acquiring new guests through activities like cold calling or personalized visits, with a monthly salary cost of $50K. If, on average, they succeed in bringing in 25 new customers each month, the cost of acquiring each customer amounts to approximately $2,000.

With our model, you have the flexibility to fine-tune these variables to determine the profitability of your business and assess whether your cash flow can support long-term operational sustainability.

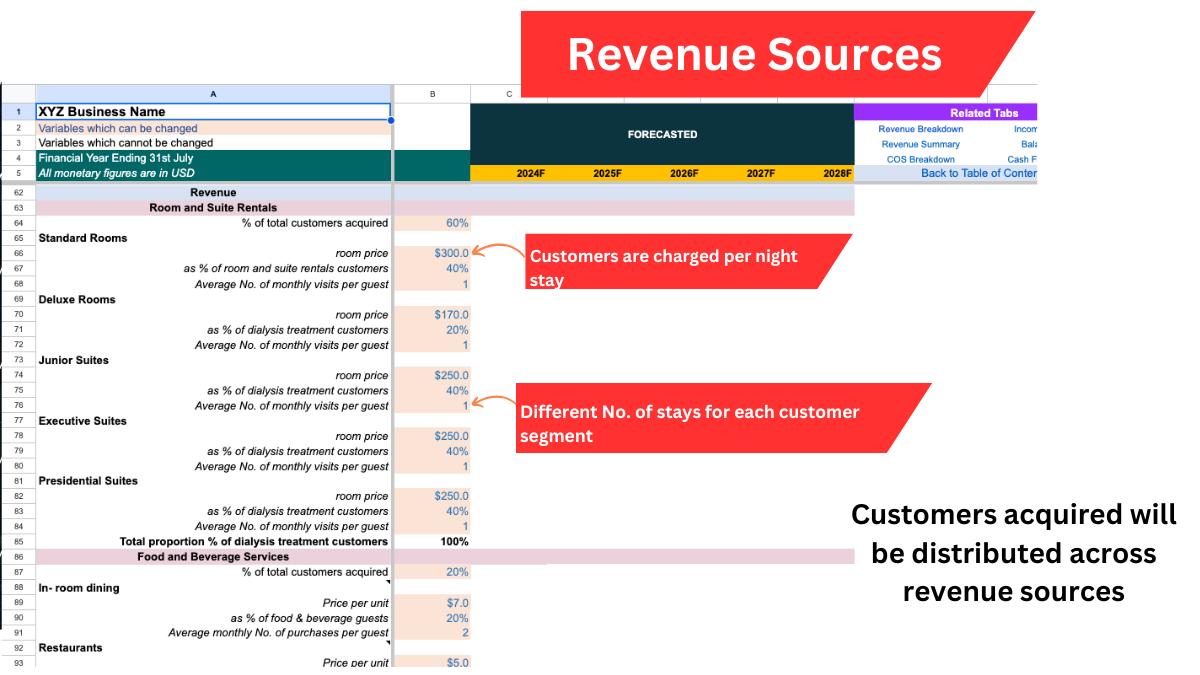

Let’s explore the revenue framework for your resort, aligning it with the guest acquisition metrics discussed earlier. For the first year, let’s envision your resort attracting 100 new guests. Among these, 70% opt for extended stays, indicating strong guest loyalty or a membership-based model, while the remaining 30% opt for one-time visits or short-term stays. As a result, 70 guests contribute to your Repeat Guest Revenue, and 30 guests to your One-Time Guest Revenue.

Diving deeper into the group of repeat guests, consider:

– 40 guests prefer frequent visits, staying multiple times per month (high frequency),

– 20 guests opt for regular but less frequent stays, aligning with specific travel plans or seasonal preferences (moderate frequency),

– 10 guests visit on occasion, possibly during special events or for shorter getaways (low frequency).

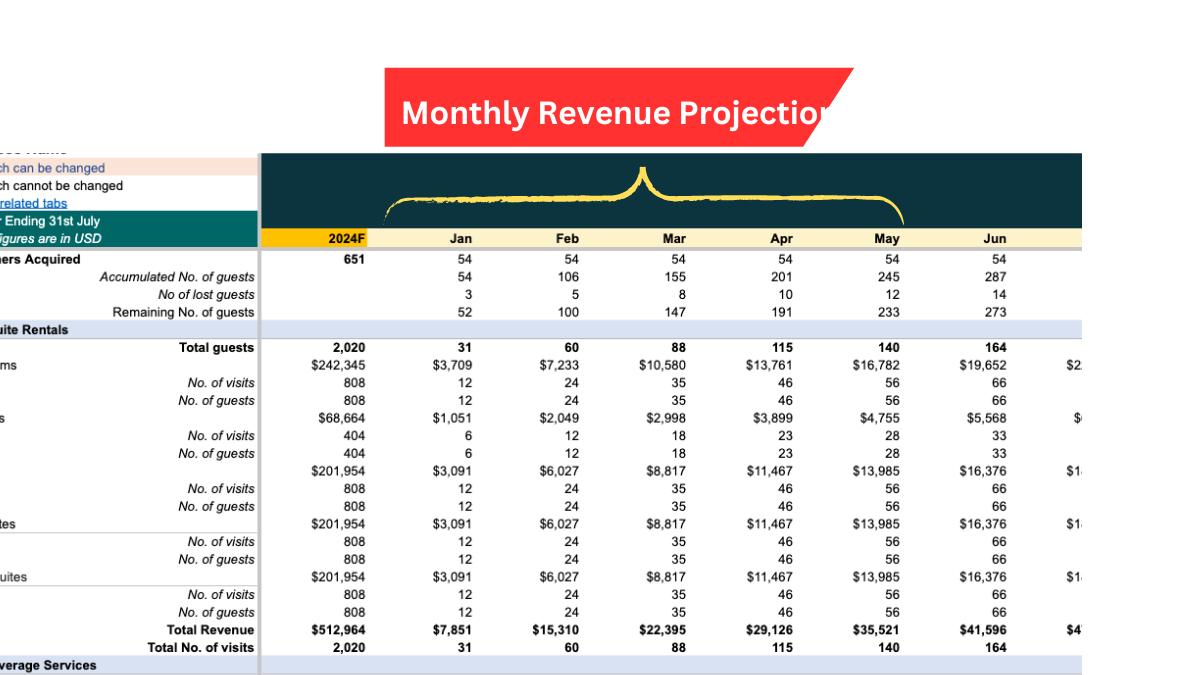

This segmentation enables a customized revenue structure tailored to the unique dynamics of your resort, providing a clear revenue projection with detailed monthly breakdowns. Such a structured approach enhances revenue forecasting accuracy by accounting for new guest arrivals, retention rates, and turnover dynamics, all vital for financial planning and overall fiscal strategy.

By projecting revenue on a monthly basis, you gain deep insights into guest behaviors over time — including new guest acquisition rates, the percentage of returning guests, and guest retention levels. This detailed analysis supports precise financial forecasting and empowers strategic decision-making for the success of your resort business.

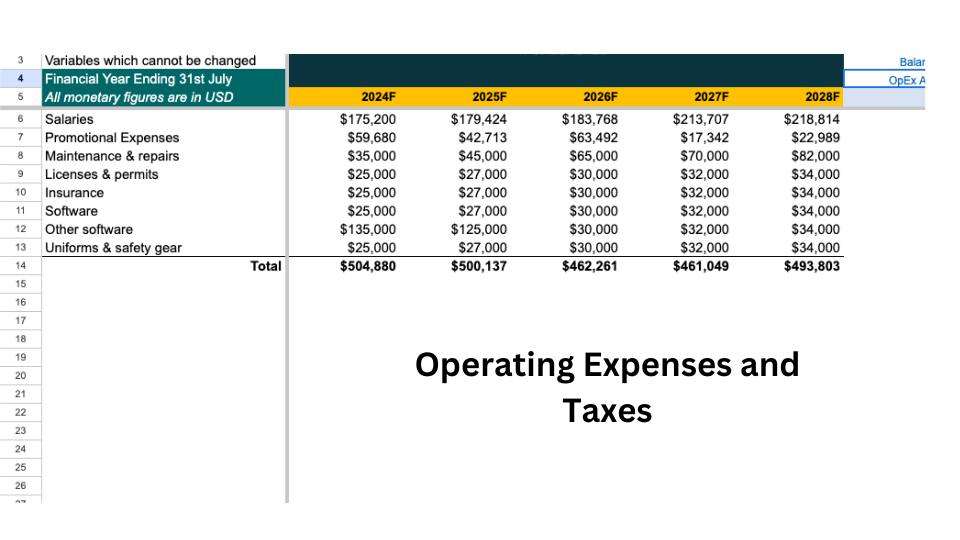

Step 4: Cost Assumptions

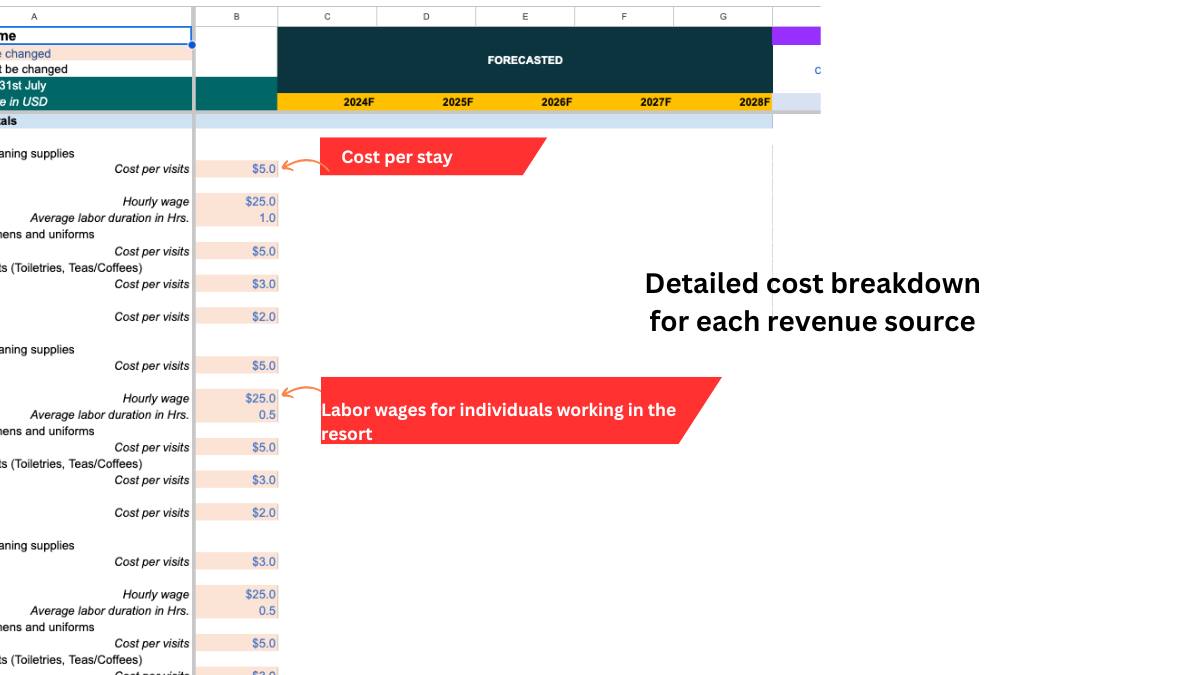

In the realm of your resort business, distinguishing between variable and fixed costs plays a vital role in prudent financial management. Variable costs fluctuate in relation to the level of guest services provided — for instance, as you host more guests, expenses for amenities (such as linens, toiletries, and room supplies) and operational costs will rise. Other variable costs may encompass utilities like electricity and water, which vary based on usage, and expenses for housekeeping and maintenance that increase with guest occupancy levels.

On the other hand, fixed costs remain consistent regardless of the number of guests accommodated. These include expenditures like property lease or mortgage payments, salaries for essential staff members, and subscription fees for property management software. These costs persist irrespective of fluctuations in guest numbers.

In alignment with Generally Accepted Accounting Principles (GAAP) and standards from the Financial Accounting Standards Board (FASB), these costs are typically classified as Cost of Goods Sold (COGS) and Operating Expenses (OPEX):

Cost of Goods Sold (COGS): This category encompasses all variable costs directly linked to providing guest services at the resort. It covers expenses for guest amenities, labor costs for staff engaged in guest services, and any other direct expenses related to guest satisfaction.

Operating Expenses (OPEX): These comprise your fixed costs, including all overhead incurred in running the resort that are not directly tied to guest services. This encompasses rent, utilities, salaries for non-service employees, marketing expenditures, as well as software and administrative costs.

Having a clear understanding of these cost differentials is crucial for accurate financial reporting, predicting future expenditures, and setting competitive pricing structures for your resort services, ensuring profitability and sustainable operations

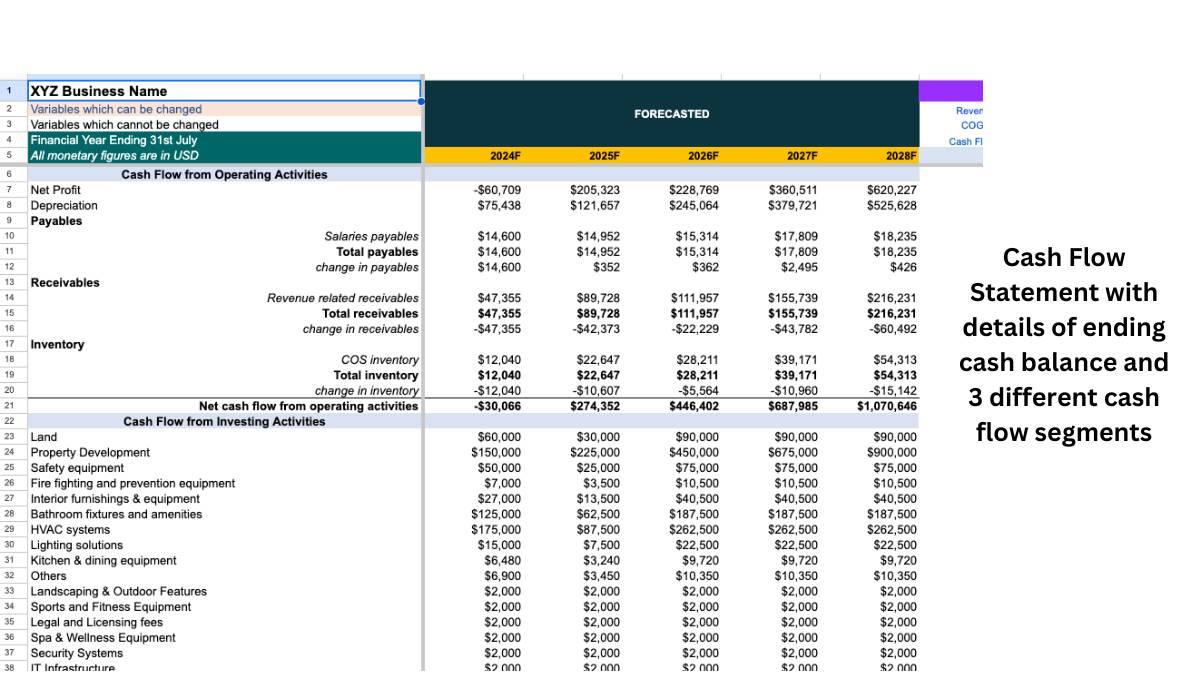

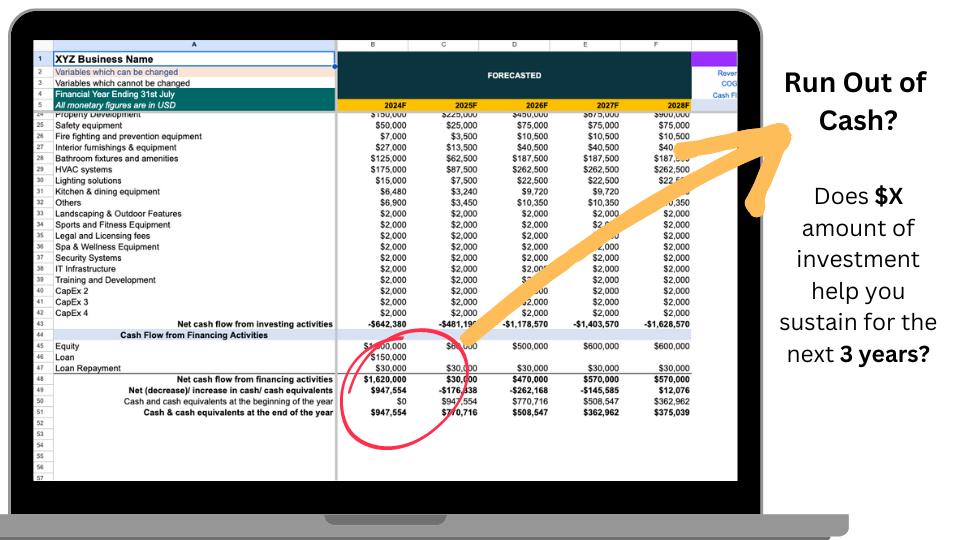

Step 5: Cash Flow Assumptions

In the context of your resort business, efficient cash flow management is paramount and relies on certain assumptions regarding guest payments, vendor transactions, and inventory control.

Guest Payment Assumptions: Delays in guest payments or settlements from booking platforms can impact your account receivables, potentially affecting your cash flow. Offering incentives for early payments or implementing stricter payment policies can help mitigate this challenge.

Vendor Payment Assumptions: Postponing payments to vendors for supplies, such as linens, toiletries, and cleaning services, may provide a temporary boost to your cash flow. However, it is crucial to manage these delays carefully to maintain positive relationships with suppliers. Negotiating extended payment terms proactively can yield similar cash flow benefits without compromising vendor relationships.

Inventory Assumptions: Maintaining excess inventory levels, especially in terms of guest amenities and supplies, can tie up significant amounts of cash. Adopting practices like just-in-time (JIT) inventory management or refining inventory forecasting can reduce the financial burden. For a resort, striking a balance between having adequate supplies on hand and minimizing inventory costs is essential.

These assumptions play a pivotal role in your financial planning and cash flow management strategy. By effectively handling guest payments, vendor transactions, and inventory control, you can cultivate a more stable cash flow, facilitating seamless operations and providing the financial agility to seize growth opportunities within your resort.

Now Let’s Dig Deeper….

Step 5: Analyze Results of the Financial Model

Now that you have entered every assumptions into the model, WHATS THE OUTCOME?

✔️ Determining Minimum Capital Requirements: Calculate the necessary startup capital based on projected expenses for setting up the initial infrastructure, marketing efforts, medical inventory, and operational expenses aligned with your service delivery objectives.

✔️ Cash Flow Analysis: Evaluate how cash flow could be impacted in various scenarios such as lower-than-expected patient numbers in the initial phases, higher patient acquisition costs, or unexpected increases in medical supplies expenses. This analysis will assist in assessing your clinic’s financial resilience without significant initial investments.

✔️ Securing Financing Options: When exploring financing options through loans or investor backing, this financial model will aid in elucidating the total capital needed, rationale behind the amount, planned utilization of funds, anticipated timeline for achieving profitability, and comprehensive strategies to attain these financial targets. It also substantiates your patient service forecasts and expansion plans with solid data and evaluations.

✔️ Viability Assessment: Evaluate the feasibility of establishing a dialysis center by examining market demands, competitive environment, pricing structures, and expenditure frameworks.

✔️ Strategic Planning for Established Centers: For existing healthcare entities, this financial model offers an impartial assessment to enhance strategies, optimize clinic operations, and strategically plan for future expansion or introduction of new services.

Step 6: Start Writing The Business Plan with Industry Analysis

Initiate the business plan by conducting an industry analysis, as this will assist in refining the details within the financial model. During the competitive landscape analysis within the industry study, it is crucial to gather pricing and relevant data about competitors. This may entail extracting pricing details from competitors’ websites or social media platforms, and in some instances, direct communication with competitors may be necessary. Understanding competitors’ pricing structures will aid in determining the most suitable pricing strategy, which can subsequently be incorporated into the financial model.

Step 6: Marketing Plan

Start your marketing plan which the promotional channels that you plan to use. Now, in the previous section (industry analysis) you conducted a competitive landscape analysis and that helps you identify the promotional channels used by your competitors. There are tools to identify performance across these promotioanl channels of a particular business, for e.g. you can use Semrush to find out the No. of visitors on a competitors website per month. This can help you figure out how polular a competitors is. Also, you can find out which blog pages are visited most by the target market in your competitors website to find out interesting topics for your target market.

Step 7: Operational Overview

Step 8: Organizational Overview

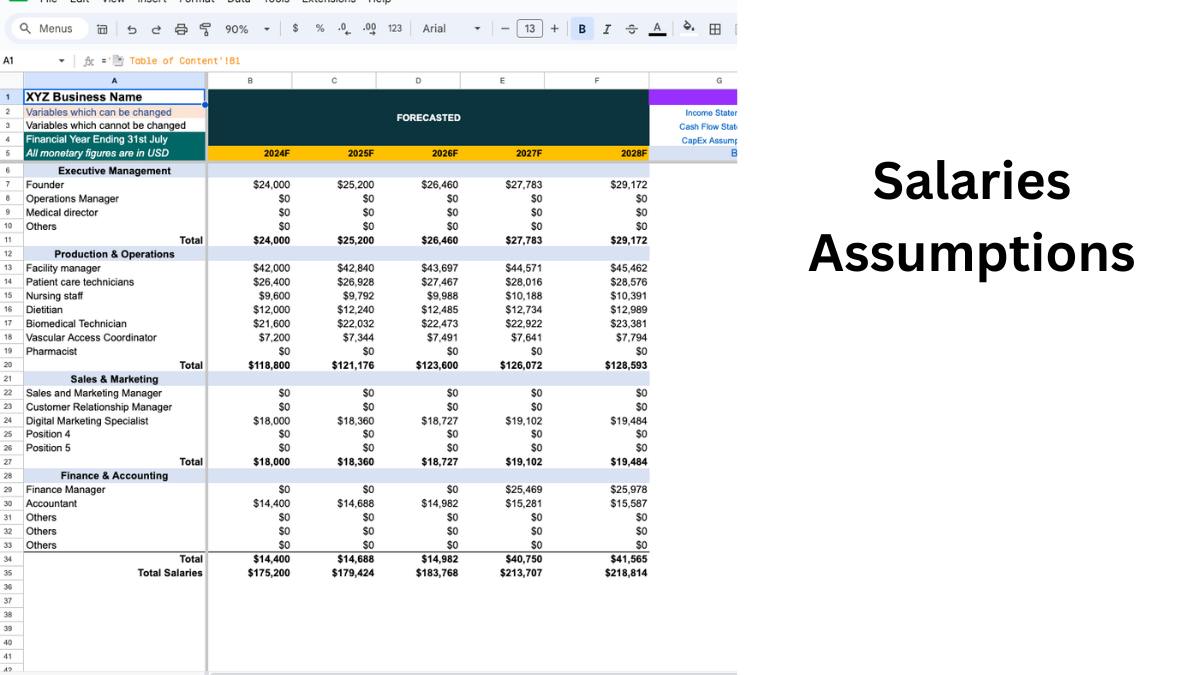

Compile a roster of employees you intend to hire, outlining their salaries and additional benefits. Detail the job descriptions for each role. Subsequently, establish an organizational chart depicting the appropriate hierarchy within the team structure.

Select and customize! The positions and job descriptions most suitable for the resort business plan have been presented. Keep what is essential and tailor as needed. The needs of each resort vary. For instance, if you are collaborating with external hospitality services, in-house specialists may not be required.

Step 9: Executive Summary + Other Sections

Make a list of personnel that you plan to recruit, their salaries and other benefits. Write down the job description of each position. Then create an organogram with appropriate hierarchy.

Reviews

340+ Downloads & Counting

The resort business plan templates and financial model have been a game-changer for my startup. They’re incredibly detailed and easy to use, making my business planning a breeze.

★★★★★

I was hesitant at first, but the template and financial model have exceeded my expectations. They’ve provided me with a roadmap for success in the hospitality industry.

★★★★★

The resort business plan is well-structured and comprehensive. Combined with the financial model, they’ve given me a clear understanding of the box truck market and its potential.

★★★★★

I’m impressed with the quality of the financial model. It had a lot of info which I did not even think of earlier.

★★★★★

F.A.Q

Yeah but will this template help me get a loan?

Maybe. This mostly depends on your business idea, previous experiences, ability to provide collateral and relevant factors. This is a template for present your plan in the best possible way. In addition, the financial model helps to validate your business concept or your expansion plan. It’s kind of hard to provide more for just $49.

Is the payment secure?

Our payment is processed by Stripe or PayPal so you can rest assured about your data privacy and security.

What is the refund or cancellation policy?

Due to the fact that templates are downloaded, we cannot give refunds.

Digital material is exempt from the 14-day return policy applicable to physical products. Because of this, our downloadable content are non-returnable. All sales are final. You can also check out the video in the product page to get an idea of contents of the template. This should help you get a clear idea on the features of the product.

However, we do value the customer experience and are accessible to assist you with any problems you may have while using our goods. If you have particular queries regarding our product, please use the chat box on this page or send an email to [email protected].

How can I edit the template?

Simple. If you are using Google Doc and Sheets then just make a copy in your own Google Drive. In case you are using Microsoft Office then Download the files and start editing.

What about support?

You can email us at [email protected] and we will respond in 24 to 48 Hrs. We offer in-person or email based support depending on your needs.

Every other reason for not buying....

❌ “But you can’t replace hiring a business plan writer to do this”

✅ This template costs $49 not $2,000. Also, you have more control over the writing process. The template is very specific so you will have relevant info in Industry Analysis, Financial Model and other sections.

❌ “I feel like just browsing online and using the free templates available online.

✅ Sure, if you wish to spend 4 weeks instead of 2 days to write a plan then please go ahead. Our research team found that free resources are very generic and does not offer fill-up and use facility. Also, you won’t get the specialized financial model from the free resources.

❌ But wouldn’t everyone’s content look the same?

✅ Nope. Our customers are smart and customize by adding their own images, logo, company description, etc.

❌ “But can you guaruntee that I will get a bank loan using this?

✅ No, I cannot guarantee anything for $49. The purpose of this template is to make it easier and less time consuming for you to write a business plan.

Who developed this template?

Our templates are developed by CPAs, CFAs and Ex- consultants of BCG, Mckinsey, PwC and KMPG. Elma Steven is the Head of our Quality Control.

Can I validate my the prospect of my MVP using this?

Yes. The financial model will help you plug in price, unit cost, payables and other assumptions which will allow you to project the revenue, profit and other KPIs.