Written by Elma Steven | Updated on April, 2024

In order to write a BBQ Restaurant Business Plan you need to start with executive summary. In order to write an executive summary for a Business Plan you need to mention- what your business is about and what you’ll sell. Explain how you’ll get people to buy it. The executive summary should be written at the end. Then you should write a Business Description mentioning goals, objectives, mission and vision. Some of the major sections or components of a Plan involves Fund Usage Plan, Marketing Plan, Industry Analysis, Organizational Overview, Operational Overview and Financials.

This article will provide you a step by step process to write your Business Plan. Get a free Business Plan at the end!

Table of Contents

Executive Summary

Overview : Smoke is thought to have magical characteristics in Kansas City, where barbeque is a way of life. Smoke has the ability to elevate the mundane to the sublime. It has the ability to turn even the most unappealing slices of meat into delightful treats. It may even turn a local petrol station into one of the world’s most popular eateries.

Mission: To establish an atmosphere where complete visitor happiness is our first goal, and to deliver real deep-dish BBQ to the neighborhood.

Vision: Be a well-known restaurant in the community and the go-to spot for those looking to satisfy their BBQ desires.

Industry Overview: Barbecue Restaurants have witnessed an upsurge in demand throughout the five years leading up to 2021. Restaurants have been serving barbecue menu items such as pulled pork, brisket, and ribs. As a consequence, industry revenue climbed by 2.0 percent annually to $4.0 billion during the same time period. External competition has been rising as restaurants from other sectors add industry items to their menus, creating a challenge to industry operators. Check out this guide on how to write an executive summary? If you don’t have the time to write on then you can use this custom Executive Summary Writer to save Hrs. of your precious time.

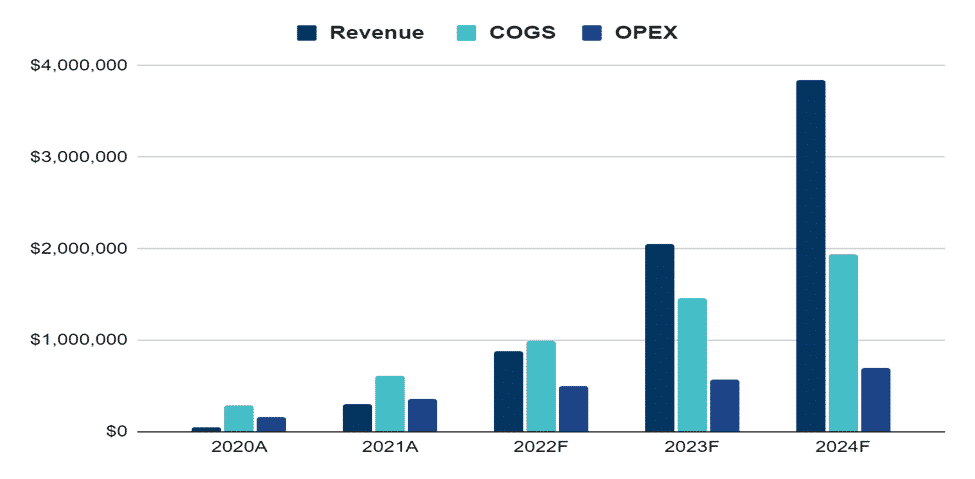

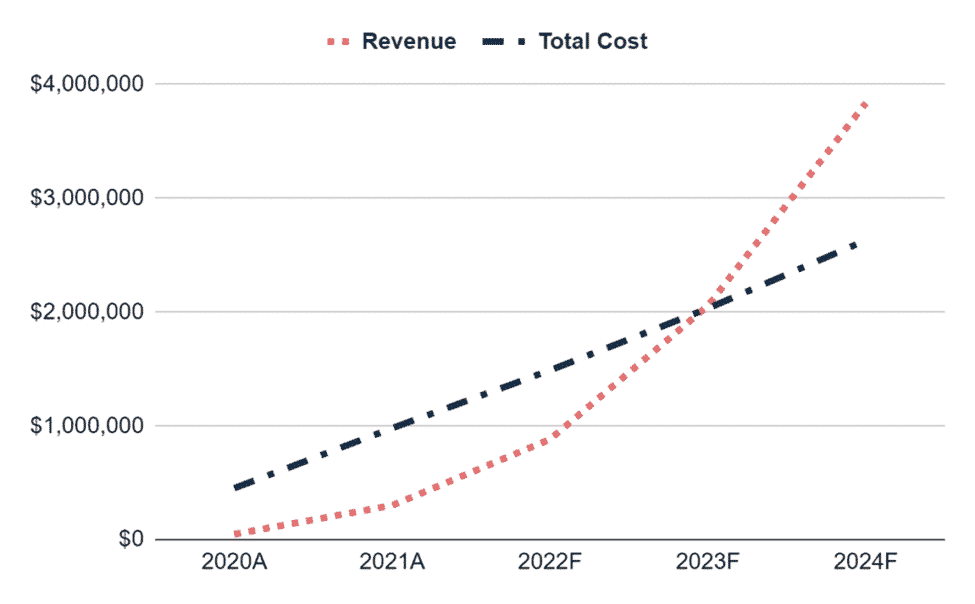

Financial Overview:

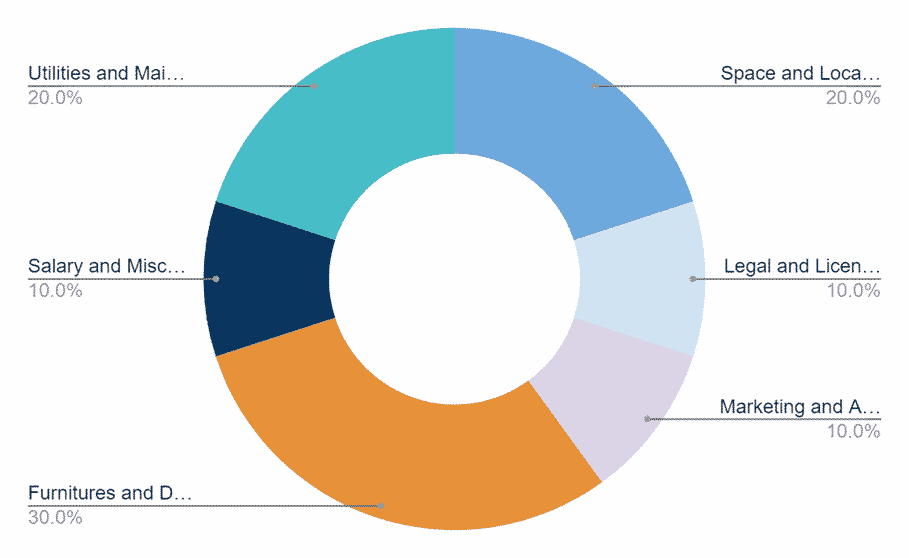

FUND USAGE

Business Model Canvas

Tips on Business Model Canvas

The Business Model Canvas is a high-level overview of the business model. It can also be considered as the business model map in the overall plan. The important partners, key activities, value proposition and cost & revenue sections are only some of the nine vital components. A company idea’s complexities may be mapped out, analyzed and communicated with the use of the canvas. It shows the whole picture of a company’s value creation, delivery and capture processes. It helps new business owners hone their ideas, encourage creative thinking and make sound strategic decisions. It’s a helpful resource for coming up with ideas, organizing plans and presenting business models to key players. Check out the 100 samples of business model canvas.

SWOT

Tips on SWOT Analysis

It offers a clear lens into a company’s strengths, weaknesses, opportunities and threats. This self-awareness enables effective resource allocation and strategic positioning against competitors. Businesses can mitigate risks, make informed decisions and set realistic goals. In addition, presenting a SWOT analysis in a business plan communicates to stakeholders that the company possesses a deep understanding of its market environment. In essence, SWOT ensures a business’s strategy is grounded in reality enhancing its chances of success. Check out the 100 SWOT Samples

Industry Analysis

According to Chicago-based Mintel International’s Menu Insights, barbecue is rising steadily in restaurants, with total barbecue menu items increasing 11% between the fourth quarter of 2016 and the fourth quarter of 2019. (MMI). Boneless chicken wings (up 32%), chicken wings (up 13%), barbecue pizza (up 13%), and bacon burgers are among the fasted growing menu items utilizing barbecue sauces (up 4 percent).

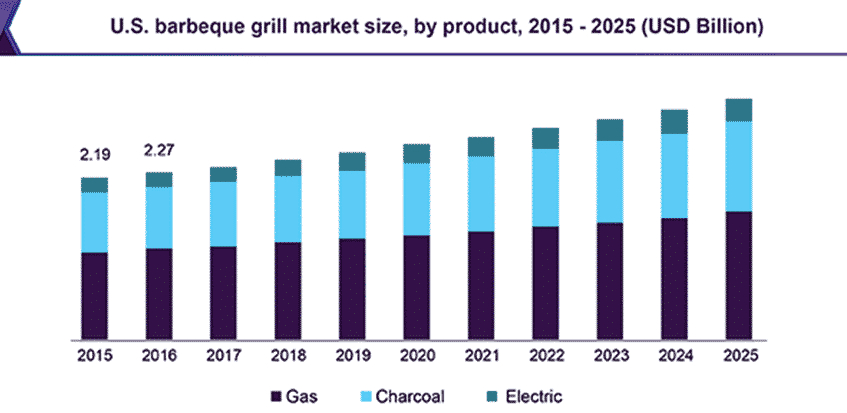

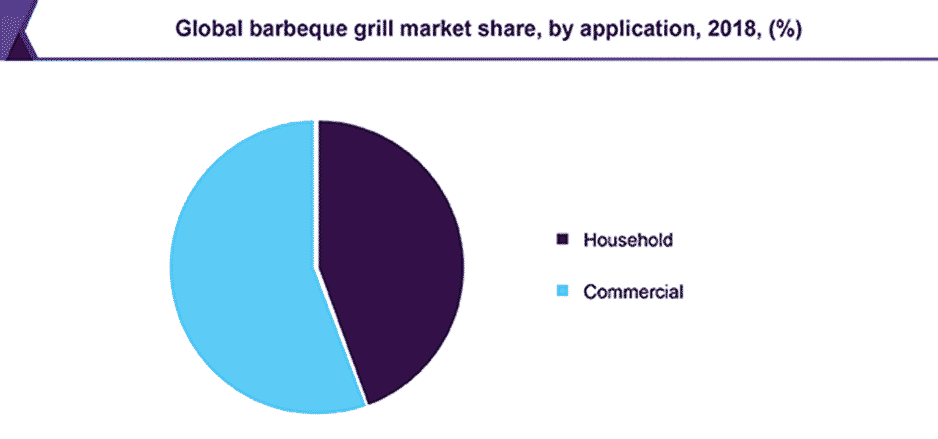

In 2018, the worldwide barbeque grill market was valued at USD 4.79 billion, with a CAGR of 4.5 percent predicted during the projected year. Cookouts on weekends and holidays are likely to increase in popularity, particularly among the younger generation. In addition, changing lifestyles, together with the adoption of premium items for home and outdoor culinary activities, are expected to drive product demand in the near future. Porcelain-enameled cast iron, porcelain-enameled steel, and stainless steel are the most common materials used to make barbecue grills. Stainless steel has a longer lifetime than other materials while also being less expensive, which contributes to its widespread use. Depending on the kind of grill material, manufacturers provide a one to ten year guarantee. A lifetime burner warranty is usually included with high-end equipment. Vintage, a premium grill and accessory company located in the United States, for example, offers a lifetime guarantee on burners and certain accessories.

Source: globenewswire

While working on the industry analysis section make sure that you add significant number of stats to support your claims and use proper referencing so that your lender can validate the data.

To attract more consumers, companies provide goods with features such a portable gas grill, heavy-duty grates, electronic igniter, LED-light control, fuel gauge, pullout tray, and fuel valves. Natural gas barbeque grills are preferred by a huge number of people in the United States due to their inexpensive cost and ease of availability, as well as their ability to burn cleaner than propane. By 2017, around 70% of adult Americans had a smoker or grill. As outdoor activities become more popular, demand for portable barbeque grills is projected to grow in the region. Outdoor activities are enjoyed by over half of the people in the United States over the age of six at least once a year. Market increase is expected in the next years as a result of these advancements.

In 2018, the gas category had the highest share of the barbecue grill market, with USD 2.67 billion in sales. According to utility providers, this is the most common backyard barbecue product type, with the capacity to operate on natural gas or bottled propane. Product demand is driven by the capacity of gas items to swiftly flare up. Premium gas goods with stainless steel bodies, three to five burners, and the option of a side burner for heating pans and pots are projected to be adopted by a growing percentage of the middle class population.

From 2019 to 2025, the quickest CAGR for electric products is predicted to be 5.6 percent. The industry is expected to develop in response to the growing popularity of home cooking as a hobby and leisure activity. In addition, product demand is expected to be driven by the interior usefulness and convenience afforded by these goods. To meet the growing demand, manufacturers are focusing on product innovation. For example, in 2016, under the George Foreman Grills brand, Spectrum Brands, Inc. released an electric grill with five nonstick plates named Grill & Broil. IntelliKEN Touch, which has a built-in kitchen timer and a touch control system, was released in March 2019 by Kenyon International, Inc.

With a revenue of USD 2.66 billion in 2018, the commercial application area was the most profitable. The items are used in a vast number of restaurants. BBQ restaurants’ rising appeal among customers in emerging nations like as China, India, Brazil, and Mexico is expected to boost the segment’s development. The increase in hiking and camping activities is expected to boost product demand even further. Working people are more drawn to spend their weekends and vacations outside due to rising job pressures and a demanding lifestyle. Over the projected period, this aspect is likely to provide new business opportunities for the major players.

From 2019 to 2025, the household category is predicted to grow at a 4.8 percent CAGR. To deliver a professional barbecue experience to residential customers, companies provide unique product features. The majority of customers choose to buy portable items with a flat compact top. Portable single burner items are used for both indoor and outdoor cooking. In the next years, this element is expected to help the industry flourish.

In 2018, North America dominated the industry with a market share of over 55%. In places like the United States and Canada, barbeque grilling is a way of life. On most holidays and special events, consumers choose BBQ meals. According to the Hearth, Patio, and Barbecue Association (HPBA), over 70% of consumers participate in weekend BBQ cooking throughout the summer. Cookouts are also popular on national holidays such as Thanksgiving, Independence Day, Christmas, and New Year’s Eve. Barbecue is preferred by over 50% of customers in North America for birthday celebrations and by roughly 24% for camping excursions. To increase income in this increasing sector, businesses are investing in innovative product development. In January 2016, for example, Char-Broil, a business located in the United States, released the SmartChef Smoker app to teach users how to regulate meat temperature, chamber temperature, and cooking time.

From 2019 to 2025, Asia Pacific is expected to grow at the quickest rate of 5.6 percent, thanks to rising street food consumption and significant investments by major companies in emerging countries such as India and China. Furthermore, increased demand for barbecue goods over hot dogs, burgers, and pizza is expected to drive regional market expansion in the future years.

Source: mordorintelligence

In 2018, North America dominated the industry with a market share of over 55%. In places like the United States and Canada, barbeque grilling is a way of life. On most holidays and special events, consumers choose BBQ meals. According to the Hearth, Patio, and Barbecue Association (HPBA), over 70% of consumers participate in weekend BBQ cooking throughout the summer. Cookouts are also popular on national holidays such as Thanksgiving, Independence Day, Christmas, and New Year’s Eve. Barbecue is preferred by over 50% of customers in North America for birthday celebrations and by roughly 24% for camping excursions. To increase income in this increasing sector, businesses are investing in innovative product development. In January 2016, for example, Char-Broil, a business located in the United States, released the SmartChef Smoker app to teach users how to regulate meat temperature, chamber temperature, and cooking time.

From 2019 to 2025, Asia Pacific is expected to grow at the quickest rate of 5.6 percent, thanks to rising street food consumption and significant investments by major companies in emerging countries such as India and China. Furthermore, increased demand for barbecue goods over hot dogs, burgers, and pizza is expected to drive regional market expansion in the future years.

Marketing Plan

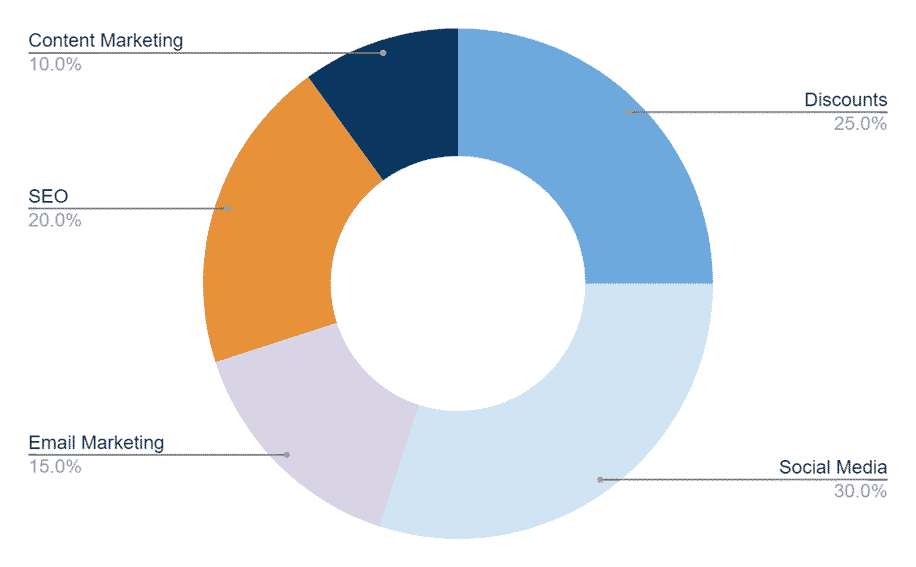

A key part of the marketing plan is the marketing budget. The growth in the number of customers is proportional to the budget and dependent on the CAC.

Content Marketing: Create a blog on your Joe’s City Bar-B-Que website that has material that prospective customers.

Discounts: Provide multiple rewards or incentives to Joe’s City Bar-B-Que

Frequent customers, you’ll be more likely to attract them. Create a member referral scheme, for example, where members get a discount if they successfully recommend someone.

Social Media: Engage and promote Joe’s City Bar-B-Que on Twitter, publish news on Facebook, and utilize Instagram to promote curated photos of your space and events. Think about if you have place in your budget for Facebook Marketing or other social media focused ads.

SEO (Search Engine Optimization) Local SEO makes it easier for local consumers to find out what you have to offer and creates trust with potential members seeking for what your place has to offer.

Email Marketing: Joe’s City Bar-B-Que will be sending an automated in-product and website communications to reach out to consumers at the right time. Remember that if your client or target views your email to be really important, they are more likely to forward it or share it with others, so be sure to include social media share buttons in every email.

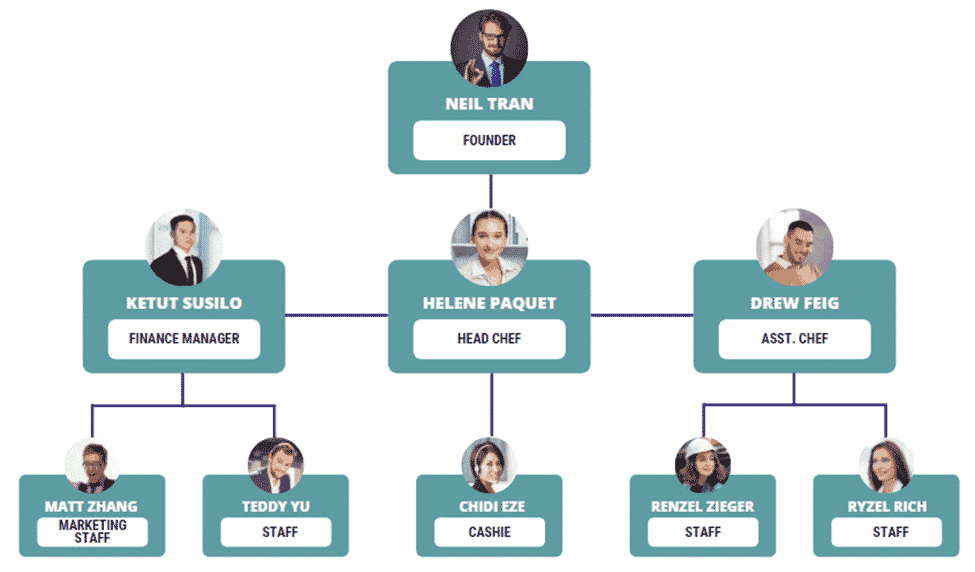

Organogram:

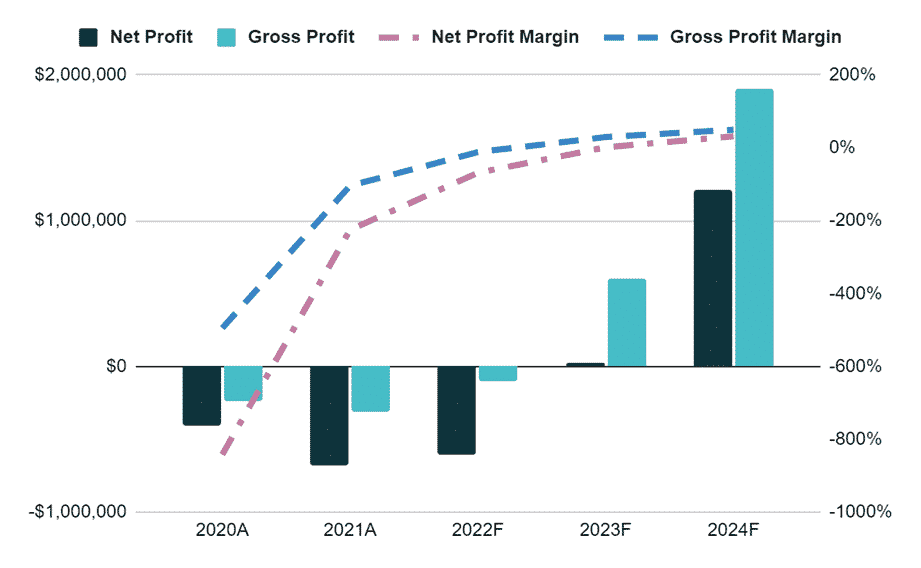

Financial Plan

This section helps your lender figure out whether you will be able to pay off the loan, whether the business is sustainable, what are the growth prospects, etc.

Earnings:

Break-Even Analysis:

Income Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| Total Cost of Revenue | 285,560 | 615,220 | 987,794 | 1,455,612 | 1,935,625 |

| as % of revenue | 595% | 204% | 112% | 71% | 50% |

| Gross Profit | -237,575 | -313,984 | -105,583 | 601,578 | 1,902,218 |

| SELLING & ADMIN EXPENSES | |||||

| Item 1 | 28,000 | 96,800 | 154,880 | 175,692 | 193,261 |

| Item 2 | 75,000 | 105,000 | 120,000 | 120,000 | 120,000 |

| Item 3 | 36,000 | 96,000 | 108,000 | 120,000 | 120,000 |

| Item 4 | 8,000 | 12,000 | 12,000 | 12,000 | 12,000 |

| Item 5 | 3,839 | 18,074 | 44,111 | 61,716 | 115,135 |

| Item 6 | 3,359 | 12,049 | 26,466 | 41,144 | 76,757 |

| Item 7 | 5,600 | 10,000 | 12,904 | 15,034 | 17,376 |

| Item 8 | 6,667 | 14,000 | 22,067 | 30,940 | 40,701 |

| Total selling & admin expenses | 166,464 | 363,924 | 500,428 | 576,525 | 695,230 |

| as % of revenue | 347% | 121% | 57% | 28% | 18% |

| Net profit | -404,039 | -677,907 | -606,011 | 25,052 | 1,206,987 |

| Accumulated net profit | -404,039 | -1,081,947 | -1,687,957 | -1,662,905 | -455,918 |

Cash Flow Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| CASH FLOW from OPERATING ACTIVITIES | |||||

| Net profit before tax | -$404,039 | -$677,907 | -$606,011 | $25,052 | $1,206,987 |

| Depreciation | $44,267 | $85,333 | $120,504 | $158,127 | $199,512 |

| Payables | |||||

| Item 1 | $4,333 | $5,417 | $6,500 | $7,583 | $8,667 |

| Item 2 | $11,667 | $28,000 | $46,667 | $70,000 | $93,333 |

| Item 3 | $6,250 | $8,750 | $10,000 | $10,000 | $10,000 |

| Item 4 | $3,000 | $8,000 | $9,000 | $10,000 | $10,000 |

| Item 5 | $667 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| change in payables | $25,917 | $25,250 | $22,000 | $25,417 | $24,417 |

| Receivables | |||||

| Item 1 | $320 | $1,506 | $3,676 | $5,143 | $9,595 |

| Item 2 | $360 | $1,807 | $4,411 | $8,229 | $11,514 |

| Total receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| change in receivables | -$680 | -$2,634 | -$4,773 | -$5,285 | -$7,736 |

| Net cash flow from operating activities | -$334,536 | -$569,958 | -$468,280 | $203,311 | $1,423,180 |

| CASH FLOW from INVESTING ACTIVITIES | |||||

| Item 1 | $16,000 | $13,200 | $14,520 | $15,972 | $17,569 |

| Item 2 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Item 3 | $28,000 | $22,000 | $14,520 | $10,648 | $11,713 |

| Item 4 | $96,000 | $88,000 | $72,600 | $79,860 | $87,846 |

| Item 5 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Net cash flow/ (outflow) from investing activities | -$180,000 | -$167,200 | -$150,040 | -$159,720 | -$175,692 |

| CASH FLOW from FINANCING ACTIVITIES | |||||

| Equity | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net cash flow from financing activities | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net (decrease)/ increase in cash/ cash equivalents | -$114,536 | -$297,158 | -$134,320 | $575,991 | $1,833,128 |

| Cash and cash equivalents at the beginning of the year | – | -$114,536 | -$411,693 | -$546,014 | $29,978 |

| Cash & cash equivalents at the end of the year | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

Balance Sheet:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| NON-CURRENT ASSETS | |||||

| Item 1 | $16,000 | $29,200 | $43,720 | $59,692 | $77,261 |

| Item 2 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Item 3 | $28,000 | $50,000 | $64,520 | $75,168 | $86,881 |

| Item 4 | $96,000 | $184,000 | $256,600 | $336,460 | $424,306 |

| Item 5 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Total | $180,000 | $347,200 | $497,240 | $656,960 | $832,652 |

| Accumulated depreciation | $44,267 | $129,600 | $250,104 | $408,231 | $607,743 |

| Net non-current assets | $135,733 | $217,600 | $247,136 | $248,729 | $224,909 |

| CURRENT ASSETS | |||||

| Cash | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

| Accounts receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| Total current assets | -$113,856 | -$408,380 | -$537,927 | $43,349 | $1,884,214 |

| Total Assets | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

| LIABILITIES | |||||

| Account payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| Total liabilities | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| EQUITIES | |||||

| Owner’s equity | $400,000 | $840,000 | $1,324,000 | $1,856,400 | $2,442,040 |

| Accumulated net profit | -$404,039 | -$1,081,947 | -$1,687,957 | -$1,662,905 | -$455,918 |

| Total equities | -$4,039 | -$241,947 | -$363,957 | $193,495 | $1,986,122 |

| Total liabilities & equities | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |