Written by Elma Steven | Updated on April, 2024

How to Write a Bed and Breakfast Business Plan?

Bed and Breakfast Business Plan is an outline of your overall bed and breakfast business. The business plan should include a 5 year financial projection, marketing plan, industry analysis, organizational overview, operational overview and finally an executive summary. Remember to write your executive summary at the end as it is considered as a snapshot of the overall business plan. You need to be careful while writing the plan as you need to consider various factors that can impact the business’s success.

Table of Contents

Executive Summary

Located in the lovely Coconut Grove district of Miami, “Sunrise Haven Bed and Breakfast” is a delightful and comfortable place to stay. Emily Robinson, a seasoned hospitality professional with more than 15 years of expertise, established Sunrise Haven to provide guests with an exceptional combination of upscale boutique accommodation and home-like comfort. Our unique concierge services, gourmet breakfasts, and individualized guest rooms are just a few of our offerings. The bed and breakfast offers a one-of-a-kind, genuine Miami experience with its individualized guest service, tranquil garden location, and outstanding regional food.

Mission: Providing visitors with individualized, comfortable, and opulent lodgings that mimic home while they are in Miami is our first priority. Our top priorities are providing exceptional service that our visitors will never forget, making sure they are comfortable and happy, and promoting the finest of Miami hospitality.

Vision: Our vision is to become Sunrise Haven Bed & Breakfast the go-to boutique hotel in Miami for those in search of a one-of-a-kind getaway, distinguished by our impeccable service, charming atmosphere, and peaceful urban sanctuary. Contributing to and improving Miami’s attractiveness as a tourist destination is our goal.

Industry Overview:

American bed and breakfasts (B&Bs) have shown to be resilient and adaptable despite shifting market conditions. A number of reasons that favor customized hospitality experiences are expected to keep the business growing steadily, with a current market value of $2.8 billion in 2023.

Check out this guide on how to write an executive summary? If you don’t have the time to write on then you can use this custom Executive Summary Writer to save Hrs. of your precious time.

Financial Highlights

Earnings & Profitability

Break-Even Analysis

Business Description

Business Name: Sunrise Haven Bed and Breakfast

Founders: Emily Robinson

Management Team: [You can ignore this/ delete this but its better to provide it]

Legal Structure: LLC

Location: Miami

Goals & Objectives:

- Guest Satisfaction Improvement: By year’s end, as evaluated by online reviews and feedback forms, reach a visitor satisfaction score of 95%.

- Occupancy Rate Increase: Over the following twelve months, raise the occupancy rate by 20% by more focused advertising and better service to guests.

- Repeat Guest Rate: Increase the percentage of returning customers by 15% in 18 months via the use of a loyalty program and customized services.

- Revenue Growth: Over the following two years, diversify your service offerings to include event hosting and special package deals in order to increase total income by 25%.

- Brand Awareness: Increase local brand recognition by 30% in one year with smart collaborations, community involvement, and efficient social media advertising.

- Sustainable Practices Implementation: In the following twelve months, have a positive impact on the environment and attract visitors who are concerned about sustainability by implementing five new sustainable practices into the B&B’s operations.

- Staff Training and Development: Improve service quality and make sure your staff knows all the ins and outs of Miami by instituting a quarterly training session.

- Guest Experience Personalization: Within six months, you should have a framework in place to tailor your guests’ experiences to their individual tastes.

- Online Booking Increase: Increase the number of reservations made directly via the B&B’s website by 40% during the following 12 months, decreasing the use of third-party booking services.

- Community Engagement: In order to build relationships within the community and encourage word-of-mouth advertising, it is recommended that you take part in or support three local events or causes every year.

- Upgrade and Renovation: Within the following two years, update or renovate one important part of the B&B (such as the dining area, guest rooms, or garden) to make it more contemporary and better for guests.

- Strategic Networking: In order to provide visitors with unique experiences, you should form at least five new strategic alliances with nearby companies (such as eateries, tour operators, and event organizers) in the next year.

- Customer Relationship Management (CRM) System Implementation: Improve the management of guest relationships, reservations, and preferences by implementing a customer relationship management system over the next six months.

- Social Media Engagement: Get 30% more people to engage with your social media posts and 50% more people to follow you in the next year by consistently posting high-quality material and engaging with your followers.

- Financial Management Efficiency: Introduce updated accounting and budgeting software or procedures during the next twelve months to boost the effectiveness of financial management.

Services:

- Luxury Accommodation: Provide spacious rooms with high-quality linen, contemporary conveniences, and distinctive furnishings that capture the essence of the surrounding area.

- Gourmet Breakfast: Serving a delicious breakfast every morning with a focus on locally produced, fresh foods and alternatives to accommodate various dietary needs is our top priority.

- Concierge Services: Provide clients with a range of concierge services, including help with bookings, tickets, transportation, and suggestions for area restaurants, shows, and events.

- Personalized Room Customization: Let your visitors create their own unique experience by selecting their preferred room scent, pillow type, and other amenities in advance.

- Guided Tours: Provide unique tours of Miami’s historical, cultural, and ecological landmarks by organizing guided excursions or partnering with local tour companies.

- Event Hosting: Gathering places for smaller gatherings including weddings, reunions, business get-togethers, and health retreats should be made available.

- Spa and Wellness Services: Massages, facials, and other health treatments may be enjoyed in the comfort of your own room.

- Culinary Experiences: Host culinary events like wine tastings, cooking classes, or themed dinners showcasing local cuisine and ingredients.

- Transportation Services: Provide or arrange transportation services, including airport transfers, car rentals, or bicycles for local exploration.

- Custom Itineraries: Assist guests in creating custom itineraries tailored to their interests, whether it’s exploring local art scenes, nature trails, or culinary hotspots.

- Exclusive Access: Arrange for VIP or exclusive access to local events, clubs, or attractions for your guests.

- Rooftop or Garden Relaxation Areas: Offer a serene rooftop or garden area where guests can relax, enjoy a drink, or participate in activities like yoga or meditation.

- High-Speed Internet and Workspace Amenities: Cater to business travelers by providing high-speed internet, work desks in rooms, and a small business center with printing and scanning facilities.

- Pet-Friendly Services: Offer services for guests traveling with pets, such as pet beds, feeding bowls, and pet-sitting services.

- Eco-Friendly Initiatives: Implement and promote eco-friendly practices, such as recycling, composting, and using sustainable products, to attract environmentally conscious travelers.

- Local Art and Culture Showcasing: Decorate the B&B with works from local artists and host events like art exhibitions or performances by local musicians.

- Fitness Options: Provide fitness options like gym access, jogging maps, or collaboration with local fitness centers for guest access.

- Gift Shop: A small gift shop featuring locally-made products, souvenirs, and essential travel items can add convenience and local flavor.

Financial Overview

Startup Cost

Revenue & Cost Projection

Profitability & Cash Flow Projection

Business Model

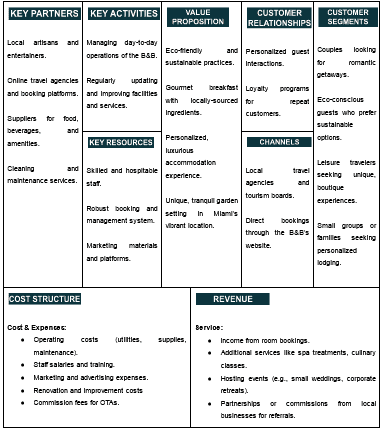

Tips on Business Model Canvas

The Business Model Canvas is a high-level overview of the business model. It can also be considered as the business model map in the overall plan. The important partners, key activities, value proposition and cost & revenue sections are only some of the nine vital components. A company idea’s complexities may be mapped out, analyzed and communicated with the use of the canvas. It shows the whole picture of a company’s value creation, delivery and capture processes. It helps new business owners hone their ideas, encourage creative thinking and make sound strategic decisions. It’s a helpful resource for coming up with ideas, organizing plans and presenting business models to key players. Check out the 100 samples of business model canvas.

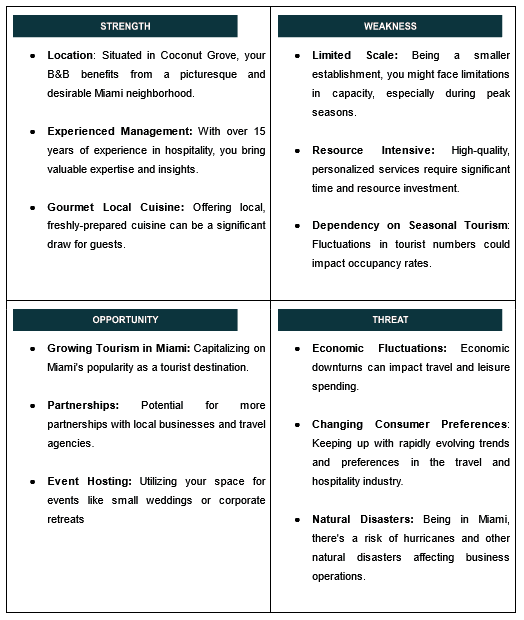

SWOT

Tips on SWOT Analysis

It offers a clear lens into a company’s strengths, weaknesses, opportunities and threats. This self-awareness enables effective resource allocation and strategic positioning against competitors. Businesses can mitigate risks, make informed decisions and set realistic goals. In addition, presenting a SWOT analysis in a business plan communicates to stakeholders that the company possesses a deep understanding of its market environment. In essence, SWOT ensures a business’s strategy is grounded in reality enhancing its chances of success. Check out the 100 SWOT Samples

Marketing Plan

Promotional Channels

Social Media Marketing – $12,000 (30%)

- Platform Focus: Concentrate on Instagram, Pinterest, and Facebook for sharing captivating images of your property, guest testimonials, and local sights.

- Paid Ads: Use targeted ads to reach potential guests interested in travel, boutique accommodations, and Miami vacations.

- Content Strategy: Regular posts showcasing your rooms, gourmet breakfasts, and special events. Create themed content series like “Miami Mondays” featuring local attractions.

Website and SEO – $8,000 (20%)

- Website Revamp: Ensure the website is visually appealing, easy to navigate, and highlights your B&B’s unique features, such as the garden setting and personalized services.

- Blog Content: Publish regular blog posts about Miami travel tips, local events, and unique aspects of staying at a B&B.

- SEO: Focus on keywords related to bed and breakfasts, boutique Miami accommodations, and unique travel experiences.

Email Marketing – $4,000 (10%)

- Newsletter: Develop a monthly newsletter with updates, special offers, and features on local events or attractions.

- Segmentation: Create tailored messages for different audience segments like returning guests, first-time inquiries, and special event planners.

Local Partnerships and Community Engagement – $6,000 (15%)

- Local Events: Partner with local events and festivals, offering your B&B as a preferred accommodation choice.

- Collaborations: Work with local businesses (cafés, tour operators) for cross-promotion and package deals.

Influencer and Travel Blogger Collaborations – $5,000 (12.5%)

- Collaborations: Partner with travel bloggers and influencers who can showcase the unique experience of staying at your B&B.

- Special Packages: Offer special packages or experiences for guests referred through these influencers.

Targeted Print and Local Advertising – $3,000 (7.5%)

- Print Ads: Place ads in local travel magazines and brochures distributed at tourist spots.

- Local Media: Invest in local radio spots or community bulletin boards.

Referral and Loyalty Programs – $2,000 (5%)

- Referral Program: Implement a program offering discounts or perks for guests who refer new customers.

- Loyalty Program: Design a loyalty program providing benefits for repeat stays.

Brand Management

Social Media Marketing

- Brand Voice and Visual Identity: Develop a warm, welcoming brand voice that reflects the cozy and personalized experience of your B&B. Use a consistent visual style on platforms like Instagram, Facebook, and Pinterest, showcasing the beauty of your property, rooms, and meals.

- User-Generated Content: Encourage guests to share their experiences and tag your B&B. Repost these stories and reviews to build credibility and authenticity.

- Live Sessions: Host live virtual tours of your B&B, Q&A sessions about travel in Miami, or live cooking sessions showcasing your breakfast offerings.

Search Engine Marketing (SEM) and Local SEO

- Ad Copy: Emphasize unique aspects such as the tranquil garden setting, personalized guest experiences, or gourmet local cuisine.

- Website Optimization: Ensure your website highlights guest testimonials, stunning photography of your B&B, and is optimized for search engines with keywords like “bed and breakfast in Miami”, “boutique accommodation”, etc.

- Google My Business: Regularly update with high-quality images, guest reviews, and detailed information about your services.

Email Marketing

- Newsletter: Share updates about seasonal offers, events in Miami, and showcase guest stories or experiences.

- Segmentation: Create different email streams for various segments like repeat guests, potential customers, and event planners.

Local Partnerships and Community Engagement:

- Local Events and Festivals: Partner with local events, providing accommodation deals or packages that include local experiences.

- Collaboration with Local Businesses: Form partnerships with nearby attractions, restaurants, and tour operators for cross-promotion.

Content Marketing

- Educational Content: Blog posts or videos about local attractions, travel tips in Miami, and the benefits of staying at a B&B.

- Behind-the-Scenes Content: Share stories about your B&B’s history, day-to-day operations, or feature your staff and their roles.

Influencer and Travel Blogger Collaborations:

- Partnerships with Influencers: Collaborate with travel bloggers or influencers who can authentically share the experience of staying at your B&B.

- Content Collaboration: Create content that showcases both the influencer’s experience and the unique aspects of your B&B.

Offline Advertising

- Local Media and Print: Place ads in local travel guides, magazines, and collaborate with tourist centers. Ensure ads capture the essence of your B&B’s experience.

- Community Boards and Local Businesses: Distribute flyers or business cards in community centers, cafes, and local tourist spots.

Referral Program

- Incentivize Referrals: Offer a discount or special package for guests who refer new customers to your B&B.

Go To Market Strategy

Online Presence and Community Engagement

- Professional Website: Create a visually appealing, easy-to-navigate website showcasing your B&B’s unique charm, with a user-friendly booking system and high-quality images of your rooms and amenities.

- Content Marketing: Publish regular blog posts or articles about Miami’s attractions, travel tips, and the benefits of staying at a bed and breakfast. This content should be SEO-optimized to drive organic traffic.

- Local Directory Listings: List your B&B on relevant travel and accommodation directories, ensuring that your listings are updated with high-quality images and detailed descriptions.

- Partnerships: Collaborate with local businesses, such as restaurants, tour operators, and event organizers, to create package deals and promote mutual referrals.

Launch Event and Promotional Offers:

- Grand Opening Event: Host a special event to introduce your B&B to the community. Invite local business owners, travel influencers, and the press for a tour and networking.

- Introductory Discounts: Offer promotional rates for first-time guests or create special packages that combine accommodation with local experiences.

Digital Marketing and Customer Relations

- Social Media Campaigns: Utilize platforms like Instagram, Facebook, and Pinterest to showcase your property, special events, and guest experiences. Regularly post engaging content, such as behind-the-scenes glimpses and guest testimonials.

- Email Marketing: Develop a newsletter to keep past and potential guests informed about special offers, events, and updates from your B&B.

- Loyalty Program: Implement a program that rewards repeat guests with discounts, upgrades, or special amenities.

Brand Awareness and Public Relations

- Local Media Outreach: Connect with local newspapers, magazines, and travel bloggers for features, interviews, and collaborative articles.

- Community Involvement: Participate in local events, sponsor community activities, or host public events at your B&B to increase visibility.

- Influencer Partnerships: Partner with travel influencers or bloggers who can authentically showcase the experience of staying at your B&B.

Performance Tracking

- Analytics and Feedback: Regularly monitor the performance of your marketing efforts through tools like Google Analytics, and gather guest feedback through surveys or direct communication.

- Adaptation: Be flexible and ready to adjust your strategies based on performance data, guest feedback, and evolving market trends.

Organizational Overview

Founder

Emily Robinson, a visionary with a deep love of hospitality and an ability to create welcoming, unforgettable experiences, is the driving force behind Miami’s Sunrise Haven Bed & Breakfast. With a passion for travel and an eye for beauty, comfort, and detail, Emily set out to become a boutique hotelier.

Emily has an extensive background in the hospitality business, having worked for over 15 years. She has a natural knack for knowing how to make guests feel unique throughout their stay. From managing small, elegant inns to serving as a customer service representative for five-star hotels, her career has been rather varied. Through her varied experiences, Emily has developed a fresh perspective on ensuring guests are happy, combining the efficiency of high-end hotels with the individualized warmth of more intimate venues.

When Emily decided to take the business plunge with Sunrise Haven, it was to fulfill her dream of opening a bed and breakfast that combines the coziness of a home and the sophistication of a boutique retreat. Her bed and breakfast is a reflection of her conviction in offering an intimate and elegant experience, situated in the beautiful and culturally rich Miami.

Thanks to Emily’s careful direction, Sunrise Haven distinguishes out thanks to its personalized guest services, tastefully decorated rooms, and emphasis on offering a genuine, locally-sourced experience. As a result of Emily’s unwavering commitment to quality, Sunrise Haven offers concierge services that highlight the top of Miami and gourmet breakfasts that include local delicacies.

Emily has many connections in the Miami community outside the B&B. She is always working with local craftsmen, chefs, and event planners to incorporate Miami’s rich cultural tapestry into Sunrise Haven’s offerings. She has a sincere desire to help strengthen the social and cultural fabric of the community she serves, and her participation in local activities and projects reflects that.

As long as Emily Robinson remains at the helm, Sunrise Haven Bed & Breakfast will continue to grow into more than simply a hotel—it will become an integral element of visitors’ Miami experience. An oasis of comfort and elegance in one of the world’s most beautiful cities—that is her narrative, a tale of love, devotion, and an unrelenting desire.

Positions and Responsibilities

Chief Executive Officer (CEO) – Emily Robinson

Emily, in her role as CEO, is in charge of the B&B’s general strategy and operations. Her responsibilities include making important decisions, representing the company in all official capacities, and facilitating productive dialogue amongst the many departments.

General Manager

Every aspect of the B&B is managed by the general manager, who is responsible for making sure that guests are satisfied and that everything runs smoothly. Oversight of guest services, management of personnel, and upkeep of lodging and amenity quality are all within their purview.

Front Desk Coordinator

Managing interactions with guests, taking bookings, and responding to questions all fall within this position’s purview. As visitors’ first point of contact, the front desk coordinator sets the tone for their entire stay.

Housekeeping Supervisor

In charge of ensuring that the bed and breakfast is always neat and tidy. They oversee the cleaning crew, set up cleaning schedules, and check that every room and common space is spotless.

Chef and Kitchen Staff

Gourmet breakfasts and other meals are prepared under the direction of the Chef and his or her kitchen staff. High culinary standards, menu planning, and food preparation are all under their purview.

Maintenance Technician

Keeping the B&B’s facilities in good repair is part of this position. They are in charge of fixing things and doing regular maintenance to make sure the B&B is in good shape.

Marketing and Social Media Coordinator

Charged for advertising the B&B via different mediums. They are responsible for the B&B’s social media accounts, marketing materials, and managing the B&B’s internet presence.

Guest Relations Specialist

Improving the experience for guests is the main objective of this role. They make sure visitors have an unforgettable stay by attending to their unique requirements, offering concierge services, and interacting with them.

Financial Controller

Oversees the budget, accounting, and reporting of the B&B’s finances. They are in charge of payroll and buying in addition to ensuring the company’s financial health and compliance.

Event Coordinator

Planning and implementation of activities hosted by the B&B are overseen by this function. They are in charge of client coordination, event preparation, and execution.

Organogram

Operational Overview

Services

Standard Accommodation Services:

- Luxurious and comfortable accommodations with modern amenities.

- Designed for both leisure and business travelers, ensuring a homely ambiance.

.

Gourmet Breakfast and Dining

- Gourmet breakfast featuring fresh, locally-sourced ingredients.

- Varied menu catering to different dietary preferences and showcasing Miami’s culinary culture.

Concierge and Personalized Services:

- Dedicated concierge service for personalized local recommendations.

- Assistance with reservations, transportation arrangements, and tailored guest experiences.

Event Hosting and Management:

- Ideal for hosting intimate events such as weddings, family gatherings, or corporate retreats.

- Comprehensive event planning and management services.

Local Tours and Experiences:

- Exclusive access to a variety of local tours and experiences..

- Partnerships with local tour operators to offer cultural excursions and outdoor adventures.

Wellness and Relaxation Amenities:

- Serene garden area for relaxation and meditation.

- In-room spa services like massages and wellness treatments available upon request.

Business Facilities:

- High-speed internet access and work desks in rooms.

- A business center equipped with printing and scanning facilities.

Pet-Friendly Services:

- Pet-friendly rooms with amenities such as pet beds and feeding bowls.

- Information on local pet-friendly attractions.

Eco-Friendly Practices:

- Incorporation of recycling, energy-efficient lighting, and sustainable products.

Custom Itineraries and Activity Planning:

- Assistance in creating custom itineraries tailored to guests’ interests.

- Personalized guidance for a memorable Miami experience.

Fitness and Recreation Options:

- Information on local fitness centers and outdoor recreation activities.

- Arrangements for activities like yoga sessions or bike rentals.

Gift Shop and Local Artisan Products:

- On-site gift shop featuring locally-made products and souvenirs.

- Support for local artisans and unique keepsakes for guests

Industry Analysis

In the United States and across the world, bed and breakfasts (B&Bs) are a popular choice for those seeking a more intimate and customized kind of lodging. Factors such as the rising desire for genuine travel experiences and the popularity of experiential tourism are expected to propel the business to a projected $13.4 billion in sales by 2028 in the United States, up from an anticipated $10.5 billion in 2022. Even more substantial is the worldwide B&B industry, which is anticipated to generate $35 billion in 2022 and $51.3 billion in 2028. This increase is driven by the increasing demand for local experiences, the popularity of tourism, and the emergence of home-sharing services such as Airbnb.

Source: mordorintelligence

With 10% of all U.S. overnight stays and 5% of business travel attributed to B&Bs, they command a substantial portion of the lodging industry. These businesses, which are usually run by their owners, have an average of five rooms and a 70% occupancy rate. In the United States, a bed and breakfast room costs an average of $150 a night, compared to $100 worldwide.

Similar to what has recently propelled the B&B business to success, it is anticipated that this growth will persist in the years to come. Bed and breakfasts are in a prime position to cater to the growing demand from tourists for more genuine and tailored experiences. In addition, the B&B idea has become more well-known and accessible to a larger audience due to the proliferation of home-sharing websites. As a result of its distinctive character and emphasis on individualized hospitality, the bed and breakfast sector is well-positioned for future expansion.

Source: ibisworld

Industry Problems

- Booking and Reservation Issues: Some guests have reported problems with the booking procedure, such as rooms being unavailable due to overbooking or a complicated online reservation system.

- Room Satisfaction: Room size, facilities, and view may fall short of certain customers’ expectations. Problems with cleanliness, noise levels, or insufficient heating or cooling might also develop.

- Service Quality: Service delays, personnel unavailability, and variable cleanliness standards are all examples of inconsistent service quality that guests may encounter.

- Dining and Food Preferences: Difficulties in meeting the needs of individuals with varying dietary restrictions and preferences. Even with gourmet breakfast options, guests can have reservations about the food’s diversity or quality.

- Amenities and Facilities: Issues with the room’s facilities (such as broken appliances or slow Wi-Fi) or the hotel as a whole (such as parking, garden upkeep, or the state of the fitness facility).

- Check-in and Check-out Process: Guests who are in a rush or who come at unusual hours may find the check-in/check-out procedure tedious or difficult.

- Handling Special Requests: Challenging to meet individual requests for things like early or late check-outs, surprise party arrangements, or preferred room design.

- Communication Gaps: Guests may be dissatisfied if there is a lack of clarity or understanding about the regulations, services, local attractions, or B&B restrictions.

- Managing Guest Expectations: Guests’ expectations may not always match up with what they experience throughout their stay, especially if they are influenced by your marketing materials.

- Dealing with Diverse Guest Personalities: Staff members may sometimes face difficulties while dealing with demanding or unpleasant customers, as well as those with special requirements.

- Payment and Billing Issues: Matters pertaining to inaccurate invoicing, mistakes in processing payments, or disagreements about costs.

- Emergency Preparedness: A lack of readiness to handle unexpected events, such as power outages, medical crises, or natural calamities, may have a major influence on the satisfaction of guests.

Industry Opportunities

Enhanced Booking System: Create an effective and easy-to-use online booking platform. Think about teaming up with well-known booking sites to get your name out there. Improving the client experience and maybe increasing reservations may be achieved by streamlining the booking process.

Room Customization Options: Allow clients to personalize their stay by selecting their preferred pillows and room scent, for example. More satisfied guests and good ratings might be the result of personalized experiences.

Staff Training and Service Quality Improvement: Maintain a constant level of service by regularly training employees. Your B&B can stand out from the competition and attract more guests with outstanding service.

Diverse and Flexible Dining Options: Add more options to your menu to accommodate different dietary restrictions and tastes. Having a reputation for being able to accommodate a wide range of dietary choices may bring in more customers.

Regular Maintenance and Upgrade of Amenities: Be sure to inspect and improve the room’s amenities and Wi-Fi on a regular basis. Modern conveniences that are well-kept may greatly improve guests’ stays.

Efficient Check-in/Check-out Procedures: Simplify the check-in/check-out procedure, maybe with the use of technology. Making things easy for visitors may make a lasting impression.

Special Request Fulfillment: Create a mechanism to deal with and complete exceptional requests effectively. Guest loyalty and word-of-mouth advertising may both benefit from personalized service.

Clear Communication and Information Availability: Clearly and comprehensively describe your services, rules, and nearby attractions on your website and in guest welcome packages. Guests will have a better experience and misconceptions will be lessened with clear communication.

Marketing Aligned with Guest Experience: Incorporate a realistic portrayal of the visitor experience into your marketing materials. Improving visitor satisfaction and decreasing negative feedback may be achieved by bringing expectations in line with reality.

Training in Handling Diverse Guest Personalities: Educate workers on how to deal with difficult customers and difficult circumstances. Reputation and visitor relations may be enhanced via skilled management of varied guests.

Streamlined Payment and Billing Process: Set up a charging system that works well and is easy to understand. Trust and dispute resolution may both benefit from an easy payment procedure.

Emergency Preparedness Plans: Create and instruct employees on procedures for handling emergencies. Make sure your guests are secure and have faith in your management by being ready for any emergency.

Target Market Segmentation

Geographic Segmentation

- Miami-Dade County Residents: Aim for local residents seeking a staycation or hosting visiting friends and family. This segment can provide steady business and local word-of-mouth referrals.

- Target Specific Miami Neighborhoods: Focus on neighborhoods known for their tourism draw, like Coconut Grove, Coral Gables, and Miami Beach, attracting visitors who are exploring these areas.

Demographic Segmentation

- Age Groups: Cater to various age groups, from young couples looking for a romantic getaway to older travelers seeking a comfortable and serene experience.

- Income Levels: Offer a range of packages, from standard rooms for budget-conscious travelers to premium suites for those seeking luxury.

- Cultural Diversity: As Miami is a melting pot of cultures, ensure your services and hospitality reflect an understanding and appreciation of diverse backgrounds.

Psychographic Segmentation

- Leisure Travelers: Focus on individuals or families looking for a relaxing vacation, offering them a tranquil retreat with personalized services.

- Business Travelers: Cater to business professionals with amenities like high-speed internet, a business center, and convenient transportation options.

- Health and Wellness Enthusiasts: Attract guests interested in wellness retreats by offering yoga sessions, spa services, and healthy dining options.

Behavioral Segmentation

- Event Attendees: Target guests in town for local events, such as festivals, concerts, or conferences, offering them a comfortable stay close to event venues.

- Romantic Escapes: Couples seeking a romantic getaway can be a key demographic, with tailored packages including couple’s massages, private dinners, or room decorations.

- Eco-Conscious Travelers: With a growing trend towards sustainable travel, focus on guests who prioritize eco-friendly practices and sustainable living.

Lifestyle Segmentation:

- Pet Owners: Offer pet-friendly accommodations and amenities, appealing to guests who travel with their pets.

- Cultural and Art Aficionados: Attract guests interested in the local art and cultural scene by providing guides and arranging tours to local galleries, museums, and cultural events.

Market Size

- Total Addressable Market (TAM) for Bed and Breakfast: Your bed and breakfast’s total addressable market (TAM) includes every single person in the United States who may be interested in a more upscale, individualized hotel experience. This encompasses all types of vacationers—those on a business trip or seeing the world on a leisurely stroll, families in search of something out of the ordinary, and anybody else who values the individualized attention and distinctive atmosphere of a bed and breakfast over a chain hotel.

The expansion of domestic tourism, the appeal of one-of-a-kind hotel alternatives, and the trend toward experiential travel are all elements that are shaping the industry. According to these tendencies, Sunrise Haven and similar bed and breakfasts have a great deal of potential in the market.

- Serviceable Addressable Market (SAM) for Bed and Breakfast: A subset of the whole ATM, your SAM is more targeted. It stands for the segment of the market that Sunrise Haven should reasonably target. Given your location in Miami, this encompasses both locals looking for ways to spend a vacation and visitors to the city for its beaches, museums, and business prospects.

Your SAM is defined by factors like your target client profiles (e.g., eco-conscious tourists, couples, business travelers), the attractiveness of your location, and your distinctive offers (e.g., gourmet breakfast, luxury facilities, eco-friendly practices).

- Serviceable Obtainable Market (SOM) for Bed and Breakfast: Sunrise Haven’s reasonable expectation of capturing the SOM is based on the SAM’s segmentation. This measure is vital because it shows how much of the market you can capture with your existing assets, standing in the industry, and planned advertising campaigns.

The Miami competitive environment, the efficacy of your marketing (particularly digital and word-of-mouth), the quality of your visitor experiences, and the operational capabilities of your organization are factors that impact your SOM. This section is useful for establishing attainable goals for occupancy rates, income, and new client acquisition.

Industry Forces

Market Demand and Tourism Trends:

The rising popularity of boutique and experience tourism, for example, affects the demand for Miami’s bed and breakfasts. Sunrise Haven’s demand for its hotel services is greatly affected by Miami’s prominence as a major tourist destination and the influence of seasonal travel patterns.

Competition

Competition for Sunrise Haven comes from other bed and breakfasts, bigger hotels, and online vacation rental services like Airbnb. The key to sticking out in this competitive industry is to provide unique services, tailored experiences, and specialized facilities.

Technological Advances

It is crucial for contemporary hospitality companies to embrace technology in order to streamline booking, CRM, and digital marketing. You may increase your exposure and appeal to prospective visitors by maintaining an active presence on online travel platforms and review sites.

Regulatory Environment

Important considerations include obtaining the necessary licenses and adhering to all local health and safety requirements for businesses. In order to operate legally and adapt, it is vital to be updated about changes in zoning and legislation that pertain to tourism.

Economic Factors

There is a correlation between the state of the economy and the demand for bed and breakfast services, especially when considering tourist expenditure and disposable income. Pricing, promotion, and service offers may be fine-tuned by keeping an eye on these developments.

Supplier Dynamics

Because of the reliance on suppliers for food, facilities, and maintenance services, operating expenses may be affected by changes in supplier availability and pricing. Services are always of high quality because of strong partnerships with dependable local suppliers.

Customer Preferences and Expectations

Unique local experiences, customized treatment, and home-like comfort are becoming more important to travelers. To ensure client satisfaction and encourage repeat business, it is essential to adapt to their tastes while maintaining high standards of hospitality.

Social and Environmental Responsibility

Attracting visitors who care about the environment and social issues is possible via the implementation of sustainable practices and participation in community projects. In order to better integrate into the neighborhood and increase its attractiveness, the B&B actively participates in many community initiatives and events.

Workforce Availability and Skills

A key component of any successful hospitality or customer service business is attracting and maintaining talented employees. Providing excellent guest service requires ongoing training and a supportive workplace.

Health and Pandemic-Related Impacts

The significance of accommodating booking regulations and implementing stringent health and safety protocols has been brought to light by the COVID-19 pandemic. Changing operating processes in response to evolving health regulations and guest safety requirements might impact trust levels.

Financials

Investment & Capital Expenditure

Revenue Summary

Cost of Goods Sold Summary

OpEX Summary

Income Statement

Cash Flow Statement

Balance Sheet