Written by Elma Steven | Updated on April, 2024

In order to write a Coffee Shop Business Plan you need to start with executive summary. In order to write an executive summary for a Business Plan you need to mention- what your business is about and what you’ll sell. Explain how you’ll get people to buy it. The executive summary should be written at the end. Then you should write a Business Description mentioning goals, objectives, mission and vision. Some of the major sections or components involves Fund Usage Plan, Marketing Plan, Industry Analysis, Organizational Overview, Operational Overview and Financials.

This article will provide you a step by step process to write your Business Plan. Get a free Business Plan at the end!

Table of Contents

Executive Summary

You can now find [Company Name] coffee, pastries, and light breakfast and lunch fare in [City] at the brand new [Café Name]. We’re in this to promote sustainability and support local businesses such as coffee shop while also giving our customers a comfortable place to enjoy a cup of high-quality coffee.

Overview: In the year 1962, Mr. W. E. Huber, a Swiss national and commodities dealer, started his lifetime dream of turning Boncafé into a regional household name. Boncafé’s goods and services are now available in 15 countries. Every part of our business has been motivated by our desire to provide you with the finest brew from the beginning. We’ve scoured the globe for the finest beans and tea leaves from the world’s most prestigious growing locations. We are continually testing and improving their quality, and we are able to forecast drinking trends and develop goods that have been praised for their inventiveness. This passion shows itself in the way we treat you. All of this contributes to our solid reputation as a firm that understands beverages and follows through on its promise of brewing excellence.

Mission: To achieve the Boncafé Promise, we serve with pride and work with passion.

Vision: To be the world’s premier coffee roaster and supplier of gourmet coffees and food service goods by focusing on integrity, quality, service, and relationships.

Industry Overview: Coffee shops exist in a variety of shapes and sizes, but they are often businesses that serve tea, freshly brewed coffee, and other hot drinks. The coffee industry in the United States had more than 82 billion dollars in sales in 2019. Around 166.63 million of 60kg bags of coffee were globally consumed in 2020/2021. The United States stands out as a drinker. In terms of coffee consumption, the Northeast led the way, with an average of 1.97 cups per person per day. Despite the fact that coffee lovers may be found all throughout the nation, coffee consumption differed by location in 2020. Meanwhile, the South consumed the least quantity of coffee that year, with an average of 1.8 cups per day. Check out this guide on how to write an executive summary? If you don’t have the time to write on then you can use this custom Executive Summary Writer to save Hrs. of your precious time.

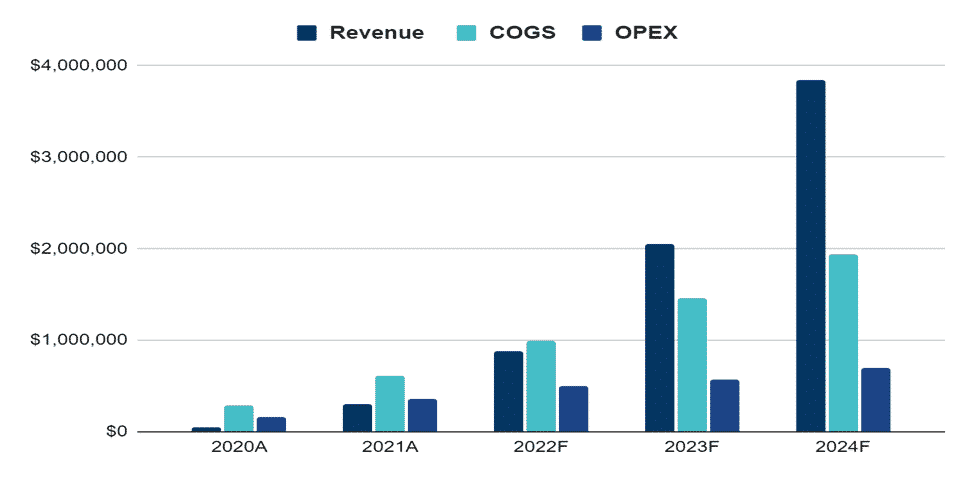

Financial Overview:

Financial Highlights:

| Liquidity | 2020A | 2021A | 2022F | 2023F | 2024F |

| Current ratio | 6 | 12 | 23 | 32 | 42 |

| Quick ratio | 6 | 11 | 22 | 31 | 40 |

| DSO | 8 | 8 | 8 | 8 | 8 |

| Solvency | |||||

| Interest coverage ratio | 8.2 | 11.1 | 14.2 | ||

| Debt to asset ratio | 0.01 | 0.01 | 0.2 | 0.18 | 0.16 |

| Profitability | |||||

| Gross profit margin | 51% | 51% | 53% | 53% | 53% |

| EBITDA margin | 12% | 14% | 21% | 22% | 22% |

| Return on asset | 5% | 6% | 13% | 14% | 14% |

| Return on equity | 5% | 6% | 16% | 17% | 17% |

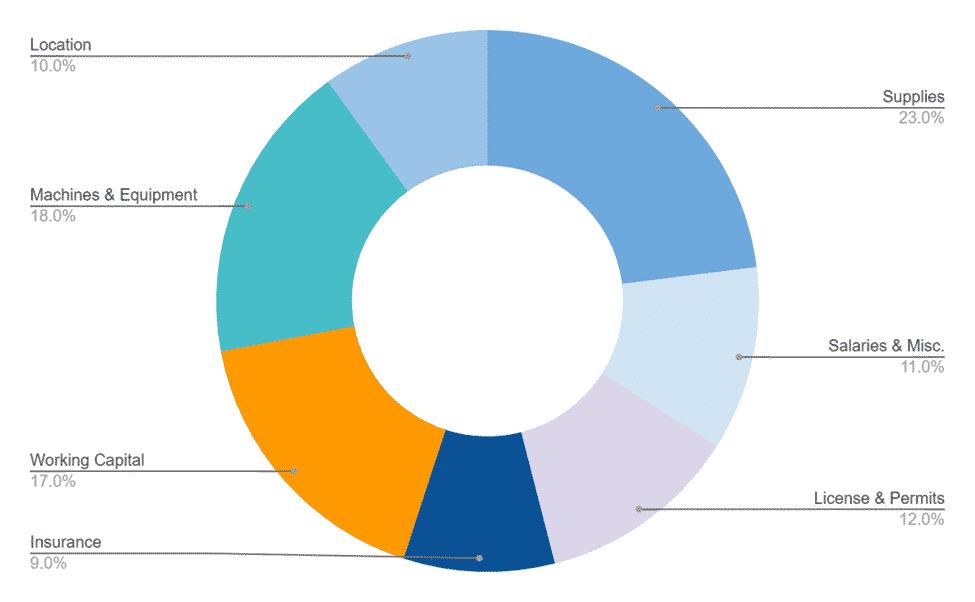

FUND USAGE

Business Model Canvas

Tips on Business Model Canvas

The Business Model Canvas is a high-level overview of the business model. It can also be considered as the business model map in the overall plan. The important partners, key activities, value proposition and cost & revenue sections are only some of the nine vital components. A company idea’s complexities may be mapped out, analyzed and communicated with the use of the canvas. It shows the whole picture of a company’s value creation, delivery and capture processes. It helps new business owners hone their ideas, encourage creative thinking and make sound strategic decisions. It’s a helpful resource for coming up with ideas, organizing plans and presenting business models to key players. Check out the 100 samples of business model canvas.

SWOT

Tips on SWOT Analysis

It offers a clear lens into a company’s strengths, weaknesses, opportunities and threats. This self-awareness enables effective resource allocation and strategic positioning against competitors. Businesses can mitigate risks, make informed decisions and set realistic goals. In addition, presenting a SWOT analysis in a business plan communicates to stakeholders that the company possesses a deep understanding of its market environment. In essence, SWOT ensures a business’s strategy is grounded in reality enhancing its chances of success. Check out the 100 SWOT Samples

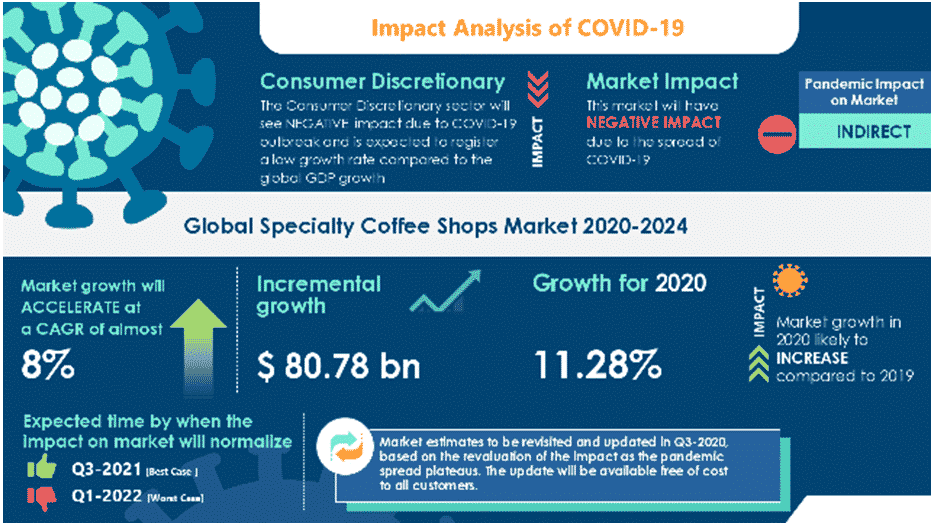

Industry Analysis

In the United States, the coffee shop business employs 20,000 people and generates $11 billion in yearly sales. Starbucks, Dunkin’ Donuts, Caribou, Coffee Bean, Tea Leaf, and Diedrich (Gloria Jean’s) are some of the most well-known firms. The sector is highly concentrated at the top and fragmented at the bottom: the top 50 businesses account for more than 70% of total revenue.

One of the essential commodities on the planet is coffee. Brazil, Colombia, and Vietnam are the world’s leading producers of green coffee. Many coffee-growing countries are tiny, impoverished developing countries that rely on the crop to keep their economy afloat. The United States is both the world’s top importer and consumer of green coffee beans. The climate in the United States cannot sustain coffee trees, with the exception of Hawaii and Puerto Rico.

The National Coffee Association said that coffee consumption is most significant in the Northeast, where more than 60% of the population drank coffee every day in 2005. (NCA). The Central United States has the largest per capita consumption, with 3.7 cups consumed per day.

During the forecast period, the coffee market in the United States is expected to rise at a CAGR of 4.8 percent (2020-2025). The increasingly hectic lifestyle and long working hours are important drivers of industry expansion and led to an increase in the popularity of coffee chains in the United States among consumers who want their coffee on the move. Furthermore, consumers in the United States prefer premium items that stress quality, and as a result, they flock to high-end coffee shops where the quality of the coffee is the most important factor in repeat visits. More than 70% of customers prefer at-home coffee brewing, according to a poll performed by the National Coffee Association in the United States.

Coffee shops provide a variety of drinks and snacks. Baked goods, pastries, desserts, sandwiches, and confectionery are all examples of food products. For home consumption, many coffee businesses offer whole or ground coffee beans. Coffee and espresso machines, grinders, cups, and other accessories are available in some coffee establishments. Specialty coffee is served in the majority of coffee shops.

Source: maximizemarketresearch

Coffee drinkers in their prime are rich, educated individuals between the ages of 25 and 45. While the popularity of coffee shops has been driven by the baby boomer generation, specialty coffee appeals to a wide range of adult demographics, including college students and young adults. Larger businesses may also sell coffee beans in bulk to commercial clients like grocery shops and restaurants.

Demand is driven by consumer preferences and money. Individual firms’ success is determined by their ability to acquire great sites, increase shop traffic, and supply high-quality goods. In buying, financing, and marketing, large corporations have an edge. Small businesses might compete successfully by producing specialized goods, catering to a local market, or delivering personalized customer care. The industry is very labor-intensive, with an average yearly wage of $40,000 per worker.

Coffee shops rely on foot traffic and are often placed in regions where pedestrians and automobiles can easily reach them. Shopping malls, business complexes, and university campuses are all typical venues. The layout and size of the store vary per location, with some having more room than others. The typical Caribou Coffeehouse is 1,200 to 1,600 square feet. Some businesses provide a kiosk version without seats for tiny places such as airports and supermarkets.

Coffee shop drinks come in a variety of pricing. An espresso-based beverage may cost upwards of $4 at retail. Retail prices often change due to the price volatility of green coffee and dairy. Roasted coffee beans may cost anywhere from $10 to $20 per pound. A pound of high-end or “reserve” coffee, such as certain Peet’s, may cost anywhere from $50 to $80.

The winter holiday drives sales, which peak in the fourth quarter. Furthermore, bad weather may reduce shop traffic, which might decrease sales. Inventory may last anywhere from 40 to 80 days in major firms. Commercial clients account for 20 to 30 days of sales receivable. Between 30 and 60 days after sales, accounts payable is due. Green coffee and dairy products may be purchased via contracts. Gross margins typically vary from 40 to 60%, with more commercial sales lowering profits. To gauge growth, retailers look at comparable-store sales. (pestleanalysis)

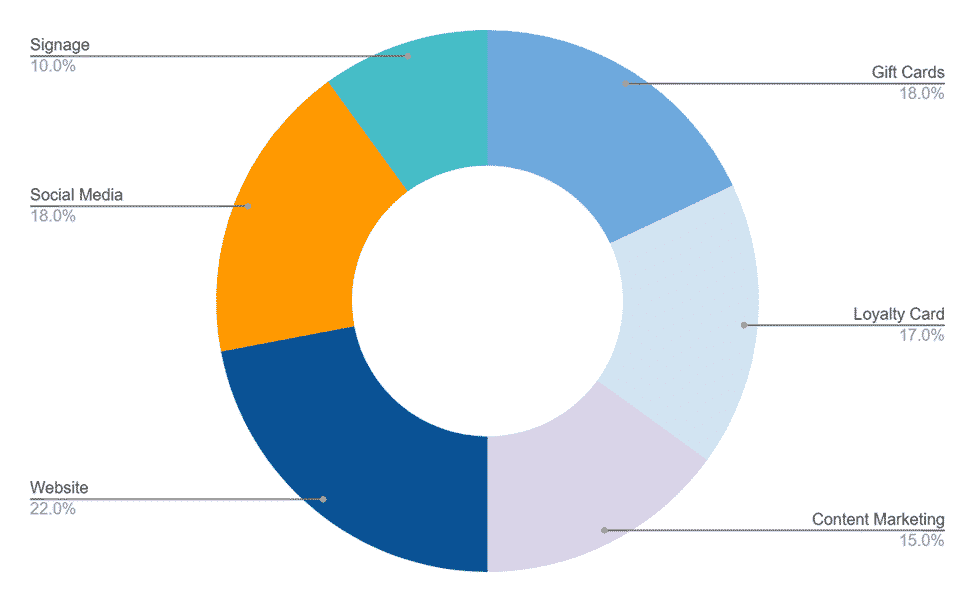

Marketing Plan:

Website: Boncafé has a fully functional website. With our updated menus and rates, potential customers will feel at ease learning more about our products.

Social Media: Boncafé ‘s Facebook and Instagram pages are one of the ways we swiftly engage our local community. We may accomplish so by aggressively responding to customer and prospective client queries and requests.

Signage: Boncafé offers simple signage that is ideal for informing our customers and new clients that we are open for business.

Gift Cards: Gift cards and Wash booklets from Boncafé are fantastic presents for friends and family. They are simple to purchase and utilize.

Loyalty Card: Boncafé ‘s customers may visit as frequently as they desire and have their discounts.

Content Marketing: Uploading footage of Boncafé in action helps reassure consumers that they’re in excellent hands.

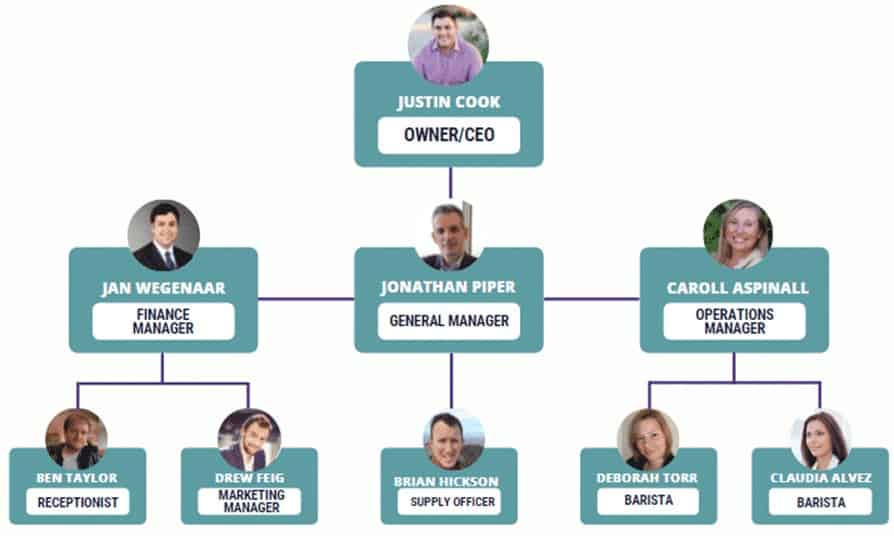

Organogram:

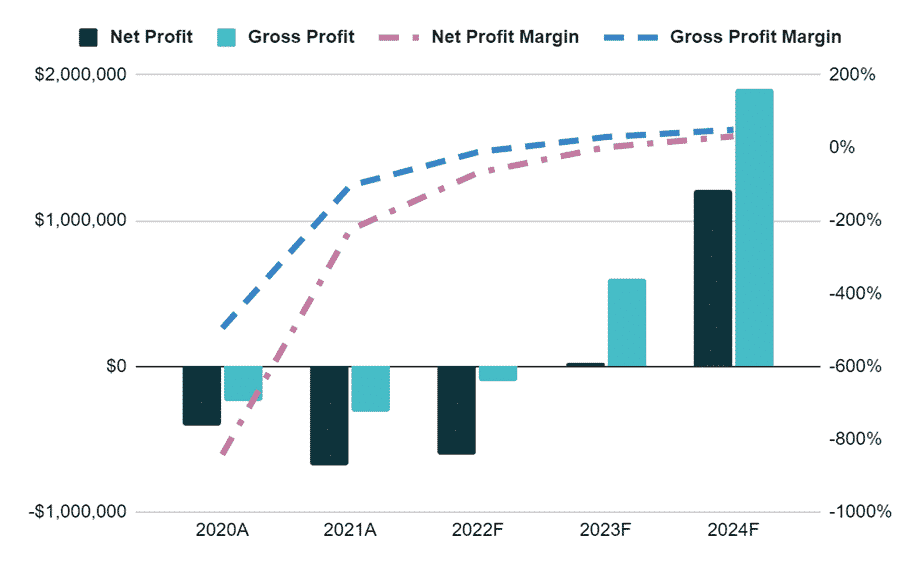

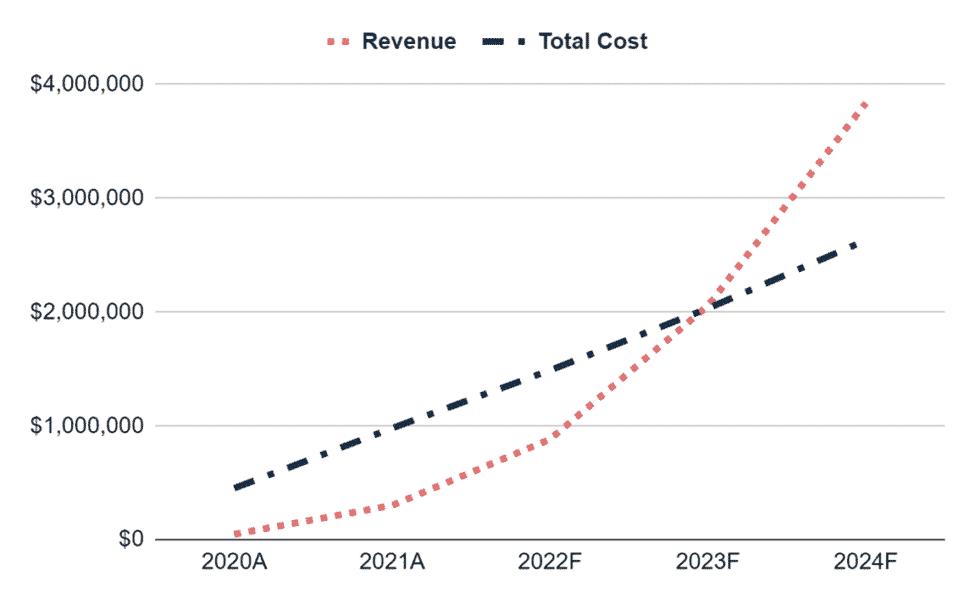

Financial Plan:

Earnings:

Break-Even Analysis:

Income Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| Total Cost of Revenue | 285,560 | 615,220 | 987,794 | 1,455,612 | 1,935,625 |

| as % of revenue | 595% | 204% | 112% | 71% | 50% |

| Gross Profit | -237,575 | -313,984 | -105,583 | 601,578 | 1,902,218 |

| SELLING & ADMIN EXPENSES | |||||

| Item 1 | 28,000 | 96,800 | 154,880 | 175,692 | 193,261 |

| Item 2 | 75,000 | 105,000 | 120,000 | 120,000 | 120,000 |

| Item 3 | 36,000 | 96,000 | 108,000 | 120,000 | 120,000 |

| Item 4 | 8,000 | 12,000 | 12,000 | 12,000 | 12,000 |

| Item 5 | 3,839 | 18,074 | 44,111 | 61,716 | 115,135 |

| Item 6 | 3,359 | 12,049 | 26,466 | 41,144 | 76,757 |

| Item 7 | 5,600 | 10,000 | 12,904 | 15,034 | 17,376 |

| Item 8 | 6,667 | 14,000 | 22,067 | 30,940 | 40,701 |

| Total selling & admin expenses | 166,464 | 363,924 | 500,428 | 576,525 | 695,230 |

| as % of revenue | 347% | 121% | 57% | 28% | 18% |

| Net profit | -404,039 | -677,907 | -606,011 | 25,052 | 1,206,987 |

| Accumulated net profit | -404,039 | -1,081,947 | -1,687,957 | -1,662,905 | -455,918 |

Cash Flow Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| CASH FLOW from OPERATING ACTIVITIES | |||||

| Net profit before tax | -$404,039 | -$677,907 | -$606,011 | $25,052 | $1,206,987 |

| Depreciation | $44,267 | $85,333 | $120,504 | $158,127 | $199,512 |

| Payables | |||||

| Item 1 | $4,333 | $5,417 | $6,500 | $7,583 | $8,667 |

| Item 2 | $11,667 | $28,000 | $46,667 | $70,000 | $93,333 |

| Item 3 | $6,250 | $8,750 | $10,000 | $10,000 | $10,000 |

| Item 4 | $3,000 | $8,000 | $9,000 | $10,000 | $10,000 |

| Item 5 | $667 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| change in payables | $25,917 | $25,250 | $22,000 | $25,417 | $24,417 |

| Receivables | |||||

| Item 1 | $320 | $1,506 | $3,676 | $5,143 | $9,595 |

| Item 2 | $360 | $1,807 | $4,411 | $8,229 | $11,514 |

| Total receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| change in receivables | -$680 | -$2,634 | -$4,773 | -$5,285 | -$7,736 |

| Net cash flow from operating activities | -$334,536 | -$569,958 | -$468,280 | $203,311 | $1,423,180 |

| CASH FLOW from INVESTING ACTIVITIES | |||||

| Item 1 | $16,000 | $13,200 | $14,520 | $15,972 | $17,569 |

| Item 2 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Item 3 | $28,000 | $22,000 | $14,520 | $10,648 | $11,713 |

| Item 4 | $96,000 | $88,000 | $72,600 | $79,860 | $87,846 |

| Item 5 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Net cash flow/ (outflow) from investing activities | -$180,000 | -$167,200 | -$150,040 | -$159,720 | -$175,692 |

| CASH FLOW from FINANCING ACTIVITIES | |||||

| Equity | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net cash flow from financing activities | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net (decrease)/ increase in cash/ cash equivalents | -$114,536 | -$297,158 | -$134,320 | $575,991 | $1,833,128 |

| Cash and cash equivalents at the beginning of the year | – | -$114,536 | -$411,693 | -$546,014 | $29,978 |

| Cash & cash equivalents at the end of the year | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

Balance Sheet:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| NON-CURRENT ASSETS | |||||

| Item 1 | $16,000 | $29,200 | $43,720 | $59,692 | $77,261 |

| Item 2 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Item 3 | $28,000 | $50,000 | $64,520 | $75,168 | $86,881 |

| Item 4 | $96,000 | $184,000 | $256,600 | $336,460 | $424,306 |

| Item 5 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Total | $180,000 | $347,200 | $497,240 | $656,960 | $832,652 |

| Accumulated depreciation | $44,267 | $129,600 | $250,104 | $408,231 | $607,743 |

| Net non-current assets | $135,733 | $217,600 | $247,136 | $248,729 | $224,909 |

| CURRENT ASSETS | |||||

| Cash | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

| Accounts receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| Total current assets | -$113,856 | -$408,380 | -$537,927 | $43,349 | $1,884,214 |

| Total Assets | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

| LIABILITIES | |||||

| Account payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| Total liabilities | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| EQUITIES | |||||

| Owner’s equity | $400,000 | $840,000 | $1,324,000 | $1,856,400 | $2,442,040 |

| Accumulated net profit | -$404,039 | -$1,081,947 | -$1,687,957 | -$1,662,905 | -$455,918 |

| Total equities | -$4,039 | -$241,947 | -$363,957 | $193,495 | $1,986,122 |

| Total liabilities & equities | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |