Written by Elma Steven | Updated on April, 2024

How to Write a Freight Broker Business Plan?

Freight Broker Business Plan is an outline of your overall freight broker business. The business plan should include a 5 year financial projection, marketing plan, industry analysis, organizational overview, operational overview and finally an executive summary. Remember to write your executive summary at the end as it is considered as a snapshot of the overall business plan. You need to be careful while writing the plan as you need to consider various factors that can impact the business’s success.

Table of Contents

Executive Summary

In the middle of Miami’s thriving transportation sector, Michael Thompson established ABC Logistics, a freight brokerage business. Facilitating the smooth movement of products across a wide range of sectors is one of our key services, along with freight management, logistics solutions, and linking shippers with carriers. We provide our customers with efficiency and dependability by streamlining the freight process with a team of skilled experts and powerful technologies.

Mission: To revolutionize the freight industry in Miami by providing exceptional brokerage services, fostering strong partnerships, and delivering reliable and cost-effective logistics solutions.

Vision: To be the leading freight brokerage firm in the region, recognized for our commitment to innovation, customer satisfaction, and creating value for our partners.

Industry Overview:

In the US, the transportation sector would not be complete without the freight brokerage business. The sector is being driven by reasons including rising e-commerce, need for effective supply chain management, and the prevalence of globalization. It is anticipated to reach a market value of $67 billion in 2023 and see a growth rate of 4.2% during the following five years.

Check out this guide on how to write an executive summary? If you don’t have the time to write on then you can use this custom Executive Summary Writer to save Hrs. of your precious time.

Financial Highlights

Earnings & Profitability

Break-Even Analysis

Business Description

Business Name: ABC Logistics

Founders: Michael Thompson

Management Team: [You can ignore this/ delete this but its better to provide it]

Legal Structure: LLC

Location: Miami

Goals & Objectives:

- Client Acquisition Strategy: Reach out to a wide range of customers, such as wholesalers, retailers, and manufacturers. Provide individualized attention to meet the demands of each customer.

- Brand Establishment: Develop a solid reputation for your business via online advertising, attendance at trade shows, and satisfied customers. Promote your skills and services via a business website and social media.

- Quality Service Delivery: Maintain open lines of communication, work with dependable carriers, and deliver items on schedule to guarantee smooth transportation logistics. Become known for being dependable and productive.

- Service Expansion: Specialized freight services (such as those for temperature-controlled goods or big shipments), help with customs clearance, and supply chain advising are all great ways to diversify your business.

- Financial Stability: Create a reliable budget, learn to control your money flow, and look at other ways to make money, such consultancy, freight insurance, or brokerage fees.

- Community Engagement: To meet prospective customers and business associates, it is a good idea to join trade groups, host or fund industry events, and take part in online forums.

- Technology Integration: To make things easier, faster, and more transparent for customers, you should put money into freight management software and tracking solutions.

- Strategic Partnerships: To increase your reach and quality of service, team up with logistics providers like warehouses and carriers. Establish connections that work for both parties.

- Industry Recognition: Investigate credible freight broker organizations and look for certificates or affiliations. To boost your credibility, attempt to be nominated for or win honors in your field.

- Sustainability Initiatives: To lessen your impact on the environment, look into greener modes of transportation, encourage shipping consolidation, and implement sustainable practices into your business.

Services:

- Freight Management: Making sure that customers’ merchandise is delivered quickly and efficiently by coordinating and managing transportation logistics.

- Carrier Sourcing: Finding dependable shipping companies and forming partnerships with them to meet customer demands.

- Customs Clearance Assistance: Providing direction and support with overseas shipping customs paperwork and processes.

- Specialized Freight Services: Transporting perishable goods, large packages, dangerous goods, etc., is only a few of the specialist services we provide.

- Supply Chain Consulting: Helping customers save expenses, improve logistics efficiency, and optimize their supply chain is my specialty.

- Freight Insurance Services: Making sure customers have enough shipping insurance is our top priority.

- Technology Integration: Incorporating tracking and freight management technologies to improve efficiency and provide customers up-to-the-minute information.

- Load Consolidation: Helping customers save space and money by consolidating shipments.

- Last-Mile Delivery Solutions: Ensuring that things reach their destination effectively by providing solutions for the last leg of delivery.

- Reverse Logistics: Taking charge of the return process and coordinating the transfer of goods from consumers to retailers.

- Intermodal Services: We provide a variety of transportation options, including train, truck, air, and ocean, to meet your shipping needs.

Financial Overview

Startup Cost

Revenue & Cost Projection

Profitability & Cash Flow Projection

Business Model

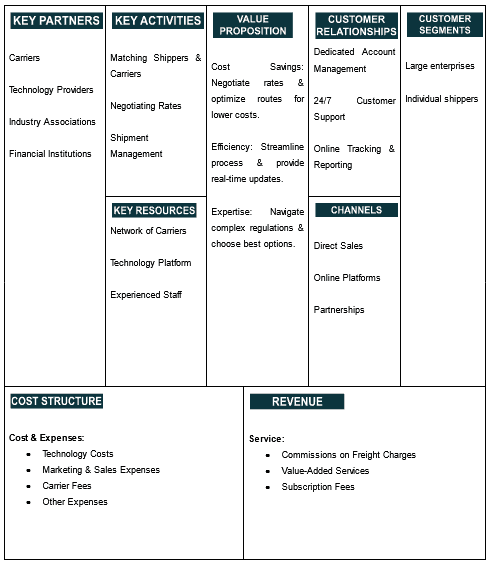

Tips on Business Model Canvas

The Business Model Canvas is a high-level overview of the business model. It can also be considered as the business model map in the overall plan. The important partners, key activities, value proposition and cost & revenue sections are only some of the nine vital components. A company idea’s complexities may be mapped out, analyzed and communicated with the use of the canvas. It shows the whole picture of a company’s value creation, delivery and capture processes. It helps new business owners hone their ideas, encourage creative thinking and make sound strategic decisions. It’s a helpful resource for coming up with ideas, organizing plans and presenting business models to key players. Check out the 100 samples of business model canvas.

SWOT

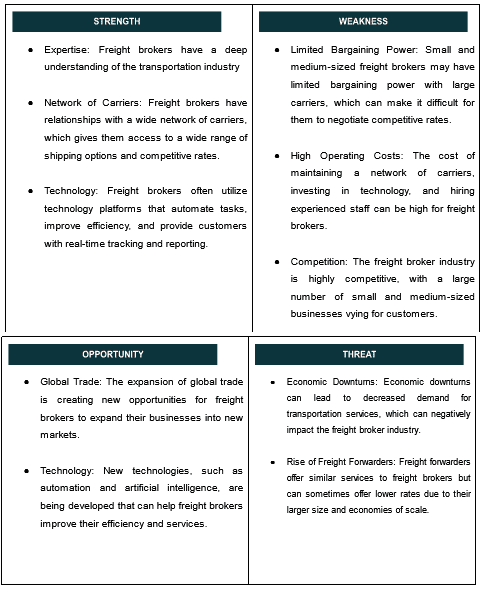

Tips on SWOT Analysis

It offers a clear lens into a company’s strengths, weaknesses, opportunities and threats. This self-awareness enables effective resource allocation and strategic positioning against competitors. Businesses can mitigate risks, make informed decisions and set realistic goals. In addition, presenting a SWOT analysis in a business plan communicates to stakeholders that the company possesses a deep understanding of its market environment. In essence, SWOT ensures a business’s strategy is grounded in reality enhancing its chances of success. Check out the 100 SWOT Samples

Marketing Plan

Promotional Channels

Digital Marketing and Online Presence – $15,000 (30%)

- Website Enhancement: Create a user-friendly, informative website showcasing your services, customer testimonials, and industry expertise.

- SEO Optimization: Focus on keywords related to freight brokerage, logistics solutions, and industry-specific terms to improve search engine rankings.

- Social Media Engagement: Regular updates on platforms like LinkedIn, Facebook, and Instagram, showcasing successful shipments, customer testimonials, and industry insights.

Industry Networking and Partnerships – $10,000 (20%)

- Trade Shows and Conferences: Attend and possibly sponsor industry events to network with potential clients and partners.

- Partnerships with Industry Bodies: Collaborate with transport associations and logistics groups for increased credibility and networking opportunities.

Content Marketing and Branding – $7,000 (14%)

- Blog and Articles: Publish regular content on your website/blog about industry trends, case studies, and logistics tips.

- Email Newsletters: Monthly newsletters featuring industry news, company updates, and success stories to engage your audience.

Paid Advertising – $6,000 (12%)

- Online Ads: Use targeted ads on Google, LinkedIn, and industry-specific websites to reach potential clients.

- Print Media: Advertise in industry magazines and publications to reach a broader professional audience.

Client Relationship Management – $5,000 (10%)

- CRM System: Implement a CRM system to manage client interactions, follow-ups, and service customization.

- Customer Feedback: Regularly collect and analyze customer feedback to improve services and customer satisfaction.

Local and Community Engagement – $4,000 (8%)

- Community Events: Sponsor local events to build community presence.

- Local Business Partnerships: Collaborate with local businesses for mutual referral programs and partnerships.

Sales and Lead Generation – $3,000 (6%)

- Cold Calling and Emailing: Allocate resources for outreach to potential clients through direct calls and emails.

- Lead Generation Campaigns: Run specific campaigns aimed at gathering leads from targeted market segments.

Brand Management

Social Media Marketing

- Brand Voice and Visual Identity: Develop a brand voice that resonates with shippers and carriers, emphasizing reliability, efficiency, and industry expertise. Use a consistent visual style across platforms featuring your operations, success stories, and team.

- User-Generated Content: Encourage clients to share their positive experiences with your services. Share these testimonials to build trust and credibility.

- Live Q&A Sessions: Host live sessions on platforms like LinkedIn or Facebook discussing logistics challenges, industry trends, and answering questions to engage with your audience.

Search Engine Marketing (SEM) and Local SEO

- Ad Copy: Focus on highlighting unique services like specialized freight solutions, efficient carrier matching, or exceptional customer service.

- Website Optimization: Ensure your website is user-friendly, showcases your services effectively, and is optimized for search engines with relevant keywords like “freight broker,” “logistics solutions,” and “cargo transportation.”

- Google My Business: Regularly update your listing with accurate information, photos, and customer reviews to improve local search visibility.

Email Marketing

- Newsletter: Share industry news, updates about your services, technology advancements, special offers, and highlight successful freight solutions.

- Segmentation: Customize emails for different groups like shippers, carriers, and industry partners to provide relevant content.

Local Partnerships and Sponsorships

- Industry Events and Trade Shows: Partner with local logistics events to increase visibility among potential clients and partners.

- Collaboration with Trade Schools: Engage with trade schools offering logistics programs to connect with emerging talent and potential clients.

Content Marketing

- Educational Content: Create blog posts, videos, and infographics about freight brokerage, logistics management, and industry best practices.

- Behind-the-Scenes Insights: Share stories and updates from successful freight operations to provide a glimpse into your business processes.

Influencer and Industry Expert Collaborations

- Partnerships with Industry Experts: Collaborate with well-known figures in the logistics industry for webinars, podcasts, and content creation.

- Content Collaboration: Co-create content that showcases your expertise and insights into the freight brokerage industry.

Offline Advertising

- Local Media and Trade Magazines: Advertise in local business publications, trade magazines, and industry newsletters with targeted, eye-catching ads.

- Community Boards and Transportation Hubs: Place flyers and business cards in strategic locations like truck stops, local chambers of commerce, and transportation hubs.

Referral Program

- Incentivize Referrals: Offer benefits like discounts or enhanced service features to clients who refer new business to your brokerage.

Go To Market Strategy

Online Presence and Community Engagement

- Professional Website: Develop a website showcasing your freight brokerage services, technology, and customer testimonials. Include a user-friendly interface with a quote request form and contact details.

- Content Marketing: Publish blog posts or articles on logistics management, shipping tips, and industry trends to enhance search engine optimization.

- Local Directory Listings: Ensure your business is listed in relevant online directories and industry-specific portals to improve local search visibility.

- Partnerships: Collaborate with local businesses, transport companies, and trade associations to offer special deals and build a professional network.

- Launch Event and Promotional Offers

- Business Launch Event: Host an event to introduce your services. Invite local business owners, transport companies, and industry professionals to network.

- Introductory Discounts: Offer special rates or value-added services for first-time clients to attract new business.

Digital Marketing and Customer Relations

- Social Media Campaigns: Use platforms like LinkedIn, Facebook, and Twitter to showcase your expertise, share industry news, and client testimonials.

- Email Marketing: Send regular newsletters with updates about your services, market insights, and special offers to engage your audience.

- Loyalty Program: Implement a program rewarding repeat clients with exclusive benefits or services.

Brand Awareness and Public Relations

- Local Media Outreach: Connect with local media for features, interviews, and expert opinions to share your business success stories.

- Community Involvement: Participate in local business events or sponsor community programs to increase brand visibility.

- Influencer Partnerships: Collaborate with industry influencers or logistics experts for guest blogs, webinars, and co-marketing initiatives.

Performance Tracking

- Analytics and Feedback: Regularly use tools like Google Analytics and client feedback surveys to monitor the effectiveness of your marketing strategies.

- Adaptation: Be prepared to adjust your strategies based on performance data, staying flexible to market trends and client needs.

Organizational Overview

Founder

In the freight brokerage sector in Miami, a center for international transportation and logistics, Michael Thompson stands head and shoulders above the competition. His fascination in international commerce and logistics led him to study supply chain management in depth before he started his career in freight.

With a strong educational background in logistics and business management, Michael has a solid grasp of the concepts of successful and efficient freight transportation. He was prepared for a job in freight brokerage thanks to his schooling and natural ability to solve problems.

Michael has worked his way up through the ranks of the logistics sector, gaining valuable knowledge in all its facets. Through his varied experiences, he has gained a deep understanding of the complex issues and potential solutions related to freight transportation. These include, but are not limited to, understanding regulatory landscapes and maximizing route efficiency.

Michael, ever the enterprising soul, saw Miami’s potential as a logistics and transportation center and set up shop there to launch his freight brokerage business. He goes above and above by providing customized, dependable, and budget-friendly logistics solutions in addition to linking shippers with carriers. Michael is a firm believer in the value of solid client connections and good partnerships within the logistics industry as a whole.

His business is based on the principle of using technology to make freight brokerage more open and efficient. The real-time tracking and efficient routing solutions provided by his firm’s use of innovative logistics technologies and data analytics guarantee client satisfaction.

Positions and Responsibilities

Chief Executive Officer (CEO) – Michael Thompson

Responsibilities: Michael Thompson, in his role as chief executive officer, is in charge of setting the company’s long-term strategy, managing day-to-day operations, and representing the company at trade shows and other industry gatherings. He oversees resources, takes important decisions, and keeps the board and operational teams in the loop.

Operations Manager

Responsibilities: Responsible for ensuring customer satisfaction, managing freight movement schedules, and overseeing daily operations of the logistics department. Responsible for coordinating shipments, communicating with shippers and carriers, and making sure all logistics operations go well.

Freight Broker Agents/Logistics Coordinators

Responsibilities: Providing shippers with dependable and cost-effective freight alternatives is the responsibility of these experts, who also negotiate prices with carriers. They should be well-versed in logistics planning, market prices, and transportation laws.

Business Development Manager

Responsibilities: Contributes to growing the company’s customer base, cultivates connections with prospective customers and business associates, and manages the expansion plan. In this position, you will be responsible for developing lasting connections with clients and discovering untapped business prospects.

Customer Service Representative

Responsibilities: Supervises customer interactions, responds to questions and requests for freight service bookings, and assists with administrative tasks. From the first point of contact all the way up to the successful delivery of freight, promises a smooth client experience.

Marketing and Communications Coordinator

Responsibilities: Creates and executes plans to increase awareness of freight brokerage services. Creates promotional materials, manages the company’s social media accounts, and actively seeks out new customers via community and industry outreach.

Financial Controller

Responsibilities: The person in charge of the finances is responsible for accounting, budgeting, and financial planning. Responsible for overseeing payroll and invoicing, as well as ensuring financial compliance and providing strategic decision-makers with financial information and insights.

Compliance and Regulatory Affairs Specialist

Responsibilities: Verifies that the business complies with all applicable laws and industry standards. Maintains knowledge of transportation legislation, oversees compliance paperwork, and provides guidance on regulatory issues.

Technology and Systems Manager

Responsibilities: Supervises the communication tools, tracking systems, and logistics software that are vital to the operations of the freight brokerage. Checks that all systems are current and work well along with day-to-day activities.

Organogram

Operational Overview

Standard Freight Brokerage Services

Range of Shipments: Handling various types of freight, including FTL (Full Truckload), LTL (Less Than Truckload), and specialized cargo.

Network Utilization: Leverage an extensive network of carriers to provide reliable and efficient transportation solutions.

Customization: Offering tailored solutions based on client-specific needs and cargo requirements.

Expedited Shipping Services

Urgent Deliveries: Specializing in time-sensitive shipments that require quick and efficient delivery.

Tracking and Communication: Providing real-time tracking and constant communication to ensure timely delivery.

Oversized and Heavy Haul Transportation

Special Equipment: Access to specialized equipment for heavy or oversized cargo.

Route Planning: Expert route planning to handle logistical challenges of transporting large loads.

Temperature-Controlled Transportation

Specialized Services: Providing refrigerated trucks for goods that require temperature control, such as perishable food or pharmaceuticals.

Quality Assurance: Ensuring the integrity of temperature-sensitive goods throughout transit.

Cross-Border Freight Services

International Logistics: Handling of international freight, including customs brokerage and documentation.

Expertise in Regulations: Navigating cross-border regulations and ensuring compliance with international shipping laws.

Transportation Management Services (TMS)

Technology Solutions: Utilizing advanced TMS to optimize shipping routes, track shipments, and reduce transportation costs.

Data Analysis: Offering insights into logistics performance and opportunities for optimization.

Carrier Management and Compliance

Carrier Vetting: Thorough vetting of carriers to ensure reliability and compliance with safety standards.

Partnership Building: Developing strong relationships with a network of trusted carriers.

Consulting and Logistics Planning

Strategic Planning: Providing expert consulting on logistics strategies, supply chain management, and cost-saving measures.

Custom Solutions: Creating customized logistics plans tailored to specific business needs and challenges.

Freight Bill Auditing and Payment Services

Billing Accuracy: Auditing freight bills for accuracy, ensuring clients are charged correctly.

Payment Processing: Streamlining the payment process between shippers and carriers.

Customer Support and Advisory

Client Relations: Offering dedicated customer support to address inquiries, provide updates, and resolve any issues.

Advisory Services: Advising clients on best practices, industry trends, and logistics solutions.

Industry Analysis

From 2022–2027, the worldwide freight broker market is expected to grow at a CAGR of 5.4%, reaching a value of $24.18 billion. Reasons for this expansion include the expansion of online shopping, the development of international trade, and the rising popularity of third-party logistics (3PL) services.

Source: skyquestt

With more than a third of the world’s freight brokerage business, the US is clearly the boss. France, Germany, Japan, and the UK are some of the other major markets. The rising need for transportation services in developing nations like India and China is driving what is predicted to be the fastest expansion in the Asia-Pacific area over the next several years.

There is a great deal of diversity in the freight brokerage market, since many small and medium-sized businesses are present. But there are a few major companies that have a lot of sway, such UPS, C.H. Robinson, and Kuehne & Nagel. These companies have an international presence and provide several services, such as risk management, cargo tracking, and freight matching.

The freight brokerage sector is evolving and inventing in response to threats including growing labor costs and fiercer competition. Improving efficiency via technology, optimizing routes and pricing with data analytics, and providing better knowledge and value to consumers by specializing in certain sectors or kinds of cargo are all part of it.

There are many potential for growth and innovation in the freight brokerage sector due to the development of new technology, the expansion of developing markets, and the global economy as a whole. Freight brokers link shippers with carriers and ensure timely delivery all across the globe, which is becoming more important as companies look for ways to save money on transportation.

Other key trends and stats:

- E-Commerce Boom: The growth in online retail has significantly increased the demand for freight brokerage services, as more businesses require efficient logistics solutions for their supply chains.

- SME Expansion: The rise of small and medium-sized enterprises creates opportunities for freight brokers, as these companies often rely on brokers for their logistics needs.

- Technological Advancements: Innovations in logistics technology, such as Transportation Management Systems and real-time tracking, have made freight brokerage more efficient and accessible.

- Economic Impact: The freight brokerage industry is a key player in the global economy, facilitating a major portion of logistics and transportation activities.

Source: mordorintelligence

Industry Problems

- Cost Management: When competing with bigger organizations, small or independent brokers often have the challenge of sustaining profitability while offering competitive prices.

- Carrier Reliability and Capacity Issues: Capacity management and dependable carrier services are not always easy, particularly during high seasons or in certain areas.

- Quality of Service: Working with various carriers makes it even more difficult to maintain good service quality in terms of safe cargo handling and on-time delivery.

- Regulatory Compliance: Maintaining compliance with industry norms and legislation while navigating the intricate terrain of transportation rules is both essential and sometimes difficult.

- Technology Integration: It might take a lot of resources to integrate effective systems for operations like tracking and route optimization and to stay up with the latest logistics technology.

- Customer Service and Communication: The key to success is providing outstanding customer service and keeping the lines of communication open and effective with carriers and shippers.

- Market Fluctuations: Brokers must be nimble since the freight business is vulnerable to economic swings that impact demand and price.

- Access to a Diverse Carrier Network: It is crucial to establish and maintain a diversified network of dependable carriers to address different shipping requirements.

- Risk Management: Staying alert and implementing strong plans are essential for managing the risks associated with cargo damage, delays, and liability concerns.

Industry Opportunities

- Flexible Pricing Models: Set up tiered pricing or create unique bundles to meet the needs of different budgets. Businesses of all sizes may benefit from your services, from sole proprietorships to multinational conglomerates, when you provide discounts for big orders or repeat customers.

- Online Booking and Efficient Scheduling: To make freight scheduling easier, use a sophisticated online booking system. Improving consumer comfort and operational efficiency, this system might provide real-time availability updates and many shipment time alternatives.

- Investment in Quality Technology and Carrier Partnerships: Put your energy into investing in cutting-edge logistics technologies and keeping your carrier network in top shape. In order to maintain dependable and effective service, it is important to regularly upgrade your tracking, route optimization, and carrier communication systems.

- Hiring Skilled Logistics Coordinators and Brokers: Hire logistics experts who can adapt to different situations. You may boost your company’s credibility and trustworthiness by investing in their continuous professional development so they can stay abreast of changes in the market.

- Creating a Customer-Focused Service Environment: Craft your offerings with the client in mind. This might include tailoring assistance to each individual consumer, establishing lines of contact that are quick to respond, and using a problem-solving approach to handle unique logistical issues.

- Enhancing Communication and Collaboration: Make it a point to communicate clearly and consistently with your staff, customers, and carriers. More efficient problem-solving, stronger connections with customers, and better delivery results may all result from this strategy.

- Comprehensive Logistics Services: Complete logistical support, customs brokerage, and cargo insurance are just a few of the offerings. By offering a wide range of services, your business can meet the different demands of your customers and become their go-to freight logistics provider.

- Convenient Location and Remote Services: Inquire about the possibility of providing remote management and consultancy services and make sure your company is conveniently available to customers. This might help you reach customers who aren’t in your local area and provide them other options.

- Ensuring Compliance and Security: To ensure the safety of customer data and shipments, put in place rigorous security and compliance procedures. Building confidence and enhancing your firm’s reputation may be achieved by assuring customers of the safety and regulatory compliance of their goods.

- Customized Service Offerings: Provide customized logistics solutions to meet the unique demands of each customer by being flexible and adaptive. Showing that you can meet specific shipping needs may make your firm stand out and appeal to a broader range of customers.

Target Market Segmentation

Geographic Segmentation

- Local Businesses in Miami-Dade County: Focus on businesses within Miami-Dade County that require regular freight services.

- Specific Miami Neighborhoods: Target businesses in neighborhoods like Wynwood, Downtown Miami, or South Beach, which may have unique shipping needs due to their location and business activities.

Demographic Segmentation

- Business Size: Cater services to different business sizes, from small local businesses to larger corporations.

- Industry Type: Customize services for businesses in various industries, acknowledging that each sector has unique logistics needs.

- Owner Demographics: Consider the age, background, and experience level of business owners, which can influence their shipping preferences and decision-making.

Psychographic Segmentation

- Cost-Conscious Small Businesses: Focus on small businesses looking for cost-effective shipping solutions.

- Quality-Focused Clients: Cater to businesses that prioritize reliability and quality in their logistics needs.

- Eco-Conscious Businesses: Offer sustainable shipping options for environmentally conscious clients.

Behavioral Segmentation

- Regular Shippers: Target businesses that require regular shipping services, offering them tailored solutions and loyalty programs.

- Occasional Shippers: Cater to businesses with less frequent shipping needs, offering flexible and on-demand services.

- Project-Based Needs: Focus on clients who require logistics solutions for specific projects or one-time large shipments.

Technological Segmentation

- Tech-Savvy Clients: Offer advanced digital solutions, like real-time tracking and automated booking systems, for clients who prefer technology-driven services.

- Traditional Clients: Provide more traditional, personal customer service and support for clients who prefer a conventional approach to freight brokerage.

Market Size

- Total Addressable Market (TAM) for Freight Brokerage:

The vast panorama of freight transportation services throughout the US is the Total Addressable Market (TAM) for our freight brokerage firm. It encompasses all prospective customers and companies across all industries and sectors in the country who are looking for freight transportation solutions for their products. This all-inclusive market analysis takes into account the magnitude of the freight brokerage business as a whole, taking into account elements such as industrial developments, global commerce, macroeconomic impacts, and the dynamic nature of supply chain management. In terms of transportation, it encompasses the widest range of possible clients and freight transit requirements.

- Serviceable Addressable Market (SAM) for Freight Brokerage:

As a freight brokerage, our Serviceable Addressable Market (SAM) zeroes down on a narrow subset of the total addressable market (TAM). Several factors, including regional expertise, industry-specific needs, and customized services, characterize this market. Geographically, our SAM may target certain U.S. areas or trade lines where our knowledge, connections, and efficiency might provide us an advantage. We are able to distinguish ourselves in this market because we focus on a certain kind of cargo or because we provide specialized logistics solutions to certain businesses, such as those dealing with hazardous chemicals or perishable commodities.

- Serviceable Obtainable Market (SOM) for Freight Brokerage:

The portion of our SAM that our freight brokerage firm can reasonably target and service well is called the Serviceable Obtainable Market (SOM). The efficiency of our sales and marketing efforts, our technical infrastructure, our connections within the industry, and our operational competencies will decide this. The trustworthiness of our business, the effectiveness of our carrier matching process, the use of state-of-the-art logistics technology, and the quality of our customer service all contribute to our SOM. In this niche, we want to carve out a sizable portion of the market, so we’re establishing realistic targets for growth and revenue and honing our tactics to make the most of our time here.

Industry Forces

Market Demand and Industry Trends:

Several industry developments impact the need for freight brokerage services. These include changes in supply chain dynamics, the rise of e-commerce, and globalization. You may increase your market share by keeping up with these developments and meeting the changing wants of your clientele.

Competition:

There is a wide spectrum of competitors in the freight brokerage market, from smaller regional organizations to national chains and online marketplaces. In order to stand out, it is crucial to differentiate yourself via focused market strategies, effective logistical management, individualized customer care, and better service offerings.

Technological Advancements:

Keeping abreast of the most recent developments in logistics technology and software is crucial. Improving operational efficiency and attracting customers seeking simplified services may be achieved by investing in contemporary software for load monitoring, route optimization, and customer management.

Regulatory Environment:

Transporting freight legally necessitates adhering to all state and federal legislation regarding licencing, insurance, and safety requirements. Maintaining operations requires keeping up of regulatory developments and making sure everyone follows the rules.

Economic Factors:

Investment in freight services is sensitive to macroeconomic conditions. Making strategic adjustments and predicting changes in demand is much easier when one understands how economic swings affect customers’ shipping expenditures.

Supplier Dynamics:

It is critical to establish solid connections with shippers and carriers. The operating expenses and service offerings are susceptible to changes in carrier availability, price, and technology.

Customer Preferences and Expectations:

Timely and precise delivery, low pricing, and adaptation to clients’ individual freight needs are of the utmost importance. The key to keeping customers is meeting their expectations for dependability, openness, and good communication.

Social and Environmental Responsibility:

Practices that promote sustainable mobility are gaining prominence. The credibility of your brokerage may be boosted by taking part in environmentally conscious and socially conscious endeavors.

Workforce Availability and Skills:

It is critical to hire and keep competent staff, such as customer service agents and logistics coordinators. The staff may be prepared to meet the changing expectations of the business via ongoing training and development programs.

Financials

Investment & Capital Expenditure

Revenue Summary

Cost of Goods Sold Summary

OpEX Summary

Income Statement

Cash Flow Statement

Balance Sheet