Written by Elma Steven | Updated on April, 2024

In order to write a Motorcycle Store Business Plan you need to start with executive summary. In order to write an executive summary for a Business Plan you need to mention- what your business is about and what you’ll sell. Explain how you’ll get people to buy it. The executive summary should be written at the end. Then you should write a Business Description mentioning goals, objectives, mission and vision. Some of the major sections or components of a Plan involves Fund Usage Plan, Marketing Plan, Industry Analysis, Organizational Overview, Operational Overview and Financials.

This article will provide you a step by step process to write your Business Plan. Get a free Business Plan at the end!

Table of Contents

Executive Summary

Overview: Path Riders will cater to a rising market of motorcycle enthusiasts by providing high-quality used motorcycles and motorcycle parts. Recycled Riding Dreams offers good value in a first bike that will not break the customer’s budget for the beginner. Quality second-hand components will save the skilled biker 50 percent to 75 percent on repairs and upgrades.

Bike riding has gained a completely new consumer base among baby boomer men aged 40 to 65 in the last ten years. Motorcycle sales for this age group were twice as high as for young males aged 18 to 25 last year. Motorcycle sales in Montclair surpassed $6 million in 2000, and sales are expected to increase by 15% this year.

Montclair has a population of 650,000 people with a median household income of $28,000. The city is home to seven motorcycle clubs and hosts an annual cycling event as part of its spring festival.

Products:

• Used Motorcycles: These motorcycles have been inspected and, in some cases, refurbished to provide the best value to the consumer.

• Used Parts: Engine parts, bodywork, gas tanks, electrical parts, frame, and chassis wheels and brakes are among the high-quality parts available.

Mission: Recycled Riding Dreams’ mission is to become Montclair’s principal source for used motorcycle parts.

Vision: We want to be so effective that we can help others.

Industry Overview: Over the last decade, motorbikes have become increasingly popular as a cost-effective mode of individual transportation. Through 2021-2031, the motorcycle industry is expected to develop at a steady 3.5 percent CAGR. While technological developments in the automotive industry have boosted sales significantly, macroeconomic factors such as increased disposable income and urbanization are also driving motorcycle sales across regions. Fact.MR has released a new analysis that examines the global motorcycle market in terms of new trends, growth drivers, restraining factors, and demand-supply dynamics, with an emphasis on lucrative regions like Asia Pacific, Europe, and North America.

Check out this guide on how to write an executive summary? If you don’t have the time to write on then you can use this custom Executive Summary Writer to save Hrs. of your precious time.

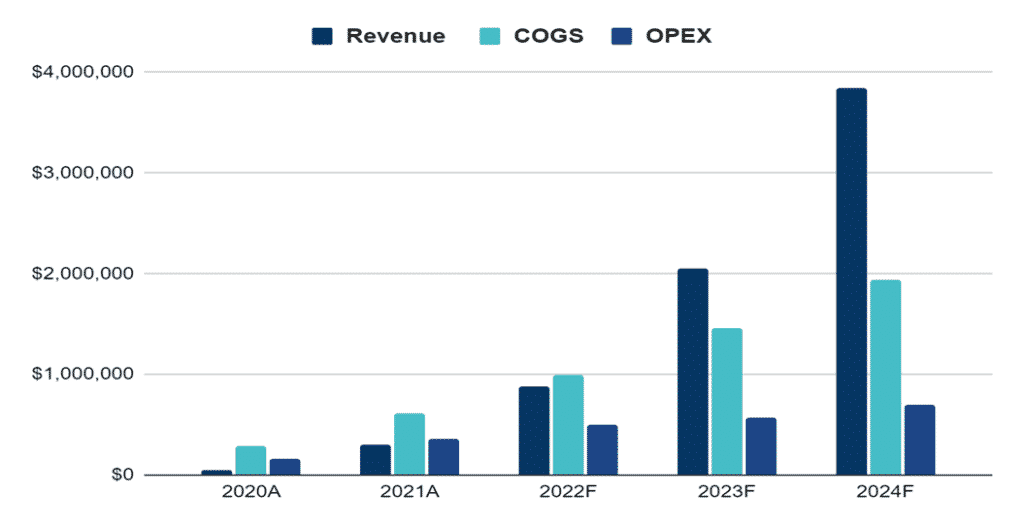

Financial Overview

Financial Highlights

| Liquidity | 2020A | 2021A | 2022F | 2023F | 2024F |

| Current ratio | 6 | 12 | 23 | 32 | 42 |

| Quick ratio | 6 | 11 | 22 | 31 | 40 |

| DSO | 8 | 8 | 8 | 8 | 8 |

| Solvency | |||||

| Interest coverage ratio | 8.2 | 11.1 | 14.2 | ||

| Debt to asset ratio | 0.01 | 0.01 | 0.2 | 0.18 | 0.16 |

| Profitability | |||||

| Gross profit margin | 51% | 51% | 53% | 53% | 53% |

| EBITDA margin | 12% | 14% | 21% | 22% | 22% |

| Return on asset | 5% | 6% | 13% | 14% | 14% |

| Return on equity | 5% | 6% | 16% | 17% | 17% |

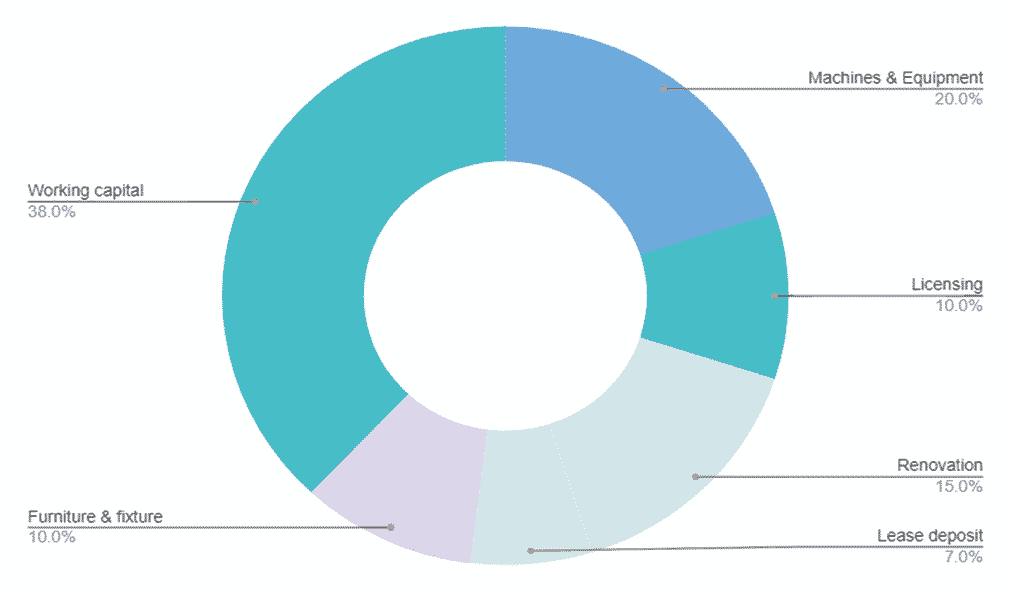

Use of Funds

Business Model Canvas

Tips on Business Model CanvasThe Business Model Canvas is a high-level overview of the business model. It can also be considered as the business model map in the overall plan. The important partners, key activities, value proposition and cost & revenue sections are only some of the nine vital components. A company idea’s complexities may be mapped out, analyzed and communicated with the use of the canvas. It shows the whole picture of a company’s value creation, delivery and capture processes. It helps new business owners hone their ideas, encourage creative thinking and make sound strategic decisions. It’s a helpful resource for coming up with ideas, organizing plans and presenting business models to key players. Check out the 100 samples of business model canvas.

SWOT

Tips on SWOT AnalysisIt offers a clear lens into a company’s strengths, weaknesses, opportunities and threats. This self-awareness enables effective resource allocation and strategic positioning against competitors. Businesses can mitigate risks, make informed decisions and set realistic goals. In addition, presenting a SWOT analysis in a business plan communicates to stakeholders that the company possesses a deep understanding of its market environment. In essence, SWOT ensures a business’s strategy is grounded in reality enhancing its chances of success. Check out the 100 SWOT Samples

Industry Analysis

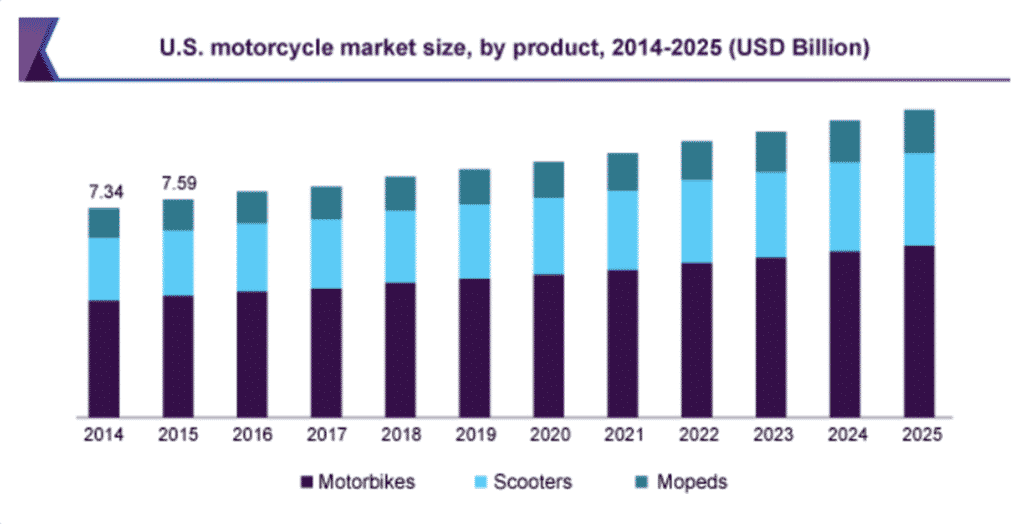

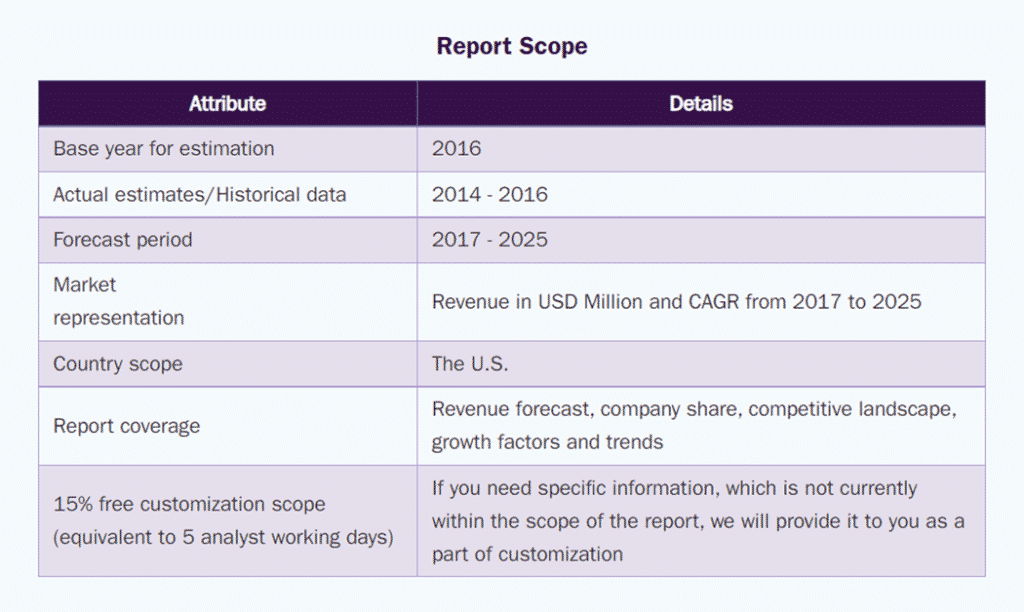

The market for motorcycles in the United States was valued at USD 7.85 billion in 2016 and is expected to increase at a CAGR of 3.7 percent over the next five years. Over the projected period, high disposable income is expected to boost demand for motorbikes in this region.

Source: Statista

According to the Motorcycle Industry Council, 8.4 million motorcycles were registered in the United States in 2014. New and various types of vehicles, such as scooters and motorcycles, are being developed by market players. They also offer personalized designs that are tailored to the needs of the rider in order to attract more clients and hence increase market demand. Furthermore, the motorbike is a popular product due to its higher fuel efficiency supplied by improved engines in compared to autos, low cost, and ease of operation in congested places. According to the Motorcycle Industry Council, overall motorcycle sales in the United States hit 413,128 units in the first nine months of 2015, a rise of 4.7 percent. Market growth can be ascribed to a surge in demand for a better and more efficient means of transportation.

Bikes are also more appealing to the younger generation. Female motorcycle ownership grew to 14% in 2014, according to the Motorcycle Industry Council. This sector has an entirely new consumer base in the form of women. As a result, manufacturers are concentrating on designing smaller, lighter bikes. All these factors are boosting the growth of the industry.

Source: USITC

Marketing Plan

A key part of the marketing plan in a Motorcycle Store business plan is the marketing budget. The growth in the number of customers is proportional to the budget and dependent on the CAC.

The motorbike industry is rapidly evolving. Today’s biker is 47 years old, up from 40 in 2009 and 32 in 1990. It’s undeniable that riders are becoming older and purchasing fewer bicycles. As a result, the motorcycle sector, which is still hurting from the recession, is turning to the future.

Manufacturers of motorcycles are betting on the Millennial generation. However, this generation, the largest since the Baby Boomers, isn’t as enthusiastic about bikes as their forefathers. Because of the shifting tide, manufacturers and dealers must learn about their new audience and how to interact with them.

More motorcycle manufacturers are beginning to design bikes that appeal to a younger market in order to achieve this goal. What about motorcycle dealers, though?

Dealers must understand their audience—and how to sell to this new generation—in an e-commerce environment where Millennials prefer digital buying. Only approximately a quarter of the motorbike market was made up of those aged 50 and older in 2003. That number has virtually doubled in the last few years. Because older riders are starting to put down their helmets, obtaining them does not generate a high lifetime return. As a result, motorcycle manufacturers are producing new, simplified (and affordable) models to appeal to younger riders who will be buying motorcycles for the rest of their lives.

Smaller, more cost-effective bikes that are more entry-level friendly are preferred by these younger audiences over the daunting 1000cc displacement bikes. The race for horsepower is gone, and the era of 300cc and 500cc bikes has arrived.

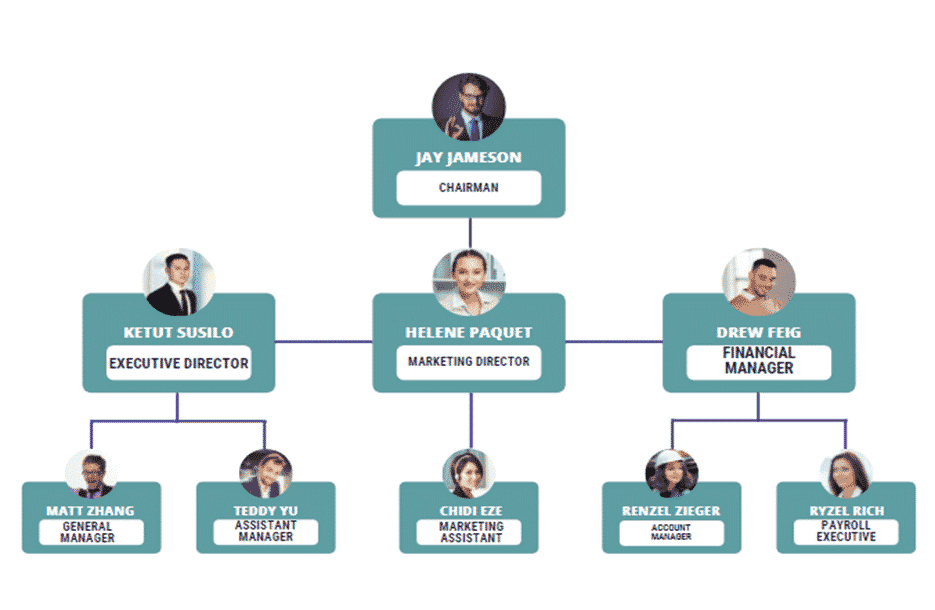

Organizational Plan

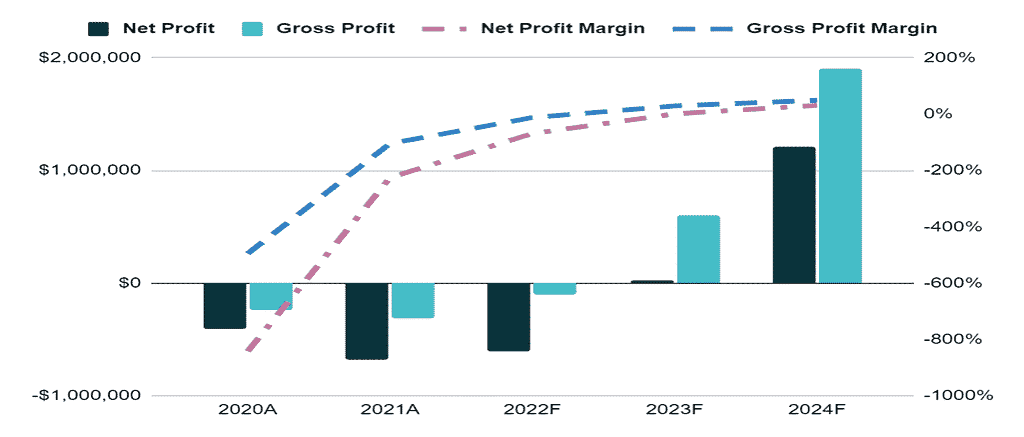

Financial Plan

Earnings:

Income Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| Total Cost of Revenue | 285,560 | 615,220 | 987,794 | 1,455,612 | 1,935,625 |

| as % of revenue | 595% | 204% | 112% | 71% | 50% |

| Gross Profit | -237,575 | -313,984 | -105,583 | 601,578 | 1,902,218 |

| SELLING & ADMIN EXPENSES | |||||

| Item 1 | 28,000 | 96,800 | 154,880 | 175,692 | 193,261 |

| Item 2 | 75,000 | 105,000 | 120,000 | 120,000 | 120,000 |

| Item 3 | 36,000 | 96,000 | 108,000 | 120,000 | 120,000 |

| Item 4 | 8,000 | 12,000 | 12,000 | 12,000 | 12,000 |

| Item 5 | 3,839 | 18,074 | 44,111 | 61,716 | 115,135 |

| Item 6 | 3,359 | 12,049 | 26,466 | 41,144 | 76,757 |

| Item 7 | 5,600 | 10,000 | 12,904 | 15,034 | 17,376 |

| Item 8 | 6,667 | 14,000 | 22,067 | 30,940 | 40,701 |

| Total selling & admin expenses | 166,464 | 363,924 | 500,428 | 576,525 | 695,230 |

| as % of revenue | 347% | 121% | 57% | 28% | 18% |

| Net profit | -404,039 | -677,907 | -606,011 | 25,052 | 1,206,987 |

| Accumulated net profit | -404,039 | -1,081,947 | -1,687,957 | -1,662,905 | -455,918 |

Cash Flow Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| CASH FLOW from OPERATING ACTIVITIES | |||||

| Net profit before tax | -$404,039 | -$677,907 | -$606,011 | $25,052 | $1,206,987 |

| Depreciation | $44,267 | $85,333 | $120,504 | $158,127 | $199,512 |

| Payables | |||||

| Item 1 | $4,333 | $5,417 | $6,500 | $7,583 | $8,667 |

| Item 2 | $11,667 | $28,000 | $46,667 | $70,000 | $93,333 |

| Item 3 | $6,250 | $8,750 | $10,000 | $10,000 | $10,000 |

| Item 4 | $3,000 | $8,000 | $9,000 | $10,000 | $10,000 |

| Item 5 | $667 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| change in payables | $25,917 | $25,250 | $22,000 | $25,417 | $24,417 |

| Receivables | |||||

| Item 1 | $320 | $1,506 | $3,676 | $5,143 | $9,595 |

| Item 2 | $360 | $1,807 | $4,411 | $8,229 | $11,514 |

| Total receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| change in receivables | -$680 | -$2,634 | -$4,773 | -$5,285 | -$7,736 |

| Net cash flow from operating activities | -$334,536 | -$569,958 | -$468,280 | $203,311 | $1,423,180 |

| CASH FLOW from INVESTING ACTIVITIES | |||||

| Item 1 | $16,000 | $13,200 | $14,520 | $15,972 | $17,569 |

| Item 2 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Item 3 | $28,000 | $22,000 | $14,520 | $10,648 | $11,713 |

| Item 4 | $96,000 | $88,000 | $72,600 | $79,860 | $87,846 |

| Item 5 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Net cash flow/ (outflow) from investing activities | -$180,000 | -$167,200 | -$150,040 | -$159,720 | -$175,692 |

| CASH FLOW from FINANCING ACTIVITIES | |||||

| Equity | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net cash flow from financing activities | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net (decrease)/ increase in cash/ cash equivalents | -$114,536 | -$297,158 | -$134,320 | $575,991 | $1,833,128 |

| Cash and cash equivalents at the beginning of the year | – | -$114,536 | -$411,693 | -$546,014 | $29,978 |

| Cash & cash equivalents at the end of the year | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

Balance Sheet:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| NON-CURRENT ASSETS | |||||

| Item 1 | $16,000 | $29,200 | $43,720 | $59,692 | $77,261 |

| Item 2 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Item 3 | $28,000 | $50,000 | $64,520 | $75,168 | $86,881 |

| Item 4 | $96,000 | $184,000 | $256,600 | $336,460 | $424,306 |

| Item 5 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Total | $180,000 | $347,200 | $497,240 | $656,960 | $832,652 |

| Accumulated depreciation | $44,267 | $129,600 | $250,104 | $408,231 | $607,743 |

| Net non-current assets | $135,733 | $217,600 | $247,136 | $248,729 | $224,909 |

| CURRENT ASSETS | |||||

| Cash | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

| Accounts receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| Total current assets | -$113,856 | -$408,380 | -$537,927 | $43,349 | $1,884,214 |

| Total Assets | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

| LIABILITIES | |||||

| Account payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| Total liabilities | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| EQUITIES | |||||

| Owner’s equity | $400,000 | $840,000 | $1,324,000 | $1,856,400 | $2,442,040 |

| Accumulated net profit | -$404,039 | -$1,081,947 | -$1,687,957 | -$1,662,905 | -$455,918 |

| Total equities | -$4,039 | -$241,947 | -$363,957 | $193,495 | $1,986,122 |

| Total liabilities & equities | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |