Written by Elma Steven | Updated on April, 2024

How to Write a Tow Truck Business Plan?

Tow Truck Business Plan is an outline of your overall tow truck business. The business plan should include a 5 year financial projection, marketing plan, industry analysis, organizational overview, operational overview and finally an executive summary. Remember to write your executive summary at the end as it is considered as a snapshot of the overall business plan. You need to be careful while writing the plan as you need to consider various factors that can impact the business’s success.

Table of Contents

Executive Summary

Jordan Smith established Dynamic Towing Services, a leading tow truck business, in the vibrant downtown area of Dallas, Texas. Towing, accident recovery, emergency roadside assistance, and specialized transportation are our primary offerings. Jordan has been a towing professional for over ten years, so he knows what customers want and is dedicated to providing them with dependable service.

We take pride in our lightning-fast response times, cutting-edge towing equipment, and staff of expert operators that can handle any car or condition. Our top priorities are the safety, efficiency, and convenience of our customers, and we strive to provide a full range of roadside assistance services beyond just towing.

Mission: To be Dallas’s go-to for reliable, fast-response towing and emergency roadside help. With cutting-edge tech, trained employees, and an unwavering dedication to satisfying customers, we want to make sure that drivers can relax and enjoy the road.

Vision: Being known as Dallas’s most dependable and forward-thinking tow truck service is our goal. As a towing company, our mission is to revolutionize the way customers are served and establish new benchmarks for excellence. We want to be the go-to emergency road service for drivers because of our reputation for professionalism and compassion in responding to any kind of roadside situation.

Industry Overview:

When drivers are involved in accidents or have other roadside problems, the tow truck business is there to help. The increased number of vehicles on the road, worsening traffic conditions, and innovations in tow truck technology are all elements that should propel the sector forward in the years to come.

Check out this guide on how to write an executive summary? If you don’t have the time to write on then you can use this custom Executive Summary Writer to save Hrs. of your precious time.

Financial Highlights

Earnings & Profitability

Break-Even Analysis

Business Description

Business Name: Dynamic Towing Services

Founders: Jordan Smith

Management Team: [You can ignore this/ delete this but its better to provide it]

Legal Structure: LLC

Location: Miami

Goals & Objectives:

Build a Strong Client Base:

- Form alliances with nearby companies, including garages and dealerships, that engage in automobile maintenance and sales.

- Provide dependable services around the clock to earn consumers’ confidence.

- Create a referral scheme that will motivate people to spread the news.

Enhance Brand Recognition:

- Make a splash in the digital world by setting up an expert website and engaging with followers on social media.

- Take part in and support neighborhood gatherings and sporting activities.

- Raising brand awareness in the community is as easy as using branded clothes and cars.

Deliver Prompt and Efficient Service:

- Get back to customers quickly when they call for service.

- Empower your team to provide exceptional customer service and solve problems quickly.

- For towing equipment to work at its best, it is important to regularly repair and improve it.

Expand Services Portfolio:

- Introduce new services, such as car storage, specialist towing, and roadside help, during the first two years.

- Find more service options by researching the local market.

- To increase the range of services provided, team up with insurance firms and car clubs.

Achieve Financial Stability:

- Get your financial house in order and check in often to see how you’re doing.

- Keep costs in check by concentrating on efficient processes.

- Find the optimal pricing strategy to optimize profits.

Establish a Reputation for Reliability and Professionalism:

- Provide your employees with thorough training on proper customer interactions and towing techniques.

- Create and strictly adhere to safety regulations.

- Make an effort to hear out your customers and address their concerns or ideas as soon as possible.

Incorporate Advanced Towing Technology:

- For better navigation and dispatch, get up-to-date towing equipment.

- Learn about new developments in your field and use them into your work.

- Make available software and hardware training for employees.

Services:

Emergency Roadside Assistance:Give round-the-clock assistance with starting engines, changing tires, opening locked doors, and delivering gasoline.Make sure that calls in an emergency are responded to quickly.

Standard Vehicle Towing:Tow bikes, vehicles, and light trucks quickly and safely.Tow vehicles safely using up-to-date, well-maintained equipment.

Heavy-Duty Towing:Make sure to include services that can pull big rigs, recreational vehicles, and semi-trucks.Choose personnel who have received training on how to operate heavy-duty towing machinery.

Accident Recovery Services:Offer accident recovery services that are both efficient and well handled. Facilitate trouble-free service by coordinating with relevant local authorities and insurance providers.

Winch-Out Services:Get cars out of sticky conditions like mud, snow, or ditches.

Tow trucks should be outfitted with robust winches and recovery equipment.

Specialized Transport:We can help you with any big or unusual cargo needs.

Make sure that unique cargo is transported in accordance with all applicable requirements.

Vehicle Storage:Offer safe ways to keep vehicles for the short or long term.

Make sure the storage facility is well-guarded and convenient to reach.

Financial Overview

Startup Cost

Revenue & Cost Projection

Profitability & Cash Flow Projection

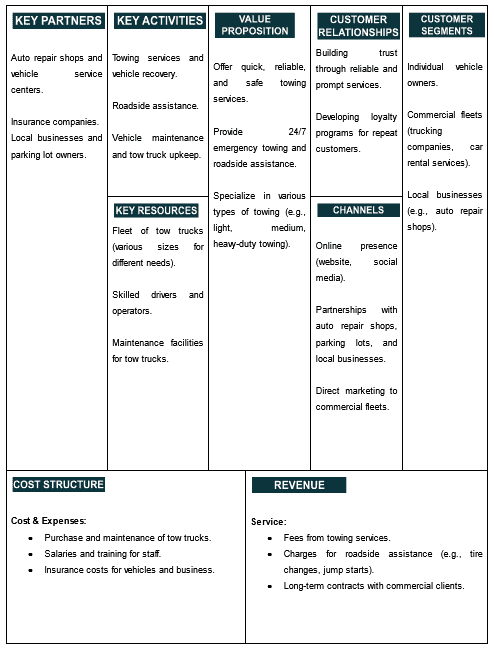

Business Model

Tips on Business Model Canvas

The Business Model Canvas is a high-level overview of the business model. It can also be considered as the business model map in the overall plan. The important partners, key activities, value proposition and cost & revenue sections are only some of the nine vital components. A company idea’s complexities may be mapped out, analyzed and communicated with the use of the canvas. It shows the whole picture of a company’s value creation, delivery and capture processes. It helps new business owners hone their ideas, encourage creative thinking and make sound strategic decisions. It’s a helpful resource for coming up with ideas, organizing plans and presenting business models to key players. Check out the 100 samples of business model canvas.

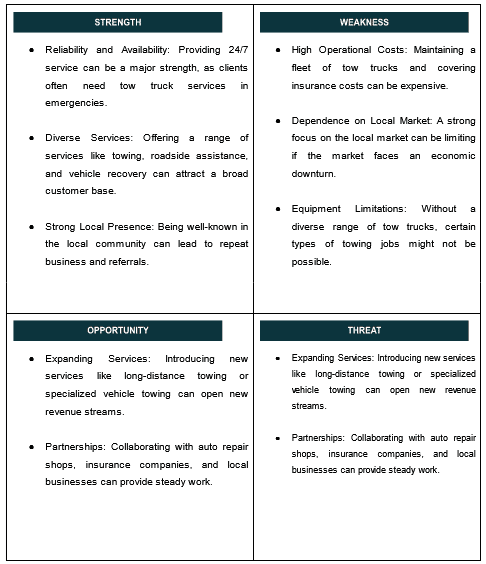

SWOT

Tips on SWOT Analysis

It offers a clear lens into a company’s strengths, weaknesses, opportunities and threats. This self-awareness enables effective resource allocation and strategic positioning against competitors. Businesses can mitigate risks, make informed decisions and set realistic goals. In addition, presenting a SWOT analysis in a business plan communicates to stakeholders that the company possesses a deep understanding of its market environment. In essence, SWOT ensures a business’s strategy is grounded in reality enhancing its chances of success. Check out the 100 SWOT Samples

Marketing Plan

Promotional Channels

Social Media Marketing – $15,000 (30%):

- Platforms: Focus on platforms like Facebook, Instagram, and Twitter, where community engagement is high. Post content like safe driving tips, behind-the-scenes glimpses of your operations, and customer testimonials.

- Paid Ads: Use targeted ads to reach local drivers, businesses, and community organizations. Leverage demographic targeting to reach specific local areas.

- Content Strategy: Share posts highlighting your team, towing equipment, emergency roadside assistance, and customer stories. Consider monthly features on road safety.

Website and SEO – $10,000 (20%):

- Website Revamp: Ensure your website is user-friendly, optimized for mobile devices, and clearly lists your services, contact information, and response times.

- Blog Content: Create blog posts on topics like vehicle maintenance, roadside safety, and local traffic updates to drive organic traffic.

- SEO: Optimize for local search keywords related to towing services, roadside assistance, and vehicle recovery.

Email Marketing – $5,000 (10%):

- Newsletter: Develop a newsletter with updates on your services, seasonal driving tips, and special offers.

- Segmentation: Create targeted content for different segments, such as individual vehicle owners, local businesses with fleets, and auto repair shops.

Local Partnerships – $7,000 (14%):

- Community Events: Sponsor local events, parades, or sports teams, offering your towing services when needed.

- Business Collaborations: Partner with auto repair shops, dealerships, and insurance companies for referrals and joint marketing efforts.

Influencer and Community Leader Collaborations – $6,000 (12%):

- Collaborations: Work with local influencers or community figures for promotion, focusing on those who can emphasize reliability and trustworthiness.

- Sponsorship Deals: Offer services at community events or local non-profits in exchange for publicity.

Direct Mail and Local Advertising – $4,000 (8%):

- Direct Mail: Send informational brochures or magnets with your contact details to local residents and businesses.

- Local Media: Invest in local radio, newspapers, and online community forums to build a presence in your service area.

Referral Program – $3,000 (6%):

- Referral Incentives: Create a referral program where customers get discounts or services for referring friends or businesses.

- Community Engagement: Encourage word-of-mouth by providing excellent, memorable service and asking satisfied customers to share their experiences.

Brand Management

Social Media Marketing

Brand Voice and Visual Identity:

- Develop a brand voice that conveys reliability, efficiency, and professionalism, key qualities customers look for in a tow truck service.

- Use a consistent visual style across all platforms, featuring images of your tow trucks, team in action, and branded uniforms or gear.

User-Generated Content:

- Encourage customers to share their experiences or reviews online, especially on platforms like Google and Yelp.

- Share positive customer stories and testimonials on your social media and website to build credibility and trust.

Live Demonstrations:

- Host live sessions demonstrating safe towing practices or basic roadside assistance tips.

- Engage your audience with Q&A sessions about vehicle safety and emergency procedures.

Search Engine Marketing (SEM) and Local SEO:

- Craft ad copy that highlights your quick response times, range of services, and areas served.

- Optimize your website for local search terms related to towing and roadside assistance.

- Regularly update your Google My Business listing with current information, photos, and service updates.

Email Marketing:

- Send out newsletters featuring vehicle maintenance tips, seasonal driving advice, and special offers.

- Segment your email list to tailor messages for individual clients, commercial accounts, and local businesses.

Local Partnerships and Sponsorships:

- Partner with local automotive events, car shows, or community safety events.

- Collaborate with auto repair shops, dealerships, and insurance companies for mutual referral programs.

Content Marketing:

- Create informative blog posts or videos about vehicle safety, emergency preparedness, and roadside assistance tips.

- Share behind-the-scenes content showcasing your team and equipment, providing insight into your day-to-day operations.

Influencer and Community Leader Collaborations:

- Partner with local influencers or community figures in safety campaigns or promotional events.

- Share these collaborations on social media to increase brand visibility and community engagement.

Offline Advertising:

- Invest in local print media, radio ads, and community bulletin boards.

- Distribute branded materials like magnets, calendars, or keychains in local businesses and auto shops.

Referral Program:

- Implement a referral program where customers get discounts or free services for referring new clients.

- Make sure the program is simple to understand and participate in, encouraging more referrals.

Go To Market Strategy

Online Presence and Community Engagement

- Professional Website:

- Develop a website that is easy to navigate, with clear information about your services, response times, and contact details.

- Implement an online booking or quote request system, and include testimonials and case studies from past jobs.

- Content Marketing:

- Publish blog posts or articles on topics like road safety, vehicle maintenance tips, and what to do in a breakdown or accident.

- Optimize your content for search engines to improve your site’s visibility and rankings.

- Local Directory Listings:

- List your business in local directories and on platforms like Google My Business, ensuring that your information is consistent and up-to-date across all platforms.

- Encourage satisfied customers to leave reviews on these platforms to enhance your reputation.

- Partnerships:

- Form partnerships with local auto repair shops, car dealerships, and insurance companies to create referral networks.

- Consider collaborative promotions or discounts with these partners to encourage mutual referrals.

- Promotional Offers and Events:

- Offer introductory discounts or loyalty programs for repeat customers.

- Host or sponsor local community safety events, like car seat safety checks or roadside emergency preparedness workshops, to raise brand awareness.

- Digital Marketing and Customer Relations:

- Use social media platforms to share valuable content, engage with your community, and showcase your services.

- Send regular newsletters with updates, promotions, and vehicle safety tips to keep in touch with your customers.

- Loyalty Program:

- Introduce a loyalty program that offers discounts or perks to repeat customers or those who refer new clients to your business.

- Introduce a loyalty program that offers discounts or perks to repeat customers or those who refer new clients to your business.

- Brand Awareness and Public Relations:

- Engage with local media for features on your business, especially focusing on stories that demonstrate your commitment to community safety and reliable service.

- Get involved in community events and sponsor local sports teams or charity events to increase brand visibility.

- Influencer Partnerships:

- Collaborate with local influencers, such as popular mechanics or automotive bloggers, to promote your services.

- Share these collaborations on social media to reach a wider audience.

- Performance Tracking:

- Use tools like Google Analytics to monitor the performance of your website and digital marketing efforts.

- Regularly collect feedback from customers to understand their needs and to refine your service offerings.

Organizational Overview

Founder

An influential figure in Miami’s tow truck sector, Jordan Smith has a deep dedication to providing emergency roadside assistance and a wealth of knowledge in car recovery operations. Starting off with a passion for cars and a need to assist others in need, he eventually became an expert tow truck driver after honing his abilities in emergency response and vehicle repairs.

Tow truck industry success is within Jordan’s reach because to his formal education and work experience, which have equipped him with the technical knowledge and people skills necessary for the job. Jordan has honed his skills over the years working in several areas of the car repair business. He knows the ins and outs of vehicle recovery and how important it is to provide quick, caring service to customers.

His extensive knowledge of automotive logistics and expertise in current towing and recovery procedures make him an invaluable asset to Miami’s fast-paced automotive scene.

Launching his tow truck business in Miami—a city with high expectations for roadside assistance and car recovery services—is Jordan’s way of showcasing his entrepreneurial flare. Building a trustworthy support system for drivers in need is key to his company concept, which goes beyond providing tow truck services. When it comes to car emergencies, Jordan is committed to offering services that are safe, fast, and compassionate so that people may rest easy.

Excellence and innovation are the bedrock of his company’s operations. In order to become the go-to firm for car recovery and roadside assistance, Jordan has assembled a staff of highly trained operators and a fleet of cutting-edge tow trucks.

Beyond the scope of his company, Jordan is actively involved in the Miami community. He takes part in car workshops and local road safety projects, where he meets customers and makes relationships in the sector. Participation in this way not only helps him better understand the car requirements of Miami residents, but it also demonstrates his commitment to raising the bar for roadside assistance in the city.

With Jordan Smith at the helm, his tow truck firm is well on its way to become a major player in Miami’s car market, known for its innovative methods, dedication to client safety, and outstanding service. Inspired by a deep love for cars and an unwavering will to help those in need, Jordan has worked his way up the corporate ladder in Miami.

Positions and Responsibilities

- Chief Executive Officer (CEO) – Jordan Smith:

You, as CEO, are answerable for setting the company’s long-term goals and making all major strategic decisions. You are the face of the firm in negotiations and at industry events, in addition to managing resources, setting long-term objectives, and overseeing operations.

- Operations Manager:

Tow truck services are run on a daily basis by the Operations Manager. This involves overseeing the dispatch crew, coordinating the towing schedule, and making sure that everything is done according to safety and regulatory requirements.

- Tow Truck Operators/Drivers:

These experts are the first point of contact for your service; it is their job to answer calls, tow automobiles securely, and provide roadside help. Maintaining a good reputation in the industry relies on their knowledge of towing techniques and customer service.

- Customer Service Representative:

Customer service, tow truck dispatch, and administrative work are all part of this position’s remit. Both the satisfaction of customers and the smooth flow of information amongst tow truck drivers depend on them.

- Marketing and Community Outreach Coordinator:

This person will be in charge of advertising the company and its services to the public by coming up with marketing plans, overseeing the company’s social media accounts, and participating in community activities in the area.

- Financial Controller:

Budgeting, bookkeeping, payroll, and financial reporting are all responsibilities of the company’s Financial Controller. They aid in strategic planning and decision-making by providing crucial financial data.

- Fleet Maintenance Manager:

This person is responsible for making sure the tow trucks and other equipment are in good working order and safe to use. They are in charge of the fleet’s routine maintenance, repairs, and improvements.

- Human Resources Manager:

In charge of overseeing employee relations, hiring, training, and regulatory compliance in the workplace. In order to keep a motivated and competent staff, they are vital.

- Safety Compliance Officer:

Ensuring compliance with safety standards and regulations is the primary responsibility of this role. In order to reduce potential dangers, they do safety audits on a regular basis, educate employees, and establish regulations.

- Administrative Assistant:

Manages office operations, provides assistance to management, and does general administrative tasks. For day-to-day operations to run smoothly, this job is crucial.

Organogram

Operational Overview

Services

Standard Towing Services:

- Assist with the towing of various vehicles, such as automobiles, motorbikes, and light trucks.

- We provide long-distance travel in addition to local towing.

Emergency Roadside Assistance:

- Get gas, fix dead batteries, unlock doors, and fix flat tires with our lightning-fast response service.

- Always ready to help drivers in a need.

Heavy-Duty Towing:

- Suitable for transporting semi-trucks, buses, and recreational vehicles.

- Providing expert towing services for business and industrial vehicles is our specialty.

Accident Recovery Services:

- In the case of an accident, provide services for the safe and quick recovery of vehicles.

- Assist emergency services and law enforcement when needed.

Winch-Out and Off-Road Recovery:

- Help people get their cars freed from off-road obstacles like mud, snow, or ditches by providing winch-out services.

- For a safe and efficient recuperation, use specialist tools and methods.

Vehicle Storage Solutions:

- Supply safe places to keep vehicles for a limited time or for an extended period of time.

- Keep all stored automobiles in a secure and well-monitored area.

Commercial Fleet Services:

- Customized services for business fleets that include towing and roadside assistance.

- Maintain a schedule of scheduled inspections and provide after-hours assistance for all fleet cars.

Illegal Parking Towing and Management:

- Address parking concerns by coordinating with nearby businesses and property owners.

- Give people the option to have their abandoned or unlawfully parked cars towed.

Motorcycle Towing:

- Expert motorcycle towing services that prioritize the safety and security of your ride.

- Make use of tools that are made especially for pulling motorcycles.

Roadside Customer Service:

- Assist and console drivers in times of crisis by providing outstanding customer service.

- Provide instructions on how to use the insurance and the repair shop.

GPS and Mobile Technology for Efficient Dispatch:

- Accelerate dispatch and optimize routing with the use of GPS technology.

- Make it simple to request and monitor services via a mobile app or web platform.

Industry Analysis

From 2022–2027, the worldwide tow truck market is anticipated to expand at a CAGR of 4.2%, reaching a value of $60.3 billion. A number of causes are propelling this increase.

Source: verifiedmarketreports

Technological developments, shifting customer tastes, and an ever-increasing need for emergency roadside assistance all contribute to the ever-changing nature of the worldwide tow truck business. Among the most important markets are those in the US, followed by those in Japan, Germany, France, and the UK. Due to increasing demand for vehicles and gridlock in emerging markets like India and China, the Asia-Pacific region is anticipated to see the most rapid expansion. The sector is adjusting by putting an emphasis on specialization, providing value-added services, and investing in technology, despite the fact that it is quite fragmented and confronts problems like increasing fuel prices and competition. A combination of factors, including an aging car fleet, rising need for roadside assistance, and widespread use of telematics devices, bodes well for the tow truck industry’s future. Businesses in the tow truck industry who are open to new ideas, flexible enough to meet the needs of their customers, and committed to providing excellent service will do well and play an important part in keeping drivers safe.

Other key trends and stats:

- Growing Demand: Increasing vehicle ownership and usage are driving up the demand for roadside assistance and tow truck services.

- Independent Operators: The rise of independent tow truck operators is expanding the market, similar to the independent music scene’s impact on recording studios.

- Technological Advancements: Innovations in towing equipment and digital tools like GPS and mobile apps are making tow services more efficient and accessible.

- Economic Impact: The tow truck industry contributes significantly to the global economy with substantial revenue and a wide range of associated industries.

Source: marketresearchintellect

Industry Problems

- High Operational Costs:It may be financially difficult, particularly for smaller operators, to run a tow truck company due to the substantial expenditures involved, such as gasoline, insurance, and staff costs.

- Scheduling and Availability:Particularly during busy periods or in large service regions, it may be difficult to manage a fleet in a way that guarantees a prompt response to calls.

- Quality and Maintenance of Tow Trucks:It is critical to keep tow trucks and other equipment in excellent working order. Service failures might occur due to equipment that is not properly maintained or has inconsistent quality.It could be difficult to find operators that have the ideal combination of technical knowledge, work experience, and people skills.

- Safety and Compliance:Although necessary, complying with regulations and safety requirements may be a time-consuming and expensive ordeal.

- Effective Communication with Clients:Customer discontent might result from misunderstandings or vague information.

- Range of Services:It takes a versatile fleet to meet the varied demands of clients for towing, heavy-duty towing, and accident recovery, among other specialized services.

Industry Opportunities

- Flexible Pricing Models:To attract a diverse clientele, from private car owners to large corporations, you should institute tiered pricing for various services. To promote customer loyalty and repeat purchases, consider offering discounts or bundles.

- Efficient Scheduling and Dispatch System:To minimize response times and manage reservations, use a sophisticated dispatch system that might be coupled with a mobile app. One way to even out the burden is to think about off-peak discounts.

- Quality Equipment and Regular Maintenance:Make sure they are reliable and safe by investing in high-quality tow trucks and keeping them well-maintained. Stay updated on the latest innovations in towing equipment.

- Skilled and Trained Operators:Recruit seasoned drivers of tow trucks and ensure them continuous education. Make sure you have top-notch technical abilities as well as customer service chops.

- Safety and Compliance:Always follow all applicable safety protocols and laws. Make sure all employees are up-to-date on safety procedures by reviewing and updating them on a regular basis.

- Effective Communication with Clients:Ensure that all customer communications, particularly service calls, are crystal clear and proactive. Set up a mechanism to guarantee consistent updates and feedback.

- Diverse Service Range:Emergency towing, roadside assistance, car storage, and specialty towing are just a few of the services you may provide to cater to your clients’ diverse demands.

- Accessible Location and Extended Service Area:Put your company in a prime location for fast responses. It may be possible to cover a bigger area by increasing your service area.

Target Market Segmentation

Geographic Segmentation:

- Miami-Dade County Residents: Focus on the diverse local population needing towing and roadside assistance services.

- Specific Miami Neighborhoods: Target neighborhoods with different vehicle traffic patterns and towing needs, like Wynwood for its art scene and bustling nightlife, Downtown Miami for business-related towing, or South Beach for tourist and luxury vehicle assistance.

Demographic Segmentation:

- Age Groups: Offer services tailored to different age groups, recognizing that younger drivers might have different needs or financial constraints compared to older, more established clients.

- Income Levels: Provide a range of services from basic, cost-effective towing to premium roadside assistance packages for higher-income clients.

- Cultural Diversity: Cater to Miami’s diverse population by offering services that are sensitive to various cultural and language needs.

Psychographic Segmentation:

- Casual Vehicle Users: Target individuals who use their vehicles primarily for personal use and might need occasional towing or roadside assistance.

- Professional and Commercial Drivers: Focus on professional clients like truck drivers or business fleets who require reliable and quick response services.

- Automotive Enthusiasts: Cater to car enthusiasts who may require specialized towing services for luxury or vintage vehicles.

Behavioral Segmentation:

- Routine Maintenance Seekers: Focus on clients who need towing for regular vehicle maintenance or transport to service centers.

- Emergency Response Needs: Cater to drivers who require immediate roadside assistance due to breakdowns or accidents.

- Special Event Services: Offer tailored services for special events or situations, like towing for community events, parades, or car shows.

Technological Segmentation:

- Tech-Savvy Clients: Utilize advanced dispatch and GPS technology for clients who prefer digital solutions for service requests and tracking.

- Traditional Service Seekers: Provide straightforward, phone-based service requests and assistance for clients who prefer traditional methods.

Market Size

- Total Addressable Market (TAM) for Tow Truck Business:The total addressable market (TAM) for tow truck services in the United States is comprehensive. This encompasses any and all entities requiring services such as automobile towing, emergency roadside assistance, accident recovery, and similar offerings.There are a lot of factors that go into determining the TAM, such as the total number of cars on the road, the frequency of accidents, and the nationwide demand for services like roadside assistance and vehicle relocation.

- Serviceable Addressable Market (SAM) for Tow Truck Business:Your tow truck company may service a reasonable portion of the total available market (TAM), which is represented by the SAM. The services you provide (emergency towing, heavy-duty towing, roadside assistance, etc.) and the areas you serve (e.g., Miami-Dade County) are what characterize this market.If your company focuses on heavy-duty towing and quick emergency roadside assistance, your target audience would be Miami companies and individuals that need these services.

- Serviceable Obtainable Market (SOM) for Tow Truck Business:The SOM represents the potential share of your SAM that your company has a good chance of capturing. Your present marketing efficacy, market position, and resources all play a role in this.Achievable market share inside the SAM is dependent on factors such as company reputation, service efficiency and responsiveness, tow truck capacity and condition, and marketing tactics.

Industry Forces

Market Demand and Service Trends:Tow truck services are in high demand because of variables such as the number of vehicles on the road, the frequency of accidents, and the necessity for emergency roadside assistance. Market demands may be better met by keeping an eye on trends, such as the increase of electric cars or changes in traffic patterns.

Competition:Competition in the industry might come from both large towing firms and smaller, independently run businesses. Get your company noticed by offering something no one else does, responding quickly, going above and beyond for customers, and knowing the ins and outs of the local market.

Technological Advances:Improving service quality and efficiency may be achieved by the investment of state-of-the-art tow trucks and equipment, together with digital technologies like as GPS tracking and mobile applications for efficient dispatch and client engagement.

Regulatory Environment:Meeting all insurance, safety, and transportation-related rules is of the utmost importance. It is critical for legal operation to be updated on changes in local legislation or industry standards.

Economic Factors:Both consumer behavior and company operations are impacted by economic situations. Fuel costs, insurance premiums, and the state of the economy are all variables that might affect the demand for services and the expenses associated with providing them.

Supplier Dynamics:Your company is vulnerable to price or availability fluctuations in suppliers since you rely on them for tow trucks, maintenance equipment, and components. Establishing solid partnerships with dependable suppliers is crucial.

Customer Preferences and Expectations:The secret to providing prompt, dependable, and polite service is to know what your customers require. Improving service quality and customer happiness may be achieved by adapting to feedback and expectations from customers.

Social and Environmental Responsibility:Reputational benefits may accrue to your company when you show that you care about the community and the environment via actions like participating in local events or adopting eco-friendly procedures.

Workforce Availability and Skills:There must be a competent and trustworthy labor force. Hire seasoned drivers and make sure they get regular training. Consistent service quality is possible with staff happiness and retention tactics.

Financials

Investment & Capital Expenditure

Revenue Summary

Cost of Goods Sold Summary

OpEX Summary

Income Statement

Cash Flow Statement