Written by Elma Steven | Updated on April, 2024

House Flipping Business Plan is an outline of your overall House Flipping business. The business plan includes a 5 year projection, marketing plan, industry analysis, organizational overview, operational overview and finally the executive summary. Remember to write your executive summary at the end as it is considered as a snapshot of the overall business plan. The creation of a plan requires careful consideration of various factors that might impact the business’s success.

Table of Contents

Executive Summary

Overview: George Real Estate will be a Denver-based licensed and registered real estate company. The strategy for flipping houses is to buy buildings for homes, schools, offices, and small companies, then restore them and resell them.

When real estate flipping is done on a broad scale, it attracts clients from all lifestyles. However, because George Home Flipping will begin on a modest scale, the following are the initial target client groups: Residential Community in General, Sector of Commerce (Stores, Private Hostels, Restaurants, Parking Lots, and Schools), and Rental Companies.

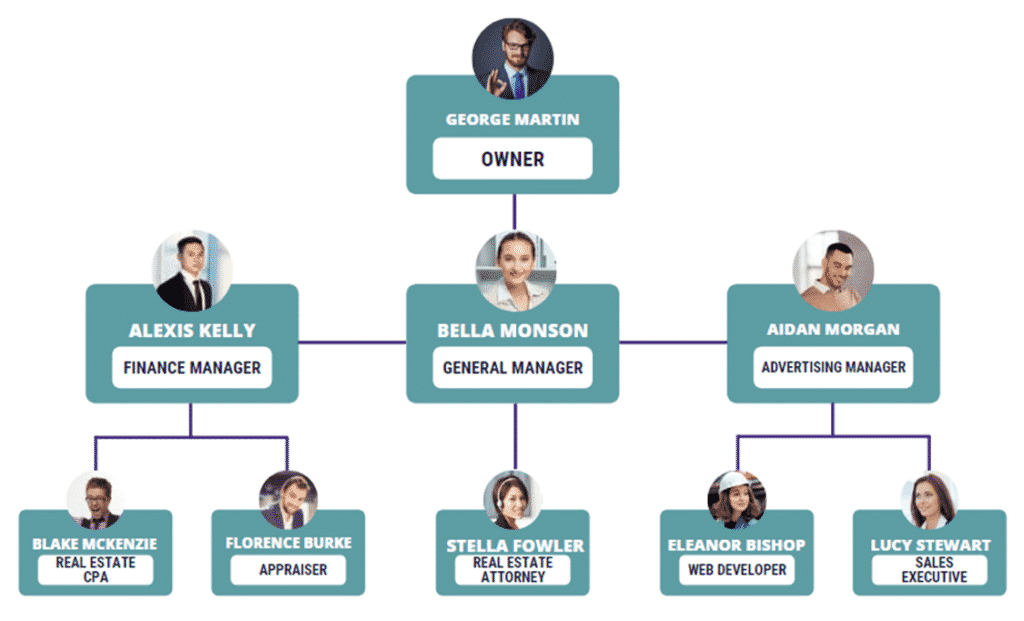

George Martin is the owner of George Home Flipping. George is a business administration graduate. He has two years of experience working in a rental agency and is regarded as an unbeatable negotiator. George is beginning a house flipping business since it is the best way for him to put his skills to use.

Mission: George Real Estate mission is to give individuals with stability, safety, and opportunity through real estate ownership. Our technology assists real estate agents in being more efficient at their jobs and finding more consumers in order to fulfill their purpose. The Ben Kinney Teams are continually assisting families in finding and selling houses, and our training prepares agents to be even better by applying remarkable approaches and processes.

Vision: We aim to be the best at what we do, so we do everything we can to help our clients, agents, and employees achieve financial success. We enjoy working with people that are committed to working well while also giving back to their communities.

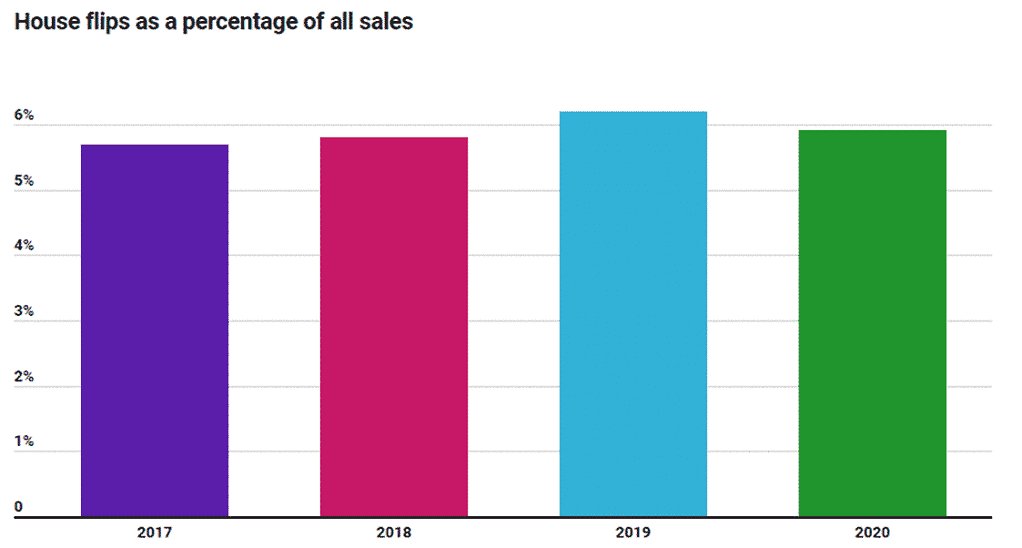

Industry Overview: Over the last few years, house flipping has been increasingly fashionable. Only 5.7 percent of all house sales in 2017 were flips. That percentage had risen to 7.5 percent in the first quarter of 2020. However, by the end of 2020, the rate seems to have decreased, falling to 5.9%. The popularity of house-flipping series like HGTV’s Fixer Upper and Flip or Flop is certainly a factor. Growing millennial interest is also beneficial. Are you considering going into the fix-and-flip business? Do you just need some advice on where to do your next flip? Here are some more important 2021 flipping statistics to keep in mind. Check out this guide on how to write an executive summary? If you don’t have the time to write on then you can use this custom Executive Summary Writer to save Hrs. of your precious time.

Financial Overview:

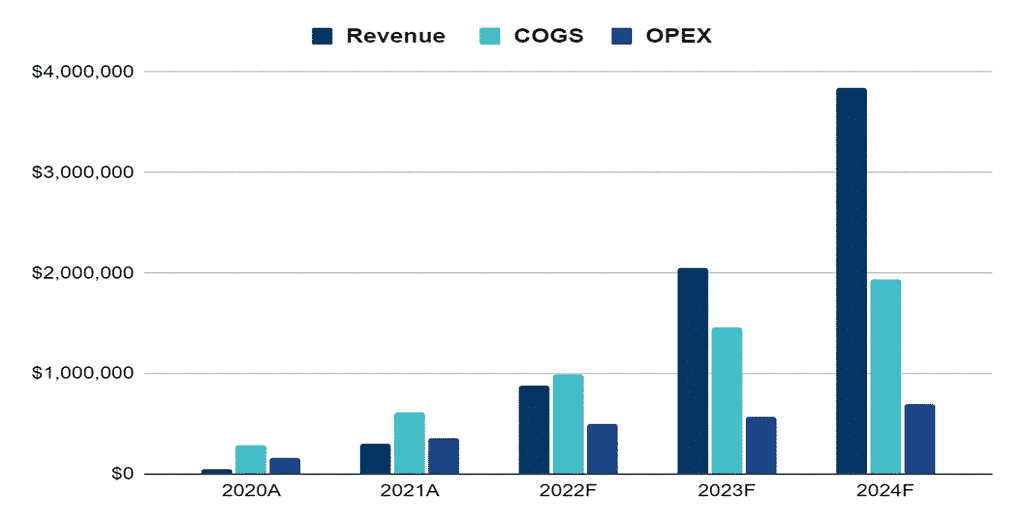

Financial Highlights:

| Liquidity | 2020A | 2021A | 2022F | 2023F | 2024F |

| Current ratio | 6 | 12 | 23 | 32 | 42 |

| Quick ratio | 6 | 11 | 22 | 31 | 40 |

| DSO | 8 | 8 | 8 | 8 | 8 |

| Solvency | |||||

| Interest coverage ratio | 8.2 | 11.1 | 14.2 | ||

| Debt to asset ratio | 0.01 | 0.01 | 0.2 | 0.18 | 0.16 |

| Profitability | |||||

| Gross profit margin | 51% | 51% | 53% | 53% | 53% |

| EBITDA margin | 12% | 14% | 21% | 22% | 22% |

| Return on asset | 5% | 6% | 13% | 14% | 14% |

| Return on equity | 5% | 6% | 16% | 17% | 17% |

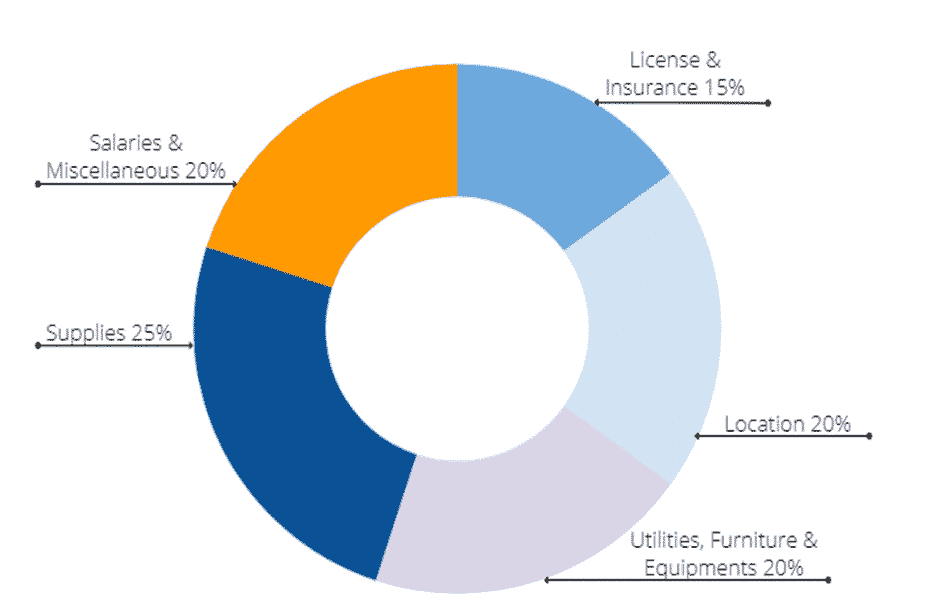

Use of Funds:

Business Model Canvas

Tips on Business Model Canvas

The Business Model Canvas is a high-level overview of the business model. It can also be considered as the business model map in the overall plan. The important partners, key activities, value proposition and cost & revenue sections are only some of the nine vital components. A company idea’s complexities may be mapped out, analyzed and communicated with the use of the canvas. It shows the whole picture of a company’s value creation, delivery and capture processes. It helps new business owners hone their ideas, encourage creative thinking and make sound strategic decisions. It’s a helpful resource for coming up with ideas, organizing plans and presenting business models to key players. Check out the 100 samples of business model canvas.

SWOT

Tips on SWOT Analysis

It offers a clear lens into a company’s strengths, weaknesses, opportunities and threats. This self-awareness enables effective resource allocation and strategic positioning against competitors. Businesses can mitigate risks, make informed decisions and set realistic goals. In addition, presenting a SWOT analysis in a business plan communicates to stakeholders that the company possesses a deep understanding of its market environment. In essence, SWOT ensures a business’s strategy is grounded in reality enhancing its chances of success. Check out the 100 SWOT Samples

Industry Analysis

The industry analysis section of the Real estate flipping business plan will help you get better insights into competitors, market growth, and overall industry prospects. You can order a custom market research report for your Real estate flipping business.

Flipping activity increased around the country in 2020. The first quarter of 2020 saw the most home flips since early 2006, representing a nearly two-percentage-point increase over the previous three years.

Source: attomdata

While working on the industry analysis section of the Real estate flipping business plan make sure that you add significant number of stats to support your claims and use proper referencing so that your lender can validate the data.

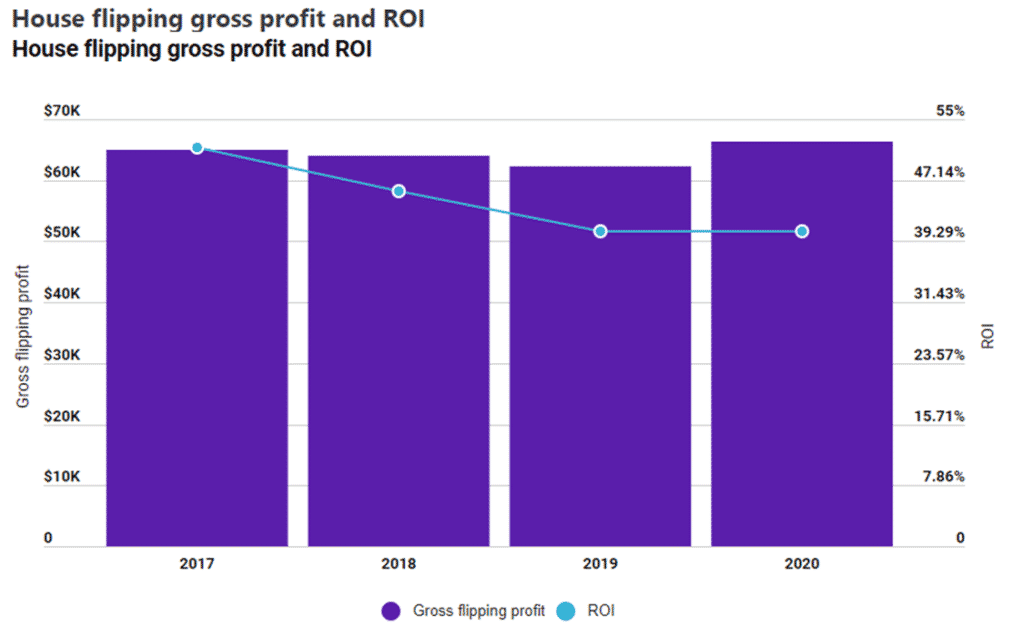

For the third year in a row, home returns have fallen. In 2019, the average ROI was 41.5 percent, compared to 46.4 percent in 2018. The average 2020 ROI was down more than 10% from the previous decade’s highs in 2016 and 2017, and it was the lowest it has been since 2011. Property taxes, rehabilitation costs, mortgage interest, and other holding costs are not included in the average ROI %. Jacksonville, Florida, saw the biggest drop in ROI, dropping from 52.2 percent in 2019 to 39.4 percent in 2020; Richmond, Virginia, dropped from 84.4 percent to 73.6 percent; Cleveland, Ohio, dropped from 108.2 percent to 98.5 percent; Birmingham, Alabama, dropped from 65 percent to 58.6 percent; and Pittsburgh, Pennsylvania, dropped from 133.8 percent to 128.1 percent, a 4 percent year-over-year drop.

The number of cash-purchased property flips increased in 2020, from 57.7% in 2019, demonstrating that cash is still king. Cash-purchased house flips accounted for 58.2 percent of all property flips in 2018. The percentage of homes purchased with finance fell to 41.8 percent in 2019 from 42.3 percent the previous year. However, there was a 1.5 percent rise in flipped properties purchased with finance in the fourth quarter of 2019 compared to the fourth quarter of 2020. Southern Tuscaloosa, Alabama, had the largest percentage of flips using financing, at 80.4 percent; Charlottesville, Virginia, had 72 percent; Lexington, Kentucky, had 74.8 percent; Syracuse, New York, had 67 percent; and Duluth, Minnesota, had just under 67 percent.

Purchasing an asset for a short period of time with the intention of selling it for a fast profit rather than staying on for long-term appreciation is known as flipping. Short-term real estate transactions, as well as some investors’ behavior in initial public offerings, are commonly referred to as flipping (IPO).

Flipping is most closely connected with real estate, where it refers to the practice of buying and selling properties for a profit in a short period of time (usually less than a year). Flipping houses usually falls into one of two categories. The first type involves real estate investors identifying assets in fast increasing markets and reselling them with little or no extra investment in the physical property. This is a bet on market conditions rather than the actual property. A quick repair flip, also known as a reno flip, is when a real estate investor leverages his expertise of what purchasers desire to enhance undervalued homes through renovations and/or cosmetic adjustments.

In real estate, flipping has made millions, but it seems to produce more infomercials than simply replicable successes. The riskier option is to flip in a hot market, as hot markets can cool unexpectedly. If market conditions change before the property can be sold, the investor will be stuck with a depreciating asset.

Market timing is less important when flipping a house after it has been improved, but market conditions might still play a factor. In a reno flip, the investor injects new cash into the property that should enhance its worth by more than the sum of the purchase price, renovation costs, carrying costs during the renovation, and closing fees. Although flipping houses sounds simple and basic in theory, it takes more than a passing knowledge of real estate to be profitable.

Real estate flipping might also include wholesaling, depending on your perspective. A person with an eye for undervalued (and hence flippable) real estate enters into a contract to buy a property subject to an inspection period, then sells the contract rights to a real estate investor for a fee or percentage. This is a more formal relationship than a classic bird dog, and the property in question may or may not be flipped. A wholesaler’s search for homes isn’t restricted to flipping. Wholesalers also look for income properties and long-term growth opportunities for real estate investors.

When an investor resells shares in the days or weeks following an IPO, this is known as flipping. These investors profit from the first IPO boom that hot issues experience. With lock-ups and rules for beginning investors, IPO flipping is partially discouraged, but a new issue requires some flippers to generate trading volume and market buzz after the IPO. IPO flipping can also be profitable, as many equities reach their peak values in the weeks and months following an IPO, and then struggle for a while before recovering to those levels, if at all.

In 2020, sales of flipped homes fell by 13.1 percent. Flipped house sales accounted for 6.3 percent of all home sales in 2019. In 2020, 241,630 homes and condominiums were flipped, up from 245,864 the year before, representing a 2% rise from 2018. The number of flipped properties sold in 2019 was at its highest level in eight years. While the market may be shifting, analysts are divided on whether this drop in sales is a transient or permanent shift in the home-flipping market. In 2020, gross flipping profit increased but sales decreased, the polar opposite of 2019, when overall flipped home sales increased while gross profit decreased.

While nationwide flipping returns fell in 2020, several metro regions (with populations of at least 1 million) showed an increase. The largest percentage increase was in Hartford, Connecticut, which went from 70.4 percent in 2019 to 83.5 percent in 2020; Rochester, New York, increased from 68.4 percent to 80.4 percent with a 17.5 percent increase; Milwaukee, Wisconsin, increased from 64.4 percent to 76.4 percent; and Austin, Texas, increased from 12.4 percent to 23.5 percent. Philadelphia rounded out the top five rises in the category, increasing by 107.2 percent year over year.

The West and South saw the highest declines in home-flipping rates in these local marketplaces. The largest drop was 27.3 percent in San Antonio, Texas. These U.S. regions accounted for nine out of ten of the most significant declines. Home flip sales decreased in 126 of the 198 metropolitan statistical areas (MSAs) studied in the report from 2019 to 2020. MSAs have to have a minimum of 100 home flips and a population of at least 200,000 in 2020 to be included in the report.

The corona virus outbreak appeared to have slowed down the average time it took to sell a home. In 2020, quarterly flip time averages varied. The average number of days it takes to flip a house grew from 184 to 192 in the third quarter. The extended average time in the third quarter was the longest since 2003. In 2019 and 2018, the average time to flip a house was 177 days and 178 days, respectively.

According to the United States, According to the United States Census Bureau, there are 3,143 counties in the country. The 31 counties with a 10% or higher home flipping rate come from 741 counties having at least 50 property flips in 2020. Macon County, Tennessee, was first with 14.3 percent; Lincoln County, Missouri, ranked second with 14 percent; Clayton County, Georgia, ranked fourth with 14 percent; Shelby County, Tennessee, ranked fifth with 13.8 percent; and Warren County, Tennessee, ranked sixth with 13.7 percent. There were 34 counties in 2019 where home flipping accounted for at least 10% of all home sales, out of a total of 678 counties. Portsmouth City/County in Virginia, Prince George’s County in Maryland, Macon County in Tennessee, Shelby County in Tennessee, and Clayton County in Georgia rounded out the top five.

Source: businessinsider

Marketing Plan

A marketing plan outlines the company’s strategy to promote its products or services to its target audience. It includes specific tactics and channels the business will use to reach potential customers. This section defines the company’s unique value proposition, identifies the target market segments, and discusses the competitive landscape. It also includes insight into budget allocation, projected outcomes and key performance indicators to measure success. Marketing plan helps businesses demonstrate their understanding of the market dynamics, their positioning within the industry and their approach to driving customer engagement and sales.

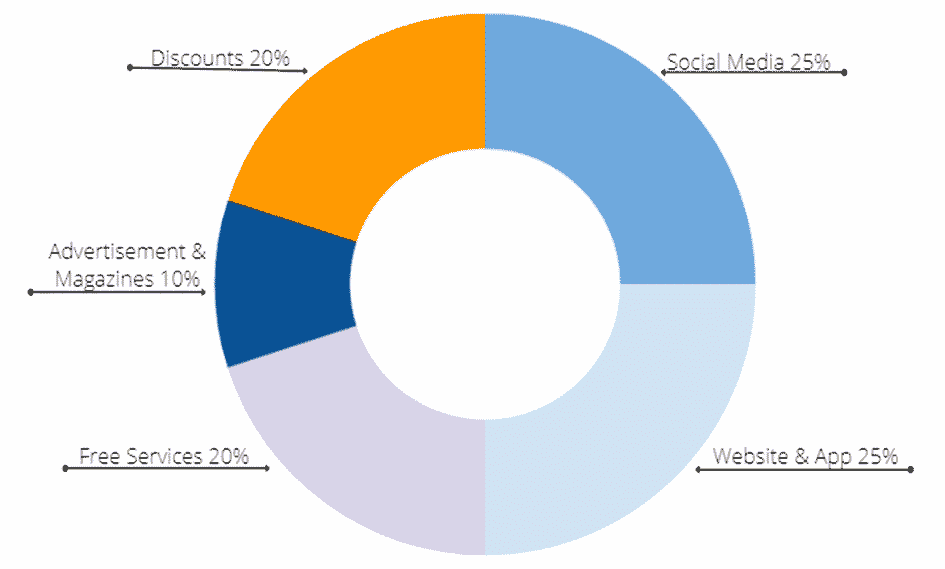

Social Media: We will launch a social media campaign (Facebook & Instagram).

Website & Apps: We are establishing a website and a mobile app so that our customers can look at available properties from the comfort of their own homes.

Discount: For the first month after we debut, we will give you a 20% discount on all of our services.

Advertisement & Magazines: We will advertise our startup on Google Local and in local newspapers.

Free Services: Our property buyers will receive complimentary electrical and plumbing services.

Organizational Plan:

Financial Plan

A financial plan provides a comprehensive projection of a company’s financial health and its anticipated monetary performance over a specified period. This section encompasses a range of financial statements and projections such as profit and loss statements, balance sheets, cash flow statements and capital expenditure budgets. It outlines the business’s funding requirements, sources of finance and return on investment predictions. The financial plan gives stakeholders particularly potential investors and lenders a clear understanding of the company’s current financial position. A financial plan helps businesses demonstrate their financial prudence, sustainability, and growth potential.

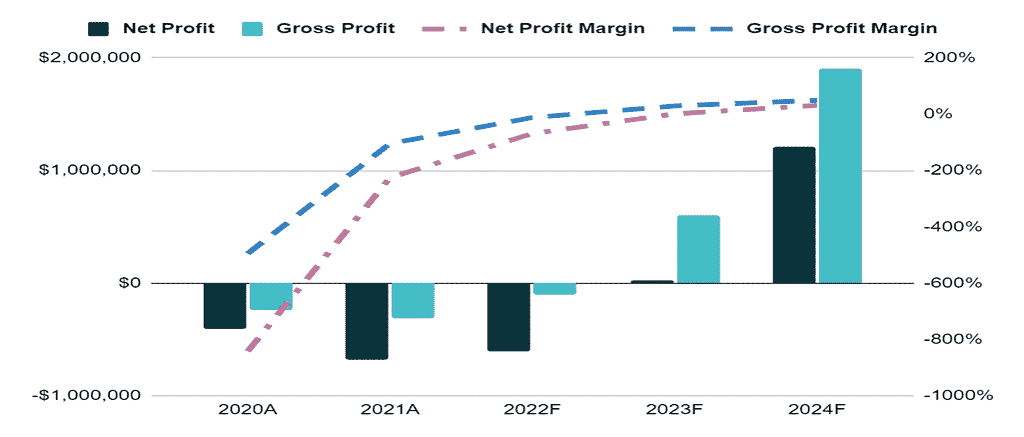

Earnings:

Income Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| Total Cost of Revenue | 285,560 | 615,220 | 987,794 | 1,455,612 | 1,935,625 |

| as % of revenue | 595% | 204% | 112% | 71% | 50% |

| Gross Profit | -237,575 | -313,984 | -105,583 | 601,578 | 1,902,218 |

| SELLING & ADMIN EXPENSES | |||||

| Item 1 | 28,000 | 96,800 | 154,880 | 175,692 | 193,261 |

| Item 2 | 75,000 | 105,000 | 120,000 | 120,000 | 120,000 |

| Item 3 | 36,000 | 96,000 | 108,000 | 120,000 | 120,000 |

| Item 4 | 8,000 | 12,000 | 12,000 | 12,000 | 12,000 |

| Item 5 | 3,839 | 18,074 | 44,111 | 61,716 | 115,135 |

| Item 6 | 3,359 | 12,049 | 26,466 | 41,144 | 76,757 |

| Item 7 | 5,600 | 10,000 | 12,904 | 15,034 | 17,376 |

| Item 8 | 6,667 | 14,000 | 22,067 | 30,940 | 40,701 |

| Total selling & admin expenses | 166,464 | 363,924 | 500,428 | 576,525 | 695,230 |

| as % of revenue | 347% | 121% | 57% | 28% | 18% |

| Net profit | -404,039 | -677,907 | -606,011 | 25,052 | 1,206,987 |

| Accumulated net profit | -404,039 | -1,081,947 | -1,687,957 | -1,662,905 | -455,918 |