Written by Elma Steven | Updated on January, 2024

In order to write a Marine Repair Business Plan you need to start with executive summary. In order to write an executive summary for a Marine Repair Business Plan you need to mention- what your business is about and what you’ll sell. Explain how you’ll get people to buy it. The executive summary should be written at the end. Then you should write a Business Description mentioning goals, objectives, mission and vision. Some of the major sections or components of a Marine Repair Business Plan involves Fund Usage Plan, Marketing Plan, Industry Analysis, Organizational Overview, Operational Overview and Financials.

This article will provide you a step by step process to write your Business Plan. Get a free Marine Repair Business Plan at the end!

Executive Summary

Overview: Marine Plus, LLC is the place to go if you’re looking for a skilled boat technician that takes pleasure in their work. Our organization specializes in engine diagnostics to resolve any problem, and we can get any components required to finish your boat repair or project. We take extreme delight in going above and beyond for you. As a mobile boat maintenance and repair company, Marine Plus, LLC brings professionalism and quality to you. For engine repairs and performance enhancements, all of our work is guaranteed.

Mission: Our objective is to ensure that your boat functions smoothly with our high-quality, low-cost services while minimizing environmental effects.

Vision: Our goal is to become the world’s leading provider of engine maintenance services.

Industry Overview:

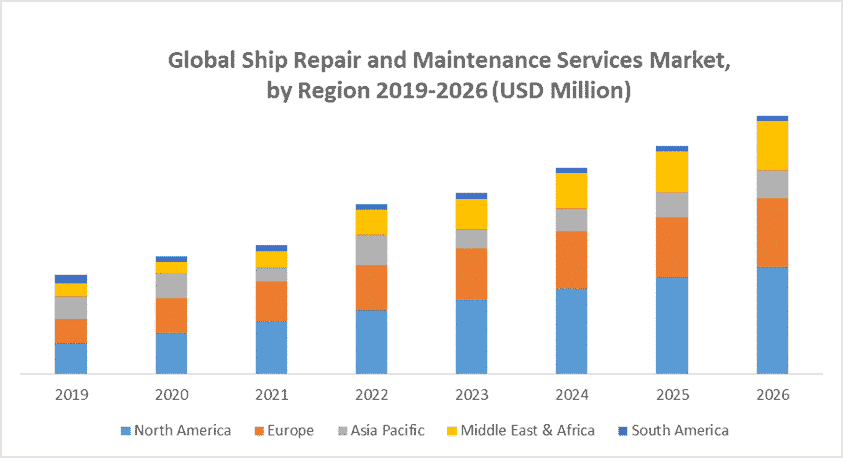

Ship conversions, overhauls, significant and small damage repairs, and equipment repairs are included in ship repair and maintenance. In the maritime business, ship repairs and upkeep are critical. Ship repair and maintenance services are in high demand due to increased shipbuilding activity. On the other hand, the market is predicted to drop by -0.01 percent from $191,913.3 million in 2019 to $177,809.0 million in 2020. The drop is mainly due to several nations implementing lockdown and social isolation policies and a global economic downturn brought by the COVID-19 outbreak and the measures taken to combat it. Between 2021 and 2026, the marine repair market will recover and increase at a 3.06 percent CAGR, reaching $191,891.1 million.

Financial Overview

Financial Highlights

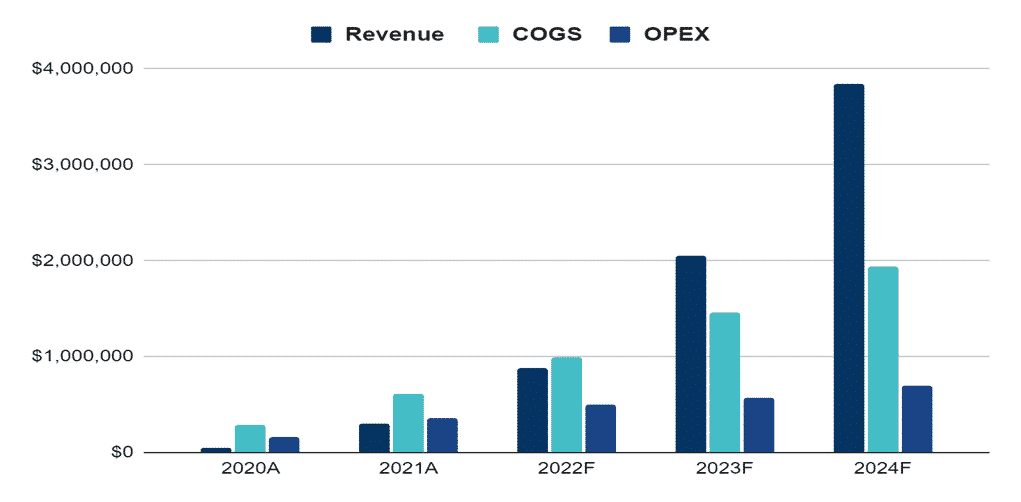

| Liquidity | 2020A | 2021A | 2022F | 2023F | 2024F |

| Current ratio | 6 | 12 | 23 | 32 | 42 |

| Quick ratio | 6 | 11 | 22 | 31 | 40 |

| DSO | 8 | 8 | 8 | 8 | 8 |

| Solvency | |||||

| Interest coverage ratio | 8.2 | 11.1 | 14.2 | ||

| Debt to asset ratio | 0.01 | 0.01 | 0.2 | 0.18 | 0.16 |

| Profitability | |||||

| Gross profit margin | 51% | 51% | 53% | 53% | 53% |

| EBITDA margin | 12% | 14% | 21% | 22% | 22% |

| Return on asset | 5% | 6% | 13% | 14% | 14% |

| Return on equity | 5% | 6% | 16% | 17% | 17% |

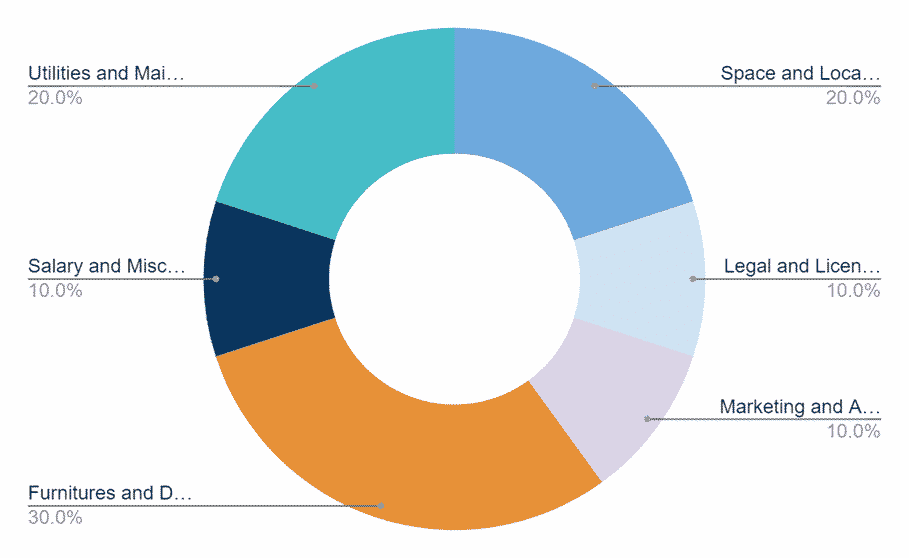

FUND USAGE

Get the Free Business Plan Template

Get the template over email

Industry Analysis

COVID-19 Growth and Change gives strategists, marketers, and senior management the data they need to evaluate the worldwide boat-repair business. Brunswick, Riviera, Holyhead Boatyard, Ancasta International Boat Sales, Survitec Survival Craft, Daewoo Shipbuilding & Marine Engineering, Hyundai Heavy Industries, Mitsubishi Heavy Industries, Samsung Heavy Industries, and General Dynamics are some of the major competitors in the ship-fixing business.

With a compound annual growth rate (CAGR) of -1.01 percent, the worldwide boat mending market will fall from $6.78 billion in 2019 to $6.71 billion in 2020. The reduction is primarily due to the COVID-19 epidemic, which has resulted in tight containment measures such as social distance, remote working, and the shutdown of industries and other commercial operations, all of which have created operational issues. The market has been badly impacted by the disruption of the whole supply chain. At an annual growth rate of 8.52 percent, the market is predicted to recover to $8.58 billion in 2023.

The spread of the COVID-19 illness has had a huge influence on the marine sector, which includes shipping, boating, and sailing activities. Due to the closure of facilities, the outbreak has stopped boat maintenance and associated operations. To stop the spread of the coronavirus, all commercial and recreational maritime activities, as well as personal pleasure boats, have been halted. Over 3 billion people have been put on lockdown, according to Willis Towers Watson, resulting in a halt in economic activity and a -3.0% drop in global GDP. The boat manufacturing and repair business will be affected by the delay in re-establishing supply chain networks and logistical capabilities.

The boat repairing market comprises firms that run shipyards or boatyards and sell boat repairs and associated services. Included are only commodities and services transferred between businesses or sold to end-users. In 2019, the boat repairs market in North America was the biggest. During the projection period, Asia-Pacific is predicted to increase quickly. In the marine sector, robots are utilized for various tasks, ranging from cleaning and maintenance to full-fledged driverless ships, to eliminate human danger and improve process efficiency. The Hull BUG, for example, is a little robot that adheres to a vessel’s underbelly to clean the surface. According to estimations from Sea Robotics, a 5% increase in fuel efficiency from routine cleanings saves $15 billion per year in fuel expenses and lowers 1 billion tons of greenhouse gas emissions. Green and environmentally beneficial advantages are envisaged from robots. As a result, sophisticated robotics impacting marine operations is a critical development in the maritime sector.

While working on the industry analysis section of the Marine Repair business plan make sure that you add significant number of stats to support your claims and use proper referencing so that your lender can validate the data.

The market for recreational boats is expected to grow in response to rising demand. Boating for pleasure is a common pastime all around the world. Water skiing, fishing, and touring are all popular leisure boating activities. According to National Marine Manufacturers Association (NMMA), 15.8 million registered boats were in the United States in 2018. The recreational boating sector in the United States grew for the seventh year in a row in 2018, with new powerboat retail unit sales reaching 280,000 units, the highest level since 2007. In 2019, sales increased by around 3% to 4%. The growing popularity of recreational boating is expected to boost demand for boat repairs.

In 2021, the market for ship repair and maintenance services will expand by 5.9% year over year (YoY), reaching a value of roughly US$ 23.6 billion. The market will rise robustly because of the increased demand for passenger ships and ferries. Ship maintenance and repair services are expected to grow at a 6.5 percent compound annual growth rate (CAGR) until 2031, with a market value of roughly $44.3 billion. The ship repairs and maintenance services market benefits from increased import and export activity via marine routes. Approximately 90% of the world’s exported and imported products were transported by ships, according to FMI.

For many items, such as petroleum and coal, which are needed in large quantities, the sea route remains the best mode of shipment. Transporting large commodities across nations and continents uses heavy tankers and ships. Because these water containers are prone to corrosion and malfunction, they often need repairs. Increased marine tourism and numerous government programs will bolster the maritime sector. The ship maintenance and repair services market will continue to benefit from this during the projected period.

Bulk carriers have a substantial market share in ship repair and maintenance. In emerging nations like India, Brazil, and Mexico, demand for bulk carriers is quite strong. They carry bulk goods such as coal, oil, ores, and cement on a vast scale. According to FMI, the North American market would increase at a CAGR of 4.1 percent during the projection period, while South Asia and the Pacific will provide an additional $ potential of US$ 9.6 billion between 2021 and 2031. Growing marine transit increased ship construction, and leading ship repair and maintenance industries contribute to these areas’ rapid development.

Marketing Plan

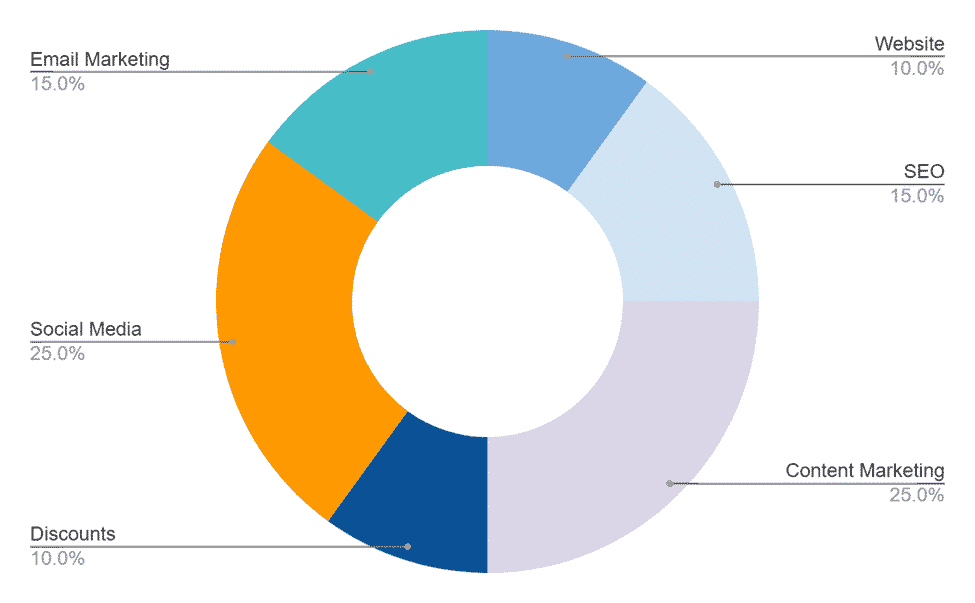

Website: Marine Plus, LLC’s website has well-organized content with a straightforward menu for searchers to understand easily.

SEO (Search Engine Optimization): Marine Plus, LLC aims to be at the top rank when client types on a search bar.SEO (Search Engne Optimization) Marine Plus, LLC aims to be at the top rank when client types on a search bar.

Content Marketing: Marine Plus, LLC uploads a blog on Youtube while doing marine repairs to let the viewers see the actual services we can offer.

Discounts: Create a scheme for Marine Plus, LLC’s frequent customers to get a deal if they successfully recommend another client

Social Media: Marine Plus, LLC builds trust with potential clients by being active on social media.

Email Marketing: We builds a list of subscriber and send them emails with information about the services offered by Marine Plus, LLC.

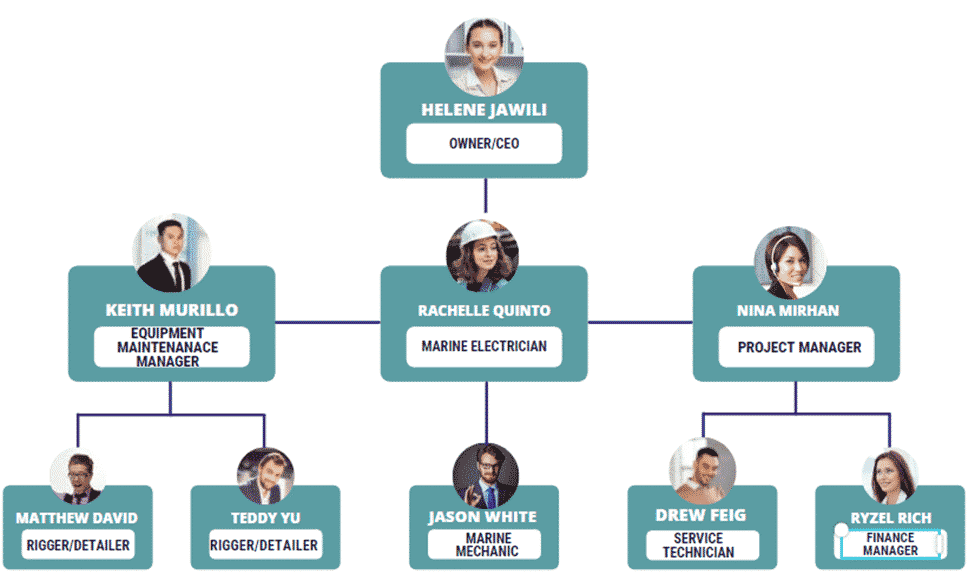

Organogram

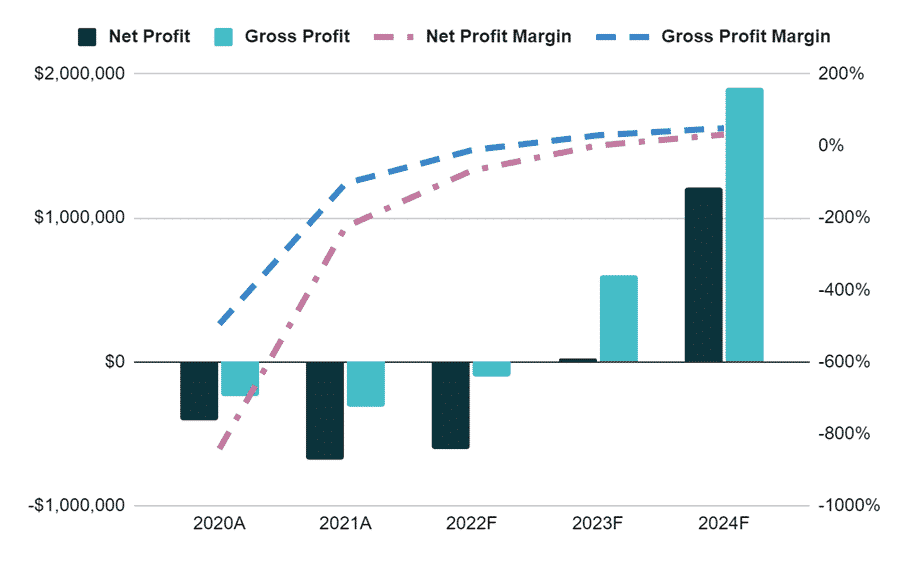

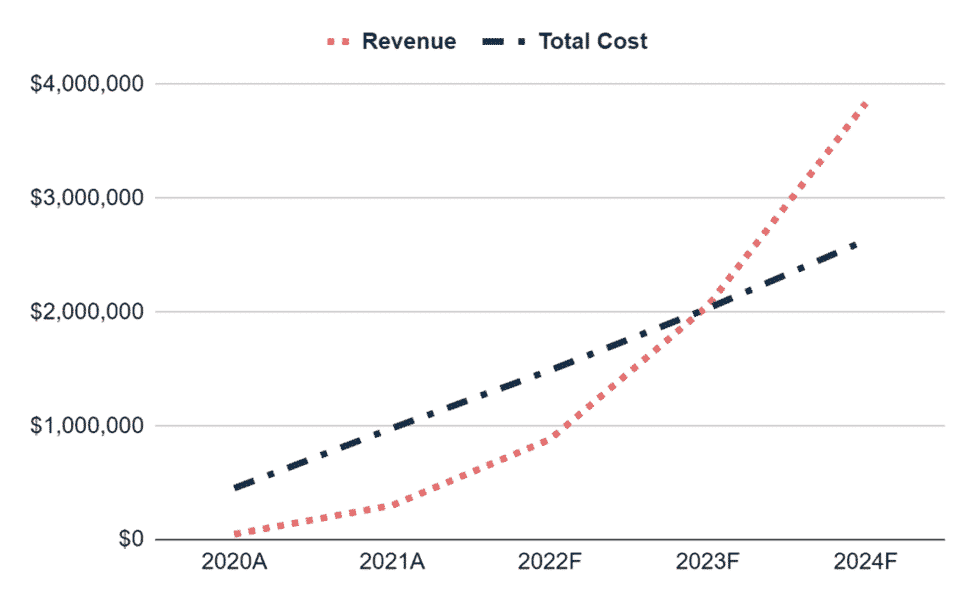

Financial Plan

Earnings:

Break-Even Analysis:

Income Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| Total Cost of Revenue | 285,560 | 615,220 | 987,794 | 1,455,612 | 1,935,625 |

| as % of revenue | 595% | 204% | 112% | 71% | 50% |

| Gross Profit | -237,575 | -313,984 | -105,583 | 601,578 | 1,902,218 |

| SELLING & ADMIN EXPENSES | |||||

| Item 1 | 28,000 | 96,800 | 154,880 | 175,692 | 193,261 |

| Item 2 | 75,000 | 105,000 | 120,000 | 120,000 | 120,000 |

| Item 3 | 36,000 | 96,000 | 108,000 | 120,000 | 120,000 |

| Item 4 | 8,000 | 12,000 | 12,000 | 12,000 | 12,000 |

| Item 5 | 3,839 | 18,074 | 44,111 | 61,716 | 115,135 |

| Item 6 | 3,359 | 12,049 | 26,466 | 41,144 | 76,757 |

| Item 7 | 5,600 | 10,000 | 12,904 | 15,034 | 17,376 |

| Item 8 | 6,667 | 14,000 | 22,067 | 30,940 | 40,701 |

| Total selling & admin expenses | 166,464 | 363,924 | 500,428 | 576,525 | 695,230 |

| as % of revenue | 347% | 121% | 57% | 28% | 18% |

| Net profit | -404,039 | -677,907 | -606,011 | 25,052 | 1,206,987 |

| Accumulated net profit | -404,039 | -1,081,947 | -1,687,957 | -1,662,905 | -455,918 |

Cash Flow Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| CASH FLOW from OPERATING ACTIVITIES | |||||

| Net profit before tax | -$404,039 | -$677,907 | -$606,011 | $25,052 | $1,206,987 |

| Depreciation | $44,267 | $85,333 | $120,504 | $158,127 | $199,512 |

| Payables | |||||

| Item 1 | $4,333 | $5,417 | $6,500 | $7,583 | $8,667 |

| Item 2 | $11,667 | $28,000 | $46,667 | $70,000 | $93,333 |

| Item 3 | $6,250 | $8,750 | $10,000 | $10,000 | $10,000 |

| Item 4 | $3,000 | $8,000 | $9,000 | $10,000 | $10,000 |

| Item 5 | $667 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| change in payables | $25,917 | $25,250 | $22,000 | $25,417 | $24,417 |

| Receivables | |||||

| Item 1 | $320 | $1,506 | $3,676 | $5,143 | $9,595 |

| Item 2 | $360 | $1,807 | $4,411 | $8,229 | $11,514 |

| Total receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| change in receivables | -$680 | -$2,634 | -$4,773 | -$5,285 | -$7,736 |

| Net cash flow from operating activities | -$334,536 | -$569,958 | -$468,280 | $203,311 | $1,423,180 |

| CASH FLOW from INVESTING ACTIVITIES | |||||

| Item 1 | $16,000 | $13,200 | $14,520 | $15,972 | $17,569 |

| Item 2 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Item 3 | $28,000 | $22,000 | $14,520 | $10,648 | $11,713 |

| Item 4 | $96,000 | $88,000 | $72,600 | $79,860 | $87,846 |

| Item 5 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Net cash flow/ (outflow) from investing activities | -$180,000 | -$167,200 | -$150,040 | -$159,720 | -$175,692 |

| CASH FLOW from FINANCING ACTIVITIES | |||||

| Equity | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net cash flow from financing activities | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net (decrease)/ increase in cash/ cash equivalents | -$114,536 | -$297,158 | -$134,320 | $575,991 | $1,833,128 |

| Cash and cash equivalents at the beginning of the year | – | -$114,536 | -$411,693 | -$546,014 | $29,978 |

| Cash & cash equivalents at the end of the year | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

Balance Sheet:

Balance Sheet:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| NON-CURRENT ASSETS | |||||

| Item 1 | $16,000 | $29,200 | $43,720 | $59,692 | $77,261 |

| Item 2 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Item 3 | $28,000 | $50,000 | $64,520 | $75,168 | $86,881 |

| Item 4 | $96,000 | $184,000 | $256,600 | $336,460 | $424,306 |

| Item 5 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Total | $180,000 | $347,200 | $497,240 | $656,960 | $832,652 |

| Accumulated depreciation | $44,267 | $129,600 | $250,104 | $408,231 | $607,743 |

| Net non-current assets | $135,733 | $217,600 | $247,136 | $248,729 | $224,909 |

| CURRENT ASSETS | |||||

| Cash | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

| Accounts receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| Total current assets | -$113,856 | -$408,380 | -$537,927 | $43,349 | $1,884,214 |

| Total Assets | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

| LIABILITIES | |||||

| Account payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| Total liabilities | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| EQUITIES | |||||

| Owner’s equity | $400,000 | $840,000 | $1,324,000 | $1,856,400 | $2,442,040 |

| Accumulated net profit | -$404,039 | -$1,081,947 | -$1,687,957 | -$1,662,905 | -$455,918 |

| Total equities | -$4,039 | -$241,947 | -$363,957 | $193,495 | $1,986,122 |

| Total liabilities & equities | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |