Written by Elma Steven | Updated on January, 2024

Executive Summary

Overview: Ladies Only Fitness caters to the busy metropolitan professional lady who has limited time to exercise. We also cater to young moms in need of a fitness atmosphere that caters to their specific requirements. The atmosphere that is developed in the facility gives Ladies Only Fitness a competitive edge. In a program that is entirely focused on women, women feel calmer and at ease. Furthermore, the childcare facility has been constructed to be visible from the main training floor. While working out, a young mother can keep an eye on her youngster in the center.

Mission:” Ladies Only Fitness will cater to people of all ages and genders. Fitness equipment, workout sessions, personal training programs, yoga, and nutrition will all be available.”

Vision: “Ladies Only Fitness will become the leading fitness establishment by only offering the highest-quality backed by superior services.”

Industry Overview:

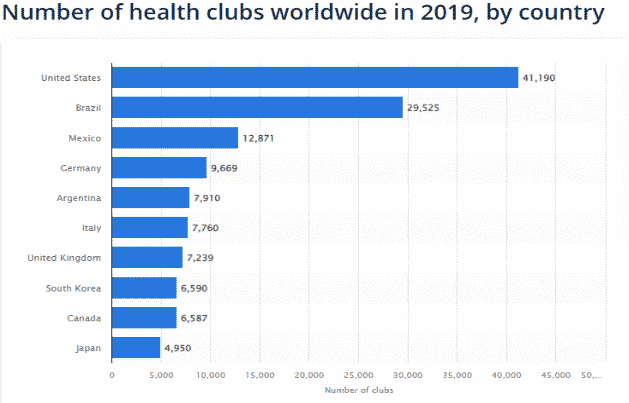

The worldwide fitness club industry is estimated to be worth $87 billion. There are over 200,000 health and fitness clubs worldwide. The United States, Germany, and the United Kingdom are the countries with the most fitness club memberships. All studies concur that hiring a personal trainer leads to better outcomes in all fitness categories, regardless of user discipline. The top fitness trends for 2019 include activity trackers, HIIT, group training, fitness programs for seniors, and bodyweight training. (calisthenics).

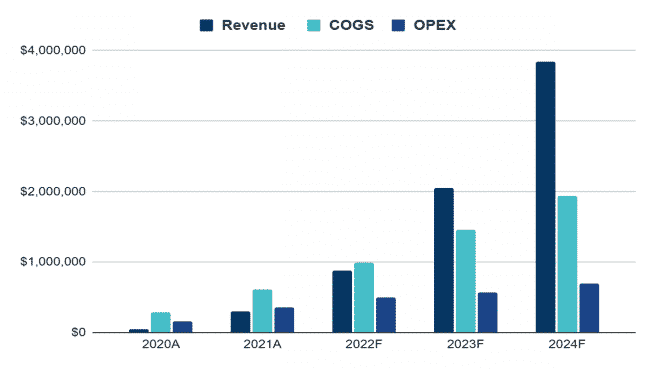

Financial Overview:

Financial Highlights:

| Liquidity | 2020A | 2021A | 2022F | 2023F | 2024F |

| Current ratio | 6 | 12 | 23 | 32 | 42 |

| Quick ratio | 6 | 11 | 22 | 31 | 40 |

| DSO | 8 | 8 | 8 | 8 | 8 |

| Solvency | |||||

| Interest coverage ratio | 8.2 | 11.1 | 14.2 | ||

| Debt to asset ratio | 0.01 | 0.01 | 0.2 | 0.18 | 0.16 |

| Profitability | |||||

| Gross profit margin | 51% | 51% | 53% | 53% | 53% |

| EBITDA margin | 12% | 14% | 21% | 22% | 22% |

| Return on asset | 5% | 6% | 13% | 14% | 14% |

| Return on equity | 5% | 6% | 16% | 17% | 17% |

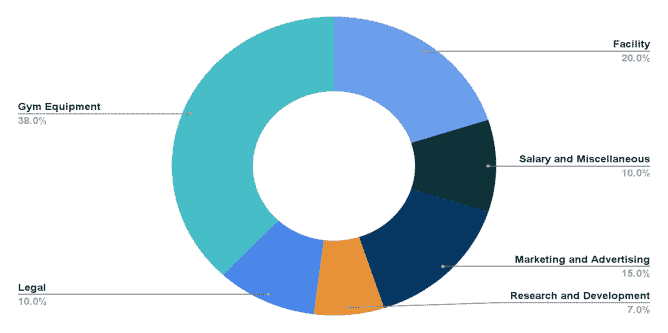

Fund Usage:

Industry Analysis:

Overview: The number of health club memberships has increased over time, indicating that more people consider fitness to be an important part of their overall health plan. In addition, population expansion has boosted demand for health club subscriptions, particularly among those aged 20 to 64, who make up the largest gym-going cohort. Annual revenue has increased from $2.4 billion to $2.6 billion over the last five years on a national level. In the first three months of the year, demand for health club memberships is often the highest. For example, according to estimates, 30.0 percent of all new members joined their gym or fitness club in the first few months of the year, owing to New Year’s resolutions, which may motivate customers to adopt healthier lifestyles. Many gyms have provided discounts and monthly subscriptions to increase the number of new memberships during other months, but January continues to account for the majority of membership purchases. With this in mind, the Company plans to begin operations. After home exercise equipment, health clubs are the second most popular market for fitness equipment (of a lower grade and price point relative to commercial equipment). Between 1997 and 1999, the number of persons who joined a health club increased by 76 percent, or 30.6 million.

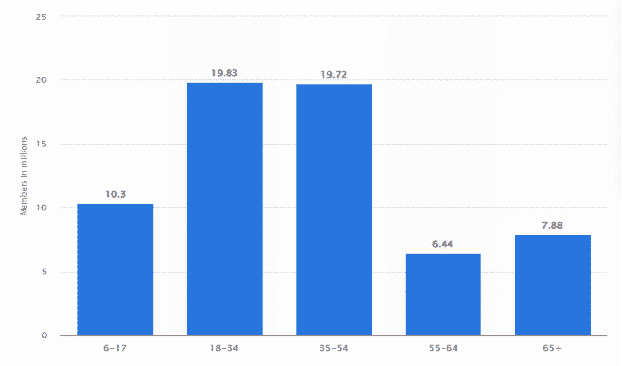

Health clubs have seen a shift in their client demographics, in addition to large membership rises.

There are major demographic shifts. Fitness clubs used to be largely occupied by bodybuilders between the ages of 18 and 34. Americans are increasingly making the cognitive link between fitness and health as a result of their paradigm shift. As a result, fitness club memberships are held by a far larger percentage of the population. This is demonstrated by the significant increase in club membership among over 55-year-olds, who are instinctively more concerned with general health than with fitness and strength.

Market Segmentation:

Fitness equipment is sold through wholesalers or directly from the manufacturer or importer in the United States. Distributors account for the vast majority of sales. The vast number of distributors in the United States is because distributors normally carry one (or two) vendors for each type of equipment (strength, cardiovascular, and so on). Typically, manufacturers will provide each distributor an

exclusive geographic region to sell their products in.

Large corporations (fitness clubs, franchises, corporations, etc.) with substantial purchasing power can typically buy directly from the manufacturer, bypassing the distributor layer of the distribution route. Circuit Fitness Importing’s target clients will include both wholesalers and end-users.

| Market Analysis | |||||||

| Potential Customers | Growth | CAGR | |||||

| Distributors | 3% | 1,200 | 1,236 | 1,273 | 1,311 | 1,350 | 2.99% |

| Health clubs | 5% | 12,545 | 13,172 | 13,831 | 14,523 | 15,249 | 5.00% |

| Vertical markets | 6% | 30,000 | 31,800 | 33,708 | 35,730 | 37,874 | 6.00% |

| Total | 5.64% | 43,745 | 46,208 | 48,812 | 51,564 | 54,473 | 5.64% |

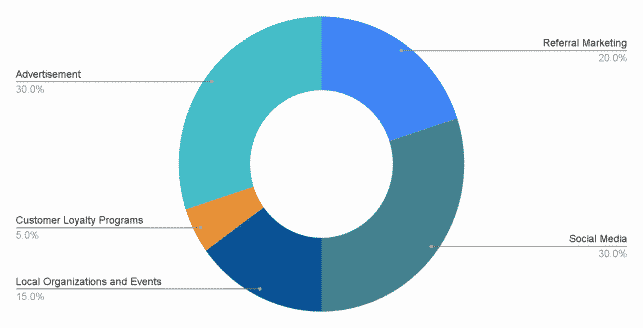

Marketing Plan:

Social Media : To advertise our business, we should use the internet and social media platforms such as Instagram, Facebook, Twitter, YouTube, Google+, and others.

List Circuit Workout in local phone books and directories.

Advertise Circuit Workout on our official website and use marketing methods to

drive visitors to it. Advertise our company in Health magazines and on the internet.

Local Organization and Events: Circuit Workout will promote itself by distributing marketing materials and participating in local community events, such as school fairs, local festivals, homeowner associations, or sporting events.

Commute Advertising: By employing individuals to display signs alongside [route or highway], we will draw attention to Company Workout. We can reach a significant number of working people with disposable income by advertising on heavily frequented commute routes.

Referral Marketing: Encourage people to use word-of-mouth marketing (referrals), Participate in direct marketing.

Customer Loyalty Program: Workout in Circuits. will develop a successful customer loyalty program to keep its most loyal customers coming back for more. When our pros and other personnel are not actively offering services to consumers in the Gym, they will make occasional, routine phone calls to customers. These phone calls will (a) ensure that consumers are satisfied with their memberships/services, and (b) remind them that they may desire a new class or session after a particular period has elapsed. Customers who have been with the company for a long time will be eligible for the loyalty program, and referrals will be recognized as well.

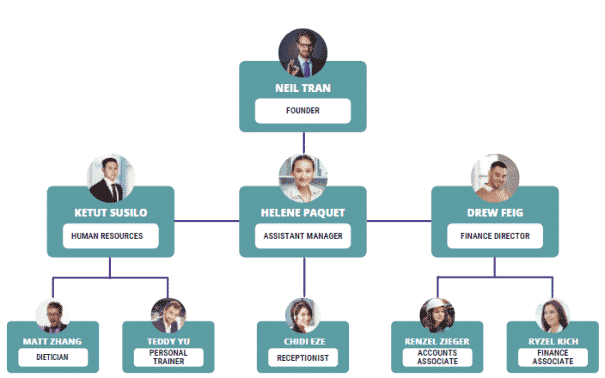

Organogram:

Financial Plan:

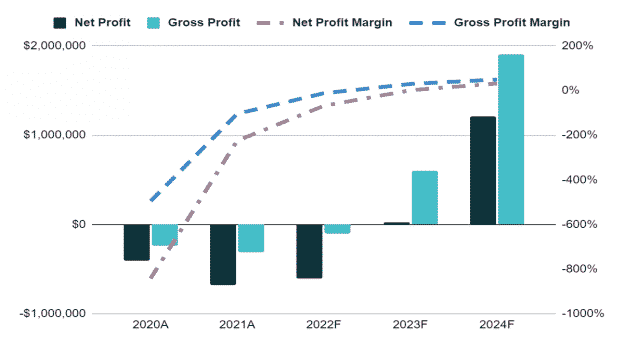

Earnings:

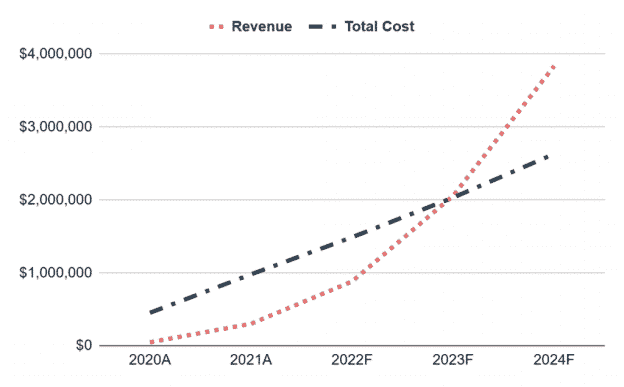

Break-Even Analysis :

Income Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| Total Cost of Revenue | 285,560 | 615,220 | 987,794 | 1,455,612 | 1,935,625 |

| as % of revenue | 595% | 204% | 112% | 71% | 50% |

| Gross Profit | -237,575 | -313,984 | -105,583 | 601,578 | 1,902,218 |

| SELLING & ADMIN EXPENSES | |||||

| Item 1 | 28,000 | 96,800 | 154,880 | 175,692 | 193,261 |

| Item 2 | 75,000 | 105,000 | 120,000 | 120,000 | 120,000 |

| Item 3 | 36,000 | 96,000 | 108,000 | 120,000 | 120,000 |

| Item 4 | 8,000 | 12,000 | 12,000 | 12,000 | 12,000 |

| Item 5 | 3,839 | 18,074 | 44,111 | 61,716 | 115,135 |

| Item 6 | 3,359 | 12,049 | 26,466 | 41,144 | 76,757 |

| Item 7 | 5,600 | 10,000 | 12,904 | 15,034 | 17,376 |

| Item 8 | 6,667 | 14,000 | 22,067 | 30,940 | 40,701 |

| Total selling & admin expenses | 166,464 | 363,924 | 500,428 | 576,525 | 695,230 |

| as % of revenue | 347% | 121% | 57% | 28% | 18% |

| Net profit | -404,039 | -677,907 | -606,011 | 25,052 | 1,206,987 |

| Accumulated net profit | -404,039 | -1,081,947 | -1,687,957 | -1,662,905 | -455,918 |

Cash Flow Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| CASH FLOW from OPERATING ACTIVITIES | |||||

| Net profit before tax | -$404,039 | -$677,907 | -$606,011 | $25,052 | $1,206,987 |

| Depreciation | $44,267 | $85,333 | $120,504 | $158,127 | $199,512 |

| Payables | |||||

| Item 1 | $4,333 | $5,417 | $6,500 | $7,583 | $8,667 |

| Item 2 | $11,667 | $28,000 | $46,667 | $70,000 | $93,333 |

| Item 3 | $6,250 | $8,750 | $10,000 | $10,000 | $10,000 |

| Item 4 | $3,000 | $8,000 | $9,000 | $10,000 | $10,000 |

| Item 5 | $667 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| change in payables | $25,917 | $25,250 | $22,000 | $25,417 | $24,417 |

| Receivables | |||||

| Item 1 | $320 | $1,506 | $3,676 | $5,143 | $9,595 |

| Item 2 | $360 | $1,807 | $4,411 | $8,229 | $11,514 |

| Total receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| change in receivables | -$680 | -$2,634 | -$4,773 | -$5,285 | -$7,736 |

| Net cash flow from operating activities | -$334,536 | -$569,958 | -$468,280 | $203,311 | $1,423,180 |

| CASH FLOW from INVESTING ACTIVITIES | |||||

| Item 1 | $16,000 | $13,200 | $14,520 | $15,972 | $17,569 |

| Item 2 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Item 3 | $28,000 | $22,000 | $14,520 | $10,648 | $11,713 |

| Item 4 | $96,000 | $88,000 | $72,600 | $79,860 | $87,846 |

| Item 5 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Net cash flow/ (outflow) from investing activities | -$180,000 | -$167,200 | -$150,040 | -$159,720 | -$175,692 |

| CASH FLOW from FINANCING ACTIVITIES | |||||

| Equity | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net cash flow from financing activities | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net (decrease)/ increase in cash/ cash equivalents | -$114,536 | -$297,158 | -$134,320 | $575,991 | $1,833,128 |

| Cash and cash equivalents at the beginning of the year | – | -$114,536 | -$411,693 | -$546,014 | $29,978 |

| Cash & cash equivalents at the end of the year | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

Balance Sheet:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| NON-CURRENT ASSETS | |||||

| Item 1 | $16,000 | $29,200 | $43,720 | $59,692 | $77,261 |

| Item 2 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Item 3 | $28,000 | $50,000 | $64,520 | $75,168 | $86,881 |

| Item 4 | $96,000 | $184,000 | $256,600 | $336,460 | $424,306 |

| Item 5 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Total | $180,000 | $347,200 | $497,240 | $656,960 | $832,652 |

| Accumulated depreciation | $44,267 | $129,600 | $250,104 | $408,231 | $607,743 |

| Net non-current assets | $135,733 | $217,600 | $247,136 | $248,729 | $224,909 |

| CURRENT ASSETS | |||||

| Cash | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

| Accounts receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| Total current assets | -$113,856 | -$408,380 | -$537,927 | $43,349 | $1,884,214 |

| Total Assets | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

| LIABILITIES | |||||

| Account payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| Total liabilities | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| EQUITIES | |||||

| Owner’s equity | $400,000 | $840,000 | $1,324,000 | $1,856,400 | $2,442,040 |

| Accumulated net profit | -$404,039 | -$1,081,947 | -$1,687,957 | -$1,662,905 | -$455,918 |

| Total equities | -$4,039 | -$241,947 | -$363,957 | $193,495 | $1,986,122 |

| Total liabilities & equities | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |