Written by Elma Steven | Updated on June, 2024

Table of Contents

Executive Summary

Overview: PARQ San Diego has gathered together industry leaders from the restaurant and nightclub sectors to provide you with an unrivaled nightlife experience on 6th and Broadway in San Diego’s Gaslamp area. We have developed the ultimate adventure with the newest technology and innovations in entertainment, from the restaurant and VIP services to sound, lighting, and design.

Mission: PARQ San Diego is dedicated to providing high-quality goods and services to its clients and consumers. It is attentive to and responsive to the demands of its clients and customers, and it is committed to their complete satisfaction.

Vision: Our vision is to provide a variety of musical genres to the residents of San Diego. We’ll be attempting to gratify a wide range of people by bringing to San Diego what you’d expect from a world-class club or restaurant.

Industry Overview: In 2022, the Bars & Nightclubs sector will have a market size of $28.6 billion dollars in sales. In 2022, the market for bars and nightclubs is predicted to grow by 14.1%. Between 2017 and 2022, the US Bars & Nightclubs market grew at an average annual rate of 0.9 percent. In the United States, the market size of the Bars and Nightclubs business increased at a slower rate than the entire economy. The Bars & Nightclubs business grew faster than the broader Accommodation and Food Services industry in the United States. The US Bars & Nightclubs sector is the 326th biggest and 9th most significant market size within the Accommodation and Food Services industries.

Check out this guide on how to write an executive summary? If you don’t have the time to write on then you can use this custom Executive Summary Writer to save Hrs. of your precious time.

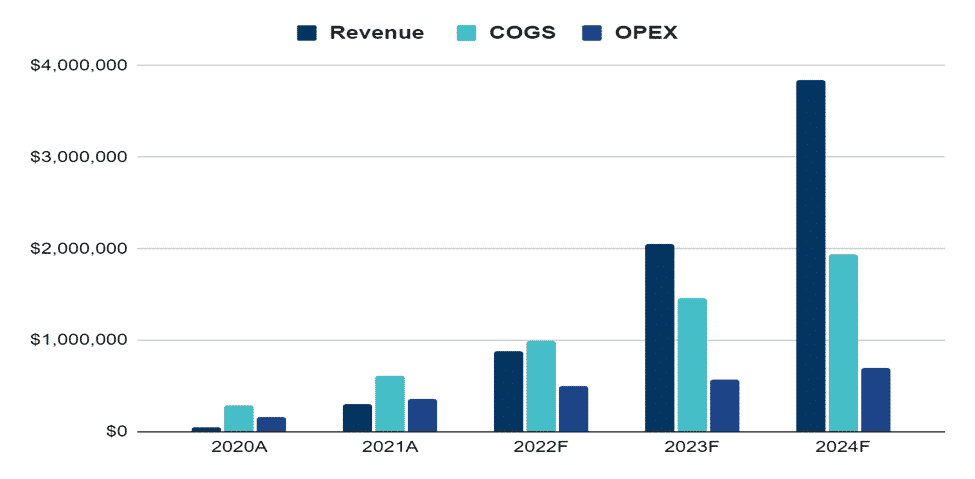

Financial Overview:

Financial Highlights:

| Liquidity | 2020A | 2021A | 2022F | 2023F | 2024F |

| Current ratio | 6 | 12 | 23 | 32 | 42 |

| Quick ratio | 6 | 11 | 22 | 31 | 40 |

| DSO | 8 | 8 | 8 | 8 | 8 |

| Solvency | |||||

| Interest coverage ratio | 8.2 | 11.1 | 14.2 | ||

| Debt to asset ratio | 0.01 | 0.01 | 0.2 | 0.18 | 0.16 |

| Profitability | |||||

| Gross profit margin | 51% | 51% | 53% | 53% | 53% |

| EBITDA margin | 12% | 14% | 21% | 22% | 22% |

| Return on asset | 5% | 6% | 13% | 14% | 14% |

| Return on equity | 5% | 6% | 16% | 17% | 17% |

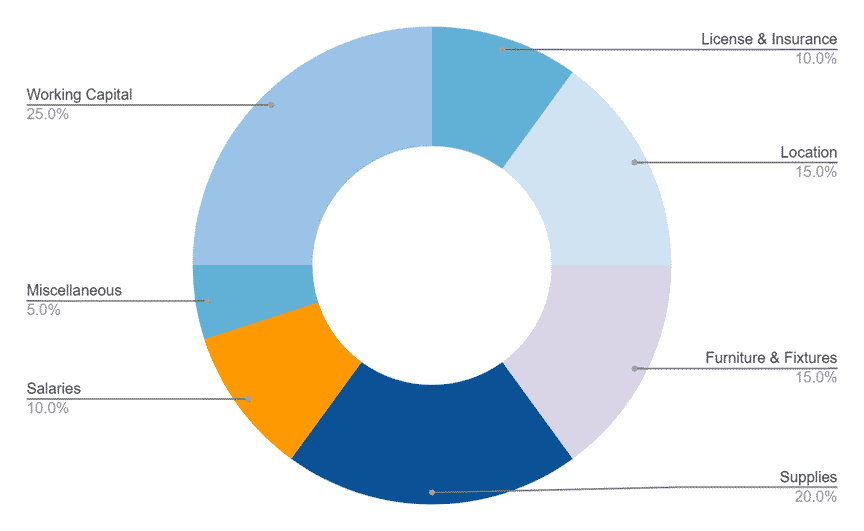

FUND USAGE

Business Model Canvas

Check out the 100 samples of business model canvas.

SWOT

Check out the 100 SWOT Samples

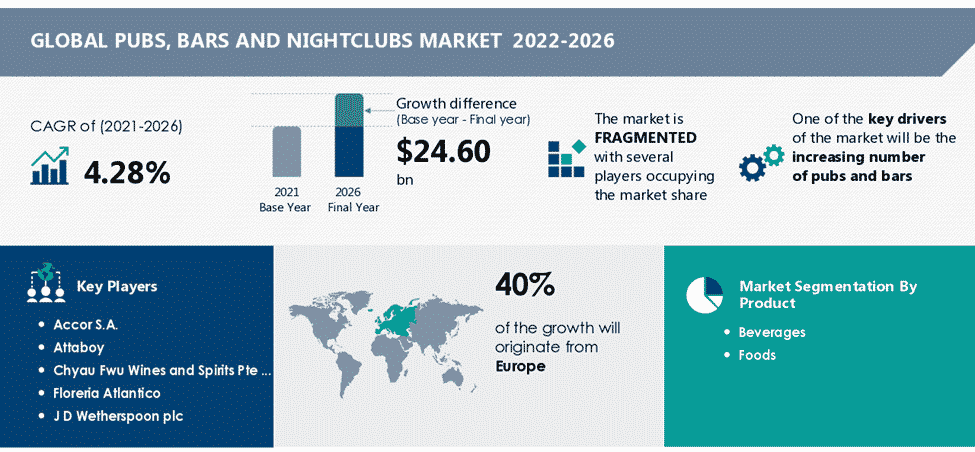

Industry Analysis

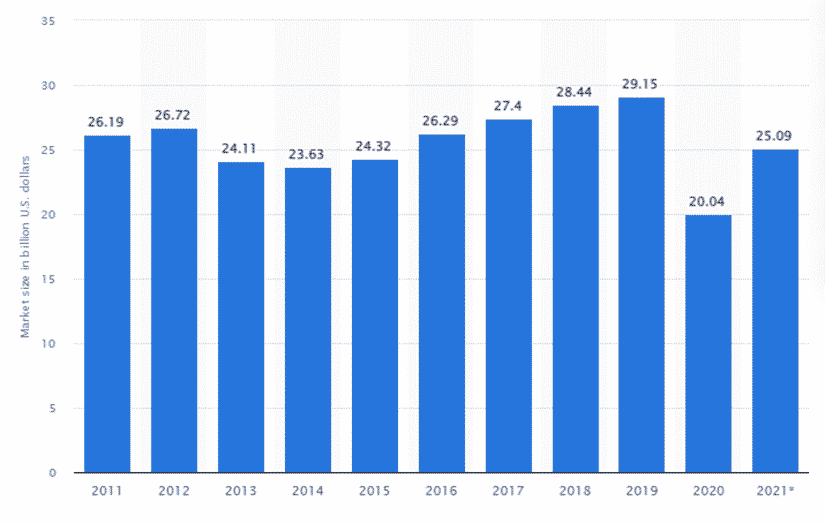

Despite small revenue losses in the first half of the five years, the Bars and Nightclubs business in the United States has grown during the last five years to 2018. Consumer confidence was fragile, and consumer habits shifted, leading more individuals to drink at home rather than at bars or nightclubs, resulting in these drops. Due to the improving domestic economy, industrial income increased in the second half. The industry is expected to compete with at-home alcohol use and non-industry locations that offer alcohol, such as restaurants, during the next five years, up until 2023. As the economy recovers and consumer spending rises, the industry’s financial performance will remain broadly stable. Bars will continue to add healthier unique goods to their menus, such as craft beer and organic cuisine, to cater to customers’ interests.

In most of the five years leading up to 2021, the Bars and Nightclubs business has grown. The COVID-19 (coronavirus) pandemic, however, halted this upward tendency. Despite the pandemic impacting almost every business, the larger hospitality industry, including pubs and nightclubs, was severely disrupted. Bars, taverns, pubs, lounges, nightclubs, and other drinking establishments that manufacture and serve alcoholic drinks for immediate consumption and offer limited food services make up the Bars and Nightclubs business. As a result, this business is mainly reliant on variables affecting the broader domestic economy and consumer drinking habits.

Source: ibisworld

While working on the industry analysis section make sure that you add significant number of stats to support your claims and use proper referencing so that your lender can validate the data.

Bars, taverns, pubs, lounges, nightclubs, and other drinking establishments that produce and serve alcoholic drinks for immediate consumption are included in this industry. There’s a chance that these places will also provide meals.

Customer Demographics for Bars and Nightclubs

The Bars & Nightclubs business produces around $26.6 billion in sales, with households accounting for 93.6 percent of the total. Markets are divided into age groups (from 25 to 65). The following is a list of the age demographic breakdown:

- Consumers aged 21 to 34 account for 22.9 percent of total sales in the business. They visit bars the most because they have more free time and fewer obligations than older age groups.

- Sales from the 35-44 age group account for 19.8% of total revenue in the sector. These clients have less free time to go to clubs, but they have started to establish themselves financially, spending more than their younger colleagues.

- Sales from consumers aged 45 to 54 account for 17.4% of total revenue in the sector. They may not visit bars as often as younger groups. Still, when they do, they tend to spend more, eating more costly and higher-quality meals or buying more expensive and higher-quality beverages since they are more established in their jobs.

- The 55-64 age group, which accounts for 17.4 percent of the population, maintains the pattern of older adults being more financially secure but less interested in going out to drink.

- The minor sector comprises 16 percent of those aged 65 and above. People over 65 do not stay out as late as their younger counterparts, preventing them from visiting numerous places.

The private sector (6.4 percent) contributes some money, such as when firms hire facilities for special events.

Market size of the bar and nightclub sector in the United States

from 2011 to 2020, with a forecast for 2021(in billion U.S. dollars)

Source: verifiedmarketresearch

In 2020, the market for bars and nightclubs in the United States was valued at $20.04 billion, down from $29.15 billion. In 2021, the market for this industry was expected to grow to $25.09 billion.

Bars and nightclubs are a vital part of the hospitality business in the United States, having a significant economic effect. This sector sells alcoholic drinks on the premises and may also provide modest food service. As various liquor regulations make running venues in numerous states or countries difficult, the market is dominated by tiny, single-location enterprises. World of Beer, McMenamins, and Winking Lizard Taverns are three of the biggest US-based bar chains. New York City and Las Vegas are home to the top-grossing nightclubs Marquee, Tao, and Lavo. About 36,000 locations (single-location corporations and parts of multi-location organizations) make up the US bar and nightclub sector, which generates about $22 billion in yearly sales.

A low growth risk score and per capita alcohol spending are the key favorable variables influencing this business. Attitudes about alcohol usage in general and the sort of alcohol drank and where it is drunk are shifting. The government is increasingly concerned about binge drinking, especially among the younger population. Regulatory restrictions on excessive alcohol use are becoming more severe for industry operators. Reduced alcohol intake and, as a result, expenditure negatively impact bar and nightclub demand. In 2021, per capita alcohol spending was predicted to rise, providing the business with a significant opportunity.

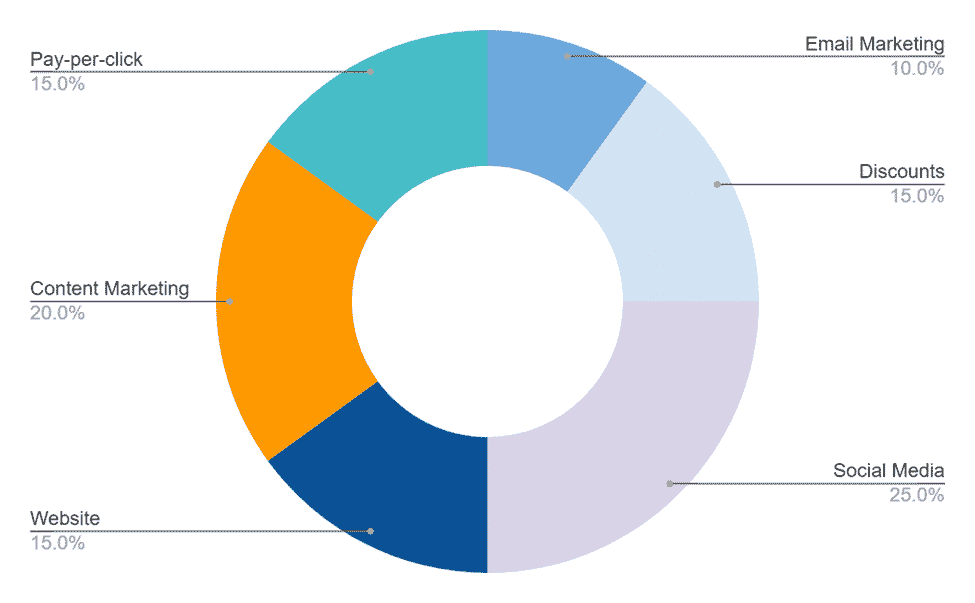

Marketing Plan

Email marketing: Email marketing is an approach to staying in touch with customers by sending them essential news and information personalized to their specific requirements.

Discounts: Create a member referral program for PARQ San Diego’s regular clients, in which members get a discount if they successfully suggest a friend.

Social media: PARQ San Diego uses social media channels such as Facebook, Instagram Stories, and Tiktok to communicate with its audience. These tools are gaining popularity.

Website: The PARQ San Diego website includes contact information, information about our services, and a quick appointment button.

Content marketing: One of the most effective strategies to create connections is to blog and provide insightful, helpful information on your PARQ San Diego website.

Pay-per-click (PPC) advertisements: Pay-per-click advertisements may put the PARQ San Diego website before individuals already seeking you.

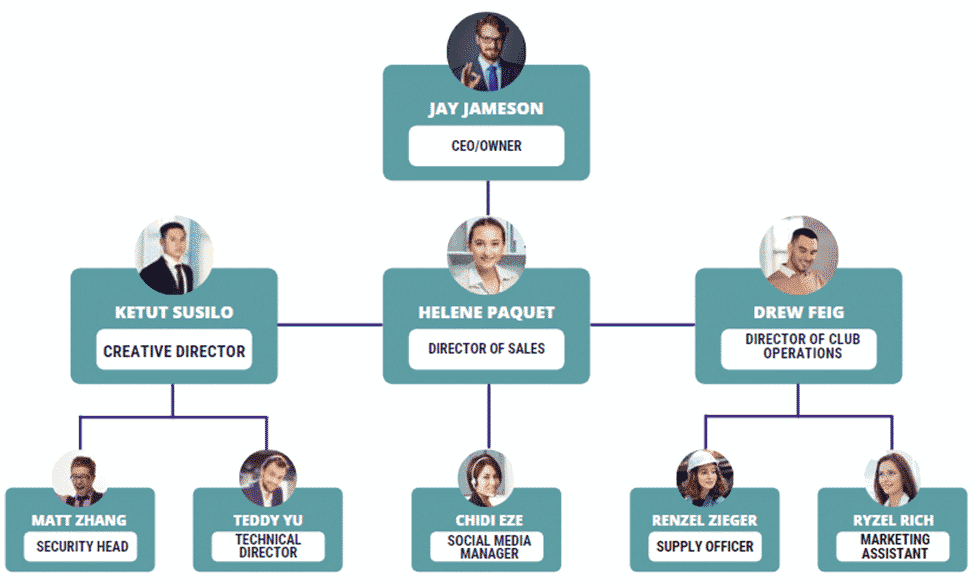

Organogram:

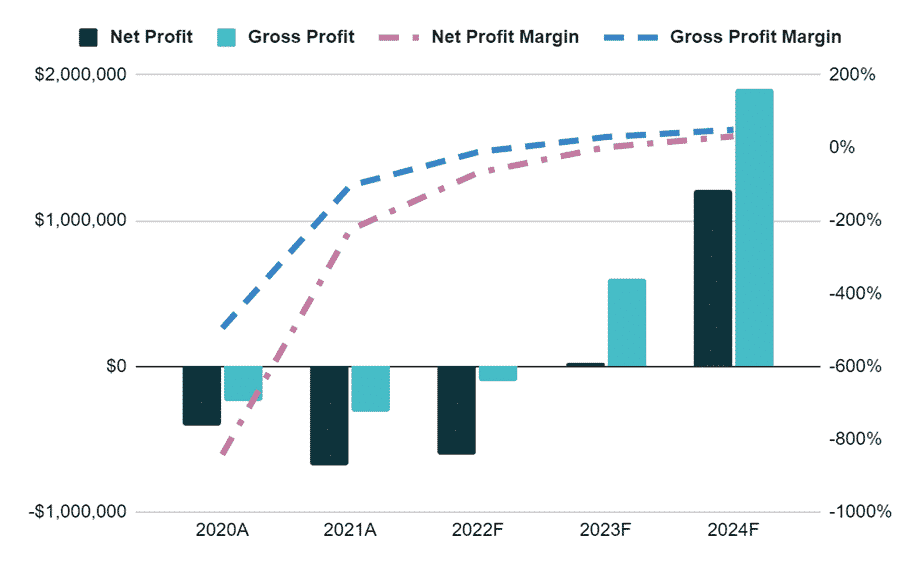

Financial Plan

This section of the Nightclub business plan helps your lender figure out whether you will be able to pay off the loan, whether the business is sustainable, what are the growth prospects, etc.

Earnings:

Break-Even Analysis:

Income Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

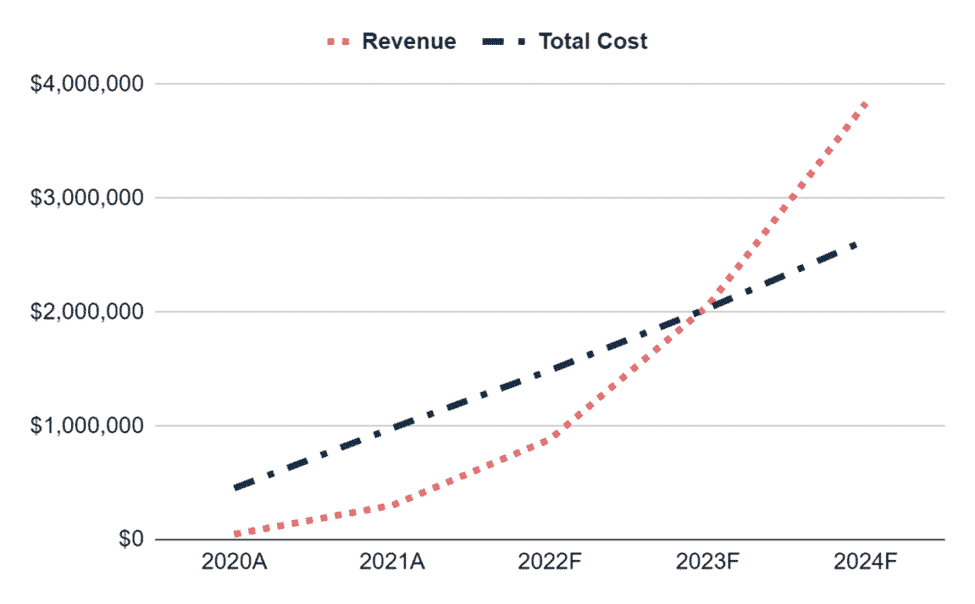

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| Total Cost of Revenue | 285,560 | 615,220 | 987,794 | 1,455,612 | 1,935,625 |

| as % of revenue | 595% | 204% | 112% | 71% | 50% |

| Gross Profit | -237,575 | -313,984 | -105,583 | 601,578 | 1,902,218 |

| SELLING & ADMIN EXPENSES | |||||

| Item 1 | 28,000 | 96,800 | 154,880 | 175,692 | 193,261 |

| Item 2 | 75,000 | 105,000 | 120,000 | 120,000 | 120,000 |

| Item 3 | 36,000 | 96,000 | 108,000 | 120,000 | 120,000 |

| Item 4 | 8,000 | 12,000 | 12,000 | 12,000 | 12,000 |

| Item 5 | 3,839 | 18,074 | 44,111 | 61,716 | 115,135 |

| Item 6 | 3,359 | 12,049 | 26,466 | 41,144 | 76,757 |

| Item 7 | 5,600 | 10,000 | 12,904 | 15,034 | 17,376 |

| Item 8 | 6,667 | 14,000 | 22,067 | 30,940 | 40,701 |

| Total selling & admin expenses | 166,464 | 363,924 | 500,428 | 576,525 | 695,230 |

| as % of revenue | 347% | 121% | 57% | 28% | 18% |

| Net profit | -404,039 | -677,907 | -606,011 | 25,052 | 1,206,987 |

| Accumulated net profit | -404,039 | -1,081,947 | -1,687,957 | -1,662,905 | -455,918 |

Cash Flow Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| CASH FLOW from OPERATING ACTIVITIES | |||||

| Net profit before tax | -$404,039 | -$677,907 | -$606,011 | $25,052 | $1,206,987 |

| Depreciation | $44,267 | $85,333 | $120,504 | $158,127 | $199,512 |

| Payables | |||||

| Item 1 | $4,333 | $5,417 | $6,500 | $7,583 | $8,667 |

| Item 2 | $11,667 | $28,000 | $46,667 | $70,000 | $93,333 |

| Item 3 | $6,250 | $8,750 | $10,000 | $10,000 | $10,000 |

| Item 4 | $3,000 | $8,000 | $9,000 | $10,000 | $10,000 |

| Item 5 | $667 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| change in payables | $25,917 | $25,250 | $22,000 | $25,417 | $24,417 |

| Receivables | |||||

| Item 1 | $320 | $1,506 | $3,676 | $5,143 | $9,595 |

| Item 2 | $360 | $1,807 | $4,411 | $8,229 | $11,514 |

| Total receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| change in receivables | -$680 | -$2,634 | -$4,773 | -$5,285 | -$7,736 |

| Net cash flow from operating activities | -$334,536 | -$569,958 | -$468,280 | $203,311 | $1,423,180 |

| CASH FLOW from INVESTING ACTIVITIES | |||||

| Item 1 | $16,000 | $13,200 | $14,520 | $15,972 | $17,569 |

| Item 2 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Item 3 | $28,000 | $22,000 | $14,520 | $10,648 | $11,713 |

| Item 4 | $96,000 | $88,000 | $72,600 | $79,860 | $87,846 |

| Item 5 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Net cash flow/ (outflow) from investing activities | -$180,000 | -$167,200 | -$150,040 | -$159,720 | -$175,692 |

| CASH FLOW from FINANCING ACTIVITIES | |||||

| Equity | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net cash flow from financing activities | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net (decrease)/ increase in cash/ cash equivalents | -$114,536 | -$297,158 | -$134,320 | $575,991 | $1,833,128 |

| Cash and cash equivalents at the beginning of the year | – | -$114,536 | -$411,693 | -$546,014 | $29,978 |

| Cash & cash equivalents at the end of the year | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

Balance Sheet:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| NON-CURRENT ASSETS | |||||

| Item 1 | $16,000 | $29,200 | $43,720 | $59,692 | $77,261 |

| Item 2 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Item 3 | $28,000 | $50,000 | $64,520 | $75,168 | $86,881 |

| Item 4 | $96,000 | $184,000 | $256,600 | $336,460 | $424,306 |

| Item 5 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Total | $180,000 | $347,200 | $497,240 | $656,960 | $832,652 |

| Accumulated depreciation | $44,267 | $129,600 | $250,104 | $408,231 | $607,743 |

| Net non-current assets | $135,733 | $217,600 | $247,136 | $248,729 | $224,909 |

| CURRENT ASSETS | |||||

| Cash | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

| Accounts receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| Total current assets | -$113,856 | -$408,380 | -$537,927 | $43,349 | $1,884,214 |

| Total Assets | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

| LIABILITIES | |||||

| Account payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| Total liabilities | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| EQUITIES | |||||

| Owner’s equity | $400,000 | $840,000 | $1,324,000 | $1,856,400 | $2,442,040 |

| Accumulated net profit | -$404,039 | -$1,081,947 | -$1,687,957 | -$1,662,905 | -$455,918 |

| Total equities | -$4,039 | -$241,947 | -$363,957 | $193,495 | $1,986,122 |

| Total liabilities & equities | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

Related Articles on Business Plan: