Written by Elma Steven | Updated on July, 2024

How to Write a Laundromat Business Plan?

Laundromat Business Plan is an outline of your overall laundromat business. The business plan should include a 5 year financial projection, marketing plan, industry analysis, organizational overview, operational overview and finally an executive summary. Remember to write your executive summary at the end as it is considered as a snapshot of the overall business plan. You need to be careful while writing the plan as you need to consider various factors that can impact the business’s success.

Table of Contents

Executive Summary

Overview: Chris Johnson is the founder of Sparkling Threads Laundry Lounge. We offer self-service laundry solutions in a contemporary and simple way and the business is located at New York. Our primary offerings include self service laundry, dry cleaning, wash & fold and ironing services. Our goal is to make doing laundry a pleasant and easy experience for families and individuals. Our laundromat is committed to providing a dependable and stress-free washing service and we are targeting both commercial and retail consumers.

Mission: Our goal is to make doing laundry a breeze for our valued clients. Through the use of cutting-edge technology, utmost tidiness and stellar service we promise to provide our customers with an unforgettable experience.

Vision: Sparkling Threads Laundry Lounge’s vision is to change the way people think about laundromats by offering first-rate service, spotless facilities and cutting-edge technology.

Industry Overview:

Rising urbanization, disposable incomes and consumer preferences are projected to propel the worldwide laundry service industry to new heights in the years to come. The worldwide market for laundry services is expected to reach $331.3 billion by 2025 expanding at a CAGR of 5.6% according to a recent analysis.

Check out this guide on how to write an executive summary? If you don’t have the time to write on then you can use this custom Executive Summary Writer to save Hrs. of your precious time.

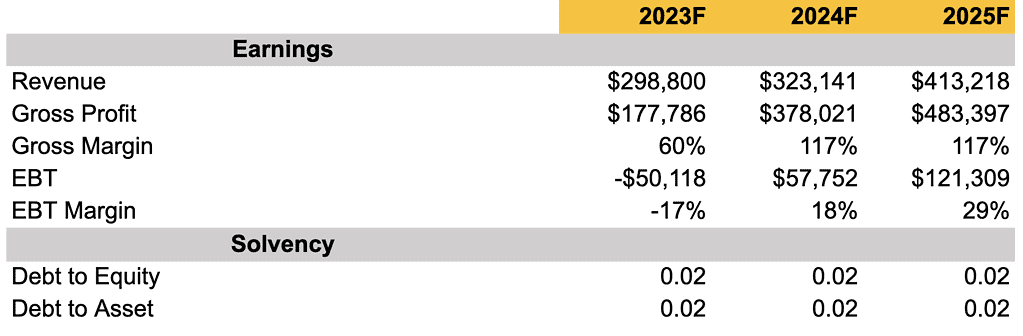

Financial Overview:

Business Description

Business Name: Sparkling Threads Laundry Lounge

Founder: Chris Johnson

Management Team:

Legal Structure: LLC

Location: New York

Goals:

✔️Market Leadership: The laundry will launch a series of focused marketing strategies including incentives and community involvement programs with the goal of increasing their market share by 15% in the following 12 months. To increase brand recognition and client acquisition via strategic alliances and events.

✔️Customer Satisfaction: The laundromat will educate all employees extensively since they know how important it is to provide great customer service. The objective is to boost customer satisfaction by 25% via enhanced interactions with customers. A continual commitment to training, feedback methods, effective and timely resolution of client problems are all part of this project.

✔️Operational Efficiency: A thorough training program will be instituted for all employees in recognition of the significance of providing outstanding customer service. A 25% improvement in customer satisfaction ratings is the target outcome of our efforts to client interactions. A dedication to solving client problems quickly, efficiently as well as regular training sessions and feedback systems, are all part of this effort.

✔️Brand Recognition: Aiming for increased brand visibility the laundromat will launch a multi-channel marketing campaign. Utilizing social media, participating in local events and forming partnerships to increase the reach of promotional efforts to achieve a 25% increase in brand visibility within the next quarter.

✔️Expansion and Growth: The following six months the laundry will launch a feasibility study to investigate potential additional locations in high-demand areas in an effort to expand their company.

Services:

✔️Express Wash and Fold Service: This service provides a time-saving and convenient alternative to doing laundry on one’s own which is especially helpful for those whose calendars are already full.

✔️Dry Cleaning Services: Expand the range of services by incorporating dry cleaning facilities. This addition caters to customers who require specialized care for delicate fabrics and garments that cannot be laundered in a traditional washing machine.

✔️Mobile App and Online Booking: Make it easy for consumers to arrange laundry services, monitor their progress, pay via a mobile app and online booking system. This technology integration showcases the laundromat’s modernity and efficiency while also improving client convenience.

✔️Subscription Packages: Introduce subscription packages for regular customers, offering discounted rates for a specified number of washes per month. This subscription model encourages customer loyalty and provides a predictable revenue stream for the business.

✔️Specialty Cleaning Services: Offer specialty cleaning services for items like comforters, blankets and large household items. This specialized service addresses the unique needs of customers with bulkier items that may require different cleaning methods than standard laundry.

Products:

✔️Self-Service Washers and Dryers

✔️ Vending Machines

✔️ Additional Services

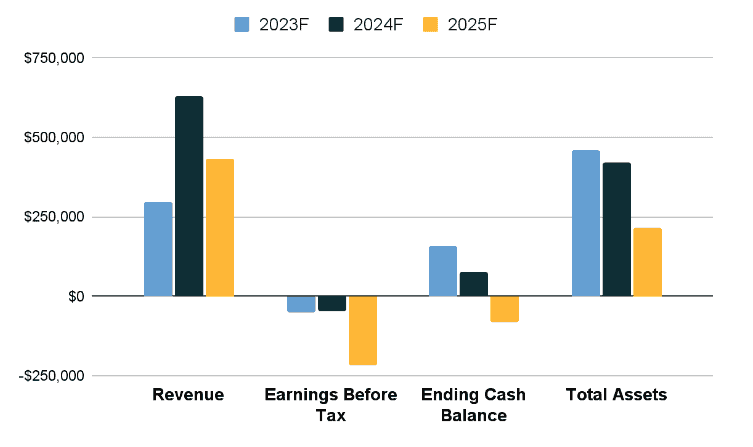

Financial Overview

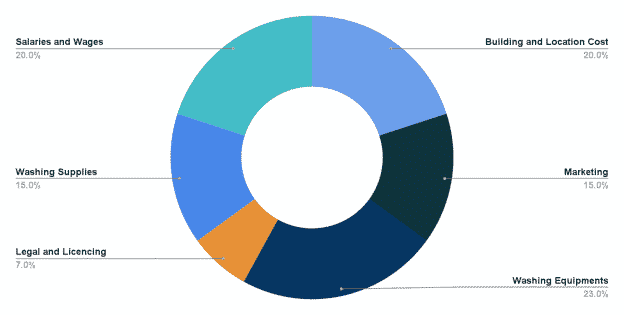

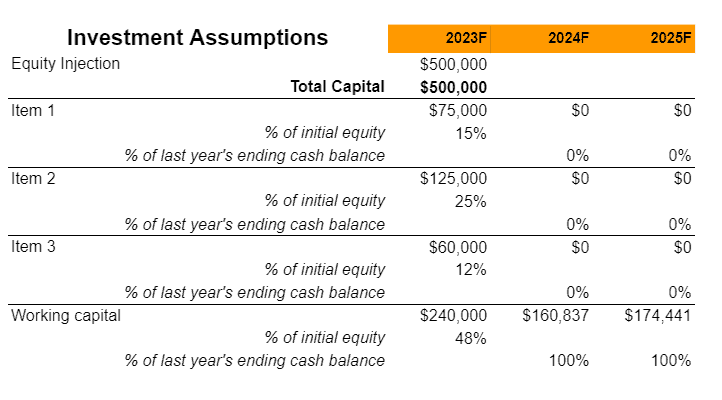

Fund Usage Plan

Key Metrics:

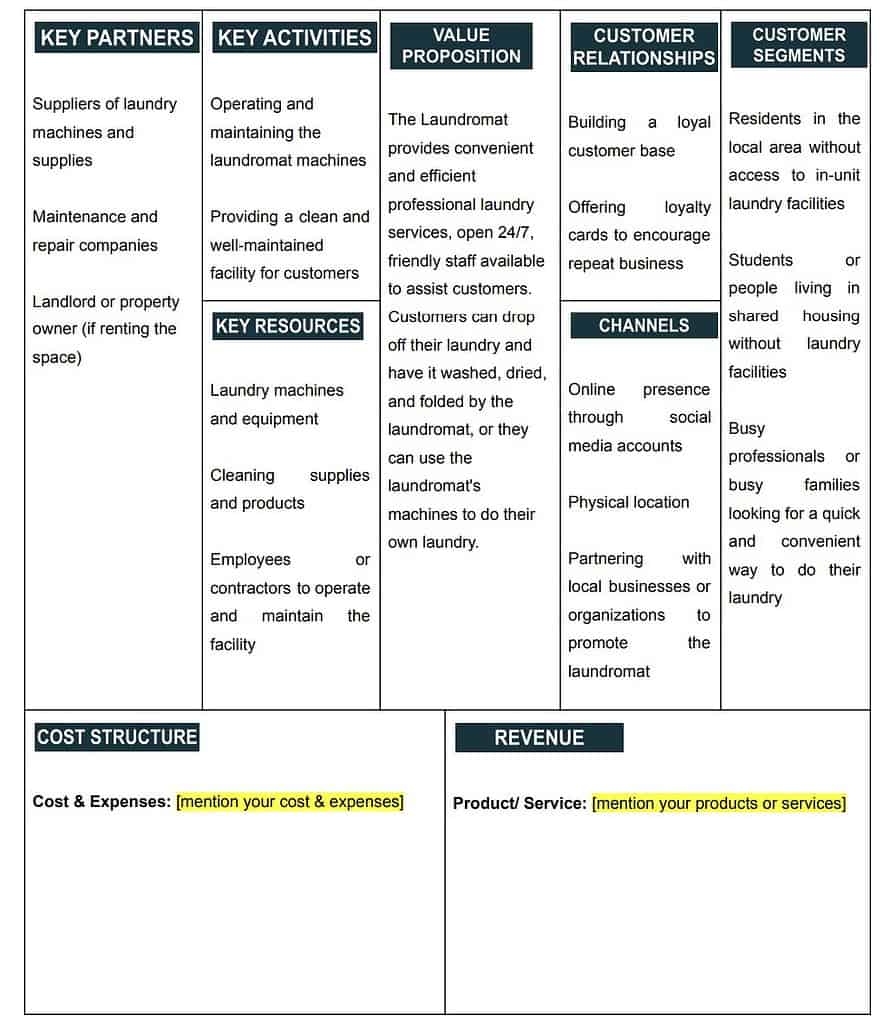

Business Model Canvas

It comprises nine key components – customer segments and value propositions to revenue streams and cost structures. The canvas provides a clear and concise way to map out, analyze, and communicate the intricacies of a business idea. It offers a holistic view of how a business creates, delivers, and captures value. It also aids entrepreneurs in refining concepts, fostering innovation, and making informed strategic choices. It serves as a versatile tool for brainstorming, planning, and presenting business models to stakeholders. Check out 100 samples of business model canvas.

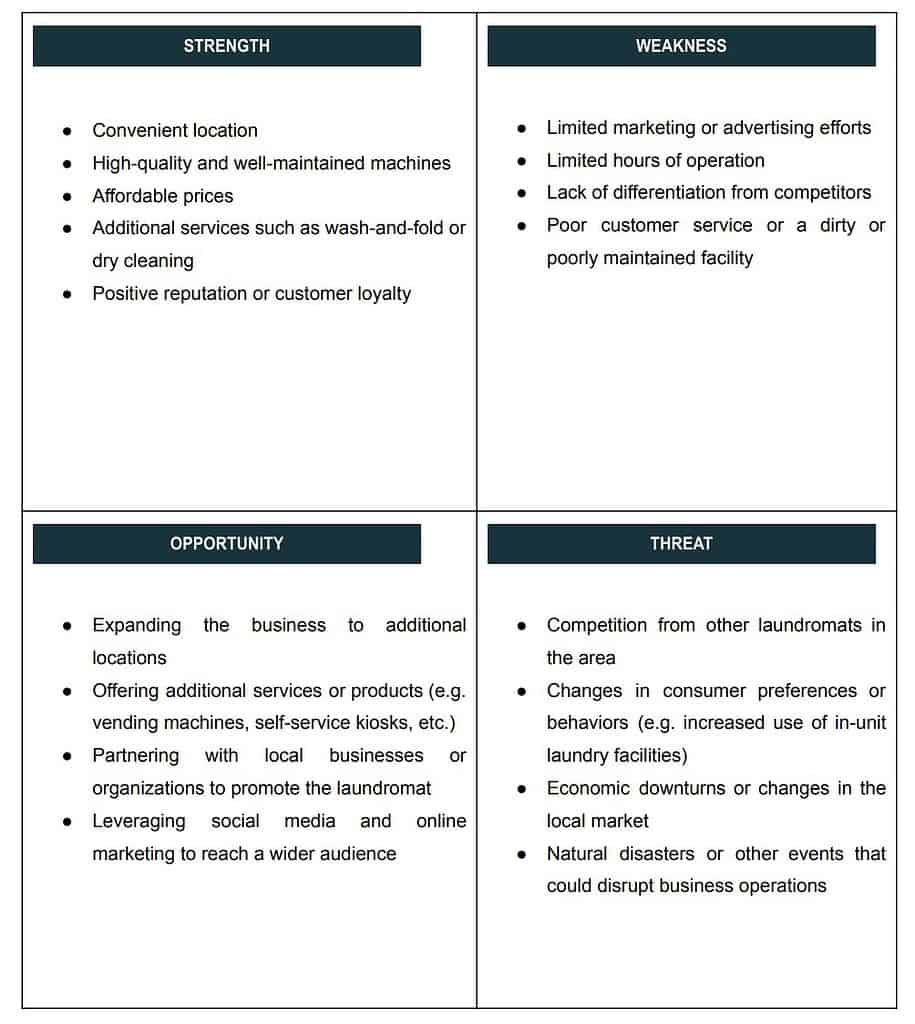

SWOT

it offers a clear lens into a company’s strengths, weaknesses, opportunities, and threats. This self-awareness enables effective resource allocation and strategic positioning against competitors. Businesses can mitigate risks, make informed decisions, and set realistic goals. In addition, presenting a SWOT analysis in a business plan communicates to stakeholders that the company possesses a deep understanding of its market environment. In essence, SWOT ensures a business’s strategy is grounded in reality enhancing its chances of success. Check out the 100 SWOT samples which will give you a better idea on SWOT writing process.

Marketing Plan

Promotional Channels

Social Media Marketing – $15,000 (30%):

✔️Platform Focus: Focus on social media sites like Instagram, Facebook and TikTok to promote your laundry business. Post videos showing how clothes change over time, testimonials from satisfied customers and details about any sales or events you’re hosting.

✔️Paid Ads: Use targeted ads to reach demographics interested in recreational activities, group events and unique experiences.

✔️Content Strategy: Implement a content strategy centered around regular posts featuring exciting laundry moments, satisfied customer testimonials and announcements for special promotions or events like discount days.

Website and SEO – $10,000 (20%):

✔️Website Revamp: Incorporate high-quality images showcasing the cleanliness and modernity of your laundromat making it an inviting online space for potential customers.

✔️Blog Content: Regularly update a blog section on your website with articles that provide laundry tips, information on garment care and insights into the benefits of using a laundromat.

✔️SEO: Optimize your website for relevant keywords related to laundry services, local convenience and community-oriented cleaning options.

Email Marketing – $5,000 (10%):

✔️Newsletter: Develop a monthly newsletter for your laundromat featuring upcoming promotions, service discounts and highlights from recent customer experiences.

✔️Segmentation: Tailor your messages for different customer segments based on their preferences and needs.

Local Partnerships – $7,000 (14%):

✔️Community Events: Partner with local festivals, fairs and community events to set up temporary laundry service stations or promote your laundromat’s offerings.

✔️Collaborations with Local Businesses: Forge collaborations with nearby businesses such as dry cleaners, cafes or local clothing stores for cross-promotion and package deals. Offer joint promotions where customers receive discounts or incentives when using both services.

Influencer and Group Collaborations – $6,000 (12%):

✔️Collaborations: Partner with local influencers or community groups for special laundry-related sessions leveraging their following for broader reach.

✔️Sponsorship Deals: Explore sponsorship deals with local businesses, schools or community organizations for team-building events or group meet-ups at your laundromat.

Direct Mail and Local Advertising – $4,000 (8%):

✔️Direct Mail: Send out flyers or discount offers to local residents and businesses.

✔️Local Media: Invest in advertising in local leisure magazines, community publications and local event listings to build a strong community presence.

Referral Program – $3,000 (6%):

- Implement a referral program that incentivizes customers to bring friends, family or colleagues, capitalizing on word-of-mouth and building a loyal customer base.

Brand Management

Social Media Marketing

✔️Brand Voice and Visual Identity: Develop a friendly and approachable brand voice that resonates with a broad audience, emphasizing the convenience, reliability and modernity of your laundromat services.

✔️User-Generated Content: Encourage customers to share their laundry experiences, showcasing before-and-after transformations, creative folding techniques or any unique laundry challenges.

✔️Live Sessions: Host live sessions on social media featuring laundry tips, quick demonstrations of machine use, fun laundry-related competitions or Q&A sessions with staff.

Search Engine Marketing (SEM) and Local SEO:

✔️Ad Copy: Craft compelling ad copy that highlights the unique and enjoyable experience of doing laundry at your laundromat. Emphasize the convenience of a well-equipped and modern facility making laundry a great group activity for friends or family.

✔️Website Optimization: Ensure your laundromat’s website is engaging, user-friendly and optimized for search engines. Incorporate relevant keywords such as “laundry services,” “group laundry activities” and “team-building laundry.”

✔️Google My Business: Keep your Google My Business listing updated with current photos, services and contact information to improve local search visibility.

Email Marketing:

✔️Newsletter: Share regular updates in your laundromat newsletter featuring information about new services, promotions and highlights from customer experiences.

✔️Segmentation: Customize your email campaigns for different customer segments to increase relevance and engagement. Tailor messages specifically for corporate clients, offering information on corporate laundry solutions and exclusive deals.

Local Partnerships and Sponsorships:

✔️Community Events: Partner with local festivals and community events to set up temporary laundry service stations or promote your laundromat’s offerings

✔️Collaboration with Local Businesses: Forge collaborations with nearby businesses such as dry cleaners, cafes or local clothing stores for cross-promotion and package deals.

Content Marketing:

✔️Educational Content: Create blog posts and videos about effective laundry practices, garment care techniques and the convenience of using a laundromat.

✔️Behind-the-Scenes Insights: Share behind-the-scenes stories and photos from your laundromat facility, emphasizing the clean and vibrant atmosphere.

Go To Market Strategy

Online Presence and Community Engagement

Social Media Marketing:

✔️Brand Voice and Visual Identity: Develop a friendly and approachable brand voice for your laundromat that resonates with a broad audience, using consistent visuals on social media platforms to showcase the excitement of a well-done laundry day and special events.

✔️User-Generated Content: Encourage customers to share their laundry experiences, showcasing before-and-after transformations and unique challenges, building a sense of community and authenticity by reposting their content.

✔️Live Sessions: Host live sessions featuring laundry tips, machine demonstrations and fun competitions to engage your audience providing a personal touch to your brand and emphasizing the convenience of your laundromat services.

Search Engine Marketing (SEM) and Local SEO:

✔️Ad Copy: Craft compelling ad copy that highlights the unique and enjoyable experience of doing laundry at your laundromat. Emphasize the convenience of a well-equipped and modern facility making laundry a great group activity for friends or family.

✔️Website Optimization: Ensure your laundromat’s website is engaging, user-friendly and optimized for search engines. Incorporate relevant keywords such as “laundry services,” “group laundry activities” and “team-building laundry.”

✔️Google My Business: Keep your Google My Business listing updated with current photos, services and contact information to improve local search visibility.

Email Marketing:

✔️Newsletter: Share updates about new game modes, league information, special offers and highlights from recent events or competitions.

✔️Segmentation: Customize emails for different groups such as corporate clients, birthday party groups and casual visitors to increase relevance and engagement.

Local Partnerships and Sponsorships:

✔️Community Events: Partner with local festivals and community events to set up temporary laundry service stations or promote your laundromat’s offerings

✔️Collaboration with Local Businesses: Forge collaborations with nearby businesses such as dry cleaners, cafes or local clothing stores for cross-promotion and package deals.

Content Marketing:

✔️Educational Content: Create engaging blog posts and videos about efficient laundry practices, fabric care techniques and the convenience of using a laundromat educating customers on best practices and the benefits of your services.

✔️Behind-the-Scenes Insights: Share behind-the-scenes stories and photos from your laundromat facility, focusing on the cleanliness, modern amenities and vibrant atmosphere to give customers a glimpse into the care and dedication behind your laundry services.

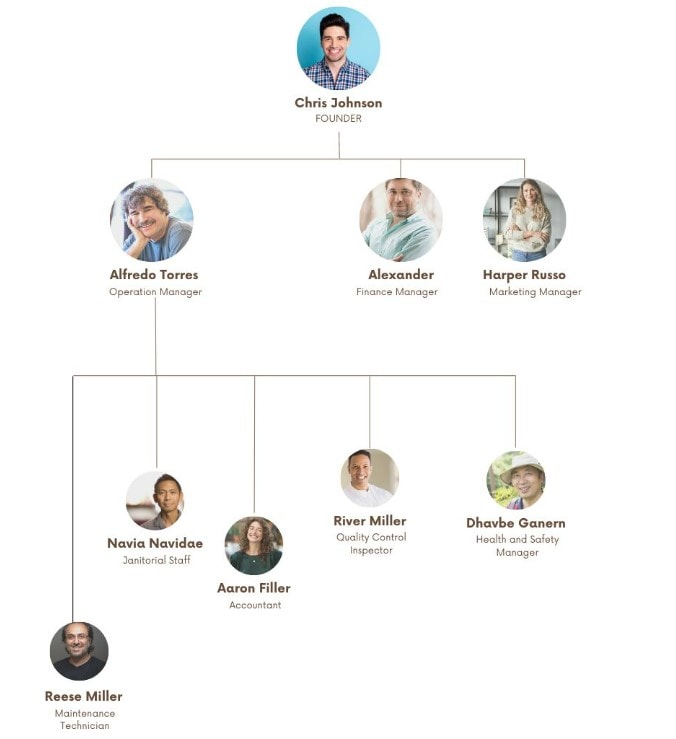

Organizational Overview

Organizational overview provides a snapshot of how a company is structured and operates. It outlines the ownership structure, roles, responsibilities of key management personnel, and the reporting hierarchy within the organization. This section offers stakeholders, investors and other readers a clear understanding of the company’s leadership and its chain of command. Additionally, it may give insight into the company’s culture, values and operational philosophy.

Founder

Chris Johnson is a businessman providing exceptional service that has inspirational brains behind the successful New York laundromat Sparkling Threads Laundry Lounge. Extensive education and impressive record of achievements which Jacob offers a lot of knowledge to his enterprise guaranteeing its triumphant success. Jacob also offers simple laundry service by combining his extensive background in business administration with an acute grasp of consumer demands. His ability is honed by his academic background and years of practical experience in the field.

Jacob’s track record demonstrates his commitment to maximizing operational efficiency and delighting customers. A chain of reliable, spotless and warmly welcome laundromats has been built under his able guidance. Reviews have been consistently good and the company has built a devoted client base all thanks to his leadership.

Jacob places his laundromats in prime locations and keeps them open late to accommodate customers with varying schedules because he values convenience and putting the consumer first. To top it all off he enhances the consumer experience by investing in user-friendly technology and facilities. These include mobile payment choices and pleasant lounging places.

Positions and Responsibilities

CEO (Chief Executive Officer): The chief executive officer (CEO) is responsible for the overall financial stability and expansion of the company. In charge of budgeting, analyzing market trends, encouraging a business culture that shares its goals and objectives.

Manager: The Manager takes on a pivotal role in the laundromat’s daily operations acting as the linchpin between the CEO’s strategic vision and its practical implementation.

Maintenance Technician: The Maintenance Technician is the laundromat’s technical expert, responsible for the upkeep and functionality of laundry equipment. Regular inspections, prompt issue resolution and preventative maintenance are essential aspects of this role.

Janitorial Staff: The Janitorial Staff is vital to maintaining a clean and hygienic environment within the laundromat. Performing routine cleaning tasks such as sweeping, mopping and sanitizing surfaces, they create a pleasant atmosphere for customers.

Accountant: The Accountant manages the financial aspects of the laundromat business, overseeing accounts payable, receivable, preparing financial reports, creating budgets and forecasts.

Organogram

Operational Overview

✔️Laundry Services: Offers comprehensive laundry services catering to individuals, families and businesses. Customers can use our state-of-the-art machines for standard wash-and-dry sessions suitable for various types of clothing and fabrics.

✔️Specialized Services: Offers specialized options such as dry cleaning, delicate garment care and bulk cleaning services. This ensures that our customers have a variety of choices to meet their unique laundry needs.

✔️Self-Service and Full-Service Options: Customers can opt for self-service using our coin-operated or card-operated machines or they can choose our full-service option for a hassle-free experience.

✔️Membership and Loyalty Programs: Customers can benefit from discounts, exclusive promotions and personalized offers creating a sense of appreciation for their continued patronage.

✔️Eco-Friendly Initiatives: This includes energy-efficient machines, water-saving measures and environmentally conscious detergent options. Our commitment to green practices aligns with the growing demand for sustainable solutions.

Industry Analysis

According to projections the laundromat business in the United States will be worth $5 billion in 2023. Its growth over the last five years has been consistent clocking in at 1.5% CAGR. There are more than 29,500 laundromats in the nation and on average they make more than $500,000 a year with profit margins between 20% and 35%. Laundry services are indispensable and the industry’s steady customer base is a major factor in its longevity.

Source: trycents

Apartment dwellers, college students and low-income families are just a few of the different populations served by the laundromat sector, which is vital in satisfying their washing requirements in urban and suburban regions. About 20% of American homes utilize shared laundry facilities, which are mostly located in cities making this service quite important. A rising number of laundromats about 35% are adopting digital payment methods showcasing the industry’s growth via technological improvements. In addition to catering to modern consumer tastes, this tech-savvy strategy helps laundromats become more efficient and more convenient for customers. This sector has shown that it can adapt to the demands of a broad and contemporary consumer base by embracing technological innovations that meet the evolving requirements of its customers.

In an effort to lessen their impact on the environment laundromats are adopting greener methods. For instance a quarter of the industry has upgraded to more efficient machines which cut water use in half and electricity consumption in half. These days 30% of laundromats provide extra services including dry cleaning and wash-and-fold. By adopting greener practices and increasing its service offerings the sector is responding to growing consumer preferences and market demands.

Source: martinray

Other key trends and stats:

✔️Growth of Competitive and Community Aspect

✔️Economic Contribution and Employment

✔️Emerging Trend in Experiential Entertainment

✔️Affordability and Accessibility: Attracts a wide range of customers due to its affordability.

✔️Community and Competitive Play: Growing popularity in competitive leagues and community

Industry Problems

✔️Safety and Liability: Laundromats must implement robust safety measures to prevent accidents, adhere to stringent liability and insurance requirements, given the potential risks associated with the operation of machinery and the handling of cleaning agents.

✔️Cost and Pricing Strategy: Laundromats face the challenge of striking a delicate balance between offering affordable services for customers and covering operational costs.

✔️Equipment Quality and Maintenance: Ensuring that washing machines and dryers are well-maintained, promptly repaired and periodically upgraded is essential for delivering a consistently high-quality service to customers.

✔️Skill Levels and Training: Laundromats must provide clear and effective guidance to users, ensuring they understand the equipment and laundry processes to enhance their overall experience.

✔️Venue Atmosphere and Comfort: A pleasant environment with clean facilities, adequate seating and possibly amenities like Wi-Fi contributes to a positive experience and encourages repeat visits.

Source: marketresearch

Industry Opportunities

✔️Eco-Friendly Practices: By integrating energy-saving machines, water conservation technologies and environmentally-friendly detergent choices they can attract consumers who are mindful of the environment and enhance their brand reputation.

✔️Technology Integration: Incorporating mobile applications that allow for online reservations, cashless payments and live updates on machine availability can greatly improve customer convenience, positioning the business as contemporary and focused on customer needs.

✔️Specialized Services: Providing specialized services beyond standard wash-and-dry options can attract a diverse customer base. Offering dry cleaning, delicate garment care or bulk cleaning services caters to varied customer needs and creates additional revenue streams.

✔️Membership and Loyalty Programs: The implementation of membership and loyalty programs represents a valuable opportunity for laundromats. By offering discounts, exclusive promotions, personalized benefits businesses can encourage customer loyalty and repeat business.

✔️Community Engagement: By actively participating in local community activities laundromats can establish a robust local presence. Involvement in neighborhood causes, local initiatives can cultivate a community spirit and enhance customer loyalty.

Source: ibisworld

Target Market Segmentation

Demographic Segmentation:

✔️Age Groups: Provide diverse experiences tailored to different ages such as kid-friendly sessions and competitive offerings for adults.

✔️Income Levels: Offer a range of prices from budget-friendly options to upscale group experiences catering to various income groups.

✔️Cultural Diversity: Celebrate New York’s multicultural environment with themed events and cultural celebrations.

Psychographic Segmentation:

✔️Convenience Seekers: Target customers who value quick and hassle-free laundry experiences offering efficient self-service options.

✔️Eco-conscious Customers: Attract environmentally conscious individuals with green machines and sustainable detergent choices.

Behavioral Segmentation:

✔️Regular Users: Develop loyalty programs or discounts to encourage repeat visits from frequent customers.

✔️Special Occasion Users: Cater to those needing laundry services for special events or delicate garments with specialized offerings.

✔️First-Time Users: Ensure a welcoming environment for newcomers with clear instructions and helpful staff.

Geographical Segmentation:

✔️Local Residents: Focus on the local community in New York with targeted marketing establishing the laundromat as a convenient neighborhood option.

✔️Tourists and Temporary Visitors: Accommodate tourists, short-term visitors with tailored services and location-specific promotions.

Technological Segmentation:

✔️Tech-Savvy Consumers: Implement advanced features like digital payments, online reservations and live updates on machine availability.

✔️Traditional Customers: Keep straightforward easy-to-use laundry options available for customers who prefer a traditional approach.

Market Size

✔️Total Addressable Market (TAM):Anyone in the specified area or city that needs laundry services makes up the laundromat’s target audience list (TAM). The lifestyle choices of the local population, the number of apartments without washers, dryers and the demographics of the region (including age, income and culture) are all variables that might impact this vast industry. The increasing number of renters and the move towards more convenient urban living are two further factors that might affect the TAM.

✔️Serviceable Addressable Market (SAM): A laundromat’s SAM uses the TAM to zero in on the customers who are really within the company’s grasp. Location of the laundry, the services it offers (self-service, full-service, specialist fabric care) and its marketing tactics are all elements that contribute to this. People that are concerned about the environment, have a knack for technology and have hectic lives would make up the SAM in a heavily crowded metropolitan region where a laundromat provides high-tech eco-friendly laundry solutions.

✔️Serviceable Obtainable Market (SOM): The SOM for a laundromat is the portion of the SAM that the business can realistically expect to capture based on its current capabilities, resources and competitive landscape. This includes considerations like the quality and convenience of the services provided, the uniqueness of the laundromat’s offerings (such as mobile app integration, loyalty programs), customer service excellence, pricing strategy and the effectiveness of local market positioning.

Industry Forces

✔️Market Demand and Entertainment Trends: A number of factors come into play including the need for environmentally conscious, technologically advanced facilities, the necessity of finding ways to save time and the demand for supplementary services such as dry cleaning and changes.

✔️Competition: Differentiation can be achieved through unique services, exceptional customer experience, offering wash-and-fold services and providing a comfortable inviting environment.

✔️Technological Advancements: Utilizing technology like online booking for laundry services, digital payment systems, social media for customer engagement can enhance the customer experience and improve operational efficiency.

✔️Regulatory Environment: Compliance with local health, safety regulations, environmental guidelines and business licensing requirements is crucial. This includes adhering to standards for laundry operations and maintaining high cleanliness levels.

✔️Economic Factors: Economic conditions can influence spending on services like laundry. Flexible pricing strategies, offering a range of services can cater to different budget levels and sustain customer interest in various economic situations.

Market Segmentation

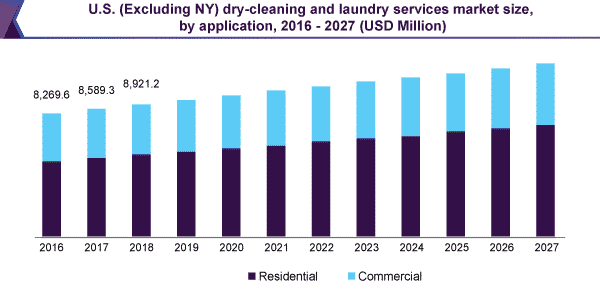

Application: The dry-cleaning and laundry services industry is divided into residential and commercial segments based on their application. In 2019, the residential application category had a significant market share. It is expected to continue in the projection period. During the projection period, the residential sector is predicted to rise due to an increase in the number of homes with working members across the world, as well as an increase in expenditure on clothing and their cleaning. Furthermore, rising consumer preference for professional cleaning services due to personal hygiene and cleanliness is expected to drive residential sector development.

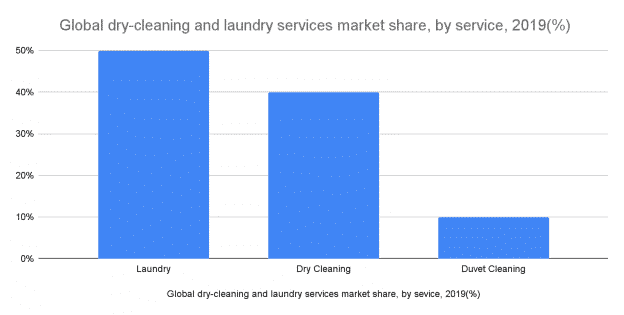

Service: Laundry, dry cleaning, and duvet cleaning are the three types of services available. In 2019, the laundry category took over half of the market share. Customers’ increased preference for casual clothes and greater washing frequency will outperform laundry services from other categories. Growing consumer awareness of the need for good personal cleanliness is encouraging people to wash their daily clothing on a regular basis. In the projection period, these variables will most likely fuel demand for washing services.

The dry-cleaning industry is predicted to develop significantly in the future years, owing to an increase in professional employees who often wear business attire, like suits and jackets, which cannot be washed with ordinary techniques and must be dry-cleaned with extreme care.

Demand is likely to be driven by the fact that dry cleaning is frequently utilized for other specialty garments, like bridal dresses, throughout the forecast period. The hotel sector and hospitals throughout the world are continuing to expand, necessitating effective laundry and duvet cleaning services, which is projected to boost the market.

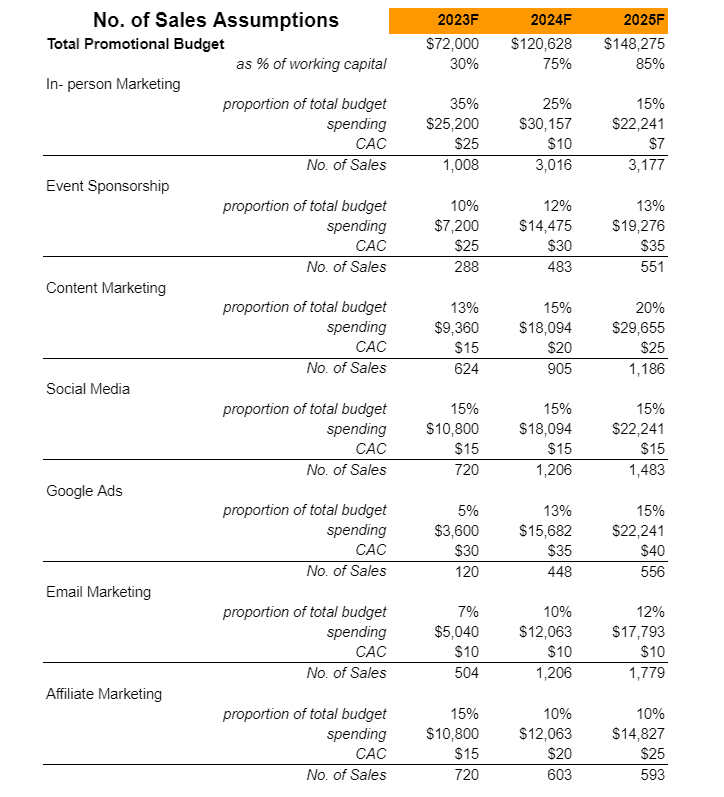

Marketing Plan

A marketing plan outlines the company’s strategy to promote its products or services to its target audience. It includes specific tactics and channels the business will use to reach potential customers. This section defines the company’s unique value proposition, identifies the target market segments, and discusses the competitive landscape. It also includes insight into budget allocation, projected outcomes and key performance indicators to measure success. Marketing plan helps businesses demonstrate their understanding of the market dynamics, their positioning within the industry and their approach to driving customer engagement and sales.

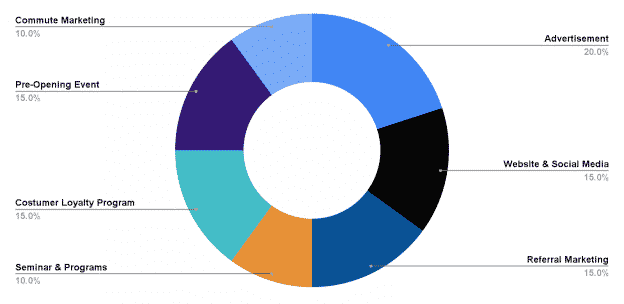

Website and Social Media: To market our brand, we use the internet and social media platforms like Instagram, Facebook, Twitter, YouTube, Google+, and others. Include Universal Laundromat in phone books and directories in your neighborhood. Create a company website and be active on key social media sites.

Seminar and Programs: Sponsor sports events and tournaments in town that are significant to you.

Referral Marketing: Encourage individuals to utilize referral marketing (word-of-mouth), and engage in direct marketing.

Advertisement: Advertise Universal Laundromat on local television, radio stations, and in local publications. Ensure that all of our employees are wearing our branded clothing and that all of our official cars and trucks are well-branded with our company emblem and other identifying information. Distribute our flyers and handbills at strategic locations. Advertise Universal Laundromat on local television, radio, and print stations.

Pre-Opening Events: To raise awareness, have a party to honor the Universal Laundromat launch.

Commute Advertising: By employing individuals to display signs alongside we will draw attention to Universal Laundromat. Install our billboards in high-traffic areas,

Customer Loyalty Program: To honor our loyal customers, we will develop customer incentive programs and promotions.

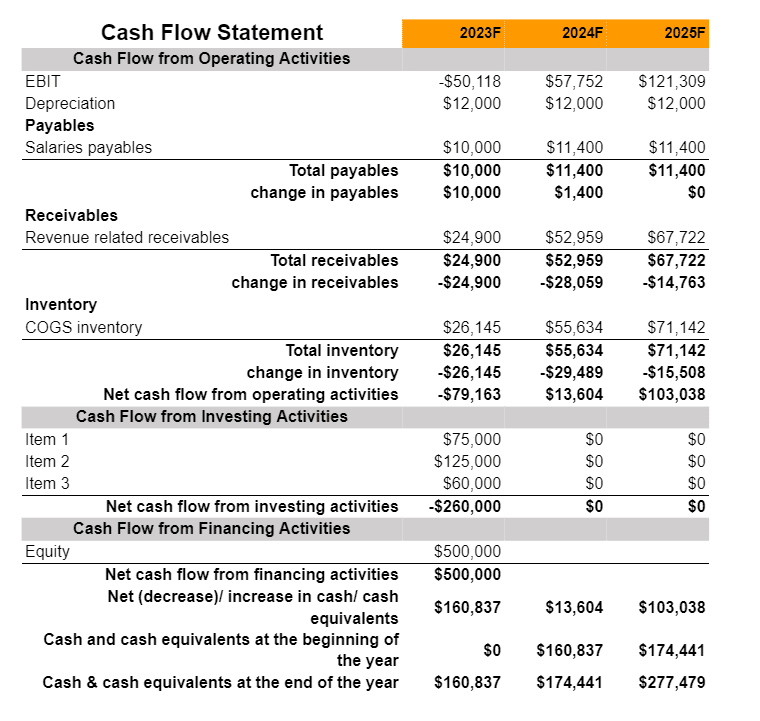

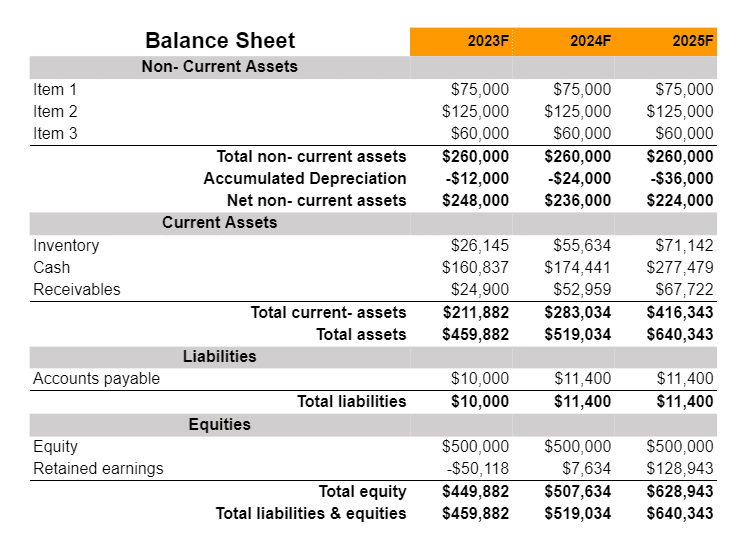

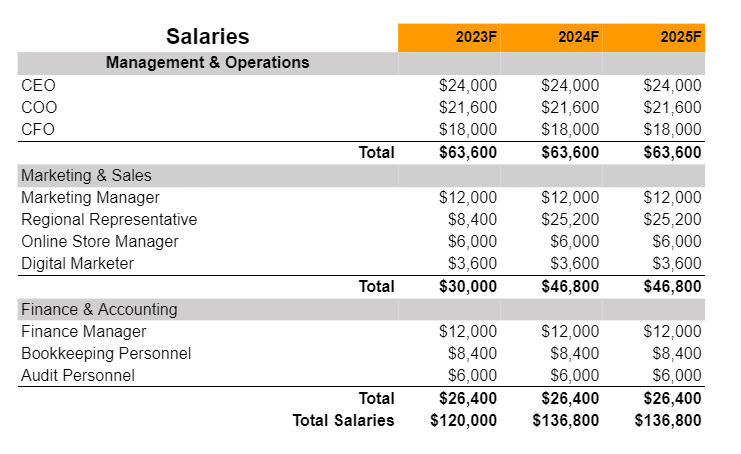

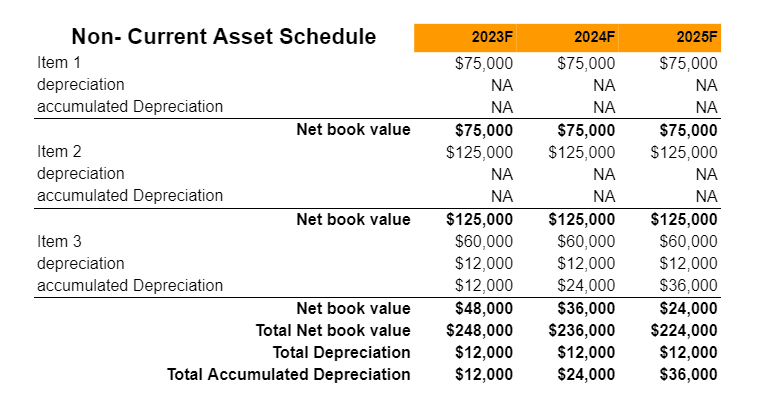

Financials

A financial plan provides a comprehensive projection of a company’s financial health and its anticipated monetary performance over a specified period. This section encompasses a range of financial statements and projections such as profit and loss statements, balance sheets, cash flow statements and capital expenditure budgets. It outlines the business’s funding requirements, sources of finance and return on investment predictions. The financial plan gives stakeholders particularly potential investors and lenders a clear understanding of the company’s current financial position. A financial plan helps businesses demonstrate their financial prudence, sustainability, and growth potential.

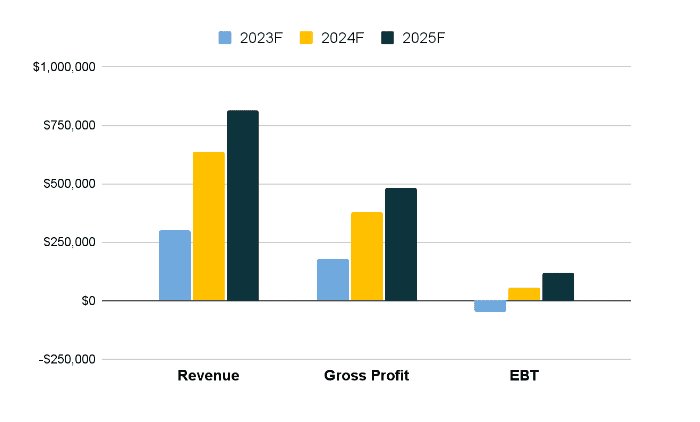

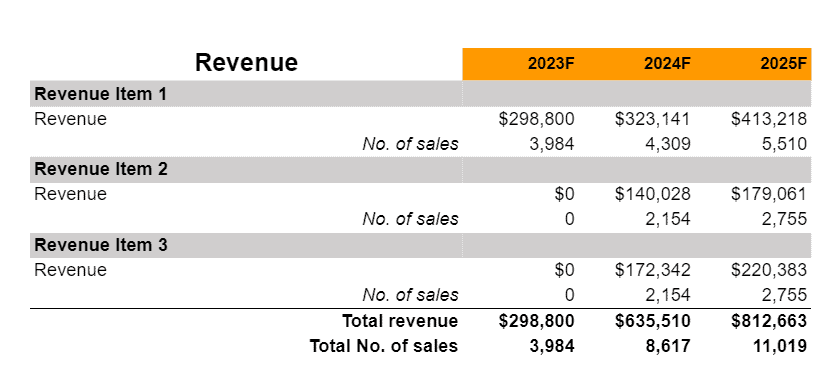

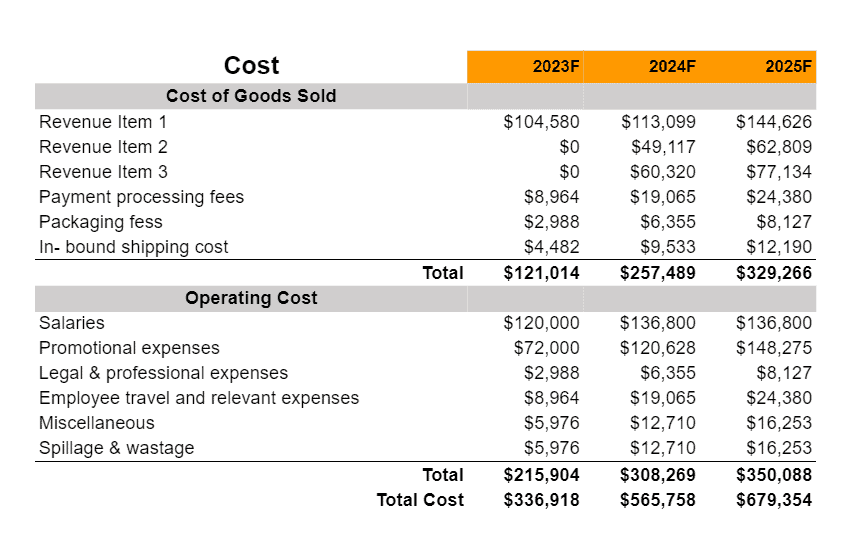

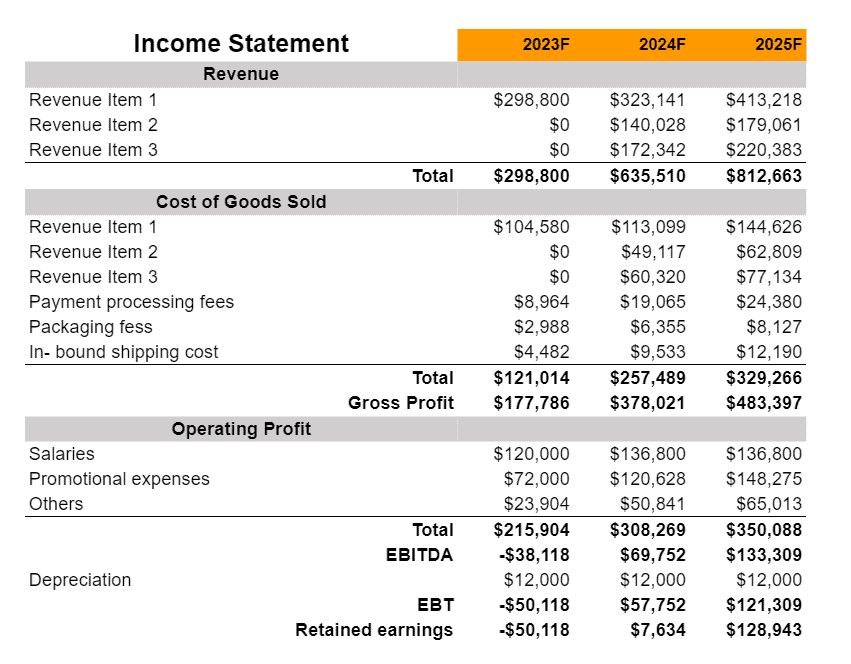

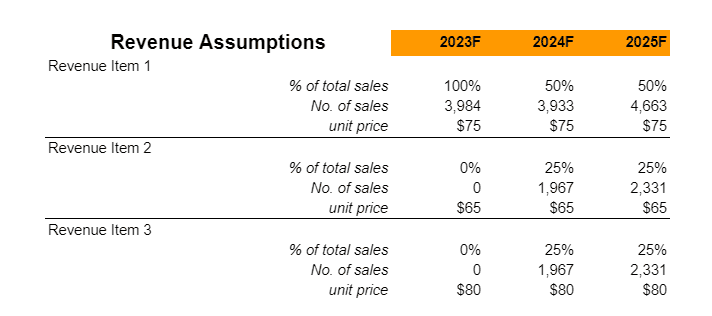

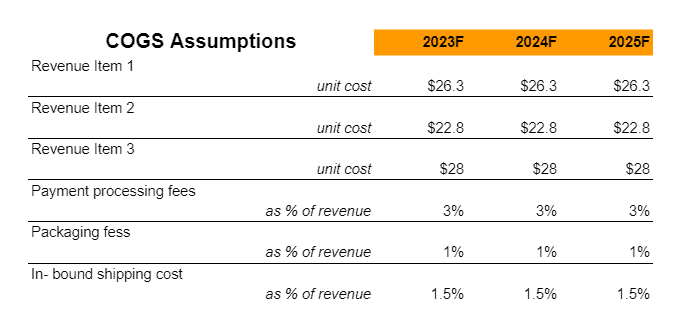

Earnings

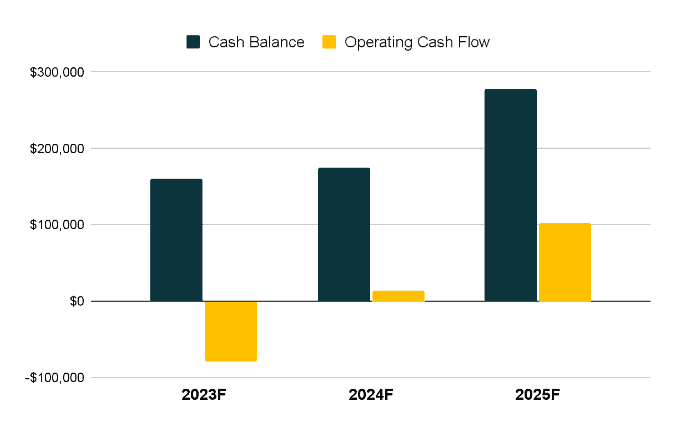

Liquidity

Related Articles: