Written by Elma Steven | Updated on June, 2024

How to Write a Winery Business Plan?

Winery Business Plan is an outline of your overall winery business. The business plan should include a 5 year financial projection, marketing plan, industry analysis, organizational overview, operational overview and finally an executive summary. Remember to write your executive summary at the end as it is considered as a snapshot of the overall business plan. You need to be careful while writing the plan as you need to consider various factors that can impact the business’s success.

Table of Contents

Executive Summary

Among the magnificent hills of Napa Valley lies Vineyard Vistas Winery, an innovative winery established by Jordan Smith. Our main services include a wide variety of premium wines, as well as wine tastings, vineyard excursions, and the ability to hold special events. Jordan has a deep understanding of winemaking and viticulture from his 10 years of experience in the field, and he is passionate about developing great wines. Our dedication to environmentally responsible winemaking, our use of rare grape varietals cultivated in the area, and the instructive and individualized wine tastings we provide are Vineyard Vistas’ USPs.

Mission: Through the production of world-class wines and the provision of unforgettable experiences to guests, in the spirit of sustainability, we want to elevate the Napa Valley wine experience. Building relationships with our consumers, sharing knowledge about winemaking, and encouraging them to become part of a community of wine lovers are our top priorities.

Vision: Our goal is to become the go-to winery in Napa Valley, California, renowned for our cutting-edge winemaking practices, dedication to environmental responsibility, and outstanding service to each and every one of our customers. We want to be the go-to spot for passionate wine lovers and novices both in the area.

Industry Overview:

Numerous possibilities exist for companies in the United States’ recording studio sector, which is both vibrant and expanding. Predictions for the next five years indicate a market size of $1.6 billion, with a CAGR (compound annual growth rate) of 3.94%. The meteoric ascent of independent musicians, the proliferation of streaming services, and the meteoric development of audio-based material like podcasts are all elements that will propel this expansion.

Check out this guide on how to write an executive summary? If you don’t have the time to write on then you can use this custom Executive Summary Writer to save Hrs. of your precious time.

Financial Highlights

Earnings & Profitability

Break-Even Analysis

Business Description

Business Name:Vineyard Vistas Winery

Founders: Jordan Smith

Management Team: [You can ignore this/ delete this but its better to provide it]

Legal Structure: LLC

Location: Miami

Goals & Objectives:

- Build a Strong Customer Base: Within the first year, aim to recruit and keep a diversified customer, including local wine connoisseurs and foreign visitors. Promotional activities such as wine tastings, membership drives, and local tourist boards might play a role in this.

- Enhance Brand Recognition: Build a solid reputation for your winery online by advertising to certain demographics, collaborating with regional food festivals, and interacting often on social media.

- Deliver High-Quality Wines: Promise to always make wines that are up to par with or better than what the market demands. From the vineyard to the bottle, maintain a focus on quality control to make sure every batch is an expression of your winery’s dedication to greatness.

- Expand Product Portfolio: Within the next two years, you want to provide a wider variety of wines and services, maybe even limited editions, wine club memberships, and seminars on wine education.

- Achieve Financial Stability: In the first three years of operation, you should strive to establish a sustainable income stream. This may include looking at export possibilities, improving sales methods, and controlling manufacturing costs.

- Foster a Community of Wine Lovers: Make your vineyard a warm and inviting place where people can learn about winemaking and have fun with wine culture. A devoted following may be formed via the organization of frequent tastings and events.

- Incorporate Innovative Winemaking Techniques: To keep your winery at the cutting edge of contemporary viticulture and enology, it is essential to embrace novel winemaking processes and technology. This will help you stay ahead of the competition.

- Develop Strategic Partnerships: To broaden your reach and improve your services, team up with nearby companies, hospitality locations, and other vineyards. Collaborative marketing, combined events, and shared clientele are all possible outcomes of such alliances.

- Gain Industry Recognition: In the next five years, you should aim to win several wine prizes. Both the status of your brand and the quality of your wines are elevated by this.

Services:

- Wine Tasting and Tours: Offer guided tours of your winery and vineyards accompanied by samples of your finest vintages. Bring attention to the special qualities of your vineyard, winemaking method, and each vintage by sharing their stories.

- Wine Club and Subscriptions: Create a wine club or subscription service where members may get your wines on a regular basis, in addition to exclusive discounts and invitations to exclusive events.

- Private Label Production: Make one-of-a-kind wines with a distinct label for companies or unique occasions. Customers seeking individualized wine experiences or business customers may be interested in this.

- Event Hosting: Make use of the area around your vineyard to hold gatherings like weddings, business retreats, or even food festivals. Highlight your venue’s breathtaking beauty and one-of-a-kind environment.

- Wine Education Workshops: Give seminars or lectures on wine tasting, food matching, and viniculture. Enthusiasts and newcomers to the world of wine may find this appealing.

- Customized Wine Experiences: Provide guests with opportunities for unique, customized experiences, like winemaking workshops or barrel tastings. Wine visitors might be enticed by these one-of-a-kind experiences.

- E-commerce and Online Sales: Create an online storefront to sell your wines, and you’ll instantly reach a far wider audience than just those in your immediate area.

- Collaborations with Local Businesses: Showcase your wines by teaming up with nearby eateries, inns, and boutiques to boost exposure and build partnerships with local businesses.

- Sustainable and Eco-friendly Practices: Customers who are concerned about the environment may appreciate your wines more if you highlight your dedication to sustainable practices.

- Winery Festivals and Seasonal Events: Festivals and other seasonal events may be great ways to celebrate harvest, new wine releases, and other milestones at your vineyard.

- Culinary Offerings: To make wine tasting even more enjoyable, consider adding a small café or hosting frequent food matching events to your vineyard.

- Corporate and Group Experiences: Corporate customers and groups may have their own unique packages created, complete with team-building exercises centered on winemaking and vineyard excursions.

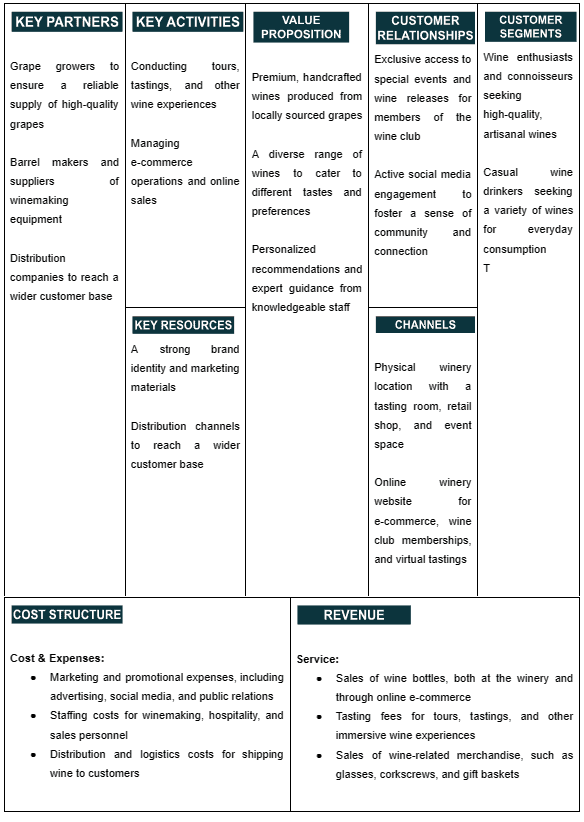

Business Model

Check out the 100 samples of business model canvas.

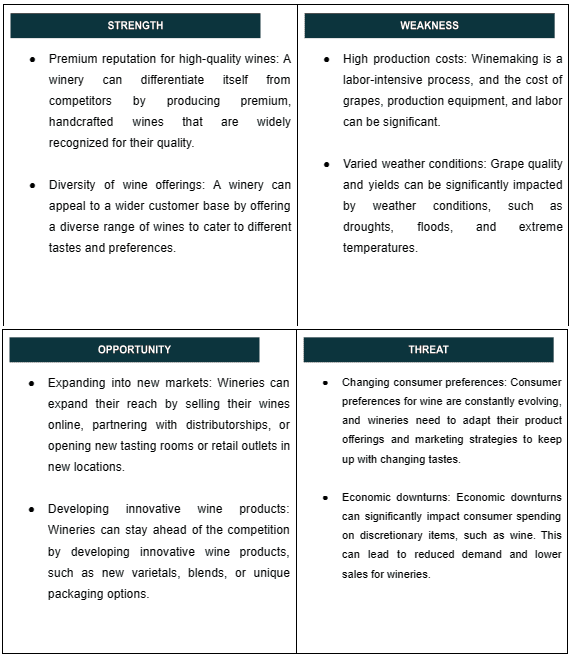

SWOT

Check out the 100 SWOT Samples

Marketing Plan

Promotional Channels

Social Media Marketing – $15,000 (30%)

- Platform Focus: Emphasize Instagram and Pinterest for their visual appeal, showcasing your vineyard, wine production, and events. Utilize Facebook for its broad user base and targeted advertising capabilities.

- Paid Ads: Target wine enthusiasts, local foodies, and tourists. Use geo-targeting for ads to reach potential visitors in your region or those planning to travel there.

- Content Strategy: Share content about wine-making processes, vineyard tours, customer experiences, food pairings, and exclusive wine releases. Feature user-generated content to build community.

Website and SEO – $10,000 (20%)

- Website Revamp: Focus on aesthetics, showcasing the ambiance of your winery and ease of navigation for bookings, wine purchases, and event information.

- Blog Content: Create content on wine education, vineyard stories, sustainability practices, and food pairings to drive organic traffic.

- SEO: Optimize for keywords related to wineries, wine tasting, local tourism, and your specific types of wine.

Email Marketing – $5,000 (10%)

- Newsletter: Feature wine specials, upcoming events, and exclusive offers for subscribers. Share stories from the vineyard and insights from the winemaker.

- Segmentation: Tailor messages for different segments like wine club members, occasional visitors, and event planners.

Local Partnerships – $7,000 (14%)

- Local Events and Businesses: Collaborate with local festivals, restaurants, and hotels to offer wine tasting events or exclusive wine menus.

- Tourism Partnerships: Work with local tourism boards and travel agencies to be part of regional travel packages.

Influencer and Artist Collaborations – $6,000 (12%)

- Collaborations: Partner with food and wine influencers for social media promotion and event hosting.

- Exclusive Experiences: Offer unique vineyard experiences or personalized wine tastings for influencers to share with their audiences.

Direct Mail and Local Advertising – $4,000 (8%)

- Direct Mail: Send out invites for exclusive wine tasting events, new release announcements, and membership offers to a targeted local audience.

- Local Media: Advertise in local lifestyle magazines, radio stations, and community event pages.

Referral Program – $3,000 (6%)

- Referral Incentives: Encourage current customers to refer friends and family with incentives like discounts on wine purchases or exclusive event invitations.

Brand Management

Social Media Marketing

- Specific Goals: Set clear, measurable goals like increasing bookings, growing your client base, or enhancing brand recognition.

- Target Audience: Identify your primary customer segments (e.g., independent musicians, bands, podcast creators).

Brand Development

- Brand Voice and Identity: Create a consistent and appealing brand voice and visual identity that resonates with your target audience and is reflected across all marketing channels.

- Consistency Across Platforms: Ensure uniformity in your messaging and visual style across different platforms for brand cohesiveness.

Digital Marketing Implementation

- Social Media Marketing: Implement a regular posting schedule, engage with followers, and promote user-generated content.

- SEM and Local SEO: Optimize your website and ads for search engines, focusing on relevant keywords and maintaining an updated Google My Business profile.

- Email Marketing: Develop and segment your email list for tailored newsletters and promotional emails.

Establish Local Partnerships and Sponsorships

- Collaborate with Local Entities: Partner with music events, festivals, and schools to increase your studio’s visibility and credibility.

- Community Engagement: Actively participate in local music scenes and community events to build relationships.

Content Marketing Strategy

- Educational and Behind-the-Scenes Content: Develop and share informative and engaging content about music production and your studio experiences.

- Content Calendar: Plan and schedule regular content updates to maintain audience engagement and interest.

Influencer and Artist Collaborations

- Strategic Partnerships: Collaborate with local artists and influencers to reach broader audiences and showcase your studio’s capabilities.

- Content Co-Creation: Engage in joint content creation to mutually enhance visibility and reputation.

Offline Marketing Tactics

- Local Advertising: Utilize local media and print advertising to reach potential clients who may not be as active online.

- Physical Presence in Community: Increase your studio’s presence in local music stores, community centers, and relevant events.

Referral Program Development

- Incentivize Referrals: Implement a referral program offering benefits to existing clients for bringing in new business.

Measure and Optimize

- Performance Tracking: Regularly assess the effectiveness of your marketing strategies and adjust based on results and feedback.

- Market Responsiveness: Stay adaptable to market trends and customer preferences, updating your strategy as necessary.

Go To Market Strategy

Online Presence and Community Engagement

- Professional Website: Launch a user-friendly website showcasing your winery, its history, products, and visitor experiences. Include an online booking system for tastings and tours, and an e-commerce section for wine sales.

- Local Directory Listings: Ensure your winery is listed in relevant local and wine-specific directories to enhance visibility.

Content Marketing and SEO

- Blog Posts and Articles: Regularly publish content related to wine education, vineyard processes, and pairing tips. This will improve your search engine rankings and establish your winery as a knowledgeable authority.

- Social Media Engagement: Utilize platforms like Instagram, Facebook, and Pinterest to showcase your vineyard, events, and wine-making processes.

Building Local and Industry Partnerships

- Collaboration with Local Businesses: Partner with local restaurants, hotels, and tour operators for joint promotions.

- Wine Industry Associations: Engage with wine industry groups for networking and collaboration opportunities.

Launch and Promotional Activities

- Grand Opening Event or Seasonal Launch: Host events to introduce new wines or promote seasonal activities at your vineyard.

- Promotional Offers: Provide introductory discounts or special packages for first-time buyers or group bookings.

Digital Marketing and Customer Engagement

- Email Marketing: Develop a newsletter to keep your audience informed about new releases, events, and vineyard news.

- Loyalty Program: Implement a program to reward frequent customers, such as a wine club with exclusive benefits.

Brand Awareness and Public Relations

- Local Media Outreach: Connect with local media for features, interviews, or articles about your winery.

- Community Involvement: Participate in or sponsor local events to increase brand visibility.

- Influencer Partnerships: Collaborate with food and wine influencers to reach a broader audience.

Performance Tracking and Adaptation

- Analytics and Feedback: Use tools like Google Analytics to monitor website traffic and social media engagement. Collect customer feedback to understand preferences and experiences.

- Strategy Adaptation: Stay flexible and ready to adjust your marketing and operational strategies based on performance data and evolving customer needs.

Organizational Overview

Founder

Jordan Smith has built a renowned boutique winery by expertly combining his love of winemaking with cutting-edge business strategies. Smith is a visionary winemaker. He got his start in the wine industry by studying viticulture and wine company management, driven by his profound admiration for the craft of winemaking. Jordan has an extensive knowledge of the science of grape cultivation and the intricacies of the wine business, thanks to his academic background and practical experience in several famous vineyards.

When Jordan set up his boutique winery in an area known for its extensive wine history, his entrepreneurial zeal was on full display. His vineyard is proof positive of his dream of fusing old and new ways of creating wine. From planting grapes to filling bottles, Jordan has made eco-friendly measures an integral part of his winery’s operations since he is a strong believer in sustainability. His dedication goes beyond only protecting the environment; it also includes using ethical and long-term business strategies to guarantee the success of his company.

As a result of Jordan’s skill and commitment to quality, the winery has become known for its high-quality wines. Because of Jordan’s unique approach to winemaking, these wines have a reputation for being complex and having great taste profiles. As a result of his insatiable curiosity and willingness to explore new things, he is always raising the bar for winemaking. Jordan’s commitment in the winery industry goes beyond a mere career path; it is a deeply personal endeavor that propels him to achieve greatness and make a significant impact on the viticulture world. In addition to being a successful winery, his establishment is a center for excellence, sustainability, and new ideas in the winemaking industry.

Positions and Responsibilities

Chief Executive Officer (CEO) – Jordan Smith

- Strategic Leadership: You, Jordan Smith, are the chief executive officer of the winery, and it is your job to determine its long-term goals and objectives.

- Business Oversight: Manage the winery’s day-to-day activities, finances, and advertising campaigns.

- Industry Representation: Participate in industry gatherings, tastings, and negotiations on behalf of the winery while cultivating connections with influential people.

Vineyard Manager

- Viticulture Supervision: In charge of the vineyard makes sure only the highest quality grapes are grown for the wine.

- Harvest Management: Make sure the grapes are picked at the right time and in the right way so that the wine turns out perfectly.

Winemaker

- Wine Production: Oversee all stages of winemaking, including grape selection, fermentation, aging, and bottling.

- Quality Control: Experiment with various mixes and processes to ensure the production of wine of the greatest quality.

Tasting Room Manager

- Guest Experience: Oversee all aspects of the tasting room and ensure that guests have a memorable experience.

- Sales and Promotion: Promote wine club memberships and sales by planning and executing wine tastings and educational seminars.

Marketing and Sales Coordinator

- Marketing Campaigns: Create a plan to advertise the vineyard and its wares, and then put it into action.

- Sales Channels Management: Manage the company’s web store, its distribution routes, and its partnerships with local eateries and merchants.

Hospitality and Events Manager

- Event Planning: Make arrangements for private tours, gatherings, and celebrations held at the vineyard.

- Hospitality Services: Guarantee first-rate hospitality services for all event goers and visitors.

Financial Controller

- Financial Oversight: Budgeting, accounting, and financial planning are all part of managing the winery’s finances.

- Reporting and Compliance: Maintain financial record-keeping and report and insight-sharing on a regular basis.

Customer Service Representative

- Customer Relations: Manage client comments, take reservations for tastings and tours, and respond to general queries.

- Administrative Support: Assist the winery’s operations with administrative tasks.

Facilities and Maintenance Technician

- Facility Upkeep: Keep the winery grounds in good repair, making sure everything is secure and looking nice.

- Repairs and Maintenance: Take care of routine maintenance and any repairs that may be required for the winery’s equipment.

Organogram

Operational Overview

Services

Guided Vineyard Tours

- Educational Experience: Provide guided tours of the vineyard, covering everything from grape growing to harvesting and how wine is made.

- Scenic Exploration: Open the vineyard to the public so they may appreciate its natural beauty while learning about the distinctive terroir that influences your wines.

Wine Tasting Sessions

- Varied Selections: You should have tastings so guests may sample a variety of your wines, including both old and new vintages.

- Expert Guidance: Guests may learn about wine’s history, style, and pairings from the well-versed staff.

Private Event Hosting

- Exclusive Venues: Private events, such weddings, business get-togethers, or special celebrations, would look beautiful in your vineyard.

- Full-Service Packages: In order to make everything go well, you should provide cuisine, wine options, and event planning services.

Wine Club and Subscriptions

- Exclusive Membership: Initiate a wine club that provides members with exclusive events, discounts, and curated wine shipments on a regular basis.

- Tailored Subscriptions: Make it possible for clients to sign up for a service that will send them personalized wine recommendations on a regular basis.

Wine Education Workshops

- Learning Opportunities: Hold seminars and workshops that cover the history of wine, proper tasting procedures, and the art of wine enjoyment.

- Engaging Sessions: Designed for wine novices and aficionados alike, guided by seasoned sommeliers or specialists.

Wine and Culinary Pairings

- Gourmet Experiences: Put on events that showcase the perfect harmony between your wines and delectable dishes to show how the two go hand in hand.

- Collaborations with Chefs: To make your vineyard more special, team up with area chefs to provide one-of-a-kind meals.

Online Wine Sales

- E-Commerce Platform: Expand your customer base by selling your wines online and providing delivery all around the country.

- Special Promotions: Offer exclusive online discounts, time-sensitive sales, and gift bundles.

Custom Labeling Services

- Personalization: Customers may customize wine bottles with your custom labeling service, which is perfect for parties or business presents.

- Vine Adoption Programs

- Unique Engagement: You may create a special bond with wine lovers by letting them “adopt” a vine in your vineyard. This will provide them unique access to wines created from their vine, among other perks.

Corporate Partnerships

- B2B Services: Collaborate with companies to provide them with special wine choices, host events, or provide corporate gifts.

Industry Analysis

The global winery industry is expected to reach a value of $380.6 billion by 2026, growing at a CAGR of 4.8% from 2021 to 2026.

Source: globaldata

The worldwide winery business is expected to reach a value of $300 billion by 2027, expanding at a CAGR of 4.4% between 2022 and 2027. This growth may be attributed to factors such as increased disposable incomes, the popularity of wine tourism, and health awareness. Important factors influencing the market include premiumization, artisanal wine, sustainability, and online shopping. There are three main regional markets: North America, Europe, and Asia-Pacific. The sector faces threats from climate change, rivalry from other alcoholic drinks, and consolidation, while potential include entering new markets, creating innovative products, and using technology.

Other key trends and stats:

- Consumer Demand: Growing interest in high-quality, unique wines.

- Wine Tourism: Increasing popularity of vineyard visits and wine tasting experiences.

- Technological Advancements: Enhanced efficiency and innovation in winemaking.

- Economic Impact: Significant contribution to the global economy.

- Employment Opportunities: Wide range of jobs created globally in the industry.

Source: toptal

Industry Problems

- High Operational Costs: It may be costly to run a winery due to the expenses associated with staffing, winemaking procedures, and vineyard care.

- Seasonal Variability: Varieties and quantities of grapes are quite susceptible to variations in weather and seasons.

- Market Competition: There are a lot many wineries and wine brands out there, so it might be hard to distinguish apart.

- Consumer Preferences: Responding to the ever-evolving demands of wine drinkers.

- Distribution and Sales Channels: Developing efficient sales and distribution methods, particularly in a competitive market.

- Regulatory Compliance: Following all local, state, and federal laws and guidelines for the making, labeling, and export of wine.

- Sustainable Practices: The use of environmentally friendly and sustainable methods in winemaking and viticulture.

- Tourism and Visitor Experience: Making wine tourism stand out from the crowd by providing an unforgettable and exciting experience for guests.

- Technological Advancements: Using and investing in cutting-edge methods and equipment for winemaking.

Industry Opportunities

Flexible Pricing Models

Tiered Tasting Options: Provide a range of wine tasting experiences at varying price points to meet the needs of diverse customers.

Membership and Subscription Deals: Make a subscription service or wine club with special perks and accept members.

Group and Event Discounts: Offer discounts for reservations made by big parties or for private events.

Online Reservations and Efficient Scheduling

Digital Booking System: Tours and tastings may be more efficiently and conveniently booked online.

Flexible Scheduling: Please provide a range of time periods to accommodate the schedules of your visitors.

Maximize Visitor Flow: Overcrowding may be avoided by using the booking system to disperse guests equally.

Investment in Quality Wines and Facilities

Premium Wine Selection: Concentrate on making wines of exceptional quality that satisfy a variety of tastes.

Facility Upgrades: Keep the tasting rooms and other tourist amenities clean and updated on a regular basis to make their stay more enjoyable.

Highlight Unique Features: Use promotional materials to highlight your winery’s distinctive features, such as its commitment to sustainability or its special wine types.

Skilled and Knowledgeable Staff

Expert Team: Staff up with experts, including sommeliers and tour guides, to make your guests’ stay more memorable.

Continuous Training: Train your employees to provide excellent service to customers and educate them about wine.

Creating an Inviting Atmosphere

Ambiance and Comfort: Create an inviting and cozy atmosphere that will make your visitors want to kick back and enjoy themselves.

Visitor Amenities: Amenities such as cozy seats, beautiful scenery, and meal matching choices should be provided.

Enhancing Communication and Customer Engagement

Active Engagement: Encourage a culture where employees proactively interact with guests, tailoring their experience to their unique needs.

Feedback Mechanisms: Establish channels for collecting and acting upon client input in order to enhance service quality on an ongoing basis.

Diverse and Accessible Offerings

Wide Range of Products: To satisfy a wide range of tastes, provide a selection of wines and complementary items.

Accessibility: You should make sure that your vineyard can be easily accessed by everyone, including those with mobility issues.

Strategic Location and Accessibility

Convenient Location: If it is possible, choose a location that is easily accessible.

Transport Options: Help guests get about, particularly those who are going wine tasting, by providing or suggesting various modes of transportation.

Protecting Customer Information and Privacy

Data Security: Set up solid safeguards to keep client information private.

Transparency in Policies: Establish credibility by making data and privacy rules easy to understand.

Customized Services and Experiences

Personalized Experiences: Provide individualized wine experiences like private tours or wines with your own label.

Adaptability to Client Needs: Show adaptability and promptness in meeting the demands of individual clients.

Target Market Segmentation

Geographic Segmentation

Local Residents of Miami-Dade County

- Community Focus: Emphasize services and products that appeal to local residents, potentially creating wines or experiences that reflect local tastes and culture.

Miami Neighborhoods

- Targeted Experiences: Offer wine experiences tailored to residents of specific neighborhoods like Wynwood, Downtown Miami, or South Beach, known for their distinctive lifestyles and preferences.

Demographic Segmentation

- Age Groups: Cater to different age demographics, offering experiences that appeal to both younger wine enthusiasts and more mature connoisseurs.

- Income Levels: Provide a range of options, from affordable wine tastings for budget-conscious visitors to premium wine experiences for high-end clients.

- Cultural Diversity: Celebrate Miami’s rich cultural diversity with wine selections and events that appeal to various ethnic and cultural groups.

Psychographic Segmentation

- Wine Hobbyists and Enthusiasts: Target individuals who are passionate about wine, offering educational tours and tastings.

- Connoisseurs and Collectors: Provide exclusive services like private cellar tours and premium wine club memberships for serious wine aficionados.

Behavioral Segmentation

- Event-Goers: Host and offer tailored wine experiences for local events, festivals, and private gatherings.

- Tourists and Visitors: Create special packages for tourists, including vineyard tours and wine-tasting experiences that highlight the uniqueness of Miami’s wine culture.

Product Preferences

- Eco-conscious Consumers: Offer organic and sustainably produced wines for environmentally aware customers.

- Innovative Wine Experiences Seekers: Introduce innovative wine-tasting experiences like food pairings, blind tastings, or wine blending workshops.

Market Size

Total Addressable Market (TAM) for Winery

Market Scope: Your winery’s target audience encompasses all possible consumers within a certain market or geographic region who could be interested in purchasing wine. Anyone from serious wine drinkers to curious onlookers, collectors, and even national or international businesses like restaurants and shops might fall into this category.

Growth Factors: Key factors that might boost your winery’s TAM include the growing interest in wine tourism, the increase in consumption of fine wine, and the expansion of online wine sales.

Serviceable Addressable Market (SAM) for Winery

Geographic and Demographic Focus: Regional or demographic targeting may be more important to your SAM. The tourist market and local wine connoisseurs would both be part of your SAM if your winery was located in a prominent tourism location, for example.

Service Specialization: Target audiences for your SAM would be defined by the characteristics of your wines (e.g., organic, premium, or certain varietals) and the events, tastings, and tours that you provide.

Serviceable Obtainable Market (SOM) for Winery

Market Share Goals: You may capture a realistic piece of the SAM, which is represented by the SOM. The present size, reputation, distribution networks, and marketing tactics of your vineyard are taken into account here.

Influencing Factors: How much of the SAM you may anticipate to collect depends on factors including the quality of your wines, the distinctiveness of your guest experience, brand awareness, and the efficiency of your sales and marketing methods.

Industry Forces

Market Demand and Wine Consumption Trends

- Independent Producers and Boutique Wineries: There has been an upsurge in the desire for rare and handcrafted wines, driven by the proliferation of boutique wineries and other independent wine makers, much like the independent music movement.

- Technological Advancements: Technological advancements in the winemaking industry have increased both the variety and quality of wines available, much as in the music industry.

- Digital Marketing and Sales: New channels for contacting customers have emerged thanks to the convenience of selling and promoting wine via digital platforms.

Competition

- Diverse Market Players: In the winery sector, you may find anything from small, family-run vineyards to multinational conglomerates.

- Differentiation Strategy: Make a name for yourself by providing one-of-a-kind wines, unforgettable experiences, and tailored assistance.

Technological Advances

- Innovative Winemaking Techniques: To enhance the range and quality of your wines, stay updated on the newest advancements in winemaking technology.

- Digital Engagement: Promote your business and interact with customers via social media, online sales platforms, and CRM software.

Regulatory Environment

- Compliance with Laws and Regulations: Do business lawfully and uphold your reputation by following all regulations concerning the manufacture, sale, labeling, and export of alcoholic beverages.

- Awareness of Changes in Regulations: Keep yourself updated on any changes to industry rules so you can adjust your company operations appropriately.

Economic Factors

- Influence of Economic Climate: Learn how changes in consumer purchasing patterns and disposable income affect wine sales in the larger economic context.

Supplier Dynamics

- Reliance on Suppliers: Those vendors that are vital to the running of your winery, such as those who provide the grapes and the machinery, should be your first priority.

Customer Preferences and Expectations

- Adapting to Consumer Tastes: Keep yourself updated on the latest trends in wine packaging, consumer tastes, and wine tourism.

- Quality and Experience: To meet and beyond consumer expectations, make sure the goods are of great quality and that the vineyard visit is an unforgettable experience.

Social and Environmental Responsibility

- Sustainability Practices: To attract customers who are concerned about the environment, try using eco-friendly methods in winemaking and vineyard management.

- Community Engagement: To increase the positive impact your winery has on the community, get involved in local activities and donate to worthy causes.

Workforce Availability and Skills

- Skilled Personnel: Spend your money on experienced hospitality workers, viticulturists, and winemakers.

- Employee Development: Ensuring a high level of service and competence requires a focus on continual training and employee happiness.

Financials

Investment & Capital Expenditure

Revenue Summary

Cost of Goods Sold Summary

OpEX Summary

Income Statement

Cash Flow Statement

Balance Sheet

Related Articles on Business Plan: