Written by Elma Steven | Updated on July, 2024

How to Write a Dental Business Plan?

Dental Business Plan is an outline of your overall dental business. The business plan should include a 5 year financial projection, marketing plan, industry analysis, organizational overview, operational overview and finally an executive summary. Remember to write your executive summary at the end as it is considered as a snapshot of the overall business plan. You need to be careful while writing the plan as you need to consider various factors that can impact the business’s success.

Table of Contents

Executive Summary

Located in the middle of Miami Beach, Florida, Oceanview Dental Care is a modern dental office that prioritizes its patients and strives to provide them with outstanding oral healthcare. Isabella Hernandez started our dental practice with the goal of making sure her patients were comfortable and satisfied with the service they received. Aiming to establish new benchmarks in dental excellence within the dynamic Miami Beach neighborhood, Oceanview Dental Care takes a contemporary approach and is committed to creating great experiences for each patient. We strive to provide individualized and superior dental care.

Mission:In order to guarantee the oral health and happiness of each and every patient that enters our doors, we will use cutting-edge technology in conjunction with individualized treatment programs to provide thorough and caring dental care.

Vision:Through unwavering dedication to our patients, a focus on their unique needs, and active participation in the Miami Beach community, we want to become the dental practice of choice. When people need reliable dental care or information about their oral health, they may come to us.

Industry Overview:

A diversified population is served by the dentistry business in Miami Beach, which is seeing an increasing focus on oral health. Personalized patient experiences, technology developments in dentistry treatments, and heightened awareness of oral health are some of the market trends fueling growth.

Check out this guide on how to write an executive summary? If you don’t have the time to write on then you can use this custom Executive Summary Writer to save Hrs. of your precious time.

Financial Highlights

Earnings & Profitability

Break-Even Analysis

Business Description

Business Name:Oceanview Dental Care

Founders:Isabella Hernandez

Management Team: [You can ignore this/ delete this but its better to provide it]

Legal Structure: LLC

Location: Miami

Goals & Objectives:

- Build a Strong Patient Base: Recruit a more diverse patient population by reaching out to the neighborhood and building relationships with other medical professionals in the area. One way to attract and retain customers is to provide discounts or rewards for referring new ones.

- Enhance Brand Recognition: It is critical for the dental clinic to have a strong brand identity. Participation in online communities, strategic use of local advertising, and heavy use of social media are all part of this strategy.

- Deliver High-Quality Dental Services: It is critical to consistently provide first-rate dental treatment. Purchasing state-of-the-art dental equipment, providing continuous training for personnel, and keeping the clinic clean and pleasant are all part of this.

- Expand Services Portfolio: In order to meet the demands of a larger variety of patients, you may want to think about adding cosmetic dentistry or specialist dental procedures to your list of services over the next two years.

- Achieve Financial Stability: Create an all-inclusive company strategy with specific monetary objectives. For long-term success, it’s crucial to assess financial performance and make strategic changes on a regular basis.

- Foster a Patient-Centric Approach: Enhancing patient satisfaction and retention may be achieved by creating a patient-focused atmosphere that prioritizes individualized treatment and patient education.

- Incorporate Modern Technology: Improve patient care and operational efficiency by staying up-to-date on technology innovations in dentistry. This includes digital patient records and improved diagnostic instruments.

- Develop Strategic Partnerships: Expanding the practice’s reach may be achieved via establishing partnerships with dental experts to get patient referrals and by cooperating with local companies to promote each other.

Services:

- General Dentistry: Facilitating the preservation of patients’ general oral health by the provision of regular dental examinations, cleanings, fillings, and preventive treatment.

- Cosmetic Dentistry: Improve the beauty of your smile with services including bonding, veneers, and teeth whitening.

- Orthodontics: Offering orthodontic treatment, including braces and aligners, for patients of all ages to improve their bite and straighten their teeth.

- Pediatric Dentistry: Dental care tailored to the unique needs of children, with an emphasis on preventative measures, early diagnosis of problems, and instruction in proper oral hygiene practices.

- Periodontics: Taking care of issues with the gums, including gum disease therapy, scaling, and root planing.

- Endodontics: Expert in rehabilitating teeth that have suffered infection or deterioration via root canal therapy.

- Oral Surgery: These treatments include surgical operations performed inside the mouth, such as tooth extractions and removal of wisdom teeth.

- Prosthodontics: Making available dental restorations including implants, bridges, dentures, and crowns for patients suffering from tooth loss or injury.

- Emergency Dental Services: Offering immediate dental treatment in cases of severe pain, tooth damage, or injury to the mouth.

Financial Overview

Startup Cost

Revenue & Cost Projection

Profitability & Cash Flow Projection

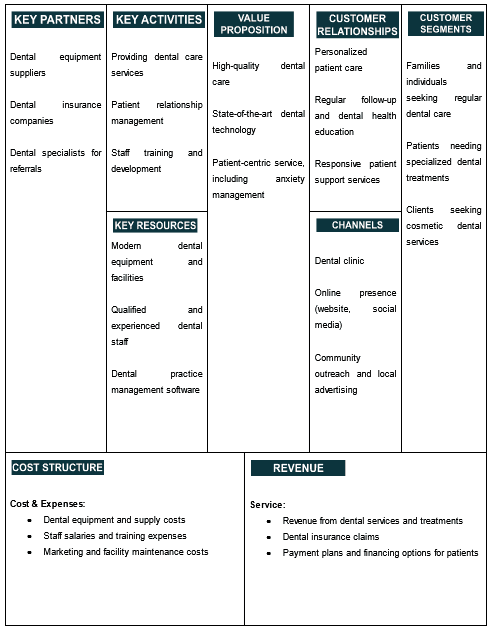

Business Model

Check out the 100 samples of business model canvas.

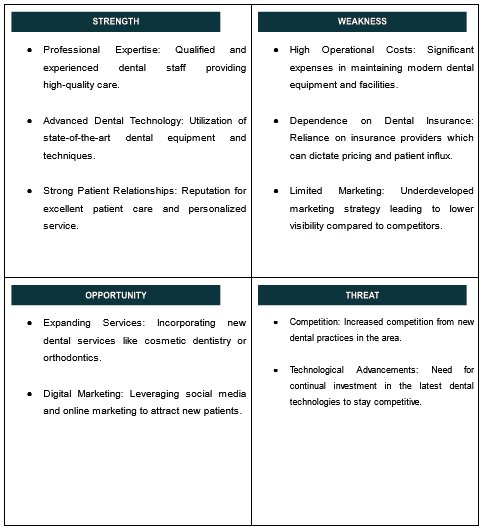

SWOT

Check out the 100 SWOT Samples

Marketing Plan

Promotional Channels

Social Media Marketing – $15,000 (30%)

- Platform Focus: Utilize platforms like Facebook, Instagram, and Twitter to showcase the dental office, patient testimonials, and before-and-after cases.

- Paid Ads: Targeted campaigns aimed at local residents, emphasizing services, patient care quality, and special promotions.

- Content Strategy: Regular posts about oral health tips, dental care services, and team highlights to engage and educate followers.

Website and SEO – $10,000 (20%)

- Website Revamp: Upgrade the website for a modern, user-friendly experience, showcasing services, patient testimonials, and easy appointment booking.

- Blog Content: Regularly update the blog with informative articles on dental health, treatments, and preventive care tips.

- SEO: Optimize for keywords related to dentistry, local dental services, and specific treatments to improve local search rankings.

Email Marketing – $5,000 (10%)

- Newsletter: Develop a regular newsletter featuring dental health tips, clinic updates, and special offers.

- Segmentation: Personalize email content for different patient groups, such as families, seniors, and those interested in cosmetic dentistry.

Local Partnerships and Community Involvement – $7,000 (14%)

- Local Partnerships: Collaborate with local businesses and schools for oral health education programs and special offers.

- Community Events: Participate in or sponsor local health fairs and community events to increase visibility and engagement.

Direct Mail and Local Advertising – $6,000 (12%)

- Direct Mail Campaigns: Send informational brochures, welcome offers, and appointment reminders to local residents.

- Local Advertising: Place ads in local newspapers, magazines, and community bulletin boards, and consider local radio spots.

Patient Referral Program – $4,000 (8%)

- Referral Incentives: Implement a referral program offering discounts or special services for patients who refer new clients.

- Patient Appreciation Events: Host events or giveaways to thank loyal patients and encourage referrals.

Professional Networking and Continuing Education – $3,000 (6%)

- Networking Events: Engage in dental associations and local business networks to build professional relationships.

- Continuing Education: Participate in or host continuing education events to stay current and build a reputation as a knowledgeable practice.

Brand Management

- Brand Development:

- Brand Identity: Create a professional and trustworthy brand image. This includes a memorable logo, consistent color scheme, and a tone of voice that conveys care and expertise.

- Office Aesthetics: Ensure your clinic’s interior design is welcoming and comforting to reduce patient anxiety.

- Digital Marketing:

- Website: Develop a user-friendly website with information about services, staff qualifications, testimonials, and online appointment booking.

- SEO: Optimize your website for search engines using relevant keywords like “dental services,” “teeth whitening,” “family dentist,” etc.

- Social Media: Regularly post engaging content on platforms like Instagram and Facebook, focusing on dental tips, patient success stories, and office events.

- Local Marketing and Community Engagement:

- Local Partnerships: Collaborate with local businesses and schools for mutual referral programs.

- Community Involvement: Participate in local health fairs and community events, offering free dental check-ups or educational sessions.

- Patient Experience Enhancement:

- Comfortable Environment: Create a calming atmosphere in your clinic with comfortable seating, pleasant decor, and soothing music.

- Patient Education: Use models, videos, and brochures to educate patients about dental health and procedures.

- Service Expansion and Specialization:

- Diverse Services: Offer a wide range of services from general dentistry to cosmetic procedures.

- Specialization: Consider specializing in areas like orthodontics or pediatric dentistry to attract specific patient groups.

- Customer Relationship Management (CRM):

- Personalized Communication: Use CRM tools to send appointment reminders, oral health tips, and personalized follow-ups.

- Feedback Collection: Regularly collect patient feedback to improve services and patient care.

- Staff Training and Development:

- Continuous Education: Encourage ongoing training and certification for your team.

- Team Building: Foster a positive work environment with regular team-building activities.

- Financial Management:

- Pricing Strategy: Set competitive pricing for your services, considering local market rates.

- Insurance and Payment Options: Offer various payment options and accept different insurance plans to cater to more patients.

- Regulatory Compliance:

- Legal Requirements: Stay up-to-date with dental practice regulations and compliance requirements.

- Emergency Dental Services:

- After-Hours Care: Offer emergency services or after-hours care for added patient convenience.

- After-Hours Care: Offer emergency services or after-hours care for added patient convenience.

- Referral Program:

- Incentives for Referrals: Implement a referral program to encourage patients to refer friends and family.

Go To Market Strategy

Online Presence and Community Engagement

- Professional Website: Create an informative and user-friendly website featuring services, staff bios, and patient testimonials. Include an online appointment booking feature.

- Educational Content: Publish blog posts or articles on oral health, dental care tips, and new treatments or technologies in dentistry.

- Local SEO: Optimize for local search by ensuring your clinic is listed in online directories and dental care portals.

- Partnerships and Community Programs: Collaborate with local schools, health fairs, and community centers to offer dental health talks or free check-up camps.

Clinic Launch and Promotional Activities

- Grand Opening Event: Host an open house event to introduce your clinic to the community. Include free consultations or dental check-ups.

- Introductory Offers: Provide special rates for first-time patients or discounts on certain treatments.

Digital Marketing and Patient Relations

- Social Media Presence: Use platforms like Instagram, Facebook, and YouTube to share dental health tips, patient success stories, and clinic updates.

- Email Marketing: Send newsletters with oral health tips, clinic news, and special promotions.

- Loyalty Program: Offer a program that rewards regular patients with discounts or complimentary services after a certain number of visits.

Brand Awareness and Community Engagement

- Local Media Outreach: Engage with local newspapers and radio stations for features or interviews about dental health awareness.

- Community Involvement: Participate in or sponsor local health events and school programs.

- Influencer Collaborations: Partner with local health and wellness influencers for promotions or educational content.

Performance Tracking and Adaptation

- Analytics and Feedback: Use tools like Google Analytics and patient feedback surveys to assess the effectiveness of your marketing efforts.

- Strategy Adaptation: Stay flexible and ready to adjust your strategies according to market trends and patient feedback.

Organizational Overview

Founder

Isabella Hernandez is a major player in the dental field because she combines a deep understanding of patient care and clinical dentistry with a deep commitment to her patients’ oral health. She decided to become a dentist after developing a lifelong passion for healthcare and deciding to get a degree in dental medicine. Isabella possesses the clinical abilities and sympathetic attitude to succeed in the industry thanks to her educational background.

Isabella has honed her abilities over the years working in a variety of dental clinics, gaining a thorough awareness of both the technical parts of dental procedures and the complexities of patient care and communication. She is a respected and beloved member of her community for her mastery of contemporary dentistry procedures and her compassionate attitude toward her patients.

Isabella’s dentistry clinic, which she founded with an entrepreneurial flair, is more than just a treatment facility. Building a warm and accepting environment where patients feel heard and understood is important to her company’s mission. She gives people a place to learn about preventative dentistry and the value of patient education because she thinks it’s important.

Her dedication to provide exceptional treatment with a focus on the individual patient drives the day-to-day operations of the clinic. The clinic is committed to providing high-quality dental treatment in a welcoming atmosphere using cutting-edge dental technologies.

Beyond her clinic, Isabella is very involved in the community. Sharing what she has learned and making connections with patients and other medical professionals, she is an active participant in community health fairs and educational programs. She gains a deeper awareness of the dynamic area of dentistry and is more motivated to have a good impact on her community’s health via this participation.

The dental clinic run by Isabella Hernandez is well on its way to becoming a landmark in her community as a result of her leadership’s emphasis on patient education and the importance of cutting-edge treatment methods. Isabella’s tale is about more than just her professional accomplishments; it’s also about her dedication to building a healthy community and her enthusiasm for oral health.

Positions and Responsibilities

Chief Executive Officer (CEO) – Isabella Hernandez

Responsibilities: Isabella Hernandez is in charge of the whole dentistry office as CEO. She also establishes long-term objectives and acts as the clinic’s representative in business transactions. She oversees the clinic’s finances, takes important choices, and guarantees that patients get top-notch dental treatment.

Practice Manager

Responsibilities: Oversees patient scheduling, manages day-to-day operations, and maintains clinic efficiency. Providing excellent patient care, managing resources, and coordinating personnel are all part of this profession.

Dental Hygienists

Responsibilities: Give patients checkups, cleanings, and education on how to properly care for their teeth. Collaborating with dentists, they are vital to patients’ overall treatment and the upkeep of their dental health.

Dental Assistants

Responsibilities: Perform dental treatments with the help of an assistant, set up treatment rooms, and make sure patients are comfortable. The efficiency of dental procedures and patient care relies on them.

Customer Service Representative

Responsibilities: Assists with administrative tasks, schedules appointments, and responds to patient queries. From the very first point of contact, they play a crucial role in ensuring a great patient experience.

Marketing Coordinator

Responsibilities: Creates plans to advertise the dentistry office. In charge of patient interaction, community outreach, and internet presence with the goal of bringing in new patients and keeping old ones.

Financial Controller

Responsibilities: Responsible for overseeing the clinic’s budget, billing, and accounting processes. Maintains financial records and provide useful information for company decisions.

Human Resources Manager

Responsibilities: Manages the hiring, induction, and professional growth of employees. Keeps the workplace pleasant and in accordance with all applicable rules and regulations.

Organogram

Operational Overview

Services

- General and Cosmetic Dentistry

- Comprehensive dental exams and cleanings.

- Dentistry treatments such as bonding, veneers, and tooth whitening are purely cosmetic.

- Fillings, crowns, and bridges are examples of common dental procedures.

- Orthodontic Services

- Classic metal braces and contemporary transparent plastic ones.

- Consultation and continuous therapy for dental alignment.

- Assistance for people of all ages…

- Pediatric Dentistry

- Dedicated dental treatment for your little ones.

- Pleasant and reassuring setting for families with small children.

- Pay special attention to children’s preventative dental care and education.

- Periodontal Care

- Gum disease diagnosis and treatment.

- Preventive measures and maintenance programs.

- Advanced procedures including thorough cleaning and gum surgery.

- Endodontics and Oral Surgery

- Therapy and treatments for root canals…

- Tooth extractions, including wisdom teeth removal.

- Procedures involving surgery, such as dental implants

- Emergency Dental Services

- Dental emergencies need immediate attention.

- Acute discomfort, fractured teeth, and infections are among the conditions that may be treated.

- Preventive Dentistry and Education

- Regular check-ups and dental hygiene treatments.

- Maintenance of oral health education for patients.

- Advanced Diagnostic Technology

- Using intraoral cameras, 3D imaging, and digital X-rays.

- Precision in diagnosis and effective organization of therapy.

- Sedation Dentistry

- Options for anxiety-free dental operations.

- Adjustable sedation levels to meet individual patient requirements.

- Tele-dentistry Consultations

- Online consultations for first evaluations and subsequent appointments.

- Apt for out-of-town patients or those undergoing preliminary assessments.

Industry Analysis

An impressive compound annual growth rate (CAGR) of 6.1% is anticipated for the worldwide dentistry business between 2023 and 2028, leading to a startling $557.5 billion by that year. Several critical causes are responsible for this substantial expansion.

Source: marketresearchfuture

The United States will have a substantial impact on the worldwide dental business, which is projected to reach an astounding $557.5 billion by 2028. Several causes are propelling this remarkable expansion, such as growing disposable incomes, heightened awareness about the importance of oral health, an aging population, and innovations in dental technology. Aesthetic dentistry, data-driven decision-making, tele-dentistry, individualized treatment, and prevention are some of the major trends influencing the business. Still, there are obstacles including cost, a lack of qualified workers, and rules and regulations. Growth may be achieved by targeting underdeveloped regions, developing expertise in a particular field, using technology to your advantage, providing services that provide value, and fostering patient loyalty. Small, medium, and big practices make up the industry’s structure, and consolidation and the participation of dental service companies are on the rise.

Other key trends and stats:

- Personalized Dentistry: Tailored treatment plans based on individual needs and preferences.

- Preventative Care: Focus on early intervention and proactive maintenance for optimal oral health.

- Aesthetic Dentistry: Growing demand for services like teeth whitening, veneers, and orthodontics.

- Data-Driven Decision Making: Utilizing data analytics to optimize operations, improve patient outcomes, and personalize treatment plans.

- Market Growth: Global dental market projected to reach $557.5 billion by 2028.

Source: ibisworld

Industry Problems

- High Costs: Address the expense of dental treatments by offering payment plans and accepting various insurance.

- Scheduling and Wait Times: Improve patient experience with an efficient booking system and reduced waiting times.

- Dental Anxiety: Alleviate patient anxiety with a calming clinic environment and sedation options.

- Quality of Care: Ensure high-quality dental services by investing in modern equipment and staff training.

- Location Accessibility: Choose a convenient, accessible clinic location for patients.

- Personalized Treatment Plans: Offer tailored treatments to meet individual patient needs.

- Emergency Services: Provide prompt care for dental emergencies.

- Communication and Education: Maintain clear communication with patients and educate them about oral health and treatments.

Industry Opportunities

- Flexible Pricing Models: To make dental treatments more affordable, consider using tiered pricing or package discounts. To cater to a range of budgets, you can think about providing discounted pricing for frequent checkups or family packages.

- Efficient Online Booking and Scheduling: To make appointment scheduling easier, use an online system. Provide patients with a range of appointment times, from early mornings to late nights and weekends, to accommodate their busy schedules.

- Investment in Advanced Dental Equipment and Facilities: Keep the dentist office clean and comfortable by regularly upgrading the equipment. Patients who prioritize sophisticated treatment choices and high-quality care are drawn to this.

- Hiring Skilled Dental Professionals: Team up with seasoned dental professionals, including hygienists and support personnel. Maintain a steady stream of education for them on modern dentistry procedures and patient care standards.

- Creating a Comfortable and Welcoming Environment: Make the dentist’s office a relaxing and welcoming place for patients. A relaxing atmosphere, a children’s play area, and a pleasant waiting space may all contribute to a more enjoyable experience for patients.

- Effective Communication and Collaboration: Maintain patient-provider dialogue that is both clear and compassionate. In order to boost patient happiness and trust, it is important to have in-depth conversations about treatment plans and include patients in making decisions.

- Comprehensive Dental Services: Give people a one-stop-shop for all of their dental needs by offering preventative, restorative, cosmetic, and emergency treatment.

- Convenient Location and Accessibility: Look for a spot that has plenty of parking or is close to public transportation. Expanding your patient group to include those who have mobility issues is another option.

- Privacy and Confidentiality Measures: Protect patient information and earn their confidence by strictly following privacy rules. It is critical to guarantee the safety of electronic health records.

- Personalized Dental Care: Make dental care individualized for each patient. Patient happiness and loyalty may be enhanced by personalized treatment programs that appeal to a varied patient base.

Target Market Segmentation

- Geographic Segmentation

- Local Residents: Focus on residents of specific neighborhoods or regions, understanding their specific dental needs and preferences.

- Urban vs. Suburban Areas: Differentiate services based on urban or suburban locations, which might have varying demographic profiles.

- Demographic Segmentation

- Age Groups: Offer services catering to different age groups – children, adults, and seniors, each with their unique dental requirements.

- Income Levels: Provide a range of services from basic dental care to more advanced cosmetic procedures to cater to various income levels.

- Cultural Diversity: Embrace the cultural diversity of your area by understanding and addressing specific dental concerns of different ethnic groups.

- Psychographic Segmentation

- Health-Conscious Individuals: Target patients who are particularly proactive about their dental health.

- Cosmetic-Focused Clients: Cater to those who are more interested in cosmetic dentistry for aesthetic enhancement.

- Anxiety-Prone Patients: Offer a calming and reassuring environment for patients who have dental anxiety.

- Behavioral Segmentation

- Regular Check-up Clients: Focus on patients who come in for regular dental check-ups and maintenance.

- Emergency Care Seekers: Be prepared to offer urgent dental care for emergencies.

- Specialized Treatment Seekers: Cater to patients seeking specialized treatments like orthodontics, periodontics, or endodontics.

- Technological Segmentation

- Tech-Savvy Patients: Utilize modern technology like online booking, virtual consultations, and advanced dental treatment technologies.

- Traditional Service Seekers: Some patients may prefer traditional methods of treatment and communication. Catering to their comfort can be beneficial.

.

Market Size

- Total Addressable Market (TAM) for Dental Business: The total addressable market (TAM) is the sum of all the people who might need dental care in your area. This encompasses all individuals who could benefit from dental treatment, ranging from regular exams to more advanced procedures. Population increase, health consciousness, and the allure of cosmetic dentistry are all variables that impact the TAM. This is the largest possible customer base for your business.

- Serviceable Addressable Market (SAM) for Dental Business: Based on the TAM, the SAM determines which market segment is feasible to target. It is determined by the demographics you want to serve, the dental treatments you provide, and the location of your clinic. A primary dental practice in a rural location would have a different SAM than a cosmetic dentistry practice in a metropolitan region.

- Serviceable Obtainable Market (SOM) for Dental Business: The SOM represents the portion of your SAM that has a reasonable chance of being captured. This is conditional on things like the efficacy of your clinic’s marketing, the knowledge and experience of your employees, and the quality of care you provide. The SOM is a more specific subset of the market that stands in for the people you really want to do business with.

Industry Forces

Market Trends & Patient Demands: Always be up-to-date on the latest dental care trends, such as modern dental technology and cosmetic dentistry. Serve a wide variety of customers, from those in need of general dental checkups to those wanting more advanced procedures.

Competition: Make a name for yourself in the industry by providing cutting-edge care, innovative treatment alternatives, and a relaxing environment for your patients. Get noticed by providing something no one else does or by focusing on a niche that your local rivals don’t go into much detail about.

Technological Advancements: If you want more precise treatments and happier patients, you should upgrade to modern dental technologies like digital X-rays, laser dentistry, and 3D imaging. Use electronic means of communication, record keeping, and appointment scheduling.

Regulatory Compliance: Maintain a dental office that complies with all applicable rules and regulations, including those pertaining to patient privacy (such as HIPAA in the United States) and health and safety. Keep abreast on any new dental rules or regulations.

Economic Factors: It is important to consider the local economic climate since it affects patients’ capacity to pay for dental treatment. Think about collaborating with many insurance carriers or providing various payment alternatives.

Supplier Relationships: It is important to be in touch with the dental equipment and material providers. To provide your patients the finest alternatives, stay up-to-date on the latest dental equipment and materials.

Patient Preferences & Expectations: Recognize and accommodate individual patient preferences about dental care, such as level of comfort, treatment alternatives, and availability of appointments. Provide excellent service in a comfortable setting with short wait times and a focus on patient happiness.

Social & Environmental Responsibility: Make your workplace more environmentally friendly by doing things like cutting down on waste and utilizing sustainable products. Participate in community activities and dental health education initiatives.

Workforce Skills & Training: Recruit competent dentists and ancillary workers. Make sure your staff is up-to-date on the latest dental practices and patient care approaches by providing chances for professional development and continuing training.

Financials

Investment & Capital Expenditure

Revenue Summary

Cost of Goods Sold Summary

OpEX Summary

Income Statement

Cash Flow Statement

Balance Sheet

Related Articles: