Written by Elma Steven | Updated on June, 2024

Executive Summary

Overview: New Seasons Adult Family Homes, Inc. aims to raise public awareness of the needs of the developmentally disabled and elderly; to research grant information from foundations, public and private corporate giving programs that share our values and will partner with us to help serve or advocate for disadvantaged people; and to educate the public about the funding needs of organizations that provide these types of services or advocacy for underprivileged people.

Mission: We exist to assist people in reaching their full potential in a compassionate, loving, and competent environment, to promote independence, and to allow each person to be fully integrated into the community in which they live.

Vision: To make this season the finest of your life and establish ourselves as the community’s chosen home health care provider.

Industry Overview: A broad range of residential care facilities and programs comprise the Group Homes sector. Group foster homes, orphanages, children’s villages, midway group homes, and boot camps are all part of the system. Both familial and nonrelative foster homes need industry services. The US Department of Health and Human Services (HHS) and state and local governments support the majority of programs. The bulk of the industry’s income is projected to come from government financing, with the rest coming from private contributions and fees.

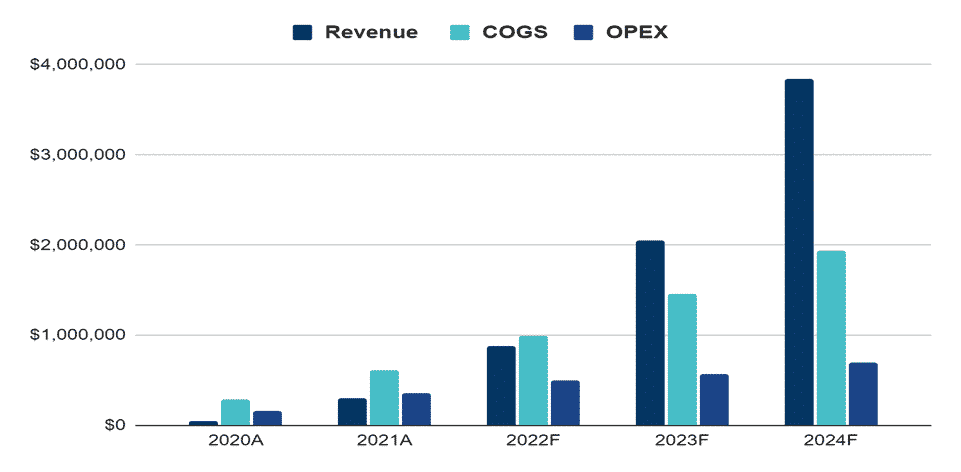

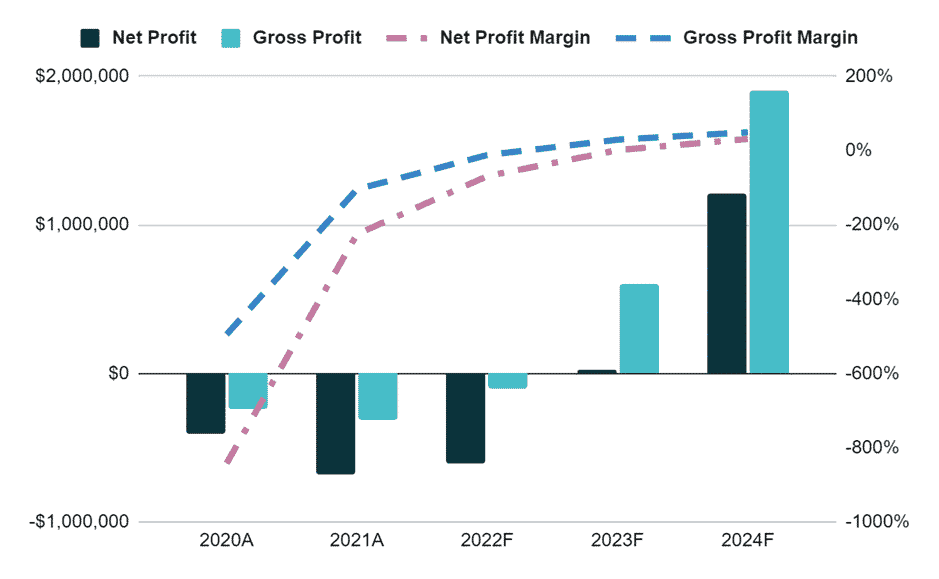

Financial Overview:

Financial Highlights:

| Liquidity | 2020A | 2021A | 2022F | 2023F | 2024F |

| Current ratio | 6 | 12 | 23 | 32 | 42 |

| Quick ratio | 6 | 11 | 22 | 31 | 40 |

| DSO | 8 | 8 | 8 | 8 | 8 |

| Solvency | |||||

| Interest coverage ratio | 8.2 | 11.1 | 14.2 | ||

| Debt to asset ratio | 0.01 | 0.01 | 0.2 | 0.18 | 0.16 |

| Profitability | |||||

| Gross profit margin | 51% | 51% | 53% | 53% | 53% |

| EBITDA margin | 12% | 14% | 21% | 22% | 22% |

| Return on asset | 5% | 6% | 13% | 14% | 14% |

| Return on equity | 5% | 6% | 16% | 17% | 17% |

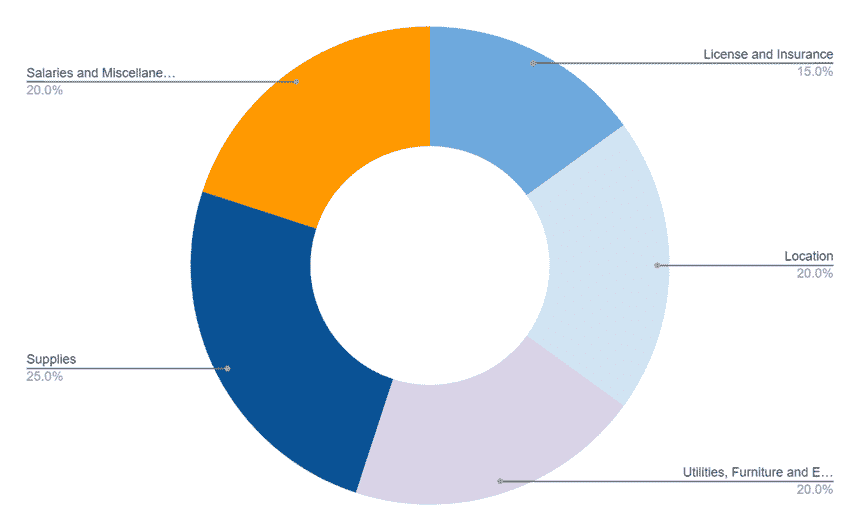

FUND USAGE:

Industry Analysis

Group homes provide a safe and secure environment for those dealing with medical or mental issues. Individuals might benefit from group homes because they can mingle and meet new people. Group houses come in a variety of forms. There are houses for children and teenagers, the elderly, disabled people, and others who need constant monitoring and care (ibisworld).

The Orphanages and Group Homes sector’s income has improved marginally during the five years to 2019, as demand for industry services has rebounded after a lengthy period of decline. The number of children in foster care has grown modestly in recent years, according to the Children’s Bureau, and government expenditure on foster care has increased to keep up with demand during the bulk of that time. Despite rising demand, this business is expected to diminish during the next five years, from 2018 to 2024 (Researchgate). As disposable income rises, so will federal financing for Medicare and Medicaid. However, during the next five years, it is expected that government spending on social services will decrease. Foster care, group homes, halfway houses, orphanages, and boot camps are all part of this sector. Substance addiction treatment centers, retirement homes, correctional facilities, and temporary shelters are not included in the industry. Although specific services are provided to adults, these institutions are mainly for children and youth.

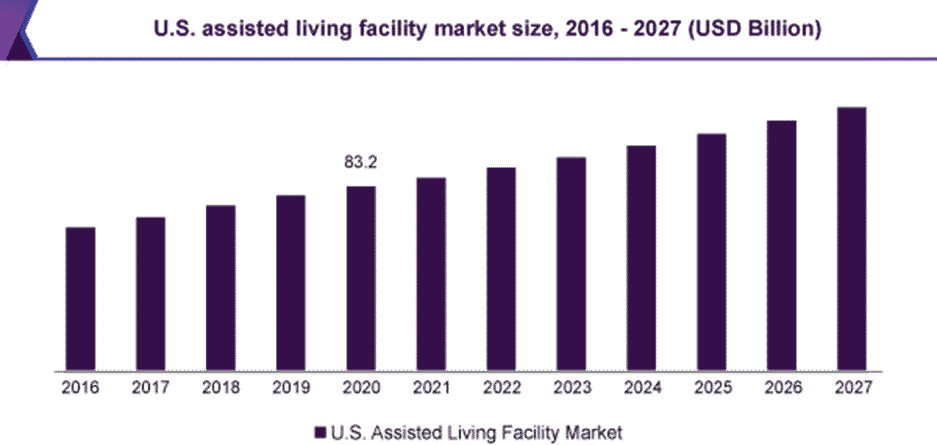

As of 2022, the United States had 9,071 orphanages and group homes, up 3.4 percent from 2021. Over the five years between 2017 and 2022, the number of enterprises in the Orphanages & Group Homes sector in the United States increased by 3.4 percent each year. In the United States, the orphanages and group homes sector is labor-intensive, meaning enterprises rely on labor rather than capital. Wages (52.2%), Purchases (4.9%), and Rent & Utilities (4.9%) are the top business expenses in the Orphanages & Group Homes sector in the United States, as a percentage of sales (4.4 percent ). From 2021 to 2027, the market for assisted living facilities in the United States is predicted to rise at a compound annual growth rate (CAGR) of 5.3 percent. The market is expected to develop due to the increasing elderly population and the rising prevalence of brain injuries. Over the projected period, the market is likely to be driven by the increasing incidence of target illnesses and developments in assisted living facilities. Over the projection period, a prominent market driver is expected to be the growth in the elderly population. According to the National Institute on Aging (NIA), around 8.5 percent of the world population is 65 or older. According to research provided by Aging.com, by 2040, two million housing units for senior inhabitants would be required, according to a study provided by Aging.com (jstor).

While working on the industry analysis section of the Home Group business plan make sure that you add significant number of stats to support your claims and use proper referencing so that your lender can validate the data.

The idea of continuing care retirement homes is gaining popularity among seniors with a lot of money. These retirement villages are mostly for persons over the age of 50. The goal of these communities is to keep elders from having to move when they need more excellent care. Consequently, the segment of people under 65 years old is expected to grow somewhat throughout the projection period.

The market for ALFs is predicted to expand in the United States due to technological advancements. Over the projected period, the market is expected to rise due to the development of sophisticated and easy-to-use devices and services, such as internet-enabled home monitoring, telemedicine, and mobile health applications. An electronic medication adherence system, for example, may monitor patients’ medication regimens and whether or not they’re sticking to them. Caregivers may program these gadgets or software to remind patients to take their medications. As a result, the market expansion is expected to be fueled by advanced devices and equipment development for ALFs throughout the research period.

Assisted living facility residents may be at a greater risk of getting COVID-19 due to the nature of the population served and the services provided. According to the CDC, around 2.1 million individuals resided in residential care or ALFs and nursing homes in the early months of the pandemic, accounting for 0.6 percent of the US population. ALF residents accounted for 42 percent of all COVID-19 fatalities in the United States.

Over the next five years, the group home business will likely expand rapidly. In the United States, there are 9,623 group homes, with an $8 billion market. In terms of market size, the group homes industry in the United States is placed 31st. Minimal competition and low revenue fluctuation are the two critical favorable characteristics impacting this business. The federal government’s spending on Medicare and Medicaid is likely to rise, creating an opportunity for the healthcare business. Children and adults with disabilities in long-term residential care institutions rely heavily on Medicaid. Industry income increases as government support for these programs increases. Furthermore, the ongoing expansion of the elderly population and those with various forms of impairment have boosted the demand for industry services.

Marketing Plan

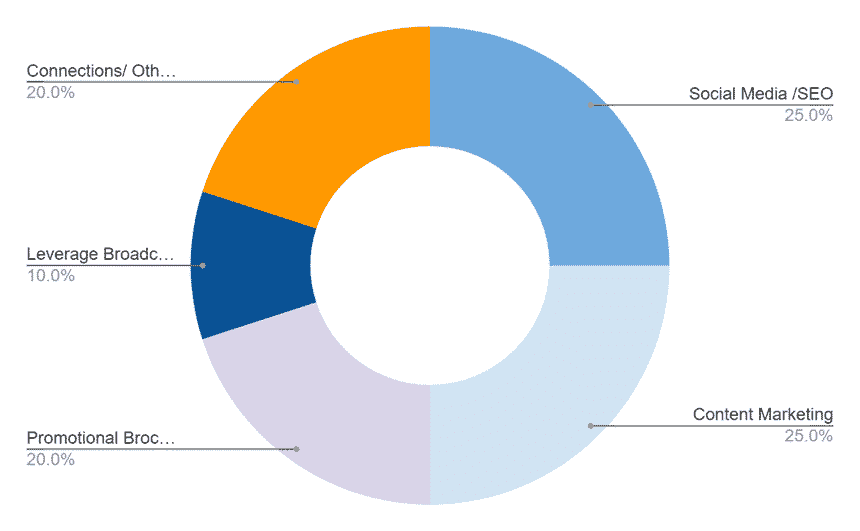

Content Marketing: Create a blog for potential consumers on your New Seasons Adult Family Homes website.

Social Media/SEO: Engage with and promote New Seasons Adult Family Homes on Twitter, share news on Facebook, and promote handpicked images of your space and events on Instagram. Consider if you have room in your budget for Facebook Marketing or other social media-related advertisements. Local SEO makes it easy for local customers to learn about what you have to offer and builds trust among prospective members.

Promotional Brochure: Brochures with the New Seasons Adult Family Homes logo. The leaflet contains thorough information about New Seasons Adult Family Homes residents.

Leverage Broadcast Advertising: Broadcast advertising has suffered significant setbacks over the last several decades. The number of people watching local television and listening to local radio has decreased, and the business has battled to recover its footing. It would be a mistake, however, to completely dismiss televised advertising. It’s worth noting that many group home companies may still benefit from it. Connections/Others: Most group home placements are based on recommendations from case managers and other human service providers.

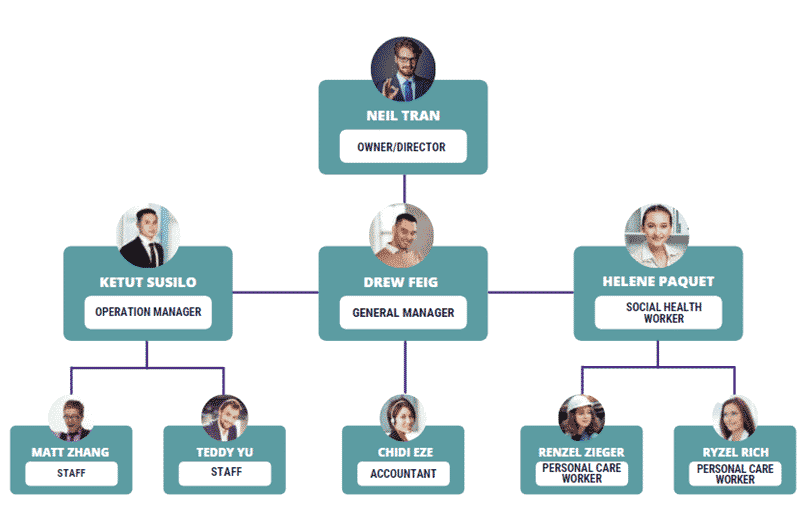

Organogram

Financial Plan

Earnings:

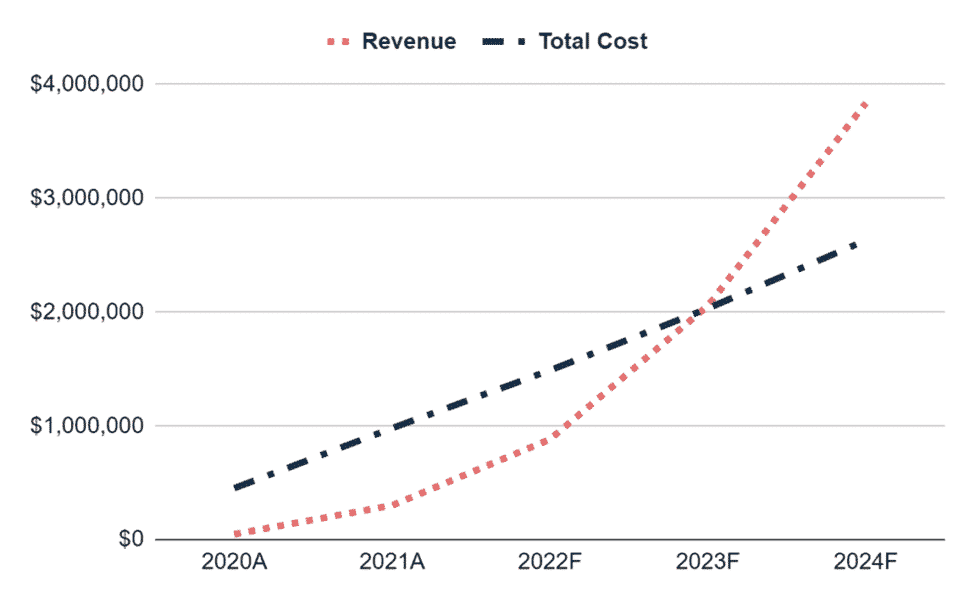

Break-Even Analysis:

Income Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| Total Cost of Revenue | 285,560 | 615,220 | 987,794 | 1,455,612 | 1,935,625 |

| as % of revenue | 595% | 204% | 112% | 71% | 50% |

| Gross Profit | -237,575 | -313,984 | -105,583 | 601,578 | 1,902,218 |

| SELLING & ADMIN EXPENSES | |||||

| Item 1 | 28,000 | 96,800 | 154,880 | 175,692 | 193,261 |

| Item 2 | 75,000 | 105,000 | 120,000 | 120,000 | 120,000 |

| Item 3 | 36,000 | 96,000 | 108,000 | 120,000 | 120,000 |

| Item 4 | 8,000 | 12,000 | 12,000 | 12,000 | 12,000 |

| Item 5 | 3,839 | 18,074 | 44,111 | 61,716 | 115,135 |

| Item 6 | 3,359 | 12,049 | 26,466 | 41,144 | 76,757 |

| Item 7 | 5,600 | 10,000 | 12,904 | 15,034 | 17,376 |

| Item 8 | 6,667 | 14,000 | 22,067 | 30,940 | 40,701 |

| Total selling & admin expenses | 166,464 | 363,924 | 500,428 | 576,525 | 695,230 |

| as % of revenue | 347% | 121% | 57% | 28% | 18% |

| Net profit | -404,039 | -677,907 | -606,011 | 25,052 | 1,206,987 |

| Accumulated net profit | -404,039 | -1,081,947 | -1,687,957 | -1,662,905 | -455,918 |

Cash Flow Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| CASH FLOW from OPERATING ACTIVITIES | |||||

| Net profit before tax | -$404,039 | -$677,907 | -$606,011 | $25,052 | $1,206,987 |

| Depreciation | $44,267 | $85,333 | $120,504 | $158,127 | $199,512 |

| Payables | |||||

| Item 1 | $4,333 | $5,417 | $6,500 | $7,583 | $8,667 |

| Item 2 | $11,667 | $28,000 | $46,667 | $70,000 | $93,333 |

| Item 3 | $6,250 | $8,750 | $10,000 | $10,000 | $10,000 |

| Item 4 | $3,000 | $8,000 | $9,000 | $10,000 | $10,000 |

| Item 5 | $667 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| change in payables | $25,917 | $25,250 | $22,000 | $25,417 | $24,417 |

| Receivables | |||||

| Item 1 | $320 | $1,506 | $3,676 | $5,143 | $9,595 |

| Item 2 | $360 | $1,807 | $4,411 | $8,229 | $11,514 |

| Total receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| change in receivables | -$680 | -$2,634 | -$4,773 | -$5,285 | -$7,736 |

| Net cash flow from operating activities | -$334,536 | -$569,958 | -$468,280 | $203,311 | $1,423,180 |

| CASH FLOW from INVESTING ACTIVITIES | |||||

| Item 1 | $16,000 | $13,200 | $14,520 | $15,972 | $17,569 |

| Item 2 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Item 3 | $28,000 | $22,000 | $14,520 | $10,648 | $11,713 |

| Item 4 | $96,000 | $88,000 | $72,600 | $79,860 | $87,846 |

| Item 5 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Net cash flow/ (outflow) from investing activities | -$180,000 | -$167,200 | -$150,040 | -$159,720 | -$175,692 |

| CASH FLOW from FINANCING ACTIVITIES | |||||

| Equity | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net cash flow from financing activities | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net (decrease)/ increase in cash/ cash equivalents | -$114,536 | -$297,158 | -$134,320 | $575,991 | $1,833,128 |

| Cash and cash equivalents at the beginning of the year | – | -$114,536 | -$411,693 | -$546,014 | $29,978 |

| Cash & cash equivalents at the end of the year | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

Balance Sheet:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| NON-CURRENT ASSETS | |||||

| Item 1 | $16,000 | $29,200 | $43,720 | $59,692 | $77,261 |

| Item 2 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Item 3 | $28,000 | $50,000 | $64,520 | $75,168 | $86,881 |

| Item 4 | $96,000 | $184,000 | $256,600 | $336,460 | $424,306 |

| Item 5 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Total | $180,000 | $347,200 | $497,240 | $656,960 | $832,652 |

| Accumulated depreciation | $44,267 | $129,600 | $250,104 | $408,231 | $607,743 |

| Net non-current assets | $135,733 | $217,600 | $247,136 | $248,729 | $224,909 |

| CURRENT ASSETS | |||||

| Cash | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

| Accounts receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| Total current assets | -$113,856 | -$408,380 | -$537,927 | $43,349 | $1,884,214 |

| Total Assets | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

| LIABILITIES | |||||

| Account payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| Total liabilities | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| EQUITIES | |||||

| Owner’s equity | $400,000 | $840,000 | $1,324,000 | $1,856,400 | $2,442,040 |

| Accumulated net profit | -$404,039 | -$1,081,947 | -$1,687,957 | -$1,662,905 | -$455,918 |

| Total equities | -$4,039 | -$241,947 | -$363,957 | $193,495 | $1,986,122 |

| Total liabilities & equities | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

Related Articles: