Written by Elma Steven | Updated on July, 2024

Executive Summary

Overview: Rex Morgan CBD Hemp Farms, LLC is a registered and licensed CBD hemp farm based in Sioux Falls, South Dakota, United States of America. We will sell our products in and around South Dakota because we know our products will be in great demand owing to the state’s demographic makeup. Governor Dennis Daugaard of South Dakota signed Senate Bill 95 into law on March 17, 2017. The bill added cannabidiol to the list of Schedule IV banned narcotics and exempted it from the classification of marijuana, but it stipulated that the CBD must come from a product that has been certified by the US Food and Drug Administration (FDA). We will be producing a special variety of the plant species Cannabis sativa L for medical and lawful recreational use at Rex Morgan CBD Hemp Farms, LLC.

Mission:” Our Mission is to begin full-time commercial production of hemp and other similar nursery plants and flowers that will not only be sold in the United States but also exported to other countries.

Vision: “Our Vision is to become one of the top ten CBD hemp farms in the world, not only in the United States of America”

Industry Overview: The CBD hemp farming industry is part of the Plant & Flower Growing industry, which grows nursery plants like trees and shrubs, as well as flowering plants like cannabis, foliage plants, cut flowers, flower seeds, and ornamentals, as well as short-rotation woody trees like Christmas trees and cottonwoods.

Financial Overview:

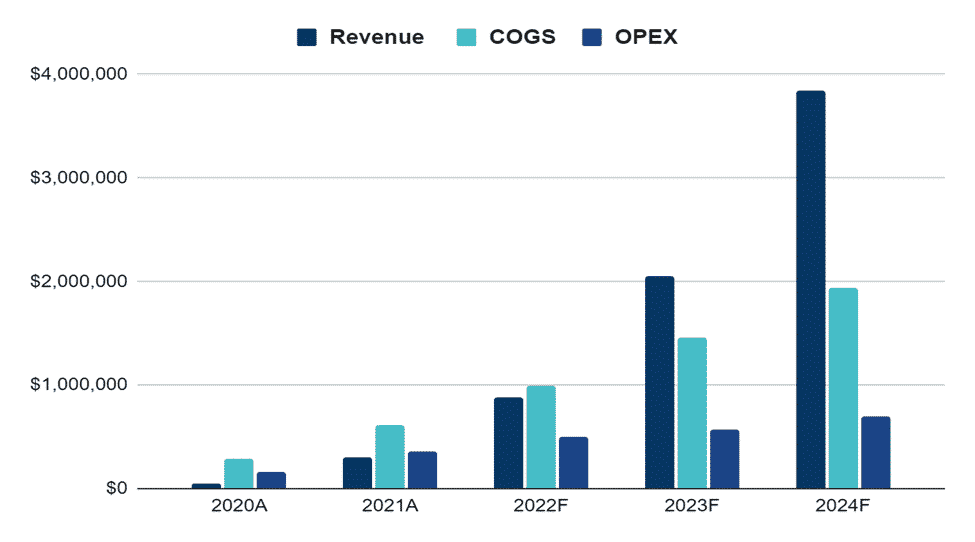

Financial Highlights:

| Liquidity | 2020A | 2021A | 2022F | 2023F | 2024F |

| Current ratio | 6 | 12 | 23 | 32 | 42 |

| Quick ratio | 6 | 11 | 22 | 31 | 40 |

| DSO | 8 | 8 | 8 | 8 | 8 |

| Solvency | |||||

| Interest coverage ratio | 8.2 | 11.1 | 14.2 | ||

| Debt to asset ratio | 0.01 | 0.01 | 0.2 | 0.18 | 0.16 |

| Profitability | |||||

| Gross profit margin | 51% | 51% | 53% | 53% | 53% |

| EBITDA margin | 12% | 14% | 21% | 22% | 22% |

| Return on asset | 5% | 6% | 13% | 14% | 14% |

| Return on equity | 5% | 6% | 16% | 17% | 17% |

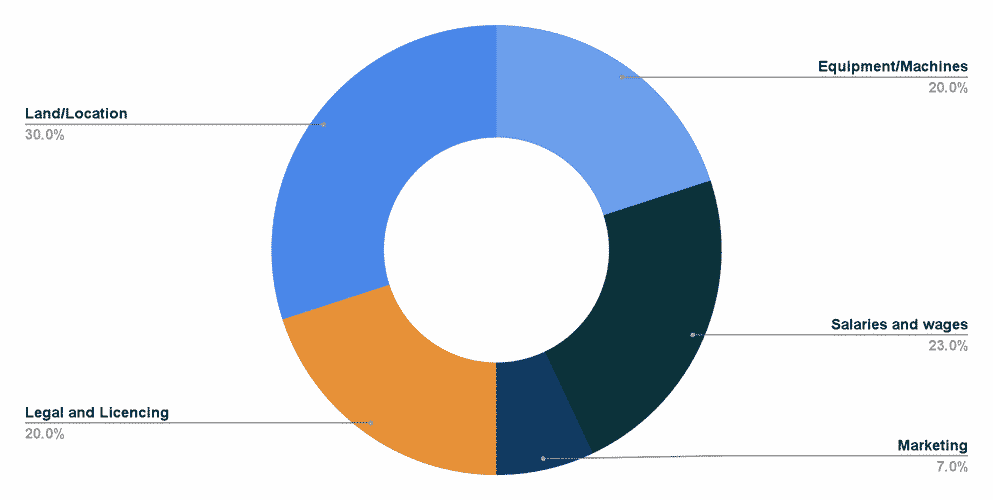

Fund Usage:

Industry Analysis:

The industry analysis section of the hemp farm business plan will help you get better insights into competitors, market growth, and overall industry prospects. You can order a custom market research report for your hemp farm business.

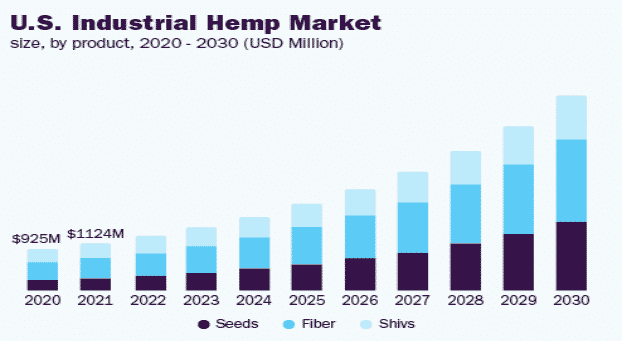

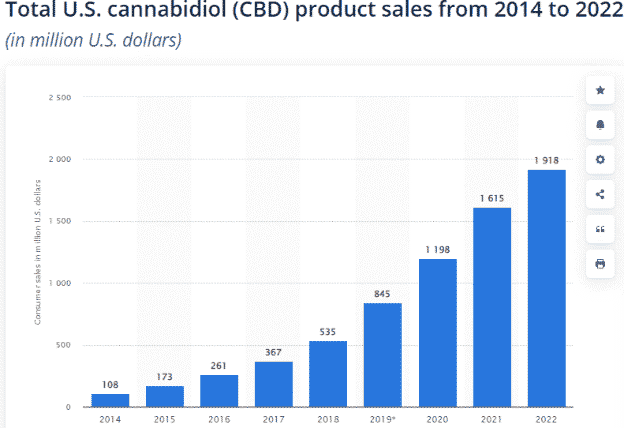

Overview: Due to the legalization of hemp production and need for biodegradable and renewable natural materials in various consumer products, the global industrial hemp market is worth over USD 205 million in 2020 and is expected to increase at a CAGR of over 6% between 2021 and 2027. There are various environmental and nutritional advantages to industrial hemp. Hemp seeds are in high demand due to the rising demand for dietary supplements, foods, and beverages, as well as growing consumer health awareness. Hemp oil is used in personal care and cosmetics because of its high antioxidant content. The expansion of the industrial hemp market is being fueled by rising demand for dietary supplements, foods, and drinks, as well as rising consumer health awareness. Cannabidiol (CBD) and CBD oil, which are found in hemp, have a variety of therapeutic characteristics and have the potential to treat cancer, diabetes, and pain, including chronic pain, which is predicted to be a major market driver. The global industrial hemp market is predicted to increase at a compound annual growth rate (CAGR) of 16.8% from 2022 to 2030, with a market value of USD 4.13 billion in 2021. The market is being driven by an increase in demand for industrial hemp from businesses such as food and beverage, personal care, and animal care all around the world. As a result of the economic slump induced by the COVID-19 pandemic, which has resulted in a drop in manufacturing operations, the worldwide market is seeing limited growth. As a result, the stock market has suffered a severe setback. The market, on the other hand, is predicted to develop at a quicker rate due to the high rate of global economic recovery.

While working on the industry analysis section of the hemp farm business plan make sure that you add a significant number of stats to support your claims and use proper referencing so that your lender can validate the data.

The CBD hemp farming business, which includes both employer and non-employer facilities that cultivate hemp for medical and recreational use, thrived throughout the five years to 2018, according to recent research published by IBISWorld. Recent legalization victories, most notably during the 2016 election cycle, demonstrated that the cannabis business is one of the fastest expanding in the US. Eight states passed marijuana legalization proposals in 2016. According to New Frontier Data, almost a third of the population of the United States now lives in states where marijuana is legal. Consumer views are also propelling state-level legalization attempts. According to Gallup, 80.0 percent of Americans support the legalization of CBD hemp.

The federal legality of industrial hemp production does not supersede state, county, or local restrictions, in addition to the regulatory vibe. Simply said, it means that a state, county, or city can impose stricter regulations than the federal government. Currently, roughly 15 states have passed pro-hemp legislation; the remaining states are either silent or vaguely neutral. Many states, counties, and localities are included in this list.

Marketing Plan:

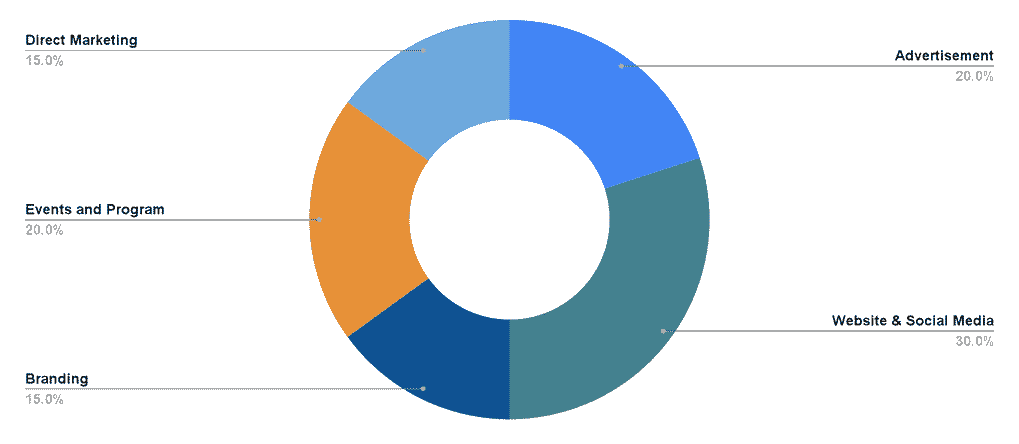

A key part of the marketing plan in a hemp farm business plan is the marketing budget. The growth in the number of customers is proportional to the budget and dependent on the CAC.

We are well aware that the incapacity of certain CBD hemp farming enterprises to sell off their farm produce on time is one of the main reasons for their lack of profitability. Our sales and marketing team will be hired based on their extensive expertise in the CBD hemp growing sector, and they will be trained regularly to ensure that they are well-prepared to fulfill their goals and Rex Morgan CBD Hemp Farms, LLC’s overall business objectives.

Social Media : To advertise our business, we should use the internet and social media platforms such as Instagram, Facebook, Twitter, YouTube, Google+, and others.

List our CBD hemp farm in local phone books and directories. Promote our CBD hemp farming business on our official website and use traffic-driving techniques.

Events and Programs: fund events/programs that are important to the community

Join local chambers of commerce and industries to promote our goods.

Direct Marketing: Distribute our fliers and handbills in targeted regions using a direct marketing strategy.

Advertisement: Send introductory letters with our brochure to firms that use hemp and cannabis plants and seeds to introduce our CBD hemp growing business. Advertise our company in business journals, newspapers, and television and radio stations that are relevant to our industry. Install our billboards in high-traffic areas in Sioux Falls, South Dakota.

Branding: Ensure that all our staff members wear our branded shirts and all our vehicles and trucks are well branded with our company logo et al.

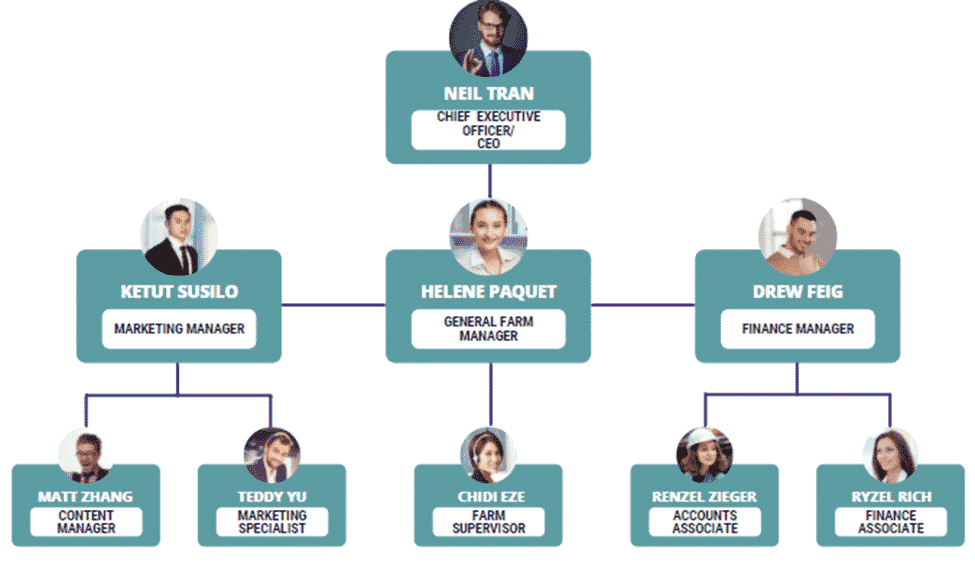

Organogram:

Financial Plan:

This section of the hemp farm business plan helps your lender figure out whether you will be able to pay off the loan, whether the business is sustainable, what are the growth prospects, etc.

Earnings:

Break-Even Analysis :

Income Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

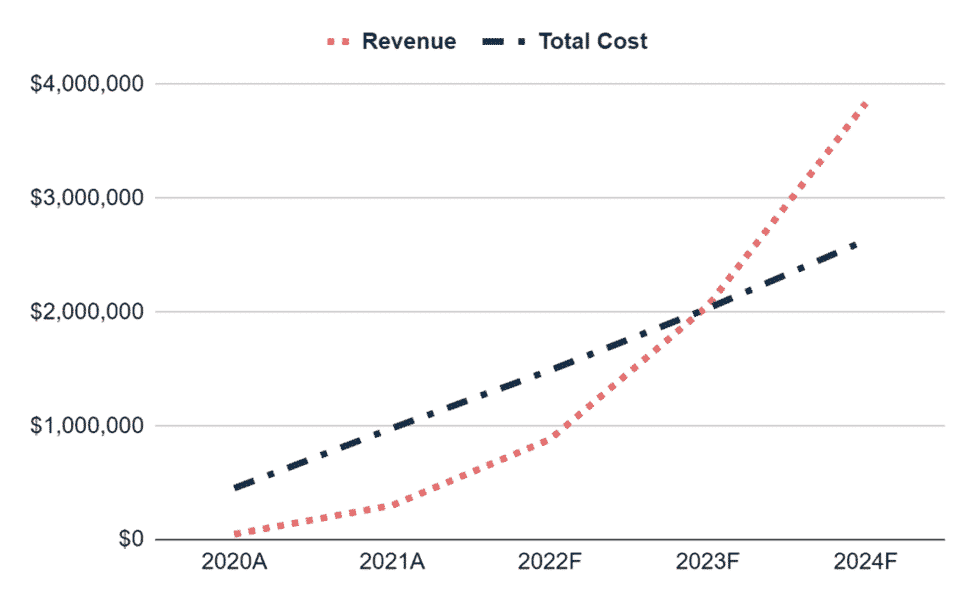

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| Total Cost of Revenue | 285,560 | 615,220 | 987,794 | 1,455,612 | 1,935,625 |

| as % of revenue | 595% | 204% | 112% | 71% | 50% |

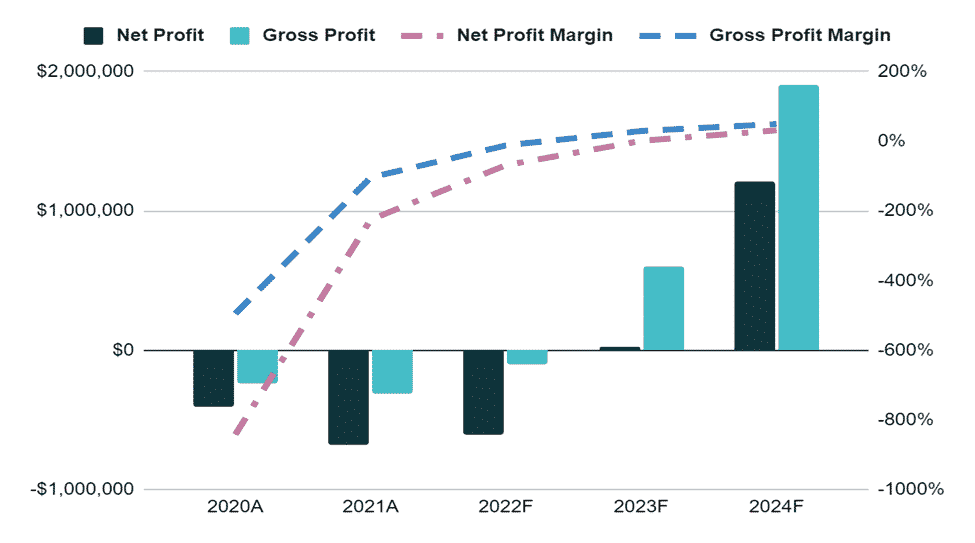

| Gross Profit | -237,575 | -313,984 | -105,583 | 601,578 | 1,902,218 |

| SELLING & ADMIN EXPENSES | |||||

| Item 1 | 28,000 | 96,800 | 154,880 | 175,692 | 193,261 |

| Item 2 | 75,000 | 105,000 | 120,000 | 120,000 | 120,000 |

| Item 3 | 36,000 | 96,000 | 108,000 | 120,000 | 120,000 |

| Item 4 | 8,000 | 12,000 | 12,000 | 12,000 | 12,000 |

| Item 5 | 3,839 | 18,074 | 44,111 | 61,716 | 115,135 |

| Item 6 | 3,359 | 12,049 | 26,466 | 41,144 | 76,757 |

| Item 7 | 5,600 | 10,000 | 12,904 | 15,034 | 17,376 |

| Item 8 | 6,667 | 14,000 | 22,067 | 30,940 | 40,701 |

| Total selling & admin expenses | 166,464 | 363,924 | 500,428 | 576,525 | 695,230 |

| as % of revenue | 347% | 121% | 57% | 28% | 18% |

| Net profit | -404,039 | -677,907 | -606,011 | 25,052 | 1,206,987 |

| Accumulated net profit | -404,039 | -1,081,947 | -1,687,957 | -1,662,905 | -455,918 |

Cash Flow Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| CASH FLOW from OPERATING ACTIVITIES | |||||

| Net profit before tax | -$404,039 | -$677,907 | -$606,011 | $25,052 | $1,206,987 |

| Depreciation | $44,267 | $85,333 | $120,504 | $158,127 | $199,512 |

| Payables | |||||

| Item 1 | $4,333 | $5,417 | $6,500 | $7,583 | $8,667 |

| Item 2 | $11,667 | $28,000 | $46,667 | $70,000 | $93,333 |

| Item 3 | $6,250 | $8,750 | $10,000 | $10,000 | $10,000 |

| Item 4 | $3,000 | $8,000 | $9,000 | $10,000 | $10,000 |

| Item 5 | $667 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| change in payables | $25,917 | $25,250 | $22,000 | $25,417 | $24,417 |

| Receivables | |||||

| Item 1 | $320 | $1,506 | $3,676 | $5,143 | $9,595 |

| Item 2 | $360 | $1,807 | $4,411 | $8,229 | $11,514 |

| Total receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| change in receivables | -$680 | -$2,634 | -$4,773 | -$5,285 | -$7,736 |

| Net cash flow from operating activities | -$334,536 | -$569,958 | -$468,280 | $203,311 | $1,423,180 |

| CASH FLOW from INVESTING ACTIVITIES | |||||

| Item 1 | $16,000 | $13,200 | $14,520 | $15,972 | $17,569 |

| Item 2 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Item 3 | $28,000 | $22,000 | $14,520 | $10,648 | $11,713 |

| Item 4 | $96,000 | $88,000 | $72,600 | $79,860 | $87,846 |

| Item 5 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Net cash flow/ (outflow) from investing activities | -$180,000 | -$167,200 | -$150,040 | -$159,720 | -$175,692 |

| CASH FLOW from FINANCING ACTIVITIES | |||||

| Equity | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net cash flow from financing activities | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net (decrease)/ increase in cash/ cash equivalents | -$114,536 | -$297,158 | -$134,320 | $575,991 | $1,833,128 |

| Cash and cash equivalents at the beginning of the year | – | -$114,536 | -$411,693 | -$546,014 | $29,978 |

| Cash & cash equivalents at the end of the year | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

Balance Sheet:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| NON-CURRENT ASSETS | |||||

| Item 1 | $16,000 | $29,200 | $43,720 | $59,692 | $77,261 |

| Item 2 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Item 3 | $28,000 | $50,000 | $64,520 | $75,168 | $86,881 |

| Item 4 | $96,000 | $184,000 | $256,600 | $336,460 | $424,306 |

| Item 5 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Total | $180,000 | $347,200 | $497,240 | $656,960 | $832,652 |

| Accumulated depreciation | $44,267 | $129,600 | $250,104 | $408,231 | $607,743 |

| Net non-current assets | $135,733 | $217,600 | $247,136 | $248,729 | $224,909 |

| CURRENT ASSETS | |||||

| Cash | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

| Accounts receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| Total current assets | -$113,856 | -$408,380 | -$537,927 | $43,349 | $1,884,214 |

| Total Assets | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

| LIABILITIES | |||||

| Account payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| Total liabilities | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| EQUITIES | |||||

| Owner’s equity | $400,000 | $840,000 | $1,324,000 | $1,856,400 | $2,442,040 |

| Accumulated net profit | -$404,039 | -$1,081,947 | -$1,687,957 | -$1,662,905 | -$455,918 |

| Total equities | -$4,039 | -$241,947 | -$363,957 | $193,495 | $1,986,122 |

| Total liabilities & equities | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

Related Articles: