Written by Elma Steven | Updated on January, 2024

Executive Summary

Overview: Kwality Ice Cream has assured that a consistent, high-quality product is produced. The all-natural ice cream is straightforward. Kwality Ice Cream is the epitome of high-end ethnic ice cream. It was created by individuals who appreciate the importance of producing a high-quality gourmet product. Consumers and chefs searching for anything else than gourmet ice cream will find Kwality Ice Cream’s selection of super-premium ice cream products to meet and exceed their expectations.

Mission: We are committed to offering high-quality items and exceptional service and pledge to transport you back home!.

Vision: To create, produce, and sell the highest-quality ice cream and euphoric concoctions while maintaining a commitment to using only healthful, natural ingredients and encouraging environmentally friendly business practices.

Industry Overview: From 2022 to 2031, the worldwide ice cream market is expected to rise at a CAGR of 5%, from $68,052.20 million in 2020 to $122,051.10 million in 2031. Product advancements, particularly in terms of flavor profile and nutritional content, are driving the ice cream business worldwide. Dairy Day Plus, a line of ice creams with immunity-boosting components, was released in 2020. The firm initially offered Haldi (turmeric) ice cream and Chyawanaprash ice cream. Furthermore, demand for non-dairy ice cream was driven by a change in consumer taste toward vegan diets and a rising population with lactose sensitivity.

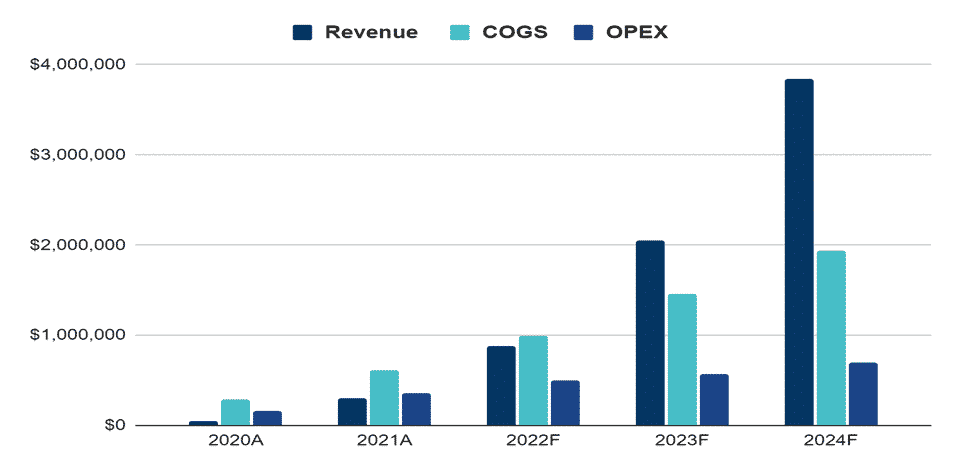

Financial Overview:

Financial Highlights:

| Liquidity | 2020A | 2021A | 2022F | 2023F | 2024F |

| Current ratio | 6 | 12 | 23 | 32 | 42 |

| Quick ratio | 6 | 11 | 22 | 31 | 40 |

| DSO | 8 | 8 | 8 | 8 | 8 |

| Solvency | |||||

| Interest coverage ratio | 8.2 | 11.1 | 14.2 | ||

| Debt to asset ratio | 0.01 | 0.01 | 0.2 | 0.18 | 0.16 |

| Profitability | |||||

| Gross profit margin | 51% | 51% | 53% | 53% | 53% |

| EBITDA margin | 12% | 14% | 21% | 22% | 22% |

| Return on asset | 5% | 6% | 13% | 14% | 14% |

| Return on equity | 5% | 6% | 16% | 17% | 17% |

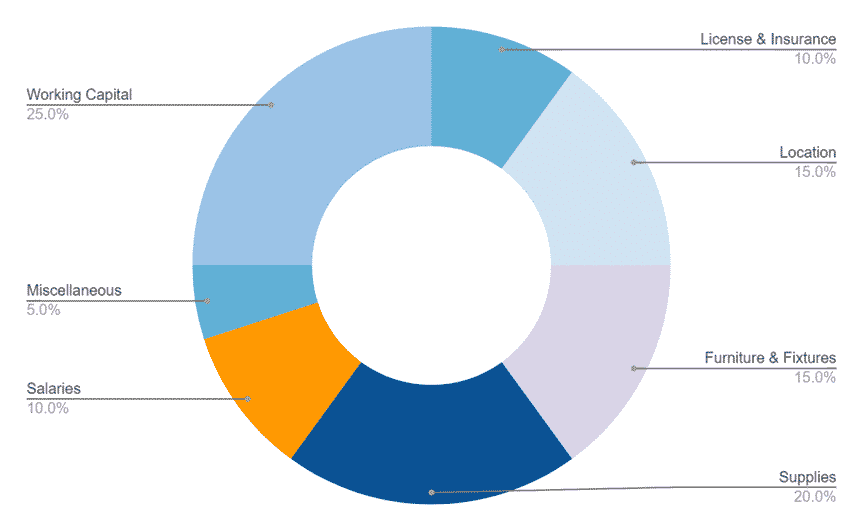

Fund Usage

Industry Analysis

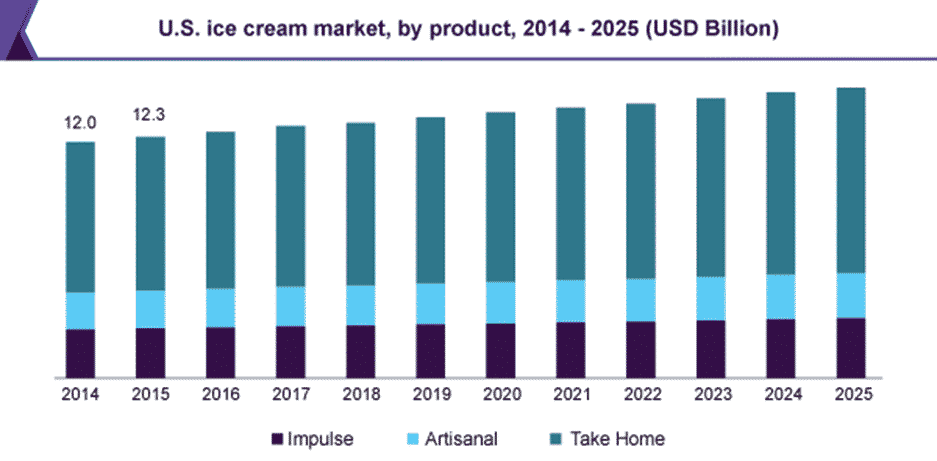

Ice cream is a dairy product sweetened with natural or artificial sweeteners. Companies on the market provide a variety of ice creams, such as hard ice cream, soft ice cream, light ice cream, low-fat ice cream, and more. Summer is unquestionably the best time to eat ice cream and other frozen treats. The availability of various flavored ice creams is fueling the ice cream industry’s expansion. Consequently, ice cream buyers are willing to spend a higher price for these items, boosting market income.

The impulsive ice cream sector of the global ice cream market is the most profitable by product type due to its ease of transport and growing popularity worldwide. This kind of ice cream is in considerable demand, particularly among kids and teens.Vanilla is the most popular flavor, having the most significant market share. This is due to an increase in demand for vanilla ice cream. Vanilla ice cream is a classic flavor that appeals to people of all ages. The fastest expanding component of the global ice cream industry is online sales. This is attributed to increased internet penetration and smartphone use. Furthermore, the internet sales channel offers advantages such as discounts and free home delivery. The fastest expanding component of the global ice cream industry is online sales. This is attributed to increased internet penetration and smartphone use. Furthermore, the internet sales channel offers advantages such as discounts and free home delivery.

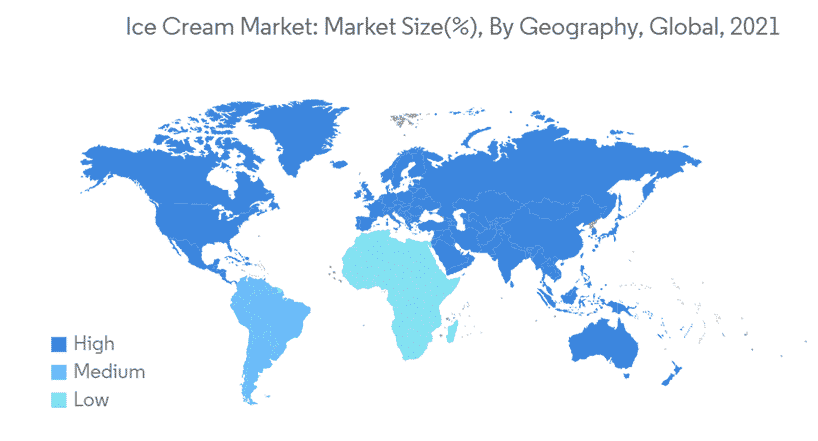

Due to rising demand from growing nations such as India, China, Indonesia, and others, Asia-Pacific is predicted to expand fastest. Furthermore, increasing disposable income and a higher quality of life contribute to the market’s expansion. During the projection period for the ice cream industry, India and China are expected to see considerable development. In Australia, the ice cream sector accounts for around 10% of the entire food industry. Due to rising regional demand, Sweden and the United Kingdom are the most attractive markets for ice cream in the European area.

Product innovation, economic development, an increase in disposable income, and the expansion of the retail sector are projected to have a significant influence on the ice cream industry. Product innovation will help to diversify offers and suit different consumer wants. At the same time, economic expansion will continue to boost customer buying power.

Ice cream makers incorporate beneficial ingredients, organic herbal fillings, and exotic tastes into their product formulas to obtain a competitive edge and appeal to a broader audience. Corporations are adding exotic flavors like tropical fruits, lemons, and coconuts to accommodate shifting customer preferences.

Licorice cream is also becoming more popular in developed nations such as North America and Europe. As a result, the goods are sold extensively in supermarkets and specialized shops and contain less than 0.5 percent alcohol. Häagen-Dazs, for example, recently released a spirit-infused ice cream flavor inspired by five classic pints prepared with Irish cream, rum, bourbon, and stout. As a result, the industry is being driven by luxury items with new flavors and high levels of pleasure.

This year’s retail ice cream sales were not on fire, but they were definitely on fire. According to statistics from Chicago-based market research company IRI, dollar sales in the ice cream subcategory of the broader ice cream/sherbet category climbed by 13.4% (to $6,841.8 million) for the 52 weeks ended Sept. 6, 2020, while unit sales increased by 8.4% (to 1,703.6 million).The frozen novelties segment has also been hot, with dollar sales up 16.0 percent (to $5,784.1 million) and unit sales up 9.1%. (to 1,650.6 million).

The North American ice cream industry will see considerable expansion due to the millennial demographic’s increased demand for frozen treats. As a meal substitute, frozen desserts are preferred by most of these customers. Furthermore, these shifts are being driven by hurried lives and health and well-being concerns. Companies may tap into the market’s development potential by catering to consumers’ rising desire for natural, less processed, and convenient foods and a growing emphasis on low-calorie ice creams. The rising popularity of gelato and soft serve in North America may be attributed to the fact that they provide a broad range of alternatives to suit customers’ preferences. They’re relatively simple to put together and maybe made using high-quality, genuine components.

Marketing Plan

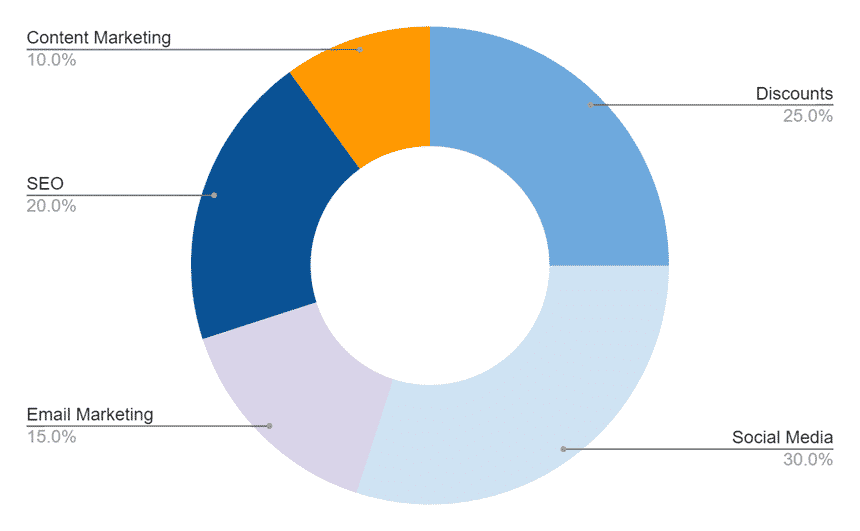

Content Marketing: Create a blog on the website with material catering to prospective customers of Kwality Ice Cream.

Discounts: Provide multiple rewards or incentives where members of Kwality Ice Cream get a deal if they successfully recommend someone.

Social Media: Engage and promote on Twitter, publish news on Facebook, and utilize Instagram to promote curated photos of your space and events.

SEO (Search Engine Optimization) Local SEO makes it easier for local consumers to find out what you have to offer. It creates trust with potential members seeking what your place offers.

Email Marketing: Sending automated in-product and website communications to reach out to consumers at the right time. Remember that if your client or target views your email as really important, they are more likely to forward it or share it with others, so include social media share buttons in every email.

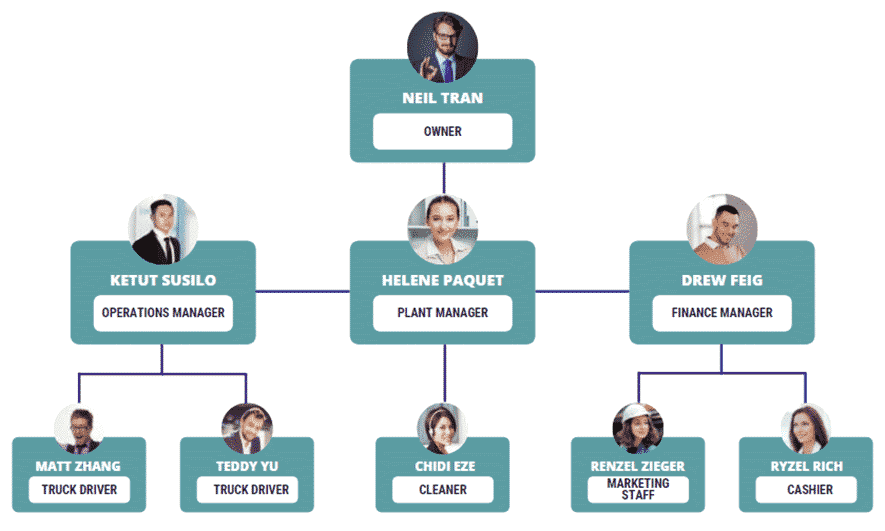

Organogram

Financial Plan

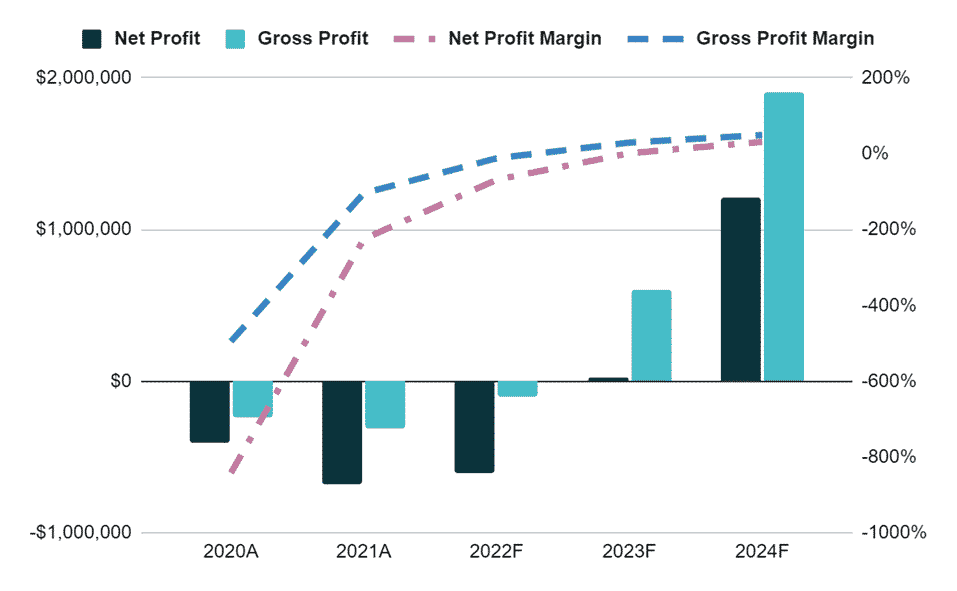

Earnings:

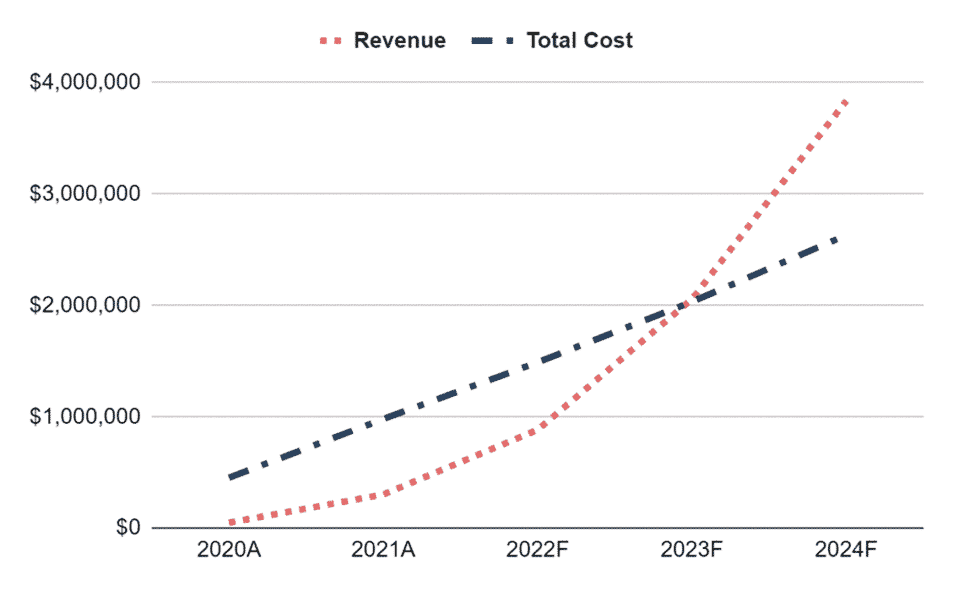

Break-Even Analysis:

Income Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| Total Cost of Revenue | 285,560 | 615,220 | 987,794 | 1,455,612 | 1,935,625 |

| as % of revenue | 595% | 204% | 112% | 71% | 50% |

| Gross Profit | -237,575 | -313,984 | -105,583 | 601,578 | 1,902,218 |

| SELLING & ADMIN EXPENSES | |||||

| Item 1 | 28,000 | 96,800 | 154,880 | 175,692 | 193,261 |

| Item 2 | 75,000 | 105,000 | 120,000 | 120,000 | 120,000 |

| Item 3 | 36,000 | 96,000 | 108,000 | 120,000 | 120,000 |

| Item 4 | 8,000 | 12,000 | 12,000 | 12,000 | 12,000 |

| Item 5 | 3,839 | 18,074 | 44,111 | 61,716 | 115,135 |

| Item 6 | 3,359 | 12,049 | 26,466 | 41,144 | 76,757 |

| Item 7 | 5,600 | 10,000 | 12,904 | 15,034 | 17,376 |

| Item 8 | 6,667 | 14,000 | 22,067 | 30,940 | 40,701 |

| Total selling & admin expenses | 166,464 | 363,924 | 500,428 | 576,525 | 695,230 |

| as % of revenue | 347% | 121% | 57% | 28% | 18% |

| Net profit | -404,039 | -677,907 | -606,011 | 25,052 | 1,206,987 |

| Accumulated net profit | -404,039 | -1,081,947 | -1,687,957 | -1,662,905 | -455,918 |

Cash Flow Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| CASH FLOW from OPERATING ACTIVITIES | |||||

| Net profit before tax | -$404,039 | -$677,907 | -$606,011 | $25,052 | $1,206,987 |

| Depreciation | $44,267 | $85,333 | $120,504 | $158,127 | $199,512 |

| Payables | |||||

| Item 1 | $4,333 | $5,417 | $6,500 | $7,583 | $8,667 |

| Item 2 | $11,667 | $28,000 | $46,667 | $70,000 | $93,333 |

| Item 3 | $6,250 | $8,750 | $10,000 | $10,000 | $10,000 |

| Item 4 | $3,000 | $8,000 | $9,000 | $10,000 | $10,000 |

| Item 5 | $667 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| change in payables | $25,917 | $25,250 | $22,000 | $25,417 | $24,417 |

| Receivables | |||||

| Item 1 | $320 | $1,506 | $3,676 | $5,143 | $9,595 |

| Item 2 | $360 | $1,807 | $4,411 | $8,229 | $11,514 |

| Total receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| change in receivables | -$680 | -$2,634 | -$4,773 | -$5,285 | -$7,736 |

| Net cash flow from operating activities | -$334,536 | -$569,958 | -$468,280 | $203,311 | $1,423,180 |

| CASH FLOW from INVESTING ACTIVITIES | |||||

| Item 1 | $16,000 | $13,200 | $14,520 | $15,972 | $17,569 |

| Item 2 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Item 3 | $28,000 | $22,000 | $14,520 | $10,648 | $11,713 |

| Item 4 | $96,000 | $88,000 | $72,600 | $79,860 | $87,846 |

| Item 5 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Net cash flow/ (outflow) from investing activities | -$180,000 | -$167,200 | -$150,040 | -$159,720 | -$175,692 |

| CASH FLOW from FINANCING ACTIVITIES | |||||

| Equity | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net cash flow from financing activities | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net (decrease)/ increase in cash/ cash equivalents | -$114,536 | -$297,158 | -$134,320 | $575,991 | $1,833,128 |

| Cash and cash equivalents at the beginning of the year | – | -$114,536 | -$411,693 | -$546,014 | $29,978 |

| Cash & cash equivalents at the end of the year | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

Balance Sheet:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| NON-CURRENT ASSETS | |||||

| Item 1 | $16,000 | $29,200 | $43,720 | $59,692 | $77,261 |

| Item 2 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Item 3 | $28,000 | $50,000 | $64,520 | $75,168 | $86,881 |

| Item 4 | $96,000 | $184,000 | $256,600 | $336,460 | $424,306 |

| Item 5 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Total | $180,000 | $347,200 | $497,240 | $656,960 | $832,652 |

| Accumulated depreciation | $44,267 | $129,600 | $250,104 | $408,231 | $607,743 |

| Net non-current assets | $135,733 | $217,600 | $247,136 | $248,729 | $224,909 |

| CURRENT ASSETS | |||||

| Cash | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

| Accounts receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| Total current assets | -$113,856 | -$408,380 | -$537,927 | $43,349 | $1,884,214 |

| Total Assets | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

| LIABILITIES | |||||

| Account payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| Total liabilities | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| EQUITIES | |||||

| Owner’s equity | $400,000 | $840,000 | $1,324,000 | $1,856,400 | $2,442,040 |

| Accumulated net profit | -$404,039 | -$1,081,947 | -$1,687,957 | -$1,662,905 | -$455,918 |

| Total equities | -$4,039 | -$241,947 | -$363,957 | $193,495 | $1,986,122 |

| Total liabilities & equities | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |