Written by Elma Steven | Updated on March, 2024

How to Write a Piggery Business Plan?

In order to write a Piggery Business Plan you need to start with executive summary. In order to write an executive summary for a Pig Farm Business Plan you need to mention- what your business is about and what you’ll sell. Explain how you’ll get people to buy it. The executive summary should be written at the end. Then you should write a Business Description mentioning goals, objectives, mission and vision. Some of the major sections or components of a Business Plan involves Fund Usage Plan, Marketing Plan, Industry Analysis, Organizational Overview, Operational Overview and Financials.

This article will provide you a step by step process to write your Business Plan. Get a free Business Plan.

Table of Contents

Executive Summary

Overview: Farm-to-table businesses have grown significantly in recent years, and the piggery industry has been no exception.Piggy Paradise Farms is dedicated to providing high-quality, sustainably-raised pork products to consumers. Our farm is committed to ethical and environmentally conscious practices that ensure the health and well-being of our pigs and the surrounding ecosystem. Our business plan outlines our mission, market analysis, financial projections, and marketing strategies to establish a profitable and sustainable operation.

Problem Summary: Despite the increasing demand for sustainably-raised meat products, many consumers struggle to find reliable sources for locally-produced pork. The industry prioritizes profit over animal welfare and environmental sustainability, has dominated the market for decades. As a result, small-scale, sustainable pig farmers often struggle to compete with larger operations, leading to a lack of access to fresh, ethically-raised pork for consumers.

Solution Summary: “Piggy Paradise Farms” seeks to address these issues by providing ethically-raised pork products to consumers in the local area. By prioritizing the health and well-being of our pigs, implementing sustainable farming practices, and maintaining a commitment to transparency and customer satisfaction, we aim to establish a loyal customer base and become a leading provider of locally-produced pork. Through strategic marketing initiatives and partnerships with local businesses and organizations, we will work to expand our reach and establish a profitable and sustainable business model.

Industry Overview: According to Statista, the global pork market was valued at over $330 billion in 2023 (Statista). The market is projected to grow at a CAGR of 3.9% from 2021 to 2028. Renub Research thinks that by 2028, the world market for pork will be worth USD 418.37 billion. The increasing demand for sustainably-raised meat products, coupled with growing concerns about the environmental impact of industrial farming, has led to a significant shift in consumer preferences towards locally-sourced, ethically-raised pork. As a result, the small-scale industry has experienced steady growth in recent years, with many consumers seeking out farm-to-table options for their pork products.

More details on How to Write an Executive Summary.

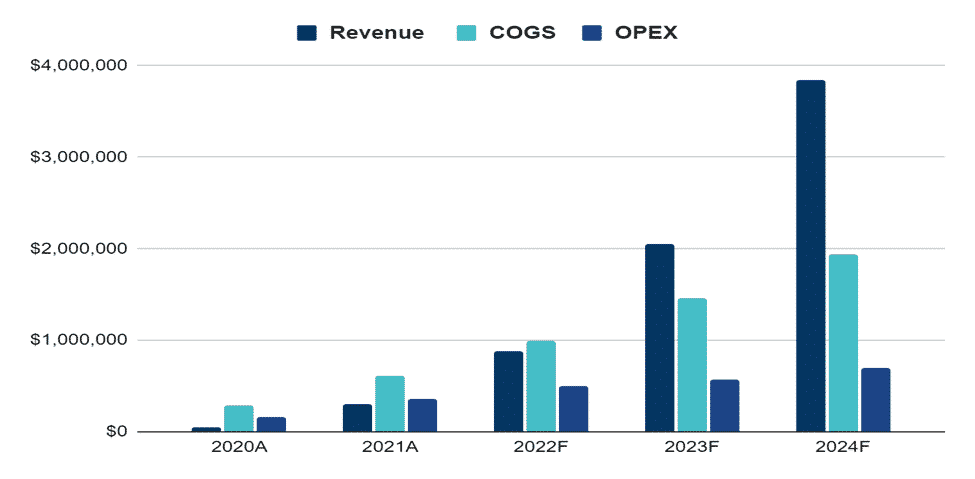

Financial Overview

Get the Free Business Plan Template

Get the template over email

Important KPIs

| Liquidity | 2020A | 2021A | 2022F | 2023F | 2024F |

| Current ratio | 6 | 12 | 23 | 32 | 42 |

| Quick ratio | 6 | 11 | 22 | 31 | 40 |

| DSO | 8 | 8 | 8 | 8 | 8 |

| Solvency | |||||

| Interest coverage ratio | 8.2 | 11.1 | 14.2 | ||

| Debt to asset ratio | 0.01 | 0.01 | 0.2 | 0.18 | 0.16 |

| Profitability | |||||

| Gross profit margin | 51% | 51% | 53% | 53% | 53% |

| EBITDA margin | 12% | 14% | 21% | 22% | 22% |

| Return on asset | 5% | 6% | 13% | 14% | 14% |

| Return on equity | 5% | 6% | 16% | 17% | 17% |

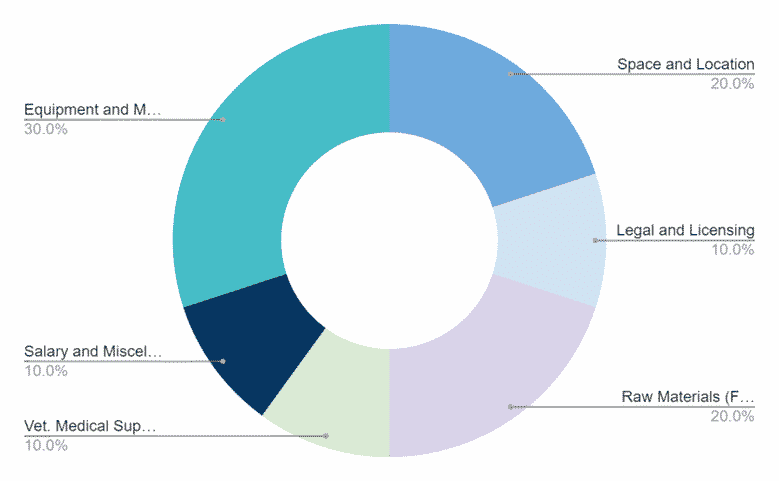

Fund Usage

Business Description

Business Name: Piggy Paradise Farms

Founder: Jacob Harrison

Management Team:

| Name | Designation |

| Jacob Harrison | Chief Executive Officer |

| Sophia Martinez | Chief Marketing Officer |

| Benjamin Johnson | Chief Financial Officer |

Legal Structure: LLC

Location: 1234 Main St, Bellevue, WA 98004

Goals:

- Establishing a profitable and sustainable farming operation

- Building a loyal customer base through transparent and trustworthy business practices

- Providing the highest quality, sustainably-raised pork products to our customers

- Expanding our reach and establishing strategic partnerships with local businesses and organizations

- Maintaining a commitment to ethical and environmentally-conscious farming practices

Products:

- Bacon

- Sausages

- Pork chops

- Ribs

- Ground pork

- Roasts

Business Model Canvas

You can check out business model samples for more details.

SWOT Analysis

Organizational Overview

Founder

Jacob Harrison

Founder/ CEO/ Jacob Harrison

Hi there! My name is Jacob Harrison. I am a seasoned entrepreneur and passionate advocate for sustainable and ethical farming practices. I was born and raised in a rural farming community, where I gained a deep appreciation for the hard work and dedication that goes into farming. After pursuing a degree in agriculture and business management, I worked for several years in various farming and livestock management positions, honing my skills in sustainable and ethical farming practices.

In 2015, I founded Piggy Paradise Farms with a vision to provide high-quality, locally-sourced pork products while maintaining a commitment to environmental sustainability and animal welfare. I have worked tirelessly to build a sustainable and profitable farming operation, leveraging my expertise in farming and business management to create a transparent and trustworthy relationship with his customers.

Under my leadership, Piggy Paradise Farms has grown into a thriving and respected business in the local community, providing delicious and sustainably-raised pork products to health-conscious consumers and local restaurants. I remain committed to my mission of creating a more sustainable and ethical farming industry, and I continue to innovate and expand my business while maintaining my commitment to quality, transparency, and customer service.

Organogram

Salaries

| All monetary figures are in USD | 2024F | 2025F | 2026F |

| Manager | $30,000 | $30,000 | $30,000 |

| Salesperson | $30,000 | $30,000 | $30,000 |

| Customer service representative | $30,000 | $30,000 | $30,000 |

| Accountant/Bookkeeper | $30,000 | $30,000 | $30,000 |

| Marketing Specialist | $30,000 | $30,000 | $30,000 |

| Operations Specialist | $30,000 | $30,000 | $30,000 |

| IT specialist/Computer technician | $30,000 | $30,000 | $30,000 |

| Human resources specialist | $30,000 | $30,000 | $30,000 |

| Production worker/Assembler | $30,000 | $30,000 | $30,000 |

| Delivery driver/Logistics Specialist | $30,000 | $30,000 | $30,000 |

| Graphic designer/Visual artist | $30,000 | $30,000 | $30,000 |

| Content writer/Blogger | $30,000 | $30,000 | $30,000 |

| Social media specialist | $30,000 | $30,000 | $30,000 |

| Total | $390,000 | $390,000 | $390,000 |

Industry Analysis

Global Pork Production (in 1,000 metric tons)

Source: Statista

Industry Problems

- Industrial farming operations often prioritize profits over animal welfare and environmental sustainability, leading to issues such as overuse of antibiotics, pollution, and animal mistreatment.

- Pig farming is vulnerable to disease outbreaks, which can devastate entire herds and disrupt the entire industry.

- Consumers are increasingly demanding transparency and ethical practices in the food industry, which can be difficult for large industrial farming operations to implement.

- Rising costs of inputs such as feed and labor can make it difficult for small and medium-sized piggeries to remain profitable.

Industry Opportunities

- Growing demand for sustainably-raised and locally-sourced meat products, which can provide opportunities for small and medium-sized pig farmers to differentiate themselves and capture a growing market segment.

- Advances in technology, such as precision farming techniques and genetic selection, can improve efficiency and productivity in the industry.

- Increased awareness and demand for animal welfare and environmental sustainability practices, which can create opportunities for small and medium-sized pig farmers who prioritize these values.

- The use of alternative feed sources, such as insects or algae, can provide opportunities for innovation and cost savings in the industry.

Market Segmentation

Demographic Segmentation

- Health-conscious individuals who prioritize organic, natural, and locally-sourced foods

- Consumers who prefer meat products that are free from antibiotics, hormones, and other additives

- Locavores and farm-to-table enthusiasts who support small and local businesses

- Restaurant and food business owners who prioritize ethical and sustainable sourcing practices

Psychographic Segmentation

- Consumers who value transparency and trustworthiness in the food industry and prefer to know where their food comes from

- Individuals who are passionate about supporting sustainable and ethical farming practices and reducing their environmental footprint

- Foodies and culinary enthusiasts who appreciate high-quality and delicious food products

- Consumers who prioritize personalized customer service and value building a relationship with the businesses they buy from

Behavioral Segmentation

- Consumers who regularly purchase meat products from local farmers markets and specialty food stores

- Individuals who are willing to pay a premium for high-quality, sustainably-raised pork products

- Consumers who are loyal to and actively seek out businesses that prioritize ethical and sustainable practices

- Restaurant and food business owners who are committed to providing their customers with high-quality and ethically-sourced food products.

Market Size

Marketing Plan

Marketing Budget

Marketing Objectives

- Boost brand awareness: Increase recognition and recall by 20% within 12 months using targeted campaigns and social media.

- Grow market share: Expand market share by 10% in two years with innovative products and new segments.

- Retain customers: Raise repeat customer rate by 15% within a year through personalization, loyalty programs, and customer support.

- Enhance online presence: Increase website traffic by 25% and social media followers by 30% in 18 months using engaging content and SEO.

- Increase sales revenue: Achieve a 20% revenue growth in the next financial year with promotional strategies and product expansion.

- Strengthen brand loyalty: Improve net promoter score (NPS) by 10 points in 12 months by focusing on customer satisfaction and loyalty benefits.

- Promote sustainability: Increase eco-friendly products by 30% in two years to appeal to environmentally conscious consumers.

- Improve customer engagement: Boost email open rates by 20% and click-through rates by 15% in a year with targeted email campaigns.

- Enter new markets: Launch products in two international markets within 24 months using market research and strategic partnerships.

- Enhance product positioning: Raise top-of-mind awareness as a leader in comfort and innovation within 18 months through marketing and product innovation.

Go-to-Market (GTM) Strategy

- Social Media Marketing:

a. Create and share engaging content that reflects the brand’s values and showcases products.

b. Collaborate with influencers who resonate with your target audience to increase reach and brand awareness.

c. Utilize paid advertising campaigns on platforms like Instagram, Facebook, and Pinterest to target specific customer segments.

d. Engage with followers, respond to comments, and address customer inquiries to strengthen customer relationships and loyalty.

- Content Marketing:

a. Develop a blog on the brand’s website featuring educational and informative content about undergarments, trends, and styling tips.

b. Leverage video content on platforms like YouTube to showcase products, share tutorials, and engage with customers.

c. Create infographics or visually appealing content to share on social media platforms and drive website traffic.

- Email Marketing:

a. Build and segment email lists based on customer behavior, preferences, and demographics.

b. Send personalized email campaigns with targeted offers, promotions, and relevant content.

c. Utilize automation tools to nurture leads and encourage repeat purchases.

- Public Relations:

a. Develop press releases and media kits to promote product launches, collaborations, or brand milestones.

b. Cultivate relationships with industry journalists and bloggers to secure coverage in relevant publications.

c. Participate in industry events, trade shows, and fashion weeks to increase brand visibility and networking opportunities.

- Search Engine Marketing (SEM) and Search Engine Optimization (SEO):

a. Optimize website content and structure to improve organic search ranking on search engines like Google.

b. Utilize keyword research and on-page optimization to target relevant search queries.

c. Implement paid search campaigns (Google Ads) to capture high-intent search traffic and drive conversions.

- Affiliate and Influencer Marketing:

a. Develop an affiliate program to incentivize bloggers, influencers, and content creators to promote the brand and products in exchange for a commission on sales.

b. Collaborate with influencers on content creation, product reviews, and giveaways to generate buzz and increase brand exposure.

- Offline Advertising and Promotions:

a. Place ads in print magazines, newspapers, or on billboards that cater to your target audience.

b. Host in-store events, pop-up shops, or fashion shows to create memorable experiences and connect with customers.

Financials

Video Tutorial on Financials

Break-Even Analysis

Liquidity

Income Statement

Cash Flow Statement

Balance Sheet

Revenue Summary

Cost Summary

Salaries

Non- Current Asset Schedule