Written by Elma Steven | Updated on July, 2024

How to Start a IV Hydration Business?

Detailed step by step process to avoid guesswork and find out how to start a IV Hydration business? Go through the initial summary of each of the 5 steps- Research & Idea Validation, Legal Structure & Registration, Capital Raising, Kickstarting the Golf Course Business and Monitoring & Evaluation. Take a deep dive into the details to start your Golf Course business. Don’t forget to write a comprehensive golf course business plan to write down your idea on paper as it will help your validate the concept and identify gaps which might have been missed during the ideation process.

Table of Contents

5 Important Steps to Start your IV Hydration Business

The mentioned steps will save you at least 2 months of research as we spent more than 2 months to write this article. Check the summary of each section and later we will take a deep dive into the overall process to start your iv hydration business.

Research and Idea Validation

- Market Research: Investigate the demand for IV hydration services in your target area. Focus on understanding customer demographics, such as athletes, busy professionals, or wellness-focused individuals. Look into competitors, such as local clinics, mobile IV services, or wellness centers.

- Cost-Benefit Analysis: Evaluate the costs involved, such as medical supplies, equipment, and personnel. Compare these against potential pricing models and revenue streams. Assess the profitability by considering factors like service frequency, clientele base, and operational costs.

Legal Structure & Registration

- Business Structure: Choose a structure like an LLC or Corporation, considering liability and tax implications. An LLC might be preferable for its flexibility and protection.

- Legal Registrations: Obtain necessary health and business licenses. This may include state medical board approvals, nursing licenses, and permits for handling medical supplies.

- Insurance: Ensure adequate insurance coverage, including liability insurance, to protect against potential medical malpractice claims.

Capital Raising

- Funding Sources: Consider personal savings, healthcare-specific loans, or investors. Look into partnerships with existing wellness clinics or gyms for shared space opportunities.

- Capital Requirements: Estimate the capital needed for medical-grade IV equipment, a suitable venue (if not mobile), initial medical supplies, and marketing expenses.

Kickstarting the Business

- Location Selection: For a physical location, choose an area with high visibility, accessibility, and proximity to your target demographic. Consider a mobile service model for wider reach and flexibility.

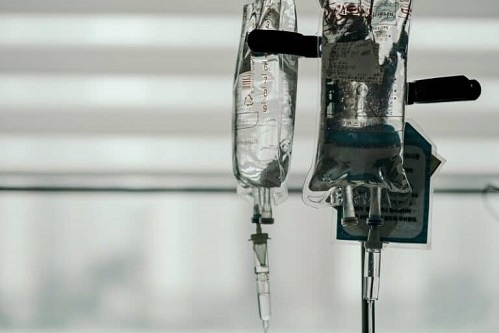

- Equipment and Supplies: Invest in quality IV hydration supplies, including medical-grade IV kits, vitamins, and electrolytes. Ensure storage and handling meet health regulations.

- Space Design: Create a relaxing and hygienic environment. Consider comfortable seating, private treatment areas, and a tranquil ambiance.

- Staffing: Hire qualified nurses or medical professionals trained in IV therapy. Provide comprehensive training in customer service and safety protocols.

Monitoring and Evaluation

- Financial Performance: Regularly review revenue, expenses, and profit margins. Use accounting software tailored for healthcare services.

- Customer Feedback: Collect and analyze client feedback for service improvements. Use surveys or direct feedback during visits.

- Performance Indicators: Monitor key metrics like customer retention rates, treatment frequency per client, and new client acquisition costs.

- Adaptation and Growth: Stay updated with wellness trends and advancements in IV therapy. Consider expanding services to include complementary wellness treatments like oxygen therapy or vitamin injections.

Now Lets take a Deep Dive into Each of the 5 Steps

Research and Idea Validation

Idea validation involves collection relevant information through industry analysis and creating a financial model to find out if a certain amount of investment will be enough, how long it can take to be profitable, analyzing various scenarios by playing with different cost and prices, etc. Bypass the guesswork and go through concrete planning to get the best possible results.

Market Research

Identifying Target Market

- Demographic Research: Focus on areas with a high concentration of health-conscious individuals, athletes, professionals with demanding lifestyles, and communities interested in wellness trends. Cities with a vibrant fitness culture or regions known for their focus on wellness, like certain Californian cities, could be ideal.

- Geographic Considerations: Evaluate different states and neighborhoods for their wellness trends. An IV hydration business in a health-centric city like Boulder, Colorado, may cater to a different demographic than one in a more traditional setting.

Competitor Analysis

- Service Assessment: Visit local wellness clinics and spas offering IV hydration. In areas like Miami, some might offer unique blends targeting specific wellness goals, which could be a unique selling point for your business.

- Pricing Strategies: Research competitor pricing strategies. In affluent areas, such as parts of New York, prices might be higher due to the clientele’s willingness to pay for premium services.

Customer Preferences and Needs

- Surveys and Interviews: Engage with potential customers in your target area to understand their health habits and preferences. For instance, clients in areas with high work stress, like Silicon Valley, might prefer services that focus on energy boosts or stress relief.

Feasibility Study and Cost-Benefit Analysis

Estimating Start-Up Costs:

- Location Costs: Rent in upmarket or central locations, like downtown Los Angeles, can be higher. A 1,000 square foot space could range significantly in rent.

- Equipment Expenses: Investment in medical-grade IV equipment and supplies can range based on the scale of your operations and the quality of the products.

Operational Costs

- Utilities: Costs can vary, especially in areas with specific health regulations.

- Maintenance and Repairs: Allocate a budget for maintaining medical equipment and ensuring a sterile environment.

Revenue Projections

- Service Pricing: Base your pricing on local competition, clientele’s purchasing power, and operational costs. For example, in wealthier neighborhoods, you might be able to charge a premium.

- Additional Revenue Streams: Consider complementary services like oxygen therapy or wellness consultations, which can significantly increase your revenue.

Break-Even Analysis

- Calculating Break-Even Point: Determine your monthly costs versus projected revenue. For example, if your monthly operational costs are $15,000 and you charge an average of $150 per session, you need 100 sessions per month to break even.

Risk Assessment

- Market Risks: Be aware of factors like changes in health trends or regulatory changes that could impact your business. For example, a shift in wellness trends might affect customer preferences.

- Operational Risks: Unexpected issues like supply chain disruptions for medical-grade supplies could impact service delivery, especially in areas dependent on external suppliers.

This detailed research and validation process for an IV Hydration business will provide a solid understanding of the specific market, set realistic financial goals, and prepare for both opportunities and potential challenges in the wellness industry.

Legal Structure & Registration

Company registration involves choosing a business structure (e.g., LLC, corporation), selecting a compliant business name and filing necessary documents with a state agency typically the Secretary of State. This includes filing Articles of Organization or Incorporation and obtaining an Employer Identification Number (EIN) from the IRS for tax purposes. The process may also require securing relevant business licenses, registering for state taxes and appointing a registered agent for legal correspondence.

Establishing an IV hydration business requires thorough planning regarding its legal structure and adherence to registration and compliance procedures. These foundational decisions impact liability, taxation, and operational efficiency, which are crucial for the healthcare-oriented nature of this business.

Choosing the Right Legal Structure

Sole Proprietorship

- Simple to Establish: Minimal regulatory requirements, ideal for a small-scale IV hydration service.

- Personal Liability: The owner is personally liable for all business debts and legal actions.

- Best For: Small operations, perhaps in areas with limited competition or a niche market focus.

Limited Liability Company (LLC)

- Liability Protection: Combines simplicity with the protection of personal assets from business liabilities.

- Tax Flexibility: Can be taxed as a sole proprietor, partnership, or corporation.

- Suitable For: IV hydration businesses in urban or high-traffic areas where the risk of legal issues might be higher.

Corporations (C-Corp and S-Corp)

- C-Corp: Separate tax entity, leading to double taxation but can attract investors and issue shares. Ideal for large-scale ventures.

- S-Corp: Avoids double taxation, suitable for medium-sized businesses looking to grow. Limited to 100 shareholders who must be U.S. citizens or residents.

Partnership

- Ideal for Collaboration: If starting with partners, a partnership offers a structured way to manage roles and profits.

- Types: General Partnerships, Limited Partnerships (LP), and Limited Liability Partnerships (LLP) depending on the level of involvement and liability desired.

Registration Process and Compliance

Business Name Registration

- Uniqueness: Ensure the name is unique and adheres to state regulations.

- Registration: File with the Secretary of State or local business authority.

Licenses and Permits

- General Business License: Required from the local government.

- Healthcare Specific Licenses: Depending on state and county regulations, specific to healthcare services.

- Environmental Permits: May be necessary for medical waste disposal.

Tax Registration and Employer Identification Number (EIN)

- EIN Application: Essential for tax purposes, obtained through the IRS.

- State and Local Taxes: Registration for relevant taxes, including sales tax if applicable.

Zoning, Land Use, and Building Compliance

- Zoning Laws: Confirm the location is zoned appropriately for medical services.

- ADA Compliance: Essential for public healthcare facilities.

Insurance

- General Liability Insurance: To protect against customer incidents.

- Property Insurance: Covering equipment and space.

- Workers’ Compensation: Mandatory if employing staff.

Banking and Financial Setup

- Separate Accounts: Essential for financial management.

- Credit Lines: For operational liquidity and unexpected expenses.

Seeking Professional Assistance

- Legal Counsel: For advice on healthcare-specific legal structure, contracts, and compliance.

- Financial Advisor or Accountant: For tax and financial planning, and setting up accounting systems.

By attentively managing each of these aspects, your IV hydration business can establish a legally robust, financially sound, and compliant operation, setting a strong foundation for long-term success in the healthcare and wellness industry.

Capital Raising

In order to raise capital for your business you need to figure out certain stuff such as how much funding do you need, how will you use the funds, etc. The capital raising process will vary from business to business as the needs and requirements are different. Also make sure that you are not too much dependent on debt for your iv hydration business.

Raising capital for an IV hydration business requires a strategic approach, combining various funding sources to meet initial and operational costs. Here’s how you can plan this, including examples:

Estimating Capital Requirements

Initial Capital

- Start-Up Costs: These vary based on location, clinic size, and equipment quality. For instance, leasing a space in a metropolitan area might cost $4,000 to $7,000 per month. High-quality medical IV equipment and comfortable furnishings could range from $20,000 to $50,000.

- Operating Capital: Ensure you have funds for at least 6 months of expenses, including staff salaries, utilities (e.g., $500 to $1,500 per month), supplies, insurance, and marketing.

Sources of Capital

Personal Savings

- Self-Funding: Ideal for retaining full control. For example, using $30,000 of personal savings for initial lease and equipment down payments.

Bank Loans

- Traditional Loans: Can finance a significant portion of start-up costs. E.g., a $100,000 loan at a 5% interest rate over 7 years.

SBA Loans

- Government-Backed Loans: Like the SBA 7(a) program, these loans offer favorable terms for small business owners.

Equipment Financing

- Specific Loans: For purchasing medical and office equipment. For instance, a $60,000 equipment loan at a 6% interest rate.

Investors

- Equity Financing: Seeking funds from angel investors or venture capitalists. E.g., giving up 15% equity for a $150,000 investment.

Considerations for Capital Raising

- Debt vs. Equity Financing: Balancing Control and Obligation: Loans must be repaid with interest but keep ownership intact, while equity financing reduces control but doesn’t require repayment.

- Financial Projections: Revenue Forecasting: Illustrate fund utilization and revenue expectations. For example, breaking even in 18 months with a growing clientele.

- Credit Score and History: Importance of Creditworthiness: A strong credit score (e.g., 720 or above) can lead to better loan terms.

- Legal and Financial Advice: Professional Guidance: Essential for understanding contracts and financial planning. A financial advisor can help draft a business plan, while a lawyer ensures legal compliance.

In conclusion, securing capital for an IV hydration business involves a mix of funding sources tailored to your financial situation and business objectives. It’s important to evaluate each option’s advantages and commitments, ranging from personal investment to seeking external investors. Detailed financial planning and professional advice are key in navigating this process effectively.

Kickstarting the IV Hydration Business

Now you have completed your due diligence process before starting your winery business and feel confident to get started! The implementation phase will also require a ton of planning and initially try to invest less and get more end user feedback to make sure that you do not create something which is not going to be accepted by the market.

Launching an IV hydration business involves meticulous planning and strategic decision-making. Here’s a detailed guide, complete with examples:

Location Selection

- Site Analysis: Choose an area with high visibility and accessibility, possibly near fitness centers, business districts, or upscale residential areas. For example, a location in a bustling neighborhood of San Francisco, known for health and wellness, could be ideal.

- Lease Negotiations: Look for a lease that benefits your business, like a 3-year lease with options to renew. Negotiate terms that could include a few months of reduced rent to offset initial setup costs.

- Accessibility: Ensure the clinic is easily accessible, with convenient parking. A ground floor space in a popular strip mall could be advantageous.

Equipment Purchase and Installation

- Selecting Equipment: Invest in high-quality IV therapy equipment, comfortable recliners, and private treatment areas. For example, 5 top-tier IV infusion pumps and 5 luxury recliners.

- Maintenance Contracts: Arrange for regular maintenance of medical equipment to ensure reliability and safety.

- Efficient Layout: Design the space for privacy and comfort, with individual treatment areas and a relaxing waiting room.

Interior Design and Amenities

- Customer-Friendly Environment: Create a welcoming atmosphere with soothing colors, comfortable seating, and ambient lighting.

- Additional Amenities: Offer complimentary Wi-Fi, refreshments, and entertainment options like tablets or magazines.

Staffing and Training

- Hiring: Recruit qualified nurses or trained professionals for administering IV treatments. For instance, hiring 2-3 part-time registered nurses experienced in IV therapy.

- Comprehensive Training: Provide extensive training in IV administration, customer service, and safety protocols.

Setting Up Operations

- Utility Arrangements: Ensure all utilities support the operational needs of an IV hydration clinic, including any special medical waste disposal requirements.

- Safety Protocols: Implement strict hygiene and safety measures, adhering to healthcare standards.

- Payment Solutions: Set up various payment options, including insurance processing, credit card, and digital payment systems.

Marketing Strategy

- Building Hype: Utilize social media and partnerships with local fitness centers or wellness communities to create pre-launch interest.

- Grand Opening: Organize an opening event with special offers, like discounted first treatments or package deals.

- Loyalty Programs: Develop programs to encourage repeat visits, such as a discount on every fifth session.

Compliance and Insurance

- Regulatory Adherence: Stay updated and comply with all healthcare regulations, including state health department standards for medical clinics.

- Insurance Coverage: Secure comprehensive insurance that includes malpractice, liability, property, and employee coverage.

In summary, launching an IV hydration business requires careful attention to location, facility setup, staff recruitment and training, and operational efficiency. Creating a customer-centric environment, coupled with effective marketing and strict adherence to healthcare regulations, is key to establishing a successful IV hydration clinic.

Monitoring & Evaluation

Quality is the most important monitoring aspect then comes financials and overall operational efficiency. You also need to constantly check out the offering of your closest competitors, learn from their mistakes and include their best offerings. Monitoring the market will help you adjust and anticipate for macroeconomic problems which can help you mitigate risks in the long term.

To ensure the sustainable success of an IV hydration business, a comprehensive monitoring and evaluation strategy is essential. This involves examining various aspects of the business, from financial health to customer satisfaction, and making informed adjustments based on gathered insights.

Financial Monitoring

- Detailed Revenue Analysis: Track revenue from different services – standard IV treatments might generate $3,000 weekly, while specialized therapies bring in $4,000. Analyze trends to understand which services are most in demand.

- Cost Management: Regularly review expenses like medical supplies, which could range from $1,000 to $3,000 monthly, depending on client volume. Compare with industry standards to identify cost-saving opportunities.

- Cash Flow Analysis: Utilize financial management tools like QuickBooks to monitor cash flow, ensuring sufficient liquidity for operations.

Operational Efficiency

- Maintenance Logs: Maintain detailed records of equipment maintenance and repairs. For instance, tracking the servicing of IV pumps can guide decisions on equipment upgrades or replacements.

- Customer Appointment Patterns: Use scheduling software to track peak appointment times. If weekend mornings are busiest, consider adjusting staff schedules and offering promotions during slower periods.

- Inventory Management: Regularly check inventory levels of IV fluids and medical supplies, adjusting orders to maintain optimal stock levels.

Customer Feedback and Engagement

- Feedback Collection: Implement digital feedback methods, like online surveys, to gather client insights. Address common themes, such as requests for additional therapy options.

- Online Reputation Management: Monitor and respond to reviews on platforms like Yelp or Healthgrades. For example, addressing a concern about appointment wait times can improve service perception.

- Loyalty Program Analysis: Evaluate the effectiveness of loyalty programs, adjusting them based on participation rates and customer preferences.

Marketing Effectiveness

- Campaign Assessments: Analyze the impact of different marketing strategies. For example, measuring the client increase due to a social media campaign versus community event participation.

- Promotional Success: Assess the effectiveness of promotions, like “First Session Discount,” by tracking new client intake and revenue changes during these periods.

Safety and Compliance

- Regular Safety Audits: Conduct thorough safety checks to ensure all medical equipment and the facility adhere to healthcare safety standards.

- Compliance Checks: Stay informed about changes in healthcare regulations, ensuring your business remains compliant.

Continuous Business Development

- Market Trend Analysis: Keep abreast of industry trends, like the popularity of wellness infusions, and consider incorporating these into your service offerings.

- Technology Upgrades: Explore new technologies, such as online appointment booking systems, to enhance client experience and operational efficiency.

Employee Performance and Development

- Regular Staff Reviews: Perform bi-annual reviews to discuss staff performance, recognizing achievements and identifying improvement areas, like client interaction skills.

- Training Programs: Offer regular training on new therapies, medical protocols, or customer service to ensure staff proficiency and high-quality service.

By implementing a robust monitoring and evaluation system, you can make data-driven decisions that enhance the efficiency and profitability of your IV hydration business. Continually assessing these key areas allows you to adapt to market changes, optimize operations, and improve customer satisfaction, fostering long-term business success.

Related Articles:

Hot Shot Trucking Business Plan