Written by Elma Steven | Updated on July, 2024

How to Write a Moving Company Business Plan?

Moving Company Business Plan is an outline of your overall moving company business. The moving company business plan should include a 5 year financial projection, marketing plan, industry analysis, organizational overview, operational overview and finally an executive summary. Remember to write your executive summary at the end as it is considered as a snapshot of the overall business plan. You need to be careful while writing the moving company business plan as you need to consider various factors that can impact the business’s success. Read the sample moving company business plan in order to have a clear understanding of the process.

Table of Contents

Executive Summary

A to Z Movers is founded by Robert Walker and is located in Miami. Our primary services include Residential Moving, Commercial MovingSets and Specialty Item Moving. Our USPs involve Multilingual Staff, Art and Antiques Specialty and Post-Move Services. Our founder has more than 12 years of experience working in the logistics and moving services industry and most of the management team members have at least 4 years of job experience.

Mission: To provide outstanding moving services in Miami by leveraging the expertise of our proficient and multilingual staff. We specialize in both commercial and residential relocations, transporting everything from antiques and priceless artwork to commonplace items. We provide extensive post-move services to guarantee a smooth transition for our valued clients.

Vision: Establish ourselves as the preeminent moving company in Miami. Our objective is to establish new benchmarks in the moving industry by innovating and excelling in every facet of the process from standard relocations to specific item management.

Industry Overview:

The size of the global Moving Services market increased from USD Million in 2022 to USD Million in 2028 expanding at a CAGR of USD Million from 2022 to 2028. Regardless of substantial volatility, moving companies in the United States have experienced a moderate increase in revenue throughout the current and outlook periods. In spite of the decline in consumer confidence and expenditure amidst the COVID-19 pandemic the residential sector maintained a substantial demand for relocating services due to still-low interest rates.

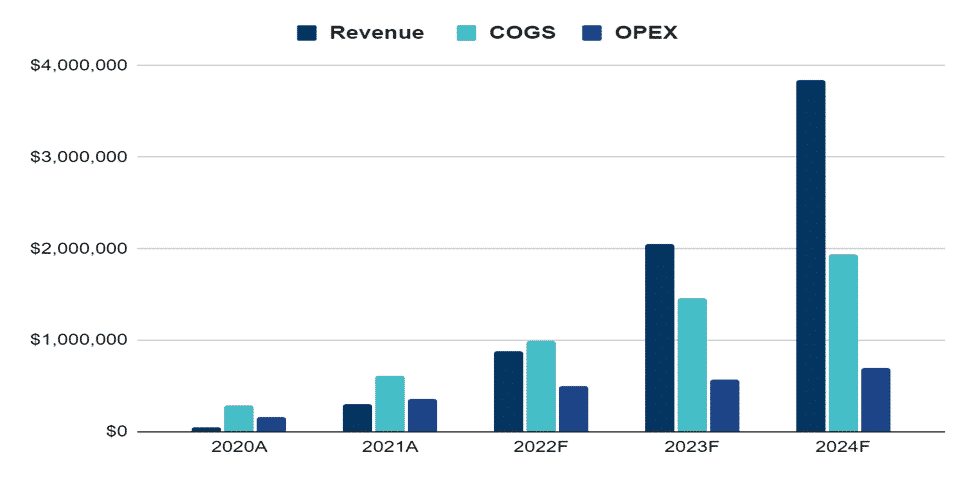

Financial Overview:

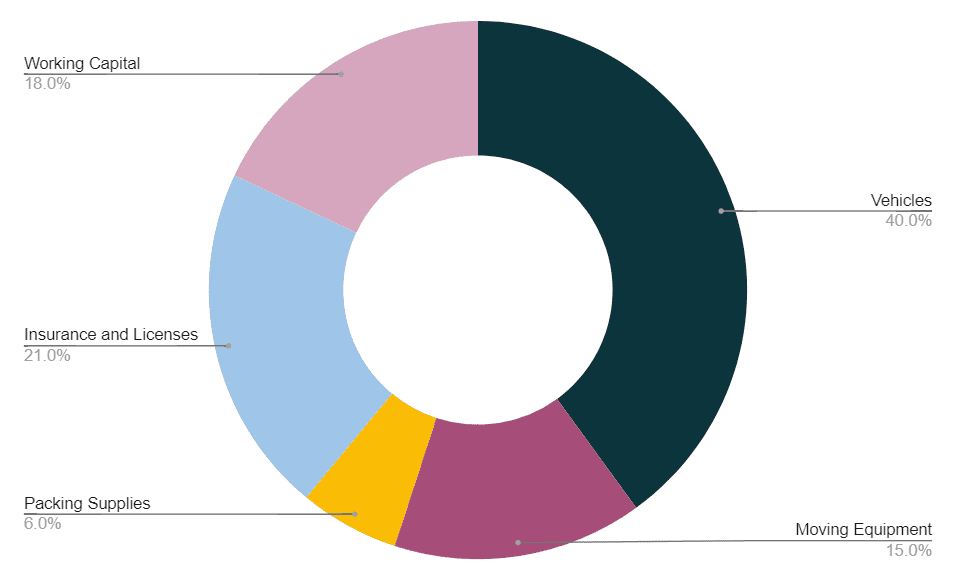

Fund Usage Plan

Business Description

Business Name: SpeedyMove

Founders: Robert Walker

Management Team:

Legal Structure: LLC

Goals:

✔️Customer Satisfaction:To maintain a customer satisfaction rate of 95% or greater on a consistent basis as determined by reviews and feedback.

✔️Environmental Responsibility: Achieve a 20% reduction in our carbon footprint over a period of five years by implementing waste reduction practices, fuel-efficient vehicles and environmentally friendly packaging materials.

✔️Market Expansion: With the objective of reaching the ten most populous metropolitan regions in the United States within the following three years and to pursue potential avenues for international expansion in the long run.

Services & Pricing Strategy:

✔️Residential Moving: This can be categorized as either essential or additional services. Transportation, loading & unloading, packing & unpacking and basic insurance coverage are all examples of fundamental services. On the other hand, we can provide packing materials and boxes, special item handling, storage solutions, advanced insurance options, and expedited service options as additional services.

✔️ Commercial Moving: The basic services can include Office Furniture and Equipment Packing and Unpacking, Secure Transportation of Equipment and Documents and IT Equipment and Server Relocation. Additional services can include Storage Solutions for Office Equipment, Special Handling for Sensitive Equipment or Documents and Disassembly and Reassembly of Office Furniture.

✔️ Specialty Item Moving: Our Specialized Moving Services accommodate the specific requirements associated with the transportation of valuable, fragile and uncommon items. This encompasses a range of valuable investments including automobiles & motorcycles, transporting artwork and antiquities. Our company provides customized crating and packaging, climate-controlled transportation and installation services at the intended location in order to meet the unique requirements of these items. In addition, white glove service is provided which consists of setup and positioning at the location and additional insurance coverage options are also available.

Download Free Moving Company Business Plan Template

Write a plan in just 2 days!

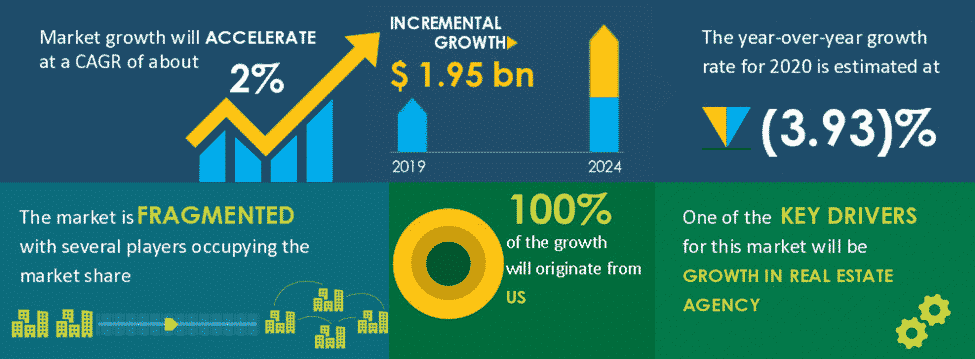

Industry Analysis

According to Technavio, the moving services market in the United States is expected to increase by USD 1.95 billion between 2019 and 2024, with a CAGR of 2%. The residential segment’s market share rise will be essential for revenue creation in the United States. People are increasingly renting outhouses as the number of home purchasers declines. Furthermore, rising property prices are causing individuals to relocate from high-cost locations such as California, Arizona, and Colorado to lower-cost cities such as Texas, Massachusetts, and North Carolina.

However, during the projection period, the high prices associated with relocation services will significantly threaten the US moving services market. Relocation costs a lot of money, whether it’s a residential or business move. When a relocation service operator is employed to do the task, it costs considerably more. Even though relocation services offer an estimate for moving, the final cost numbers are always 35 percent to 40% more than the predicted cost. Furthermore, equipment/personnel possessions that are damaged incur additional expenditures. This is primarily a worry for businesses since any damage to the facility during the move process might result in higher lease costs. Clients anticipate that transferring across states would cost roughly USD4,000-USD4,800, and moving interstate will cost around USD800-USD900. However, the average cost of relocating interstate for business and residential services is between USD 1,150 and USD 2,500. Moving across states is about USD5,300-USD6,000, or around 35% higher than the anticipated cost.

In the United States, the moving services industry is fragmented, and providers compete by using organic and inorganic expansion techniques. Some of the key players in the industry are AGS Worldwide Movers, ArcBest Corp., Armstrong Relocation and Companies, Arpin Van Lines, Atlas World Group Inc., Beltmann Relocation Group, Coleman World Group, UniGroup CA, U-Pack, and Wheaton World Wide Moving.

The COVID-19 (coronavirus) pandemic caused revenue in the Moving Services business to fall by 0.7 percent in 2020. The industry will rise 5.4 percent as the economy recovers, and movements are rebooked. During the pandemic, the industry’s profitability was harmed by increasing labor costs and increasing fuel prices in the face of poor demand. As the general economy improved in 2021, economic uncertainty will likely decrease. However, revenue growth is projected to be slowed when the housing market reaches a plateau. Despite the continuing coronavirus epidemic, the Moving Services sector has grown in the five years leading to 2021. Industry revenue is predicted to climb by 5.4 percent in 2021, outpacing reductions earlier, especially in 2020. Due to the industry’s status as a critical service, it has remained operational for the duration of the epidemic. In addition, in 2020, an increase in existing house sales and housing starts helped offset the pandemic’s revenue consequences.

About 7,000 moving firms handle roughly 14,000 sites throughout the United States, generating $86 billion in income. Professional movers are only one of several options for local, international, or long-distance relocation. This only demonstrates that the moving business is far broader than most people know, and it has a tremendous influence on the US economy and everyday life.

Small businesses are well-known as the backbone of the US economy, and the moving industry is no exception, with over half of all moving firms employing less than five people. This is another example of how the destiny of the relocation business and the migratory patterns and habits of Americans are inextricably linked to the US economy’s future and success. Hardworking movers, drivers, and packers play a significant role in facilitating migration throughout the United States. The consequences of recent technical improvements have been felt by moving firms and the industry. Those businesses that embrace technological advancements will be able to provide a more seamless relocation experience, attracting more customers and increasing profits.

Meetings, frequent calls, and interminable discussions were part of the relocation process. Clients and businesses were required to go through every element of the relocation. Relocation specialists are expected to provide high levels of efficiency these days, and the easiest way to do it is to automate recurrent and time-consuming operations. Moving firms should use virtual reality and artificial intelligence (AI) since they have the potential to transform the industry as we know it.

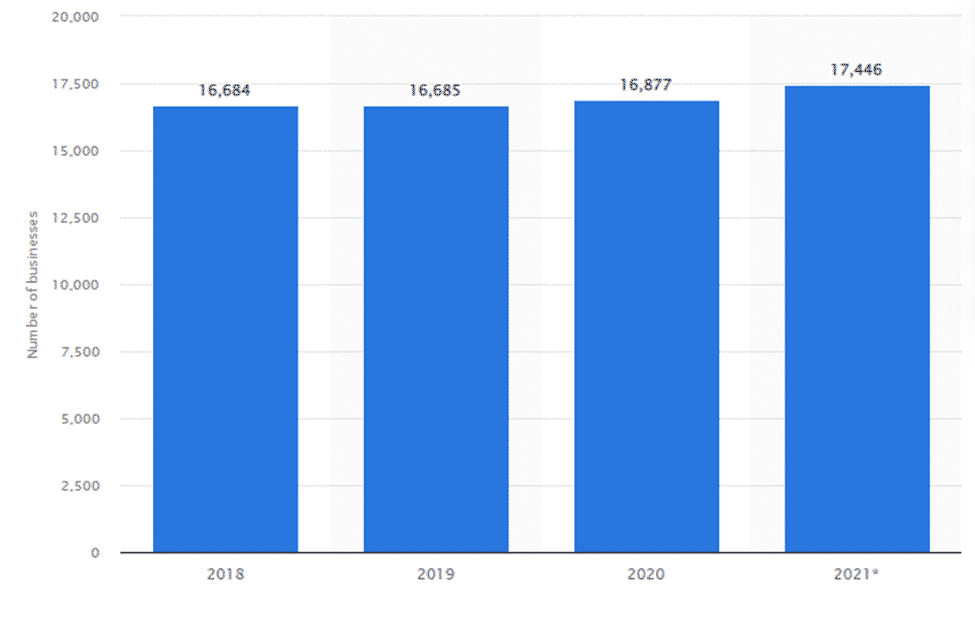

Number of enterprises in the moving services market

in the U.S. between 2018 and 2021

Many businesses have previously incorporated a variety of high-tech advances to enhance their service quality. Those who haven’t yet will undoubtedly do so in the future, as technology makes the moving process more pleasant and efficient for both clients and professional movers. Self-booking is an example of a digital trend that many businesses use. Clients may use one of the numerous applications available to book last-minute moving services in this manner. Clients may also get real-time service updates via household item monitoring. They may use an internet app to keep track of their stuff. The customer will feel more in charge and secure in this situation.

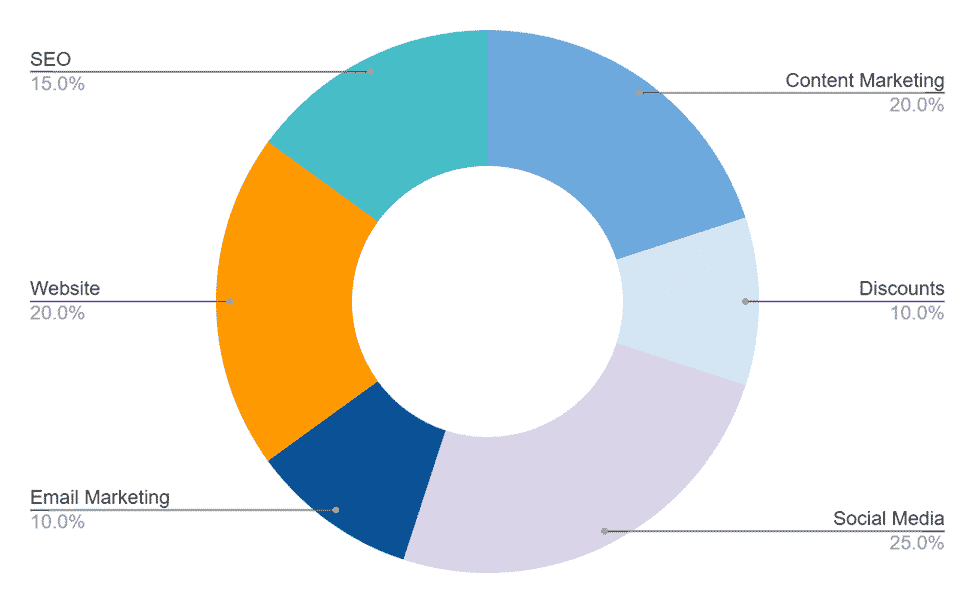

Marketing Plan

A marketing plan of a Moving Company business plan outlines the company’s strategy to promote its products or services to its target audience. It includes specific tactics and channels the business will use to reach potential customers. This section defines the company’s unique value proposition, identifies the target market segments, and discusses the competitive landscape. It also includes insight into budget allocation, projected outcomes and key performance indicators to measure success. Marketing plan helps businesses demonstrate their understanding of the market dynamics, their positioning within the industry and their approach to driving customer engagement and sales.

Content Marketing Xpress Movers posts a blog on YouTube to show viewers our services.

Discounts: Create a plan allowing Xpress Movers’ regular customers to get a discount if they successfully refer a new customer.

Social Media: Posting photos and promos by Xpress Movers gain confidence from prospective customers.

Email Marketing We create a list of subscribers and send them emails regarding Xpress Movers’ services.

Website: The material on the website of Xpress Movers is well-organized, with simple navigation that is easy to follow.

SEO (Search Engine Optimization) When a customer enters a search box, Xpress Movers wants

to appear at the top of the list.

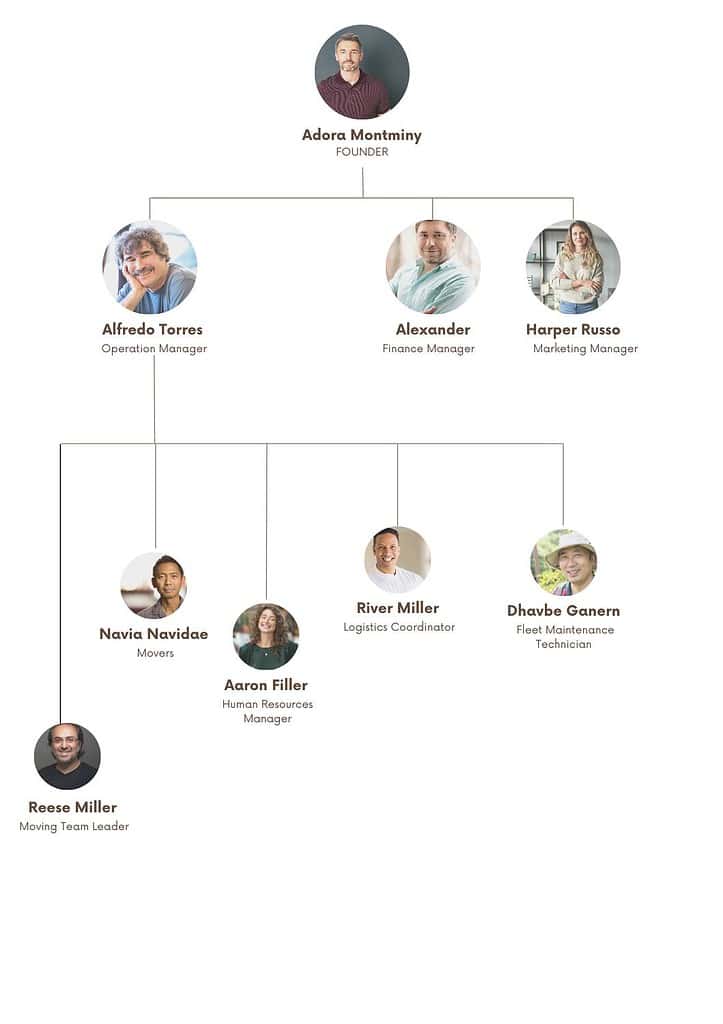

Organogram

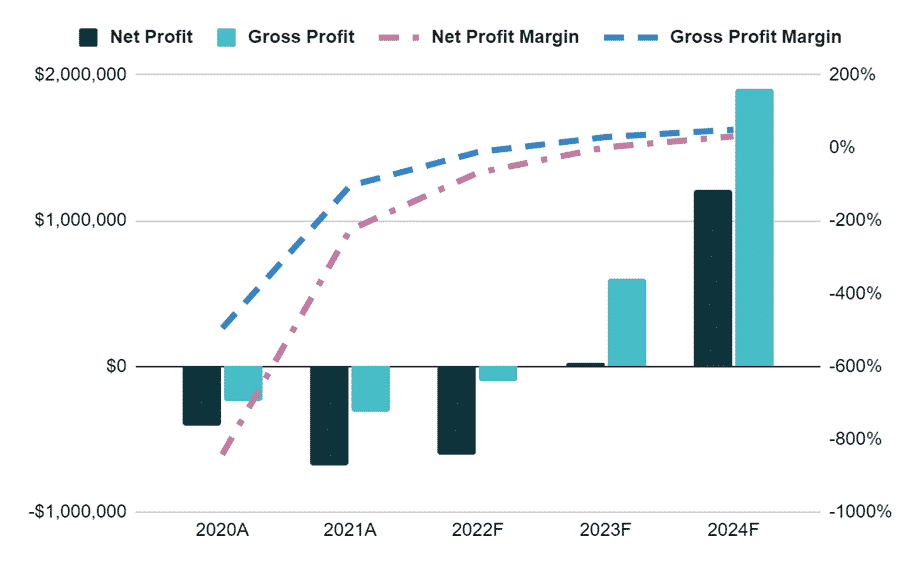

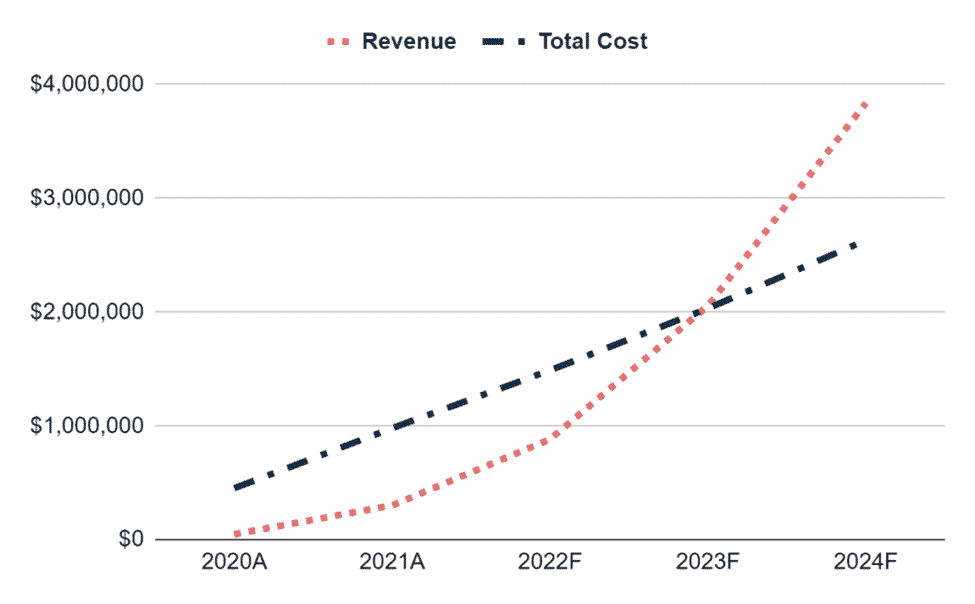

Financial Plan

A financial plan of a Moving Company business plan provides a comprehensive projection of a company’s financial health and its anticipated monetary performance over a specified period. This section encompasses a range of financial statements and projections such as profit and loss statements, balance sheets, cash flow statements and capital expenditure budgets. It outlines the business’s funding requirements, sources of finance and return on investment predictions. The financial plan gives stakeholders particularly potential investors and lenders a clear understanding of the company’s current financial position. A financial plan helps businesses demonstrate their financial prudence, sustainability, and growth potential.

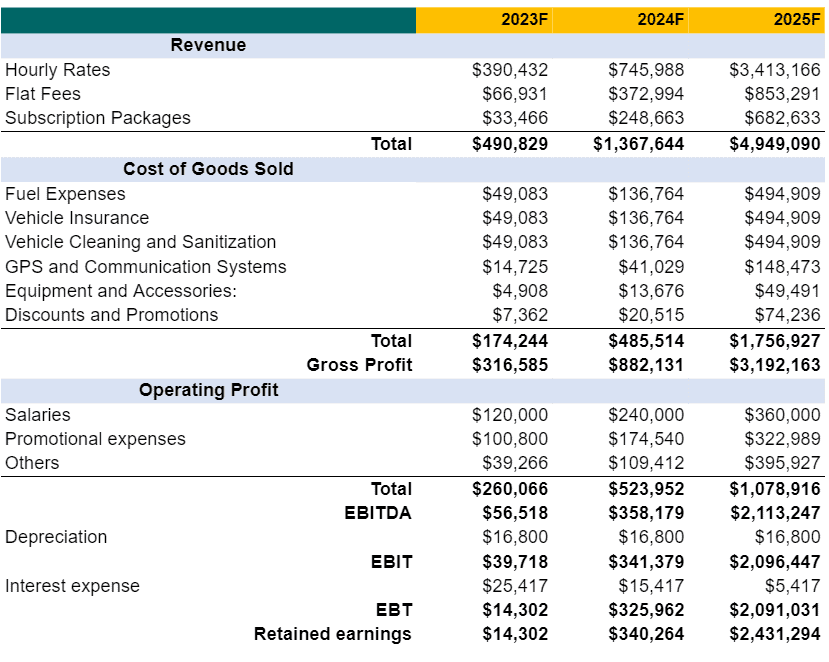

Earnings:

Break-Even Analysis:

Income Statement:

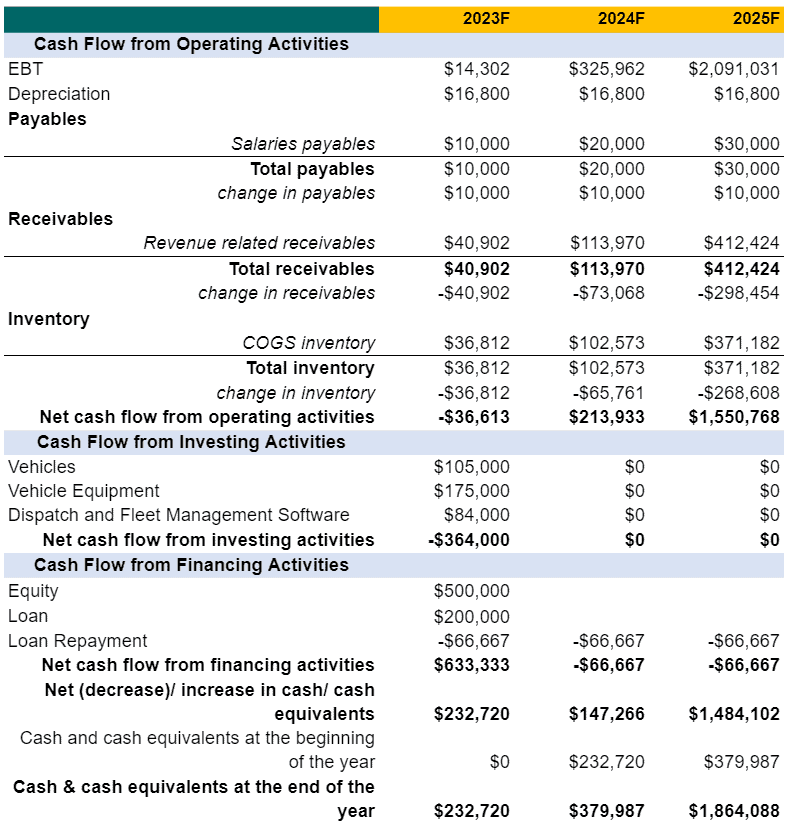

Cash Flow Statement:

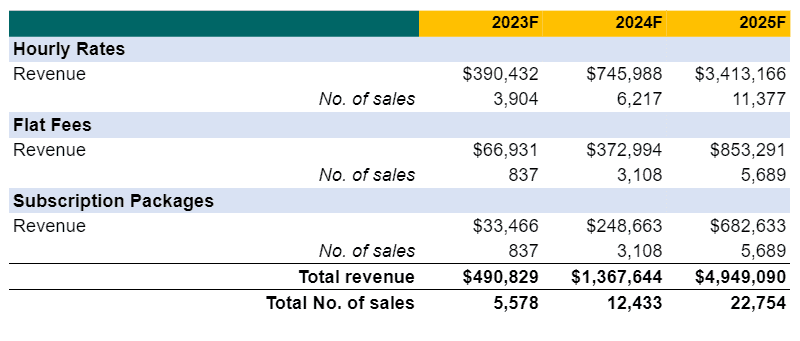

Revenue Summary:

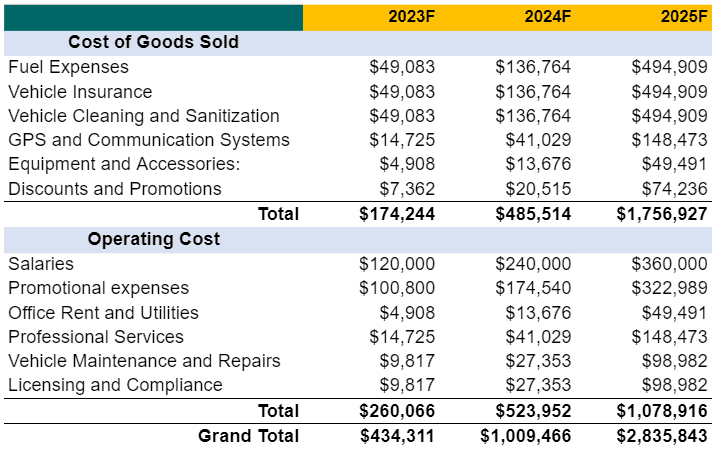

Cost Summary:

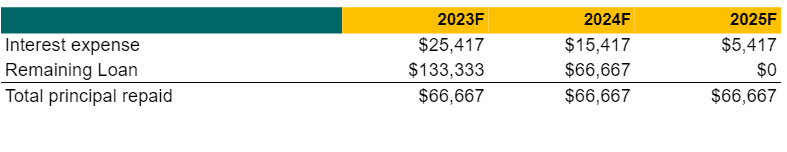

Loan Amortization Schedule:

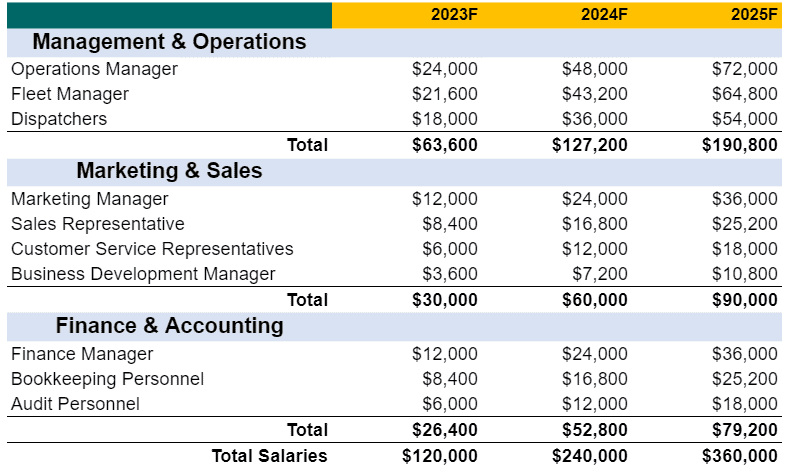

Salary Summary:

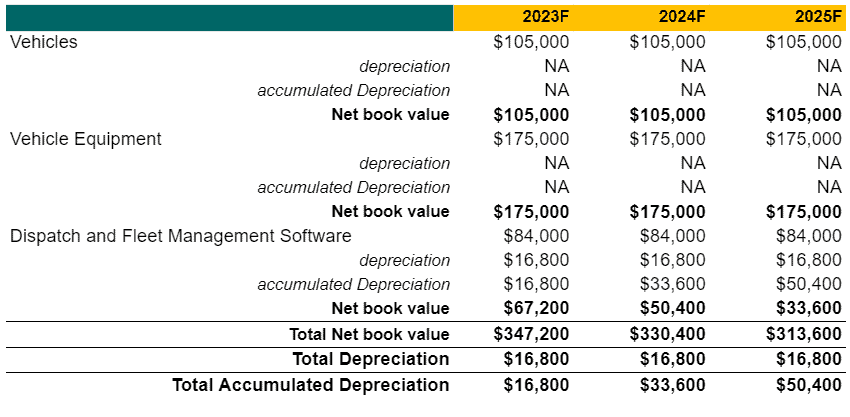

Non-Current Asset Schedule:

Related Articles: