Written by Elma Steven | Updated on July, 2024

Executive Summary

Overview: We grew up on farms and are native North Carolinians. Eastern NC Crawfish Farm is a novel approach to crawfish farming in North Carolina. We are a deep pond crawfish farmer with ponds that are 4 to 8 feet deep, similar to a fishing pond. Unlike conventional Crawfish Farmers, we don’t empty our ponds for “Crop Planting.” We may now gather crawfish from May until September. Because of the freezing water temperatures, we do not harvest throughout the winter. Our Crawfish are fed a Scratch mix that is comparable to chicken or duck feed and a variety of pesticide-free hay bales! This means you can boil all year round!

Mission: We pledge to provide you with the freshest live crawfish available from our farm.

Vision: We like difficulties and strive for excellence by pushing ourselves to new heights. We want to expand our business’s horizons with a dedicated team and cutting-edge infrastructure.

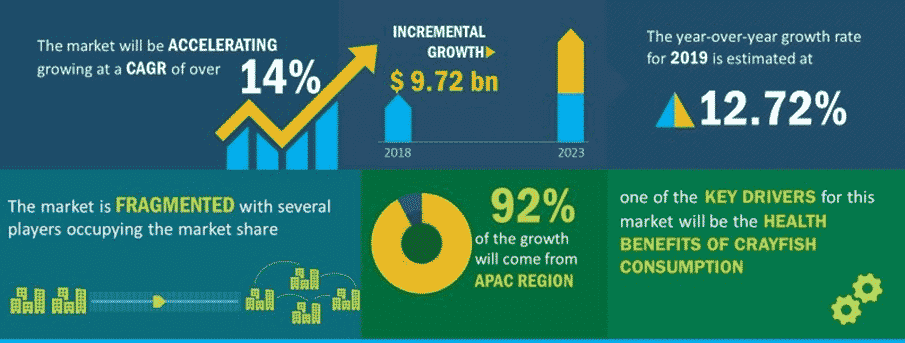

Industry Overview: The crayfish market was worth $9.8 billion in 2020 and is predicted to grow at a CAGR of 12.7% from 2021 to 2026. Mudbugs, crawdads, freshwater lobsters, freshwater crustaceans, yabbies, and crawfish are used to describe crayfish. Crayfish and freshwater crustaceans like tiny lobsters are members of the Astacoidea and Parastacoidea superfamilies. Crayfish are abundant in omega-3 fatty acids, which may help you see better by lowering your risk of macular degeneration and vision loss.

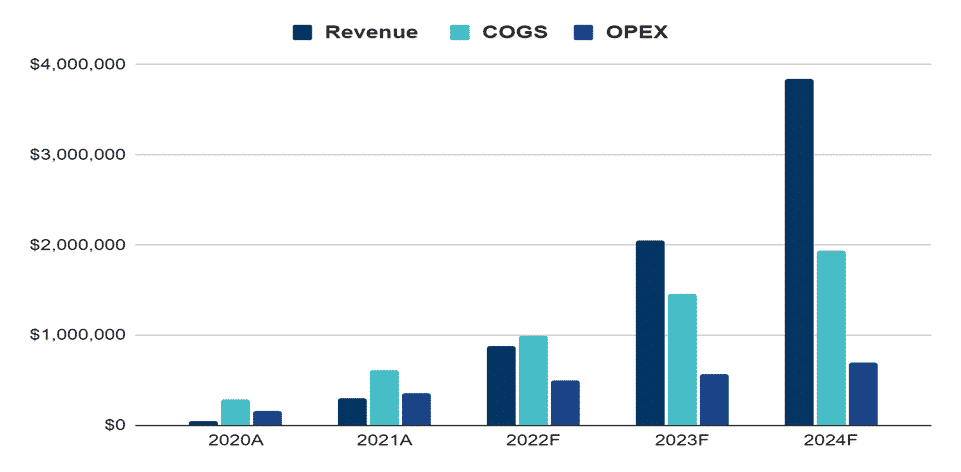

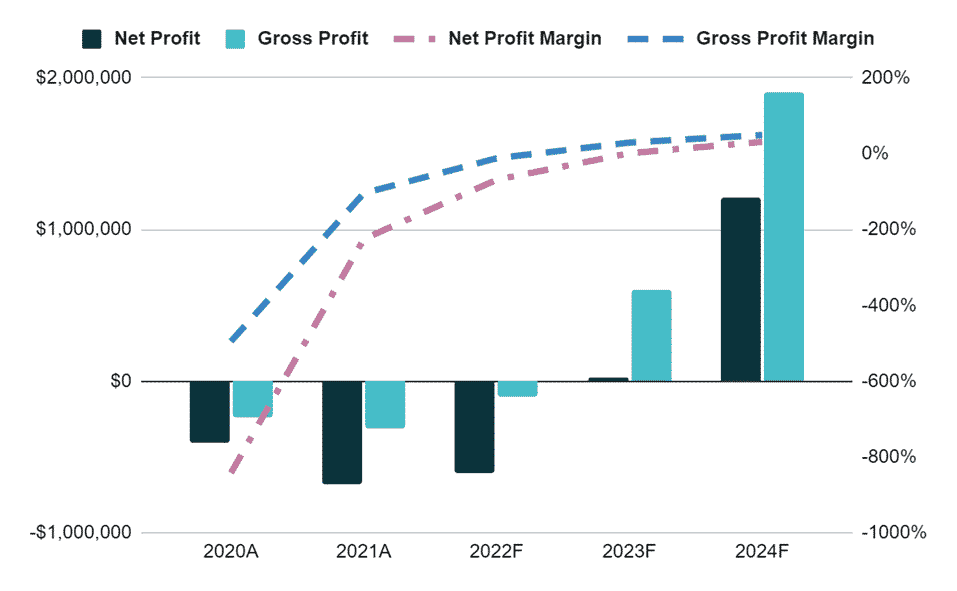

Financial Overview:

Financial Highlights:

| Liquidity | 2020A | 2021A | 2022F | 2023F | 2024F |

| Current ratio | 6 | 12 | 23 | 32 | 42 |

| Quick ratio | 6 | 11 | 22 | 31 | 40 |

| DSO | 8 | 8 | 8 | 8 | 8 |

| Solvency | |||||

| Interest coverage ratio | 8.2 | 11.1 | 14.2 | ||

| Debt to asset ratio | 0.01 | 0.01 | 0.2 | 0.18 | 0.16 |

| Profitability | |||||

| Gross profit margin | 51% | 51% | 53% | 53% | 53% |

| EBITDA margin | 12% | 14% | 21% | 22% | 22% |

| Return on asset | 5% | 6% | 13% | 14% | 14% |

| Return on equity | 5% | 6% | 16% | 17% | 17% |

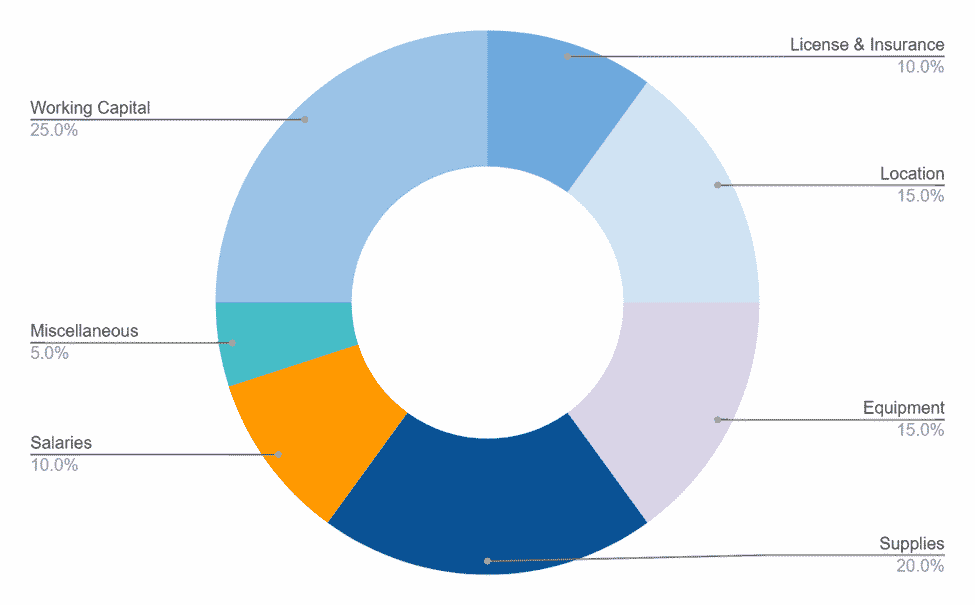

Fund Usage

Industry Analysis

Live, processed, and frozen crayfish are all available on the market. Smaller crayfish are processed or frozen, but giant crayfish are widely appreciated live. Because of the crayfish’s seasonal availability, it’s excellent to sell it frozen throughout the year. This kind of crayfish may also be sent to other parts of the world. They may be used as alternatives or to add variety to restaurant meals since they belong to the same family as crabs and lobsters. Crayfish demand will be boosted by increased demand for lobsters and crabs since they are similar. Furthermore, crayfish may be prepared and served in various ways, such as boiled, steamed, or with precisely customized abdominal flesh, which fosters market expansion by encouraging customer taste difference. Crayfish of multiple sizes have priority customers from overseas. Larger ones are mainly sold to wholesalers and processors, while smaller ones are offered directly to restaurants, retail outlets, and customers. Crayfish is a healthy and nutritious source of calcium, iron, magnesium, and vitamin B-12, allowing it to thrive in the market as health awareness and proper nutrition become the new trend. Crayfish may also be utilized as fish bait, sold for aquariums, or used as specimens by educators.

Weight loss, bone and brain development, and depression prevention are just a few of the health benefits of crayfish. The iron content in crayfish is relatively high. Regularly eating helps the body produce and circulate blood, lowering the risk of anemia and other low-iron-related health issues. The increasing demand for seafood due to its health benefits is one of the key factors driving the market’s growth. Rising health concerns and the growing popularity of omega-3 fatty acids are predicted to increase the overall market development of the Crayfish Market for 2021-2026.

Global Crayfish Market 2019-2023

While working on the industry analysis section of the Crawfish business plan make sure that you add significant number of stats to support your claims and use proper referencing so that your lender can validate the data.

People increasingly prefer processed seafood worldwide, thereby extending the expansion of the Crayfish Market. Increasing demand for seafood due to lifestyle changes. According to the Food and Agriculture Organization (FAO), by 2030, 40 million extra tonnes of seafood would be required to fulfill global demand, a roughly 30% increase. Moreover, over the projection period 2021-2026, a rise in people’s disposable income is expected to boost the Crayfish market.

The health advantages of crayfish are becoming more well known since it is an excellent source of omega-3 fatty acids that may help avoid chronic illnesses, driving the Crayfish industry forward. The World Health Organization predicts that the world’s aging population will increase cancer incidence over several decades. By 2020, there will be 17 million new cancer cases, and by 2030, there will be 27 million. The Crayfish Market is expected to rise from 2021 to 2026 due to the expansion of the food and beverage sector.

Crawfish may be found in all of the southern United States’ warm waters during the warm weather seasons. In Texas, Arkansas, Mississippi, Alabama, and the Carolinas, small harvests of farmed crawfish are made for human consumption. On the other hand, Louisiana hand is the country’s leading crawfish producer. From year to year, Louisiana is projected to account for 90 percent to 95 percent of total US output, either from the state’s natural waterways or from farms. Crawfish have been sold commercially in Louisiana since the late 1800s, and the crawfish business in the Bayou State now encompasses millions of pounds gathered from farms and natural rivers. Louisiana locals benefit from gathering wild crawfish in natural ecosystems, including bayous, swamps, and marshes. The Louisiana Crawfish Promotion and Research Board estimate that the sector directly or indirectly employs roughly 7,000 people and generates $300 million in revenue for the state each year.

The critical barrier obstructing the Crayfish market’s development is the high cost of Crayfish, which necessitates a significant investment in processing. High processing temperatures may also have an impact on product quality. Depending on the species and grade, crayfish costs anywhere from $6.95 to $149.95 a pound. Regulatory worries regarding product usage and more tight government policy and regulation in the transportation industry are other reasons that impede the market’s development.

The crayfish industry in the United States is expected to reach USD 285 million in 2020 due to increased demand domestically and internationally. The market is predicted to rise at a CAGR of roughly 31.5 percent between 2022 and 2027, reaching a value of over USD 1555 million by 2026, thanks to increasing consumer demand, health awareness, and culinary appeal.

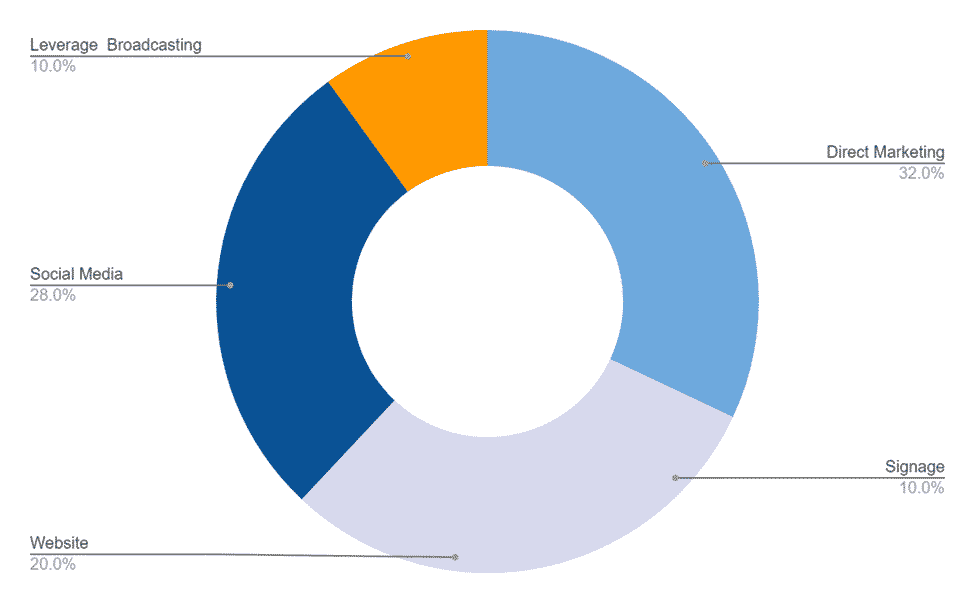

Marketing Plan

Signage: Make Eastern NC Crawfish Farm signage that is large and easy to see. It makes it simple for potential purchasers to see it, particularly when driving.

Direct marketing: To generate more income, sell Eastern NC Crawfish Farm goods directly to end-users.

Website: Create a website for Eastern NC Crawfish Farm so that customers can learn about the product, get contact information, and learn how to buy it.

Social Media: Prospective purchasers for Eastern NC Crawfish Farm might be attracted by consistent posting to social media sites of photos and activities.

Leverage Broadcasting: Advertise the Eastern NC Crawfish Farm on television and radio to reach out to non-social media users, such as senior community people.

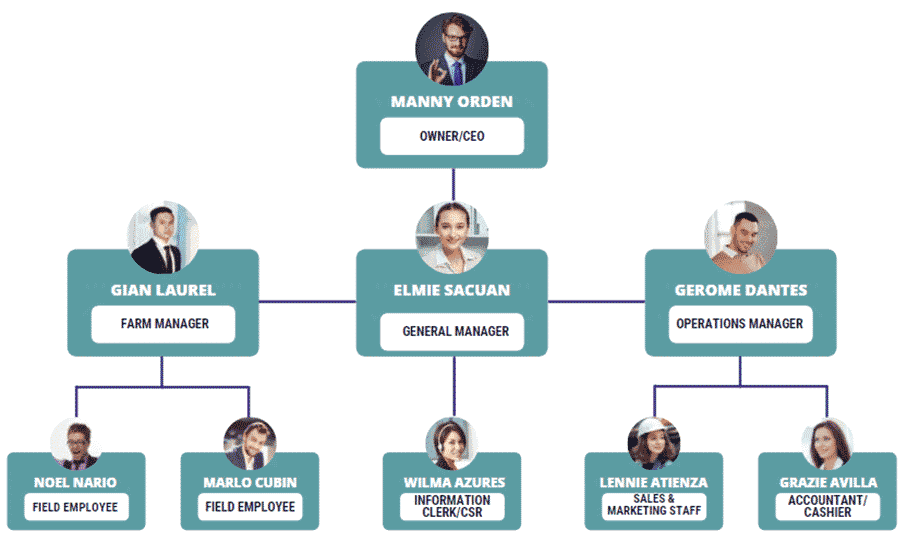

Organogram

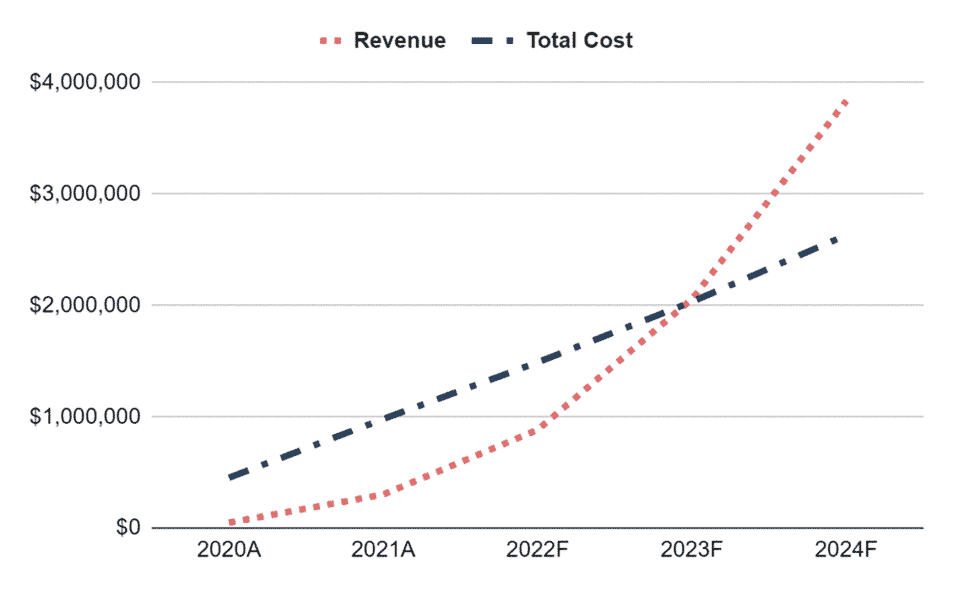

Financial Plan

Earnings:

Break-Even Analysis:

Income Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| Total Cost of Revenue | 285,560 | 615,220 | 987,794 | 1,455,612 | 1,935,625 |

| as % of revenue | 595% | 204% | 112% | 71% | 50% |

| Gross Profit | -237,575 | -313,984 | -105,583 | 601,578 | 1,902,218 |

| SELLING & ADMIN EXPENSES | |||||

| Item 1 | 28,000 | 96,800 | 154,880 | 175,692 | 193,261 |

| Item 2 | 75,000 | 105,000 | 120,000 | 120,000 | 120,000 |

| Item 3 | 36,000 | 96,000 | 108,000 | 120,000 | 120,000 |

| Item 4 | 8,000 | 12,000 | 12,000 | 12,000 | 12,000 |

| Item 5 | 3,839 | 18,074 | 44,111 | 61,716 | 115,135 |

| Item 6 | 3,359 | 12,049 | 26,466 | 41,144 | 76,757 |

| Item 7 | 5,600 | 10,000 | 12,904 | 15,034 | 17,376 |

| Item 8 | 6,667 | 14,000 | 22,067 | 30,940 | 40,701 |

| Total selling & admin expenses | 166,464 | 363,924 | 500,428 | 576,525 | 695,230 |

| as % of revenue | 347% | 121% | 57% | 28% | 18% |

| Net profit | -404,039 | -677,907 | -606,011 | 25,052 | 1,206,987 |

| Accumulated net profit | -404,039 | -1,081,947 | -1,687,957 | -1,662,905 | -455,918 |

Cash Flow Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| CASH FLOW from OPERATING ACTIVITIES | |||||

| Net profit before tax | -$404,039 | -$677,907 | -$606,011 | $25,052 | $1,206,987 |

| Depreciation | $44,267 | $85,333 | $120,504 | $158,127 | $199,512 |

| Payables | |||||

| Item 1 | $4,333 | $5,417 | $6,500 | $7,583 | $8,667 |

| Item 2 | $11,667 | $28,000 | $46,667 | $70,000 | $93,333 |

| Item 3 | $6,250 | $8,750 | $10,000 | $10,000 | $10,000 |

| Item 4 | $3,000 | $8,000 | $9,000 | $10,000 | $10,000 |

| Item 5 | $667 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| change in payables | $25,917 | $25,250 | $22,000 | $25,417 | $24,417 |

| Receivables | |||||

| Item 1 | $320 | $1,506 | $3,676 | $5,143 | $9,595 |

| Item 2 | $360 | $1,807 | $4,411 | $8,229 | $11,514 |

| Total receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| change in receivables | -$680 | -$2,634 | -$4,773 | -$5,285 | -$7,736 |

| Net cash flow from operating activities | -$334,536 | -$569,958 | -$468,280 | $203,311 | $1,423,180 |

| CASH FLOW from INVESTING ACTIVITIES | |||||

| Item 1 | $16,000 | $13,200 | $14,520 | $15,972 | $17,569 |

| Item 2 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Item 3 | $28,000 | $22,000 | $14,520 | $10,648 | $11,713 |

| Item 4 | $96,000 | $88,000 | $72,600 | $79,860 | $87,846 |

| Item 5 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Net cash flow/ (outflow) from investing activities | -$180,000 | -$167,200 | -$150,040 | -$159,720 | -$175,692 |

| CASH FLOW from FINANCING ACTIVITIES | |||||

| Equity | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net cash flow from financing activities | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net (decrease)/ increase in cash/ cash equivalents | -$114,536 | -$297,158 | -$134,320 | $575,991 | $1,833,128 |

| Cash and cash equivalents at the beginning of the year | – | -$114,536 | -$411,693 | -$546,014 | $29,978 |

| Cash & cash equivalents at the end of the year | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

Balance Sheet:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| NON-CURRENT ASSETS | |||||

| Item 1 | $16,000 | $29,200 | $43,720 | $59,692 | $77,261 |

| Item 2 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Item 3 | $28,000 | $50,000 | $64,520 | $75,168 | $86,881 |

| Item 4 | $96,000 | $184,000 | $256,600 | $336,460 | $424,306 |

| Item 5 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Total | $180,000 | $347,200 | $497,240 | $656,960 | $832,652 |

| Accumulated depreciation | $44,267 | $129,600 | $250,104 | $408,231 | $607,743 |

| Net non-current assets | $135,733 | $217,600 | $247,136 | $248,729 | $224,909 |

| CURRENT ASSETS | |||||

| Cash | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

| Accounts receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| Total current assets | -$113,856 | -$408,380 | -$537,927 | $43,349 | $1,884,214 |

| Total Assets | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

| LIABILITIES | |||||

| Account payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| Total liabilities | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| EQUITIES | |||||

| Owner’s equity | $400,000 | $840,000 | $1,324,000 | $1,856,400 | $2,442,040 |

| Accumulated net profit | -$404,039 | -$1,081,947 | -$1,687,957 | -$1,662,905 | -$455,918 |

| Total equities | -$4,039 | -$241,947 | -$363,957 | $193,495 | $1,986,122 |

| Total liabilities & equities | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

Related Articles: