Written by Elma Steven | Updated on August, 2024

Executive Summary

Overview: PowerRich has been North America’s leading specialist in matching crop nutritional needs to soil type since 1984. We’ve done it in the most cost-effective and ecologically friendly way imaginable. PowerRich has developed a unique culture. Powertech is well-positioned to help farmers produce their finest harvests today and in the future, thanks to our internationally sourced, high-quality ingredients for our patented formulae and continual innovation. Powertech will be the leading provider of cost-effective, balanced fertilizers, which are critical for delivering above-average crop yields throughout the short growing season experienced by prairie farmers in Canada and northern America.

Mission: Our mission is to provide high-performance, soil-friendly fertilizers that do not pollute the soil or plants.

Vision: Our vision has always been to ensure the long-term viability of ecologically friendly farming techniques and be good stewards of our most important living resource, the soil.

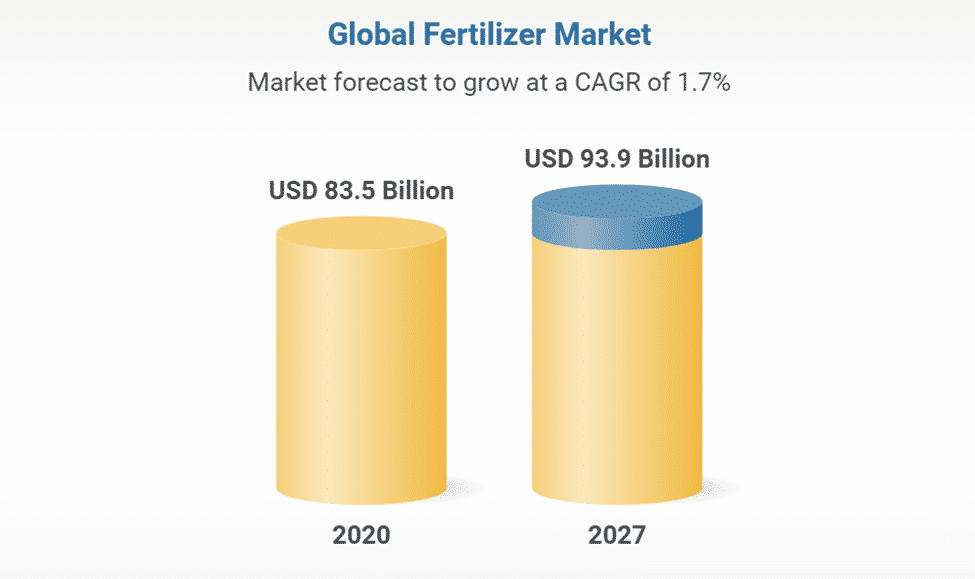

Industry Overview: From 2021 to 2027, the fertilizer market will increase at a CAGR of 2.4 percent, with market size of 171,759.7 million in 2020 (zionmarketresearch). Fertilizer’s business development is fueled by a rising global population and changing food trends. There are several issues facing the global agriculture business. The UN estimates that by 2050, the world’s population will have surpassed nine billion people. This would put a significant strain on the agricultural industry, which is already suffering from a loss of production owing to workforce shortages and the shrinkage of farmland due to rising urbanization. According to the Food and Agricultural Organization, more than 70% of the world’s population will live in cities (imarcgroup). Farmers are being forced to enhance their agricultural production by utilizing fertilizers since arable areas are being reduced around the globe.

Financial Overview:

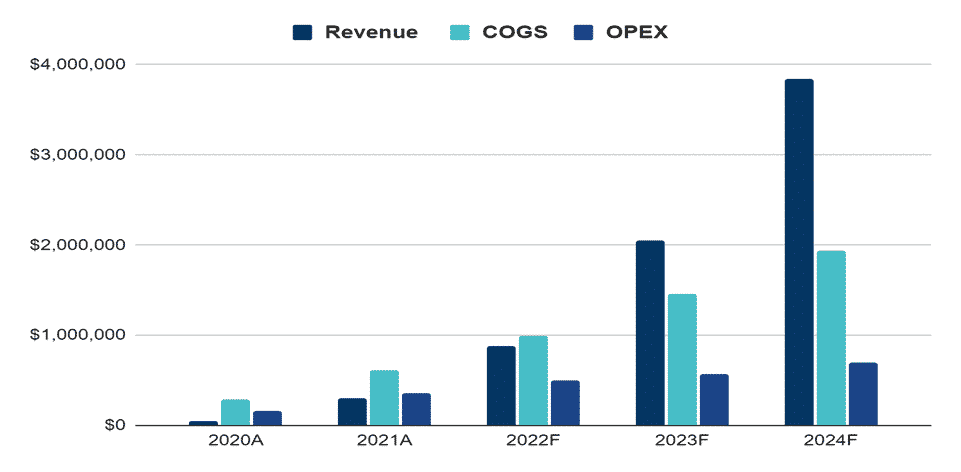

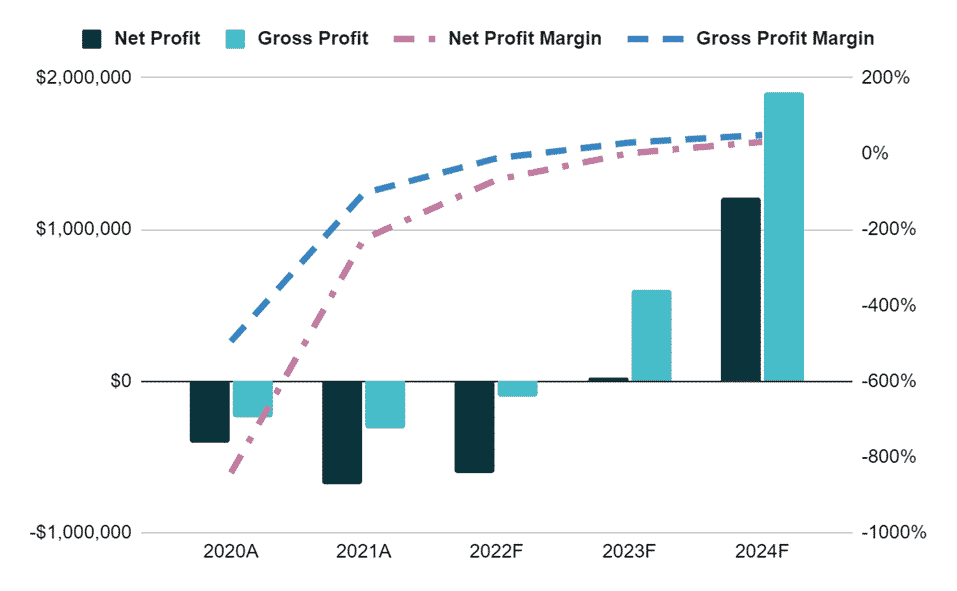

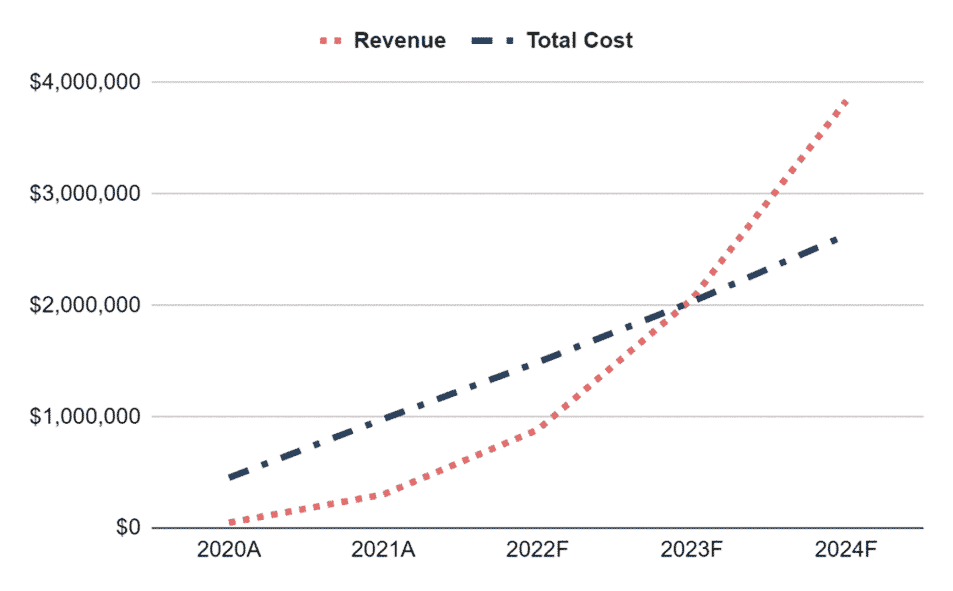

Financial Highlights:

| Liquidity | 2020A | 2021A | 2022F | 2023F | 2024F |

| Current ratio | 6 | 12 | 23 | 32 | 42 |

| Quick ratio | 6 | 11 | 22 | 31 | 40 |

| DSO | 8 | 8 | 8 | 8 | 8 |

| Solvency | |||||

| Interest coverage ratio | 8.2 | 11.1 | 14.2 | ||

| Debt to asset ratio | 0.01 | 0.01 | 0.2 | 0.18 | 0.16 |

| Profitability | |||||

| Gross profit margin | 51% | 51% | 53% | 53% | 53% |

| EBITDA margin | 12% | 14% | 21% | 22% | 22% |

| Return on asset | 5% | 6% | 13% | 14% | 14% |

| Return on equity | 5% | 6% | 16% | 17% | 17% |

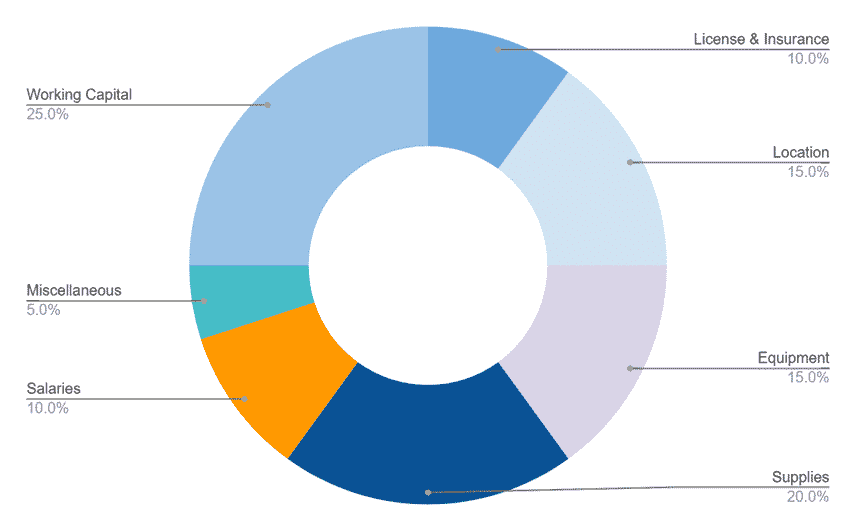

Fund Usage

Industry Analysis

Fertilizer is an important part of feeding the world’s growing population. Fertilizer is responsible for half of the food produced now across the globe. Fertilizers’ significance in enhancing production efficiency will only increase in importance as demand grows. Fertilizers are chemical ingredients that help plants grow and produce more. They may be natural or synthetic. Fertilizers may improve the soil’s inherent fertility or replenish the chemical components that previous crops removed from the ground. Nitrogenous, potash, and phosphate fertilizers are among the most common fertilizers. Certain “micronutrients,” such as zinc and other metals, are also included in certain fertilizers, essential for plant development. The fertilizers market is divided into two categories: straight and complicated fertilizers, as well as crop kinds (grains and cereals, pulses and oilseeds, commercial crops, fruits and vegetables, and other crop types) (North America, Europe, Asia-Pacific, South America, and Africa).

The world’s population is exploding. Food consumption is expected to rise as the population grows. Food security has become a concern as the world’s population grows. Industrialization and urbanization, on the other hand, are reducing arable land. According to the FAO’s ‘Resource Outlook to 2050,’ agricultural production now covers more than 1.50 billion hectares (about 12% of the world’s land area). There isn’t much room for the other agricultural area to be developed.

According to numerous projections, by 2050, the per capita arable land area in underdeveloped nations would drop to 0.18 ha, compared to 0.15 ha in developed countries and 0.42 ha in developed countries. Furthermore, the world’s population, which stood at 7.4 billion in 2016, is expected to rise to 9.7 billion by 2050, with virtually all growth in emerging nations. As a result, it is suggested that between 2005 and 2050, global food production be boosted by 60% to 70%. The per capita land is predicted to decline due to population growth and a constant rate of land degradation. As a result, current arable land is under pressure to produce more food while employing technologically improved fertilizers sustainably.

The fertilizer market in Asia-Pacific is the biggest, accounting for roughly 60.0 percent of the total. Southeast Asia is the largest fertilizer user in Asia-Pacific, with China accounting for about half of all fertilizer usage. In Asia, there is a critical requirement for nitrogen fertilizers. However, the market for potassium fertilizers is likely to expand dramatically in the future years. The increased usage of neem-coated urea, upscaling of Direct Benefit Transfer to farmers, and quick adoption of water-soluble fertilizers are likely to drive demand in Southeast Asia even higher.

The fertilizer sector has been severely impacted by the COVID-19 epidemic in various regions of the globe. During the initial lockdown phase, shipments were disrupted due to a manpower shortage and the closure of a few fertilizer units in the integrated chemical complexes. China was severely damaged in the epidemic’s early stages due to its location at the epicenter. The country’s situation has stabilized, and all fertilizer production rates have grown. As a result, COVID-19 seems to have a modest influence on the fertilizer sector. Long-term, the market is predicted to increase due to technical advancements in the industry and rising demand for N, P, K, and micronutrient fertilizers. However, the sector is expected to be hampered by legal and environmental restrictions and high manufacturing costs.

Rice is a high-nitrogen-consumption crop in the Asia-Pacific area. Asia used 35.0 percent of all fertilizer in 2017. Oil palm accounts for 17.0 percent of overall fertilizer usage and 50.0 percent of potash consumption in Asia, making it the second-largest fertilizer consumer. The expansion of rice and oil palm output is likely to continue, owing to the region’s demographic and economic advancements.

The fertilizer industry is highly concentrated, with a considerable part of the market held by a few major firms. On the other hand, based on total fertilizer market revenue in 2020, the other fertilizer firms make up a modest portion of the industry. Yara International ASA, The Mosaic Company, Nutrien Limited, EuroChem Group, PhosAgro, K+S Aktiengesellschaft, and Groupe OCP are only a few of the market’s key participants.

Fertilizers are synthetic or natural products applied to plant tissues or soil to provide one or more nutrients required for plant development. It contributes to increased crop yields while preserving and boosting soil nutrient availability. Farmers may now use fertilizers more safely and effectively thanks to the growing usage of organic fertilizers, reducing the danger of exposure to hazardous fertilizers.

Various government and non-government organizations are raising awareness about fertilizer usage and its favorable influence on agricultural productivity across the globe. Fertilizer advertising on radio, television and in rural areas is intended to boost fertilizer market share. Increased rural earnings and cheap and quick access to finance are expected to grow revenue (sphericalinsights).

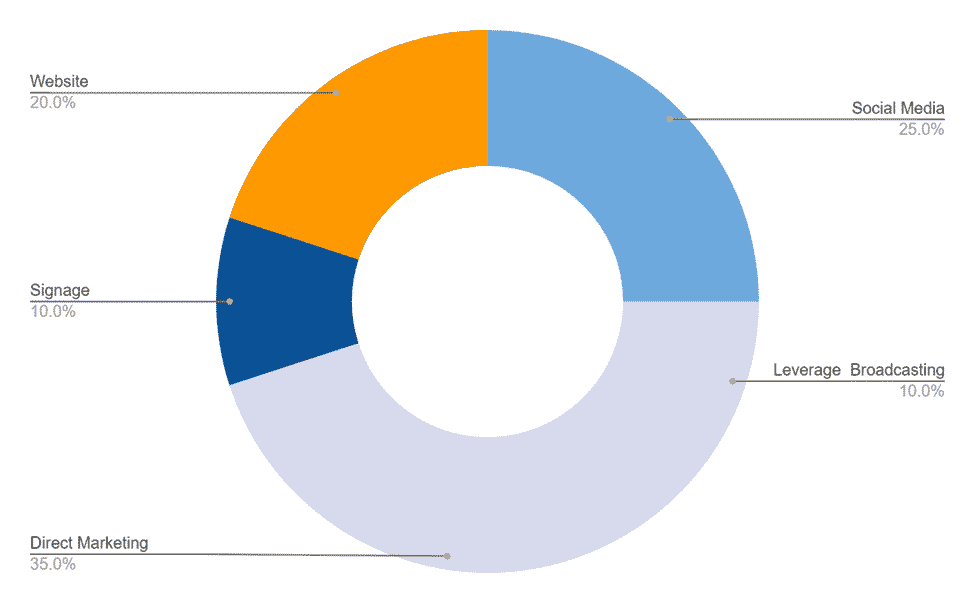

Marketing Plan

Direct marketing To generate a higher profit, sell PowerRich products directly to a consumer.

Signage PowerRich ‘s signs should be large and legible. It allows purchasers to view it more easily, particularly when driving.

Website Create a website for PowerRich so that customers can learn more about the product, get contact information, and learn how to buy it.

Social Media PowerRich activities might be advertised on social media channels to attract potential consumers.

Leverage Broadcasting Advertise the PowerRich on television and radio to reach out to non-social media users, such as seniors in the community.

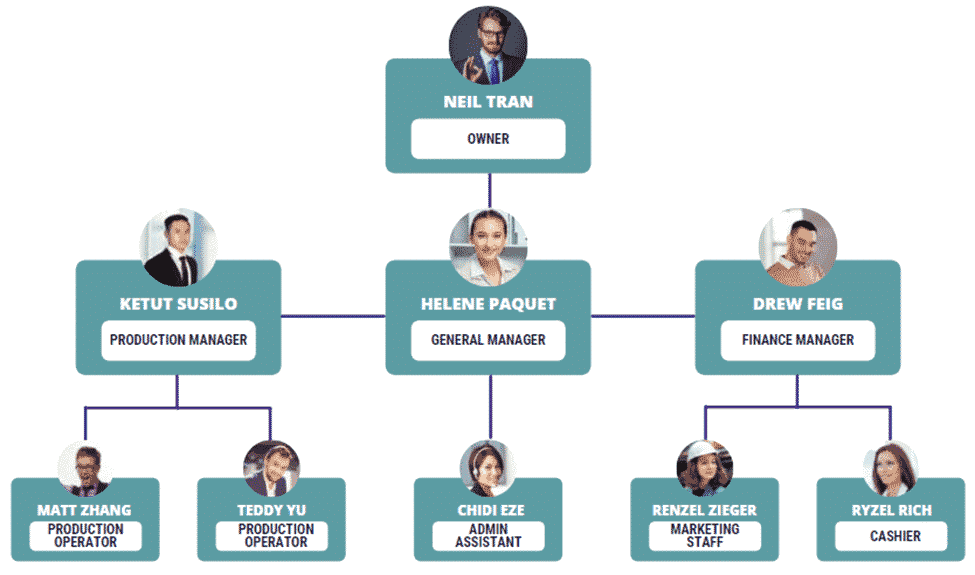

Organogram

Financial Plan

Earnings:

Break-Even Analysis:

Income Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| Total Cost of Revenue | 285,560 | 615,220 | 987,794 | 1,455,612 | 1,935,625 |

| as % of revenue | 595% | 204% | 112% | 71% | 50% |

| Gross Profit | -237,575 | -313,984 | -105,583 | 601,578 | 1,902,218 |

| SELLING & ADMIN EXPENSES | |||||

| Item 1 | 28,000 | 96,800 | 154,880 | 175,692 | 193,261 |

| Item 2 | 75,000 | 105,000 | 120,000 | 120,000 | 120,000 |

| Item 3 | 36,000 | 96,000 | 108,000 | 120,000 | 120,000 |

| Item 4 | 8,000 | 12,000 | 12,000 | 12,000 | 12,000 |

| Item 5 | 3,839 | 18,074 | 44,111 | 61,716 | 115,135 |

| Item 6 | 3,359 | 12,049 | 26,466 | 41,144 | 76,757 |

| Item 7 | 5,600 | 10,000 | 12,904 | 15,034 | 17,376 |

| Item 8 | 6,667 | 14,000 | 22,067 | 30,940 | 40,701 |

| Total selling & admin expenses | 166,464 | 363,924 | 500,428 | 576,525 | 695,230 |

| as % of revenue | 347% | 121% | 57% | 28% | 18% |

| Net profit | -404,039 | -677,907 | -606,011 | 25,052 | 1,206,987 |

| Accumulated net profit | -404,039 | -1,081,947 | -1,687,957 | -1,662,905 | -455,918 |

Cash Flow Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| CASH FLOW from OPERATING ACTIVITIES | |||||

| Net profit before tax | -$404,039 | -$677,907 | -$606,011 | $25,052 | $1,206,987 |

| Depreciation | $44,267 | $85,333 | $120,504 | $158,127 | $199,512 |

| Payables | |||||

| Item 1 | $4,333 | $5,417 | $6,500 | $7,583 | $8,667 |

| Item 2 | $11,667 | $28,000 | $46,667 | $70,000 | $93,333 |

| Item 3 | $6,250 | $8,750 | $10,000 | $10,000 | $10,000 |

| Item 4 | $3,000 | $8,000 | $9,000 | $10,000 | $10,000 |

| Item 5 | $667 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| change in payables | $25,917 | $25,250 | $22,000 | $25,417 | $24,417 |

| Receivables | |||||

| Item 1 | $320 | $1,506 | $3,676 | $5,143 | $9,595 |

| Item 2 | $360 | $1,807 | $4,411 | $8,229 | $11,514 |

| Total receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| change in receivables | -$680 | -$2,634 | -$4,773 | -$5,285 | -$7,736 |

| Net cash flow from operating activities | -$334,536 | -$569,958 | -$468,280 | $203,311 | $1,423,180 |

| CASH FLOW from INVESTING ACTIVITIES | |||||

| Item 1 | $16,000 | $13,200 | $14,520 | $15,972 | $17,569 |

| Item 2 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Item 3 | $28,000 | $22,000 | $14,520 | $10,648 | $11,713 |

| Item 4 | $96,000 | $88,000 | $72,600 | $79,860 | $87,846 |

| Item 5 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Net cash flow/ (outflow) from investing activities | -$180,000 | -$167,200 | -$150,040 | -$159,720 | -$175,692 |

| CASH FLOW from FINANCING ACTIVITIES | |||||

| Equity | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net cash flow from financing activities | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net (decrease)/ increase in cash/ cash equivalents | -$114,536 | -$297,158 | -$134,320 | $575,991 | $1,833,128 |

| Cash and cash equivalents at the beginning of the year | – | -$114,536 | -$411,693 | -$546,014 | $29,978 |

| Cash & cash equivalents at the end of the year | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

Balance Sheet:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| NON-CURRENT ASSETS | |||||

| Item 1 | $16,000 | $29,200 | $43,720 | $59,692 | $77,261 |

| Item 2 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Item 3 | $28,000 | $50,000 | $64,520 | $75,168 | $86,881 |

| Item 4 | $96,000 | $184,000 | $256,600 | $336,460 | $424,306 |

| Item 5 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Total | $180,000 | $347,200 | $497,240 | $656,960 | $832,652 |

| Accumulated depreciation | $44,267 | $129,600 | $250,104 | $408,231 | $607,743 |

| Net non-current assets | $135,733 | $217,600 | $247,136 | $248,729 | $224,909 |

| CURRENT ASSETS | |||||

| Cash | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

| Accounts receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| Total current assets | -$113,856 | -$408,380 | -$537,927 | $43,349 | $1,884,214 |

| Total Assets | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

| LIABILITIES | |||||

| Account payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| Total liabilities | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| EQUITIES | |||||

| Owner’s equity | $400,000 | $840,000 | $1,324,000 | $1,856,400 | $2,442,040 |

| Accumulated net profit | -$404,039 | -$1,081,947 | -$1,687,957 | -$1,662,905 | -$455,918 |

| Total equities | -$4,039 | -$241,947 | -$363,957 | $193,495 | $1,986,122 |

| Total liabilities & equities | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

Related Articles: