Written by Elma Steven | Updated on March, 2024

Executive Summary

Overview: The Milk Bar Store is a diner-inspired concept in Chicago that serves upscale comfort cuisine, a full bar, and extravagant desserts. A design with various eye-catching, social media-friendly components complements this over-the-top approach. JoJo’s Milk Bar is a restaurant and bar for the new generation. Its nostalgic but contemporary diner experience emphasizes inventive desserts and enhanced diner classics.

Mission To constantly deliver high-quality, fresh, seasonally appropriate, and delicious cuisine.

Vision: To introduce our products to dessert lovers all across the world by creating transforming dessert experiences with essential ingredients.

Industry Overview: North America, Asia Pacific, Europe, the Middle East, Africa, and South America are the regions where the global café market is split. Because of the high rate of coffee consumption in these nations, the café business in Europe and North America is booming. Based on the National Coffee Association, around 63 percent of the adult population in the United States consumes coffee. Cafés are expected to proliferate in emerging countries like the Asia Pacific in the near future. In the past decade, coffee consumption in China has increased exponentially. China’s coffee consumption, according to the International Coffee Organization, is growing at a pace of over 16 percent each year. Starbucks, a well-known worldwide coffee company, is quickly growing in China. From 1,017 in 2013 to 3,300 in 2018, the corporation has quadrupled its shop count. In the same way, coffee consumption in South America is skyrocketing. The demand for diversified coffee has risen as a result of the lengthy coffee heritage in certain coffee-producing nations and increased buying capacity.

Check out this guide on how to write an executive summary? If you don’t have the time to write on then you can use this custom Executive Summary Writer to save Hrs. of your precious time.

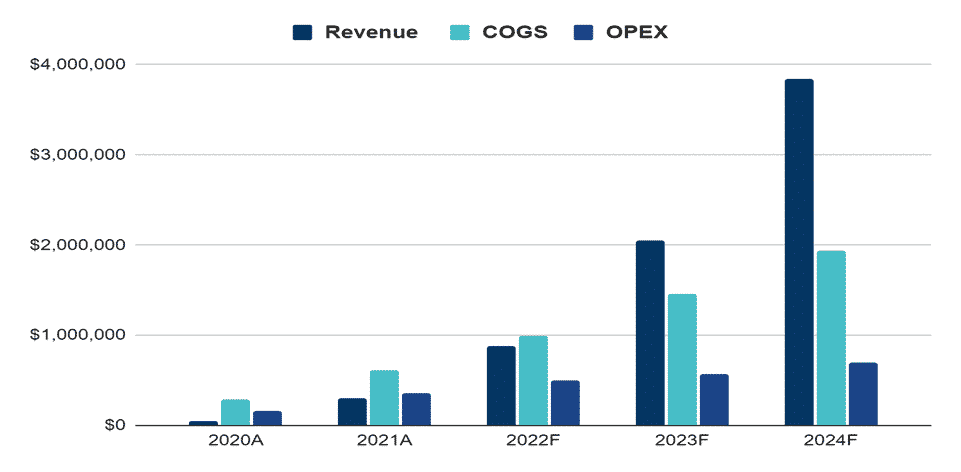

Financial Overview

Financial Highlights

| Liquidity | 2020A | 2021A | 2022F | 2023F | 2024F |

| Current ratio | 6 | 12 | 23 | 32 | 42 |

| Quick ratio | 6 | 11 | 22 | 31 | 40 |

| DSO | 8 | 8 | 8 | 8 | 8 |

| Solvency | |||||

| Interest coverage ratio | 8.2 | 11.1 | 14.2 | ||

| Debt to asset ratio | 0.01 | 0.01 | 0.2 | 0.18 | 0.16 |

| Profitability | |||||

| Gross profit margin | 51% | 51% | 53% | 53% | 53% |

| EBITDA margin | 12% | 14% | 21% | 22% | 22% |

| Return on asset | 5% | 6% | 13% | 14% | 14% |

| Return on equity | 5% | 6% | 16% | 17% | 17% |

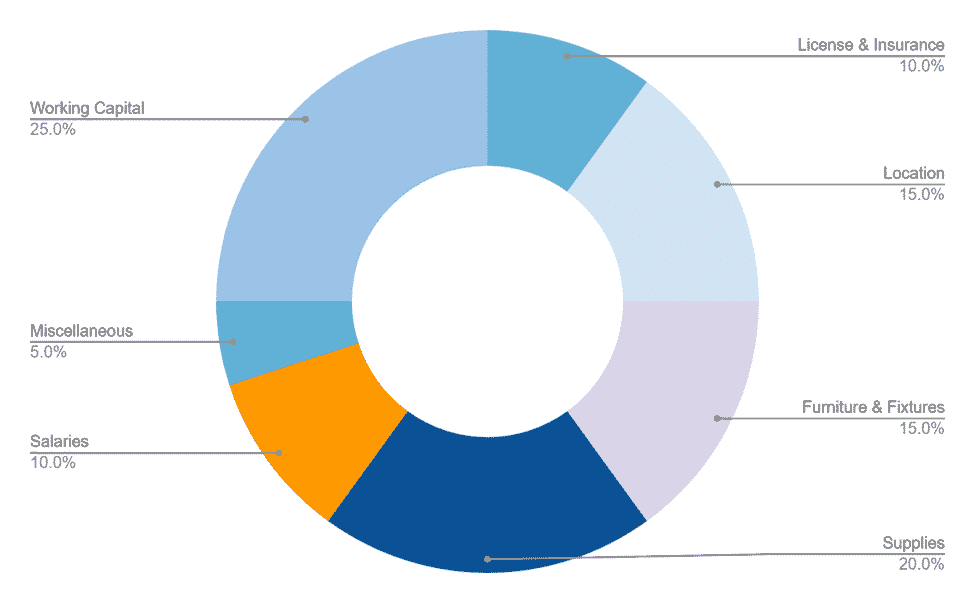

Fund Usage

Check out the funding sources for small businesses.

Industry Analysis

A milk bar is a kind of primary shop found in the suburbs. Delicatessens or “delis,” tuck shops, and corner shops or corner stores are all words that are used interchangeably (although, by definition, these are different establishments). People used to go to milk bars to get newspapers and fast food such as fish and chips and hamburgers and milkshakes and snacks. They are a smaller suburban convenience store, although they are more likely to be “mum and dad” local businesses than bigger franchised enterprises.

Bread, ice cream, lollipops, chocolate bars, soft drinks, newspapers, cigarettes, and, on rare occasions, fast food are virtually commonly sold at milk bars nowadays. Milk (in cartons or bottles) and other dairy items are often served. Despite the fact that there are fewer milk bars now than there were in the 1970s and 1980s, owing to changing shopping preferences, most suburban residents still have a milk bar within a short drive or walking distance of their house.

A milk or dairy bar is a similar restaurant/store found across the Northeastern United States, particularly in Upstate New York, a major dairy product supplier. A “malt shop,” which serves milkshakes and soft drinks as well as limited cuisines such as hamburgers and sandwiches, is quite similar to a milk or dairy bar. Although a handful remains, fast food has mainly replaced them.

A milk bar is a suburban gathering spot and snack bar that serves light refreshments, fresh sandwiches, hamburgers, milkshakes, meat pies, desserts, groceries, and newspapers. The typical Australian milk bar, like the American diner, had its heyday from the 1940s through the 1980s. Fast-food franchises eventually supplanted milk bars as a social gathering spot, while they may still be seen in many regions, frequently operating as a local corner or convenience shop.

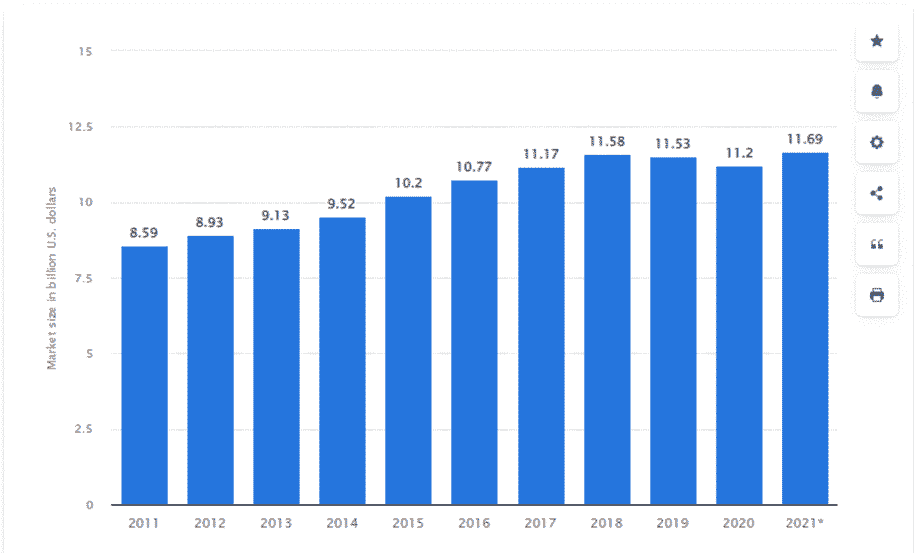

Market size of the bakery-cafe sector in the United States

from 2011 to 2020, with a forecast for 2021(in billion U.S. dollars)

Source: Statista

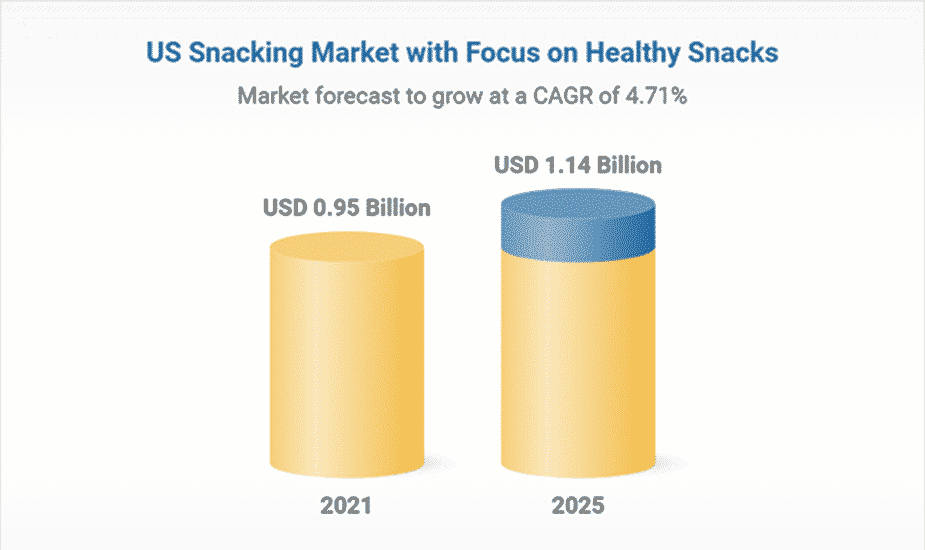

Coffee shops exist in various shapes and sizes, but they are often places where you can buy freshly brewed coffee, tea, and other hot drinks. In recent years, many coffee shops have added baked products, sandwiches, salads, and other snacks to compete with restaurants in the quick-service sector. Around 166.63 million 60kg bags of coffee were consumed globally in 2020/2021. The United States is one nation that stands out as a drinker. The coffee market in the United States had more than 82 billion dollars in sales in 2019. Despite the fact that coffee users may be found throughout the nation, per capita coffee consumption in the United States differed by location in 2020. In terms of coffee consumption, the Northeast led the way, with an average of 1.97 cups per person per day. Meanwhile, the South consumed the least quantity of coffee that year, with an average of 1.8 cups per day.

Snack foods, soft drinks, groceries, confectionery, tobacco goods, over-the-counter medications, toiletries, newspapers, and magazines are all available at a convenience shop. In the United States, in 2020, it will have over 150 thousand convenience shops, with the bulk of them being independent. The business made about 650 billion dollars in sales in the most recent year, with motor gasoline accounting for more than half. In 1927, the country’s first convenience shop chain began in Dallas, Texas. The convenience store chain later became known as 7-Eleven, and it is today the largest in terms of store count. With over 152,000 locations countrywide providing gasoline, food, and goods, the convenience store business in the United States serves 165 million consumers per day, accounting for half of the country’s population, and accounts for 11% of total retail and food service sales in the United States.

Source: IBIS

Consumers depend on their neighborhood convenience store for snacks and meals, according to foodservice growth in 2019. In 2019, foodservice sales increased by 4.4 percent, accounting for 25.4 percent of total inside sales, up from 22.6 percent in 2018. Foodservice was also a key factor in-store success: top quartile performers sold 7.7 times more food service than the lowest quartile.

Convenience shops are frequently the only and/or nearest place for much-needed gasoline, food, and grocery products, especially in smaller communities, where 8 out of 10 rural Americans (86%) indicated a convenience shop was within 10 minutes of their homes in a 2018 NACS consumer survey. According to a NACS Retailer Member survey conducted in April 2020, foodservice sales fell during the pandemic, whereas grocery sales rose by 52 percent.

Self-service choices for roller grills, bakery cases, and cold, frozen, and hot dispensed drinks have been removed from foodservice sales in 2020, as shops take additional care to reduce the danger of possible contamination. For some stores, this meant relocating self-serve meals and coffee behind the counter so that a client could be served. Others with extensive prepared foodservice programs had to close dining areas or rely on touchscreen ordering to keep foodservice menus and barista services running.

Marketing Plan

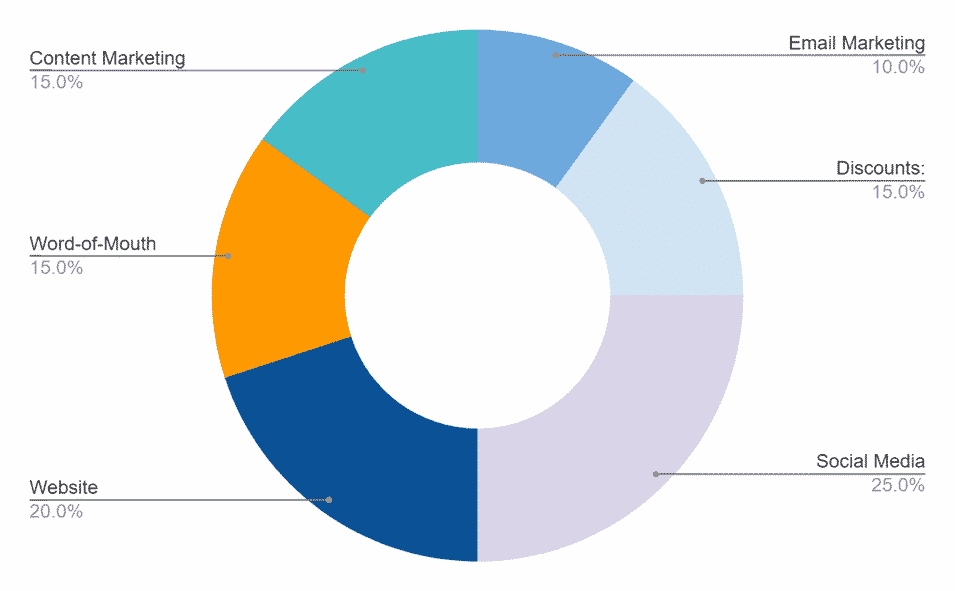

A key part of the marketing plan in a Milk Bar business plan is the marketing budget. The growth in the number of customers is proportional to the budget and dependent on the CAC.

Email marketing: Email marketing is a straightforward approach to staying in touch with customers by sending information and essential news personalized to their specific requirements.

Discounts: Create a loyalty card for JoJo’s Milk Bar’s regular customers, in which members get a deal if they complete the stamps.

Social media: JoJo’s Milk Bar uses social media channels such as Instagram, Facebook, and Tiktok to communicate with customers.

Website: JoJo’s Milk Bar has a well-organized website that allows searchers to navigate it easily.

Word-of-Mouth: Consumers who are satisfied with our food and services can quickly popularize JoJo’s Milk Bar and help it gain more profit.

Content marketing: Establish connections through blogging that provide helpful information on your JoJo’s Milk Bar website.

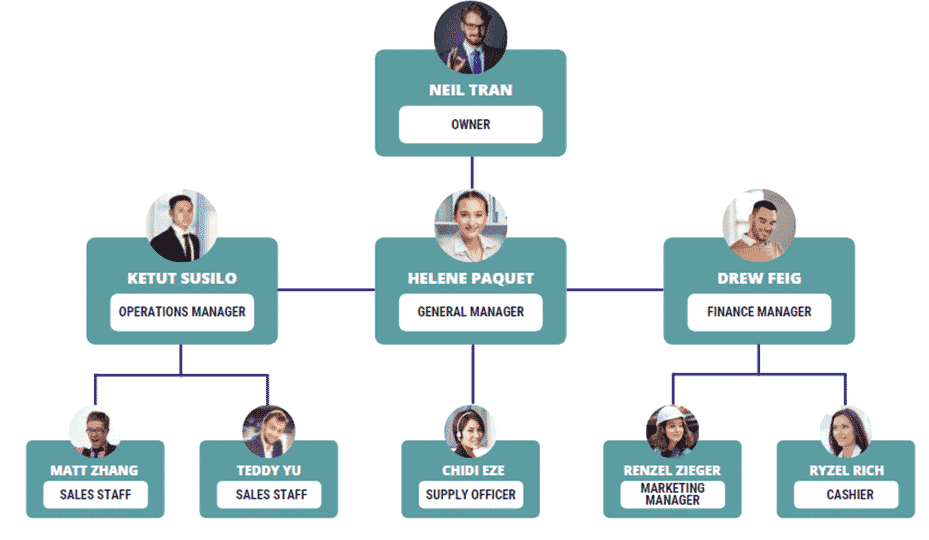

Organogram

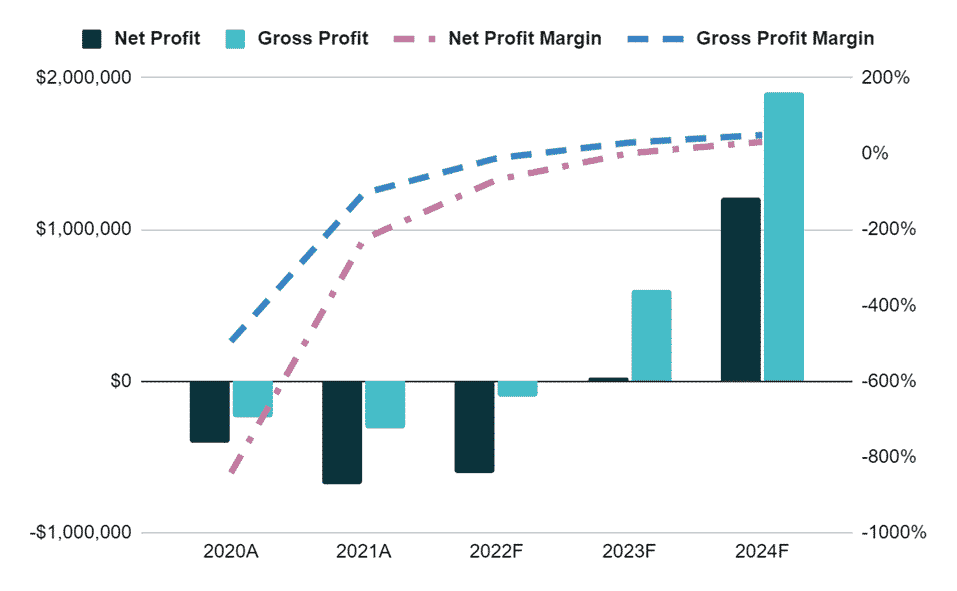

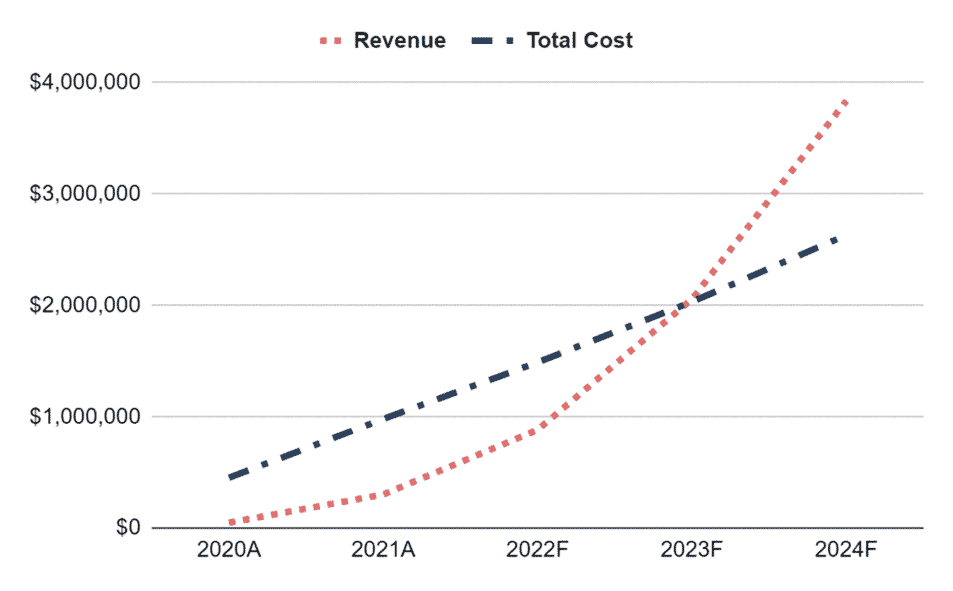

Financial Plan

This section of the Milk Bar business plan helps your lender figure out whether you will be able to pay off the loan, whether the business is sustainable, what are the growth prospects, etc.

Earnings:

Break-Even Analysis:

Income Statement:

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| ANNUAL REVENUE | |||||

| Item 1 | 9,217 | 59,117 | 175,410 | 415,277 | 781,357 |

| Item 2 | 34,701 | 222,558 | 660,368 | 1,563,394 | 2,941,580 |

| Item 3 | 4,067 | 19,561 | 46,432 | 78,519 | 114,905 |

| Total annual revenue | 47,985 | 301,236 | 882,211 | 2,057,189 | 3,837,842 |

| % increase | 528% | 193% | 133% | 87% | |

| COST of REVENUE | |||||

| Item 1 | 360 | 2,259 | 6,617 | 15,429 | 28,784 |

| Item 2 | 480 | 3,012 | 8,822 | 20,572 | 38,378 |

| Item 3 | 52,000 | 65,000 | 78,000 | 91,000 | 104,000 |

| Item 4 | 720 | 3,615 | 8,822 | 16,458 | 23,027 |

| Item 5 | 140,000 | 336,000 | 560,000 | 840,000 | 1,120,000 |

| Item 6 | 60,000 | 144,000 | 240,000 | 360,000 | 480,000 |

| Item 7 | 32,000 | 61,333 | 85,533 | 112,153 | 141,435 |

| Total Cost of Revenue | 285,560 | 615,220 | 987,794 | 1,455,612 | 1,935,625 |

| as % of revenue | 595% | 204% | 112% | 71% | 50% |

| Gross Profit | -237,575 | -313,984 | -105,583 | 601,578 | 1,902,218 |

| SELLING & ADMIN EXPENSES | |||||

| Item 1 | 28,000 | 96,800 | 154,880 | 175,692 | 193,261 |

| Item 2 | 75,000 | 105,000 | 120,000 | 120,000 | 120,000 |

| Item 3 | 36,000 | 96,000 | 108,000 | 120,000 | 120,000 |

| Item 4 | 8,000 | 12,000 | 12,000 | 12,000 | 12,000 |

| Item 5 | 3,839 | 18,074 | 44,111 | 61,716 | 115,135 |

| Item 6 | 3,359 | 12,049 | 26,466 | 41,144 | 76,757 |

| Item 7 | 5,600 | 10,000 | 12,904 | 15,034 | 17,376 |

| Item 8 | 6,667 | 14,000 | 22,067 | 30,940 | 40,701 |

| Total selling & admin expenses | 166,464 | 363,924 | 500,428 | 576,525 | 695,230 |

| as % of revenue | 347% | 121% | 57% | 28% | 18% |

| Net profit | -404,039 | -677,907 | -606,011 | 25,052 | 1,206,987 |

| Accumulated net profit | -404,039 | -1,081,947 | -1,687,957 | -1,662,905 | -455,918 |

Cash Flow Statement

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| CASH FLOW from OPERATING ACTIVITIES | |||||

| Net profit before tax | -$404,039 | -$677,907 | -$606,011 | $25,052 | $1,206,987 |

| Depreciation | $44,267 | $85,333 | $120,504 | $158,127 | $199,512 |

| Payables | |||||

| Item 1 | $4,333 | $5,417 | $6,500 | $7,583 | $8,667 |

| Item 2 | $11,667 | $28,000 | $46,667 | $70,000 | $93,333 |

| Item 3 | $6,250 | $8,750 | $10,000 | $10,000 | $10,000 |

| Item 4 | $3,000 | $8,000 | $9,000 | $10,000 | $10,000 |

| Item 5 | $667 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| change in payables | $25,917 | $25,250 | $22,000 | $25,417 | $24,417 |

| Receivables | |||||

| Item 1 | $320 | $1,506 | $3,676 | $5,143 | $9,595 |

| Item 2 | $360 | $1,807 | $4,411 | $8,229 | $11,514 |

| Total receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| change in receivables | -$680 | -$2,634 | -$4,773 | -$5,285 | -$7,736 |

| Net cash flow from operating activities | -$334,536 | -$569,958 | -$468,280 | $203,311 | $1,423,180 |

| CASH FLOW from INVESTING ACTIVITIES | |||||

| Item 1 | $16,000 | $13,200 | $14,520 | $15,972 | $17,569 |

| Item 2 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Item 3 | $28,000 | $22,000 | $14,520 | $10,648 | $11,713 |

| Item 4 | $96,000 | $88,000 | $72,600 | $79,860 | $87,846 |

| Item 5 | $20,000 | $22,000 | $24,200 | $26,620 | $29,282 |

| Net cash flow/ (outflow) from investing activities | -$180,000 | -$167,200 | -$150,040 | -$159,720 | -$175,692 |

| CASH FLOW from FINANCING ACTIVITIES | |||||

| Equity | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net cash flow from financing activities | $400,000 | $440,000 | $484,000 | $532,400 | $585,640 |

| Net (decrease)/ increase in cash/ cash equivalents | -$114,536 | -$297,158 | -$134,320 | $575,991 | $1,833,128 |

| Cash and cash equivalents at the beginning of the year | – | -$114,536 | -$411,693 | -$546,014 | $29,978 |

| Cash & cash equivalents at the end of the year | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

Balance Sheet

| 2020A | 2021A | 2022F | 2023F | 2024F | |

| NON-CURRENT ASSETS | |||||

| Item 1 | $16,000 | $29,200 | $43,720 | $59,692 | $77,261 |

| Item 2 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Item 3 | $28,000 | $50,000 | $64,520 | $75,168 | $86,881 |

| Item 4 | $96,000 | $184,000 | $256,600 | $336,460 | $424,306 |

| Item 5 | $20,000 | $42,000 | $66,200 | $92,820 | $122,102 |

| Total | $180,000 | $347,200 | $497,240 | $656,960 | $832,652 |

| Accumulated depreciation | $44,267 | $129,600 | $250,104 | $408,231 | $607,743 |

| Net non-current assets | $135,733 | $217,600 | $247,136 | $248,729 | $224,909 |

| CURRENT ASSETS | |||||

| Cash | -$114,536 | -$411,693 | -$546,014 | $29,978 | $1,863,105 |

| Accounts receivables | $680 | $3,314 | $8,087 | $13,372 | $21,108 |

| Total current assets | -$113,856 | -$408,380 | -$537,927 | $43,349 | $1,884,214 |

| Total Assets | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |

| LIABILITIES | |||||

| Account payables | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| Total liabilities | $25,917 | $51,167 | $73,167 | $98,583 | $123,000 |

| EQUITIES | |||||

| Owner’s equity | $400,000 | $840,000 | $1,324,000 | $1,856,400 | $2,442,040 |

| Accumulated net profit | -$404,039 | -$1,081,947 | -$1,687,957 | -$1,662,905 | -$455,918 |

| Total equities | -$4,039 | -$241,947 | -$363,957 | $193,495 | $1,986,122 |

| Total liabilities & equities | $21,878 | -$190,780 | -$290,791 | $292,078 | $2,109,122 |